Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

Mongolian health workers’ pay to rise 75% in staged increases next year www.asianews.network

Minister of Health J.Chinburen told reporters the proposal will be submitted to the Mongolian Health Workers’ Trade Union today and that tripartite negotiations between the government, employers and unions have begun after a preliminary agreement reached in talks with union leaders. Under the plan, basic salaries will rise 30 % from January 1, 2026, with further staged increases planned later in the year so that the total uplift reaches 75 %, bringing the basic salary for health workers to MNT 3 million in 2026.

The government is also preparing to aim for MNT 3.5 million in later adjustments, in line with the designation of 2027 as the Year of Health Promotion, the Minister said. To finance the increases, MNT 157 billion will be allocated from the Health Insurance Fund, cuts of about 10% to certain current budget expenditures, and reductions in the number of contracts and non-essential spending to free up resources. Minister J.Chinburen said MNT 191 billion in total is needed to implement the planned pay rises..

FLS continues mining service centre progress with Mongolia expansion www.im-mining.com

A major part of FLS’s globalisation strategy in mining in recent years has been bolstering its mining service centres around the world in major mining hubs, and it has been making major investments lately. In its Q3 2025 results, the company said that service orders had increased by 10% organically, affirming a positive market momentum, despite a dip in project and product orders for the period.

The year-on-year increase was primarily due to a higher level of orders within upgrades & retrofits as well as professional services.

Earlier this month, an expansion of the FLS Mongolia Service Centre in Ulaanbaatar was officially inaugurated, a significant step for the company in setting new standards for technology and service within Mongolia’s large and rapidly growing mining sector.

As outlined in The Mongolian Mining Journal, which published a story based on the expansion inauguration event, the Mongolia service centre began operations in 2014 with just two employees, performing basic warehouse refurbishments. Today, it employs over 30 staff and provides more than 100 different products and services to major players in Mongolia’s mining industry. The centre is divided into two main areas: a warehouse and a service section. The service operations include metal fabrication through welding, professional-grade rubber lining, mechanical assembly, and refurbishment work.

As part of the recent expansion, both indoor and outdoor warehouse areas were enlarged, equipment capacity increased, and the workforce expanded to improve operational efficiency. New service types were introduced, and staff skills were enhanced with the successful implementation of international standards, including ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018. All personnel, including quality control specialists, are certified in Nondestructive Testing (NDT), ensuring high-quality service delivery.

Over the years, the centre has supplied equipment such as an 80 m tailing thickener to Oyu Tolgoi and Refurbishment Sumps to Energy Resources’ Ukhaa Khudag site, using fully raw rubber lining to deliver durable, high-quality service and refurbishment.

FLS CEO Mikko Keto said the service centre in Ulaanbaatar represents a major strategic step for FLS in Central Asia. “Through this facility, we can provide faster, more reliable support to our customers while developing the skills of local experts. Mongolia is becoming increasingly important in the global mining landscape, and we are proud to be part of this development.”

T. Zorigtsaikhan, Business Development Director – Mongolia, FLSmidth, commented: “Since beginning operations in Mongolia in 2010, FLSmidth has continuously collaborated with major mining companies. Through the establishment of the Service Centre and by enhancing our equipment standards, we have been able to provide more responsive and reliable services. Supporting concentrators like Oyu Tolgoi with technical assistance, professional advice, and maintenance remains a source of pride for our team.”

FLS also recently celebrated the official launch of its new FLS Mackay Service Centre in Queensland, Australia. It stated: “FLS is not new to Mackay, we have upgraded our service operations by relocating to a larger facility and strengthening our commitment to the region. Our expanded centre is close to our customers, designed to provide faster access to critical spare parts, handle major equipment rebuilds, and deliver a broader range of services to the mining industry.” It added that it serves as a hub for pumps, cyclones and valves rebuilds, sizers, centrifuges and crushers as well as local distribution and more.

In October, FLS also share a significant milestone for the FLS Training Academy at the South African Chloorkop Service Centre – which officially received accreditation from the Department of Higher Education as an assessment centre to conduct Final Trade Testing for fitters, machinists, and fitters & turners. “With this achievement, the Academy can now not only train apprentices but also award nationally recognised trade qualifications – extending our capability to include the final testing of apprentices from other companies across the region.”

