Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

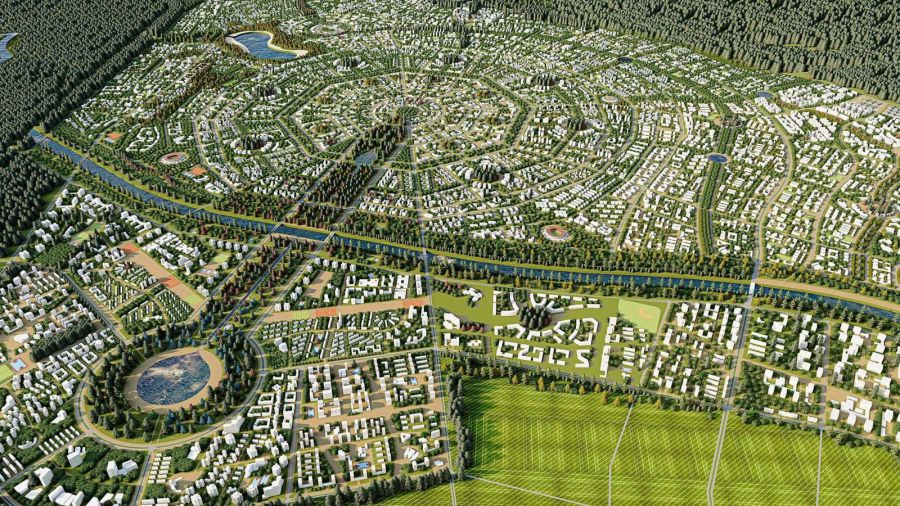

State to pay salaries for ‘Dream Team’ behind Kharkhorum City www.ubpost.mn

The Kingdom of Saudi Arabia Studies Mongolia's Export Potential of Live Animals and Eggs www.montsame.mn

A delegation of the Ministry of Environment, Water, and Agriculture of the Kingdom of Saudi Arabia paid a working visit to Mongolia on April 12-17, 2025.

The delegation, led by Head of the Animal Health Risk Department Nader Mohled Alharbi and Director of the Animal Quarantine Department Saleh Al-Saad met with officials of the Ministry of Food, Agriculture and Light Industry of Mongolia, the General Department of Veterinary Medicine, and the Mongolian Meat Association. The two sides exchanged views on the veterinary system, animal health, and the possibility of supplying live livestock and chicken eggs from Mongolia to the Saudi market.

The Kingdom of Saudi Arabia has a population of 34.4 million and imports about 10 million halal sheep meat annually for consumption. During the “Hajj” or the annual great Islamic pilgrimage, the country needs to import about 2 million live sheep. Therefore, the delegation worked in Mongolia to study Mongolian animal health, veterinary service system, and transport logistics, and agreed on quarantine measures and international certification conditions.

Azorra Delivers Mongolia’s first Embraer E195-E2 to Hunnu Air www.skiesmag.com

Azorra has delivered the first of two new Embraer E195-E2 aircraft to Hunnu Air, marking a new partnership for the lessor and the first E2 to operate in Mongolia.

The E195-E2 delivered from Azorra’s firm orderbook with Embraer will support Hunnu Air as it grows its fleet and expands its route network to key destinations across Asia-Pacific, offering greater capacity and longer-range capability.

John Evans, CEO and founder, Azorra, said: “We are thrilled to deliver Mongolia’s first new Embraer E195-E2 aircraft to our valued partners at Hunnu Air. This is a significant step in the growth of Hunnu Air and a major milestone for the future of aviation in Mongolia. This delivery also reinforces our strong partnership with Embraer. The E195-E2 is a modern, fuel-efficient aircraft that is optimally designed to reduce operating costs and improve efficiencies in existing markets, while facilitating the exploration and development of new markets. As demand for these jets surges across the Asia-Pacific region, we are excited to continue providing our airline partners with innovative fleet solutions.”

Munkhjargal Purevjal, CEO, Hunnu Air, said: “We’ve been an E190 operator since 2019 and the E195-E2 is the perfect extension as we meet growing demand for air travel across Mongolia and beyond. These new generation aircraft will allow us to increase capacity to Haikou, Sanya, and Phu Quoc, expand services to Japan, China, Vietnam, India and South Korea, and introduce scheduled flights to Tashkent. We’re thankful for the support of Azorra and Embraer as the E2 will be integral to our long-term growth.”

April 2025

Martyn Holmes, chief commercial officer, Embraer Commercial Aviation, said: “The entry of the E195-E2 into Mongolia is a key development for the region’s aviation landscape. The aircraft’s advanced technology, low noise levels, unbeatable efficiency, and unparalleled passenger comfort make it the ideal choice for airlines looking to grow strategically while optimizing operational costs. We look forward to supporting Hunnu Air’s strategic growth and thank Hunnu Air for their continued partnership and our leasing partner Azorra for their continued collaboration, combining again with Embraer.”

Azorra continues to work with Embraer to strengthen the E2’s presence in Asia, having previously delivered the region’s first E2 aircraft to Scoot in April 2024. The addition of Hunnu Air to Azorra’s expanding network of airline customers highlights the increasing demand for fuel-efficient, comfortable, new generation aircraft in the region.

This press release was prepared and distributed by Embraer.

K-culture meets the Silk Road as Korean brands and lifestyles take root in Mongolia www.koreajoongangdaily.joins.com

Turn any street corner in the Mongolian capital's downtown, and you can spot Korea's leading convenience store chains — CU and GS25.