An expansion of the Chloorkop, South Africa, Service Centre is already ongoing and will be completed in 2026. In addition, other expansions are underway at FLS Service Centres in Parauapebas, Brazil; and in Karaganda, Kazakhstan. New FLS Service Centres are also being opened in Accra, Ghana; Surabaja, Indonesia; and Dammam, Saudi Arabia.

...

Homegrown AI: Mongolia’s blueprint for developing nations www.e27.co

Mongolia’s AI journey shows how developing nations can achieve digital sovereignty through local problem-solving and sustainable growth

When global researchers predicted that speech recognition for low-resource languages wouldn’t be commercially viable until 2030, we had already achieved 97 per cent accuracy in 2020. This isn’t a story about one company – it’s about how developing nations can build AI sovereignty by solving real problems, building infrastructure patiently, and getting creative with talent.

After 25 years of building language technology in Mongolia – from basic character rendering to complex reasoning systems – I’ve learned that the path to AI independence requires three things: sustainable development, pragmatic focus on real missions, and a bigger vision. Here’s what actually works.

Start where problems challenge society

Silicon Valley starts with solutions looking for problems. Developing nations must start with problems demanding solutions. Mongolia’s AI journey began with frustrations that might sound trivial to outsiders but were paralysing daily life:

The typing crisis: We literally couldn’t type in our traditional vertical script. Eight centuries of written culture were becoming digitally extinct. This wasn’t a market opportunity – it was cultural death in slow motion.

The dictionary that wasn’t: No comprehensive digital Mongolian-English dictionary existed. Students and professionals relied on dusty paper editions from the 1960s. Every missing translation represented a lost opportunity.

The spellcheck absence: Mongolian text had no spell-checking. Government documents, business contracts, and academic papers were riddled with errors that undermined credibility and caused actual legal disputes. That was one of the biggest social problem until 2017.

The language corruption crisis: Here’s something that keeps me awake at night – we’re raising a generation that speaks broken Mongolian. Young people unconsciously rely on Google Translate for homework, social media, and daily communication. But Google Translate’s Mongolian support is so poor that it’s literally corrupting our language. Students write essays in grammatically incorrect Mongolian, thinking it’s proper because “Google said so.”

The speech recognition gap: Parliament and government operate through meetings, making transcription a critical function. Without speech recognition, protocol-keeping consumed enormous human resources. And solutions had to be on-premise for security.

The service crisis: Banks and telecoms haemorrhaged money on customer service. Without automated Mongolian language support, every query required human agents.

The procurement corruption: At Erdenet Mining, Mongolia’s largest company, manual tender evaluation enabled systematic corruption. Millions disappeared into rigged contracts or excessive delays in purchase completion.

Each problem we solved provided data, experience, and credibility for the next challenge. Our fully automatic tender evaluation system at Erdenet didn’t just save money and reduce corruption – it generated the revenue and trust that funded our speech recognition and language model research.

This problem-first approach built our capabilities organically. By the time we tackled large language models, we had accumulated 20 years of linguistic data, domain expertise, and customers who trusted us.

Harness your diaspora’s expertise

Mongolia has more software engineers in Silicon Valley, Berlin, Seoul, and Tokyo than in Ulaanbaatar. This brain drain, common across developing nations, became the cornerstone of our talent strategy.

The diaspora advantage

We couldn’t compete with FAANG salaries. Instead, we offered something money can’t buy: the chance to build their homeland’s technological future. Our pitch was simple: “Your skills + our mission = your legacy.”

AI Engineers from Germany, Switzerland, Italy, and the US were invited to work on-site, fostering knowledge exchange with local talent. They mentored, contributed code, and validated technical decisions, creating a sustainable talent flow instead of a one-way brain drain. This approach assured young engineers that they could venture out, gain experience, and return to impactful work.

Infrastructure has been our greatest challenge from day one. We move slowly, but we move forward. Our datacenter evolution tells the story of patient building:

We started in 2017, purchasing two gaming GPUs (RTX 2090 Ti). By 2019, we had received angel investment to buy our own L40S GPUs. In 2021, we added A6000 units. Today, we run our own infrastructure with local hardware for sensitive data. We use cloud resources from AWS and Google to train bigger models.

We manage everything ourselves – not by choice, but by necessity. No managed services exist for our use cases. This forced us to develop deep infrastructure expertise that later became a competitive advantage.

The lesson? Start with whatever computer you can access. Our first speech recognition model was trained on two gaming GPUs for one year. Perfect infrastructure is a luxury, developing nations can’t afford to wait for.

Competitive advantage

Cultural localisation

The assumption that AI models can simply be “translated” fundamentally misunderstands how language and culture intertwine.

The mixed language reality

Mongolians don’t speak “pure” Mongolian. Never have, never will. Real conversations flow like this:

Mongolian grammar structures with English tech terms embedded

Russian expressions from the Soviet era sprinkled throughout

Chinese trade phrases when discussing business

Our models had to understand “Kodoo push hiigeed product ownertoo мэдэгдчихлээ.” (I’ve pushed the code and notified the product owner.). When we insisted on linguistic purity, our models failed spectacularly. When we embraced messy reality, they worked.

Release strategy that makes sense

While big tech companies focus on the “top 20 languages” and throw everything else into an “other” bucket, we take a different approach. For each market, we focus on the languages that actually interact. For Mongolia, that means:

Mongolian (obviously)

English (global connectivity)

Russian (historical ties)

Chinese (trade relationships)

This connected-language approach delivers 10x better results than generic multilingual models.

Your data will be securely stored within your country’s territory, allowing you to use it with peace of mind. If governments fail to actively embrace and utilise artificial intelligence, they risk falling behind, potentially leading to significant social inequality within their societies.

Digital sovereignty through pragmatic building

True sovereignty means controlling critical layers while pragmatically using what works.

What we built ourselves:

Character encoding and input methods (100 per cent local)

Finate state automata and transducers as language complexity (100 per cent local)

Speech recognition and synthesis (100 per cent local)

Core language models (100 per cent local)

Application frameworks (80 per cent local, 20 per cent open source)

Infrastructure management (60 per cent local, 40 per cent standard tools)

The honest trade-offs:

We use NVIDIA hardware (no alternative yet)

We leverage open-source frameworks (why reinvent PyTorch?)

We adapt international research (standing on the shoulders of giants)

But we control all critical paths and data

Economic sustainability:

Sovereignty without economic sustainability is just expensive nationalism. Our model evolved through necessity:

Government as first customer, not sugar daddy

Enterprise solutions funding research

Open source contributions building global goodwill

The uncomfortable truths

Let me be honest about what building AI in a developing nation really means:

You’ll never have enough resources. We have 1/1000th of OpenAI’s budget. Make constraints drive innovation. Our GPU shortage forced us to optimise models that now run on minimal hardware

Technical debt is inevitable. Plan refactoring cycles from day one. We still maintain code from 2017 because it serves critical government systems.

International competition will arrive. Build cultural moats early. By the time OpenAI or Google supports Mongolian properly, we’ll have ten years of local context they can’t replicate.

Talent will always be scarce. Create compelling missions. We can’t match Silicon Valley salaries, but we offer something better: the chance to preserve their culture through technology.

Trust is your biggest challenge. When we first claimed 97 per cent accuracy in Mongolian speech recognition, nobody believed us. International researchers said it was impossible. Now, the customers and government say, “Why not just use ChatGPT?” You need rock-solid local success stories. Building credibility took years of consistent delivery.

Also Read:

Asia rises in the AI chip race: China to outgrow US by 30 per cent by 2030

Asia rises in the AI chip race: China to outgrow US by 30 per cent by 2030

The future is distributed

The era where a few companies in a few countries control global AI is ending. The future belongs to distributed, culturally-rooted AI systems serving specific populations with a deep understanding.

Mongolia’s journey from missing keymaps to billion-parameter models proves that developing nations don’t need charity. Don’t blame Silicon Valley for ignoring your market – they don’t owe you anything. Build it yourself.

With sustainable development focused on real problems, pragmatic building strategies, and a vision for digital sovereignty, any nation can achieve AI independence. Don’t be discouraged if someone says you can’t compete with OpenAI or Anthropic. While they are currently reducing their model parameters, we are increasing ours. In the near future, we will converge in the middle. The first to reach that point could be the winner, but nevertheless, business applications using models under 30B parameters will capture 90 per cent of the whole AI market share.

The question isn’t whether to build homegrown AI, but whether your problems are painful enough to sustain the decades-long journey to solve them. For us, watching our youth lose their mother tongue to bad machine translation was painful enough.

But when a nomadic herder can speak to AI in their own language and get help accessing government services? When corruption drops because algorithms can’t be bribed? When does your culture live digitally for future generations? Egune AI is making it possible.

By Badral Sanlig

Government Mandates Loan Repayment by Erdenes Mongol Subsidiaries www.montsame.mn

The Board of Directors of “Erdenes Mongol” LLC has been instructed to ensure the repayment of outstanding loans and accrued interest owed by its subsidiaries, “Baganuur” JSC and “Shivee-Ovoo” JSC, to the state budget by the end of the first quarter of 2026. The repayment will be carried out in accordance with loan agreements financed through the government’s external borrowing programs.

Since 1991, the Government of Mongolia has mobilized concessional and highly concessional loans from foreign and international financial institutions to support key domestic development projects. Within this framework, several initiatives have been financed for “Baganuur” and “Shivee-Ovoo” JSC, including:

The Coal Project, aimed at increasing the sustainable production levels at the Baganuur mine, was implemented under a loan agreement with the Government of Mongolia and the World Bank’s International Development Association (IDA).

The Baganuur and Shivee-Ovoo Coal Mine Development Project was launched to modernize mining equipment and build new maintenance facilities and substations, financed through a loan agreement with the Japan International Cooperation Agency (JICA).

In 2021, a loan agreement was concluded with “Baganuur” JSC and “Shivee Ovoo” JSC to implement the Export Credit Line Project, established under a financing arrangement between the Government of Mongolia and the Japan Bank for International Cooperation (JBIC). The project aimed to facilitate the acquisition of heavy mining equipment and modernize the technical infrastructure at the respective mine site.

Accordingly, the Government has issued a resolution instructing that the total debt incurred under these projects by “Baganuur” JSC and “Shivee-Ovoo” JSC – subsidiaries of “Erdenes Mongol” LLC – be transferred to the state budget, according to the Media and Public Relations Department of the Government.

Standard for Pasteurized Camel Milk Adopted www.montsame.mn

The 48th Session of the Codex Alimentarius Commission (CAC), the international body for food standards, discussed the proposal initiated by Mongolia to develop a Standard for Pasteurized Camel Milk.

During the session, 39 countries officially expressed their support, and the proposal was adopted as a “New Work” item by consensus of all member states. This marks the first time Mongolia has initiated and successfully advanced the development of an international food standard.

According to the Ministry of Food, Agriculture, and Light Industry, the proposal was developed to boost domestic production, expand markets, and increase the export of dairy products. The Ministry has also been working on the Codex standards for pasteurized camel milk and sea buckthorn oil as part of this effort.

Over the course of more than a year, the working group gathered evidence-based data and research on the composition and characteristics of Bactrian camel milk, integrating these findings into the draft standard and collaborating closely with representatives of co-sponsoring countries.

The adoption of the Standard for Pasteurized Camel Milk will enable Mongolia’s unique national products to enter the global market, increase export potential, and provide tangible benefits to herder livelihoods and the national agricultural economy.

Prime Minister Appoints MP Gankhuyag Khassuuri as Deputy Prime Minister www.montsame.mn

At the plenary session of the State Great Khural (Parliament) on November 12, 2025, Prime Minister Zandanshatar Gombojav presented his decision to dismiss and appoint a member of the Cabinet. The decision concerned the dismissal of Member of Parliament (MP) Amarsaikhan Sainbuyan as Deputy Prime Minister of Mongolia and the appointment of MP Gankhuyag Khassuuri to the position.

In his presentation, Prime Minister Zandanshatar stated that the position of Deputy Prime Minister is responsible for regional development, free zones, special economic zones, disaster prevention, emergency management, standardization, and metrology, as well as intergovernmental commissions between Mongolia and other countries. “The appointment of Gankhuyag as Deputy Prime Minister is made within the powers granted to me by the Constitution,” the Prime Minister said, instructing the newly appointed Deputy Prime Minister to carry out his duties responsibly.

The Prime Minister had presented his decision on the appointment to the President of Mongolia on October 29, 2025. Article 39, Section 4 of the Constitution of Mongolia states, “A member of the Government shall be appointed, dismissed, and resigned by the Prime Minister upon presentation to the State Great Khural and the President. A member of the Government shall take an oath before the State Great Khural.”

Following the presentation, MPs made comments, asked questions, and received clarifications. Prime Minister Zandanshatar then read the order appointing Gankhuyag as Deputy Prime Minister, after which the newly appointed official took the oath of office as a member of the Cabinet and formally assumed his duties.

Brief Biography of MP Gankhuyag Khassuuri:

Founder and Chairman of the Board, Hera Group (since 2003)

Chairman of the Board, “Remicon” PLC (2008–2014)

Member of the Board, Mining Association (2010–2014)

Chairman, Local Community Council of Tariat soum, Arkhangai aimag (since 2010)

Member, “CEO Club” (since 2013)

Member, Young Presidents’ Organization Mongolia Chapter (since 2013)

Advisor to the Minister of Industry and Agriculture (2012–2014)

Member, Organizing Committee of the Mongolia Economic Forum (2015–2017)

Member, Mongolian People’s Party Conference (since 2017)

Chairman, MPP Bayangol District; Party Committee of the 20th khoroo (since 2018)

Owner and Board Member, 3x3 UB Club (2019)

Advisor to the Chief Cabinet Secretary (2019–2020)

Member of Parliament (2020–2024; re-elected in 2024)

Chair, Parliamentary Standing Committee on Budget (since 2025)

600 Hectares Rehabilitated from Mining Damage in Selenge Aimag www.montsame.mn

A 600-hectare area of degraded land in the Tsagaan Zuriin River area, located in Khuder soum, Selenge aimag, has undergone successful ecological rehabilitation, reversing years of damage caused by irresponsible mining practices. The scale of restoration is equivalent to planting 12 million trees, marking a major milestone in ecological recovery. The revitalized land has been formally transferred to the Selenge Aimag Department of Environmental Protection for ongoing stewardship.

The rehabilitation initiative was financed by Oyu Tolgoi LLC in alignment with the policy framework of the Ministry of Environment and Climate Change, and executed by local contractors in Selenge aimag. Jinjii Mining Company restored 400 hectares, while Bugant Nandin Company rehabilitated 200 hectares – both returning the natural soil to its original state. According to Oyu Tolgoi, this represents a significant step toward the broader effort to restore the Tsagaan Zuriin River ecosystem.

Before this initiative, Oyu Tolgoi LLC had already restored 400 hectares in the Yalba Valley of Yeroo soum, Selenge aimag, and 215 hectares in Sharyn Gol soum, Darkhan-Uul aimag. These efforts are part of the company’s “100 Million Trees for the Future” campaign, which aligns with Mongolia’s national “Billions of Trees” National Movement. Through this initiative, Oyu Tolgoi has committed to rehabilitating all areas in Selenge aimag affected by abandoned and environmentally harmful mining activities by 2027. Over the past three years, Oyu Tolgoi has planted a total of 35.1 million trees through a combination of initiatives and verified offset programs.

Parliament Approves 2026 Budget Law www.montsame.mn

The State Great Khural (Parliament) of Mongolia ratified the 2026 Budget Law during its plenary session on November 12, 2025.

Under the enacted legislation, the 2026 state budget forecasts total revenue of MNT 31.93 trillion, equivalent to 31.2 percent of GDP. Total expenditure is estimated at MNT 32.98 trillion, or 32.2 percent of GDP, resulting in a fiscal deficit of MNT 1.05 trillion, representing -1.0 percent of GDP.

Key allocations under the 2026 Budget Law include:

MNT 518.62 billion allocated to raise the base salary for teachers.

MNT 190.3 billion earmarked for a 15 percent salary increase for doctors and medical staff.

MNT 145 billion is designated to support an 8.6 percent increase in pensions for the elderly.

A 20 percent increase in both disability pensions and child support allowances, raising monthly payments to MNT 80,000. This adjustment is expected to raise expenditures by MNT 29.3 billion, with total related spending reaching MNT 969.12 billion.

To offset the impact of increased spending, the 2026 budget introduces expenditure rationalization measures, including a reduction of MNT 990.17 billion in current expenditures and MNT 361.14 billion in capital outlays. Specifically, allocations for new equipment have been reduced by 50 percent, with resources redirected toward priority road transport and investment projects consistent with the objectives of the 2026 Development Plan of Mongolia.

In addition to the Budget, Parliament also approved the 2026 budgets for the National Sovereign Wealth Fund, the Social Insurance Fund, and the Health Insurance Fund.

TMK Energy Advances Mongolian CSG Project with Promising Resource Estimates www.tipranks.com

TMK Energy Limited has announced updates on its Gurvantes XXXV CSG Project in Mongolia, highlighting the independent resource estimates provided by Netherland, Sewell & Associates. The project shows significant potential for natural gas recovery, with contingent resources classified into three categories based on confidence levels. This development positions TMK Energy as a key player in Mongolia’s emerging energy market, potentially impacting stakeholders by enhancing the region’s energy supply and contributing to the company’s growth.

TMK Energy Limited operates in the natural gas industry, focusing on the exploration and development of coal seam gas (CSG) resources. The company is primarily engaged in projects in Mongolia, aiming to establish a new energy supply in the region.

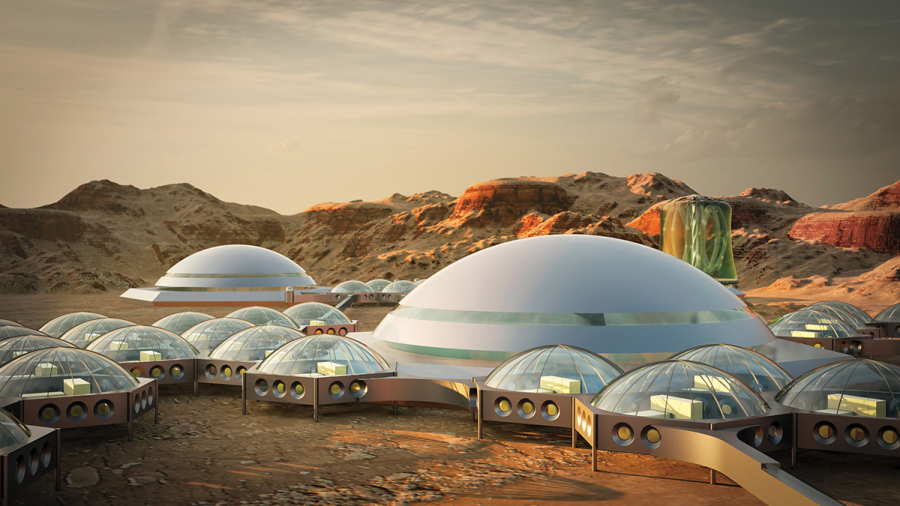

Mars-V camp to simulate life on the Red Planet in Mongolia by 2029 www.kz.kursiv.media

An ambitious project called Mars-V is slated to open in Mongolia’s Gobi Desert by 2029, offering, according to organizers, the world’s most realistic simulation of life on Mars. The site won’t just serve as a tourist attraction — it’s designed as a monthlong experiment in living like a member of humanity’s first expedition to the Red Planet.

Organizers promise a fully immersive experience: capsule-style living quarters equipped with a lab and greenhouse, freeze-dried meals, communication with Earth that includes a built-in signal delay, and a tightly regulated daily schedule that includes meditation, exercise, research, and troubleshooting.

Prospective participants will undergo a rigorous selection process, which includes physical and psychological evaluations, followed by three months of online training. Those who qualify will then form a six-person crew, surrender their phones, and spend a month isolated in the desert — cut off from roads and modern communication. The nearest settlement lies a 10-hour drive away.

The Gobi Desert is considered one of the most «Martian» landscapes on Earth, with vast red sand plains, extreme temperature swings — from 45°C to -40°C — and an arid, otherworldly atmosphere.

The program is scheduled to run during the cold season, from October to March, when temperatures can drop to as low as -30°C. Even the camp’s modular structures draw inspiration from traditional Mongolian yurts, blending local heritage with futuristic design.

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- »