Korean influence is certainly having an impact on urban Mongolians, from daily essentials to language and pop culture.

When asked questions in English, locals replied in fluent Korean. K-pop could be heard blasting in convenience stores, and Korean bakery chain Tous Les Jours was seen throughout the city.

The Korea JoongAng Daily was greeted by a familiar scene when visiting a CU store on Amarsanaa Road in downtown Ulaanbaatar on Monday.

The CU store had outdoor signage and an interior layout identical to CU stores in Seoul. As well as a counter plastered in yellow-green and snacks displayed near the counter, the store's signage came in a mixture of purple and yellow-green, just like in Korea.

The nationality of the employees and some of the products on the shelves were the only differences. Along with staples of Korean convenience stores such as Korean instant noodles, beer, rice balls and almonds, the store had some locally sourced products.

As of the end of March, CU had 467 branches in Mongolia, indicating Korea's growing presence in the country.

Is this Ulaanbaatar or Seoul?

In the city’s Khan Uul District, hypermarket chain Emart was bustling with locals regardless of age when the Korea JoongAng Daily visited on Monday afternoon. The parking space was full, and the shelves for Korean foods were relatively empty.

Emart, a leading Korean retailer owned by the Shinsegae Group, has five branches across Ulaanbaatar and aims to open five more by 2030. The retailer entered the Mongolian market in 2016 in partnership with Altai Holding, a Mongolia-based retail group that operates and manages Emart branches in Mongolia.

Inside the store, some students swiftly grabbed banana-flavored milk made by Korean food manufacturer Binggrae from the fridge before it sold out. Only a few packages of fish cakes produced by another Korean food company, Chungjungone, were left, while other food piled up.

“I visited Emart every day when I was in Korea, and that experience led me to shop at Emart in Mongolia,” Khulan, a young woman who stayed in Korea for six months last year, said in Korean while shopping for groceries at the retailer.

A spokesperson from Emart headquarters in Korea told the Korea JoongAng Daily that Mongolian consumers display a high preference for Korean culture, adding that its Mongolian branches allow local people to indulge directly in Korean culture.

Korean influence becomes a lifestyle

However, Emart has the grander ambition to shape mindsets and behavior "in a healthier way," said Javzmaa Lkhagvasuren, CEO of Emart in Mongolia.

Mongolian Emart executives added library-themed spaces to Ulaanbaatar. In this space, Mongolian visitors can freely read Korean and Mongolian books displayed on the shelves. There were books for children and for visitors with deeper academic interests, such as professional journals. New books are added to their collection each year.

“I believe that providing an environment where consumers can easily read books will empower them and the country at the same time,” Lkhagvasuren told reporters, adding that the strategy helped increase consumer satisfaction.

Lkhagvasuren also said Mongolian branches plan to list 100 healthy dishes and reduce the amount of liquor in the stores.

While Emart tries to reshape Mongolian lifestyles, Korean influence has also reached their homes.

About a mile from the Emart branch, high-rise apartments along the Tuul Gol River that crosses the southern part of urban Ulaanbaatar showed that contemporary Mongolians are settling into Korean-style apartments. This trend has been observed since the 2010s, Kim Ki-sun, a professor of Mongolian studies at Hankuk University of Foreign Studies, said.

Apartments in Korea are largely box-shaped buildings of 15 to 20 floors with several units on each floor. Apartment complexes usually have several buildings with public amenities such as gyms, saunas and libraries for residents.

There were several Korean-style apartment buildings under construction in Ulaanbaatar. The Korea Trade-Investment Promotion Agency said some 10 apartment complexes in the Mongolian capital were built by Korean construction companies.

“Mongolians who have been in Korea are fascinated by convenient amenities in Korean apartments, such as gyms, saunas and playgrounds for children,” Kim said, noting that locals admire Korean apartments.

Kim said Mongolian students, migrants and laborers who have lived in Korea, estimated to be around 350,000 over the last 35 years, played a crucial role in spreading Korean-style apartments in Mongolia. He noted that their experience in Korea made construction companies duplicate structures and features of Korean apartments in Ulaanbaatar.

Sister cities, Seoul streets

Acceptance of Korean culture can be attributed to the long shared history and friendly relations between the two countries, Mongolian experts said.

Ulaanbaatar has a 2.1-kilometer-long (1.3 miles) road called “Seoul Street.”

A pavilion decorated with Korean roof tiles stood in an open space. Lamps along the street were decorated with Seoul's city symbols. Several Korean eateries had signboards written in Korean, including the one selling grilled pork.

The street name was coined after Seoul and Ulaanbaatar became sister cities in 1995, a millennium after the royal court during the Koryo Dynasty (918-1392) reportedly sent 10 students to Mongolia in 995. According to Prof. Kim, the record marks the start of the two nations' shared history.

“Korea is one of Mongolia's most prioritized and friendly neighbors,” said Dashdorj Sainbilegt, a Korean studies professor at the National University of Mongolia.

She also said young Mongolians perceive Korea as geographically close since travel times within Mongolia are almost equal to the two or three hours it takes to fly between Seoul and Ulaanbaatar.

“More than 1,000 undergraduates take Korean language courses yearly,” said Sainbilegt. “Elementary and junior high schools in Mongolia now provide Korean language classes as an elective course.”

Korean language courses have become widely available, ranging from college academic courses to short-term evening courses offered by the three King Sejong Institute branches in Mongolia. Korea's Ministry of Culture, Sports and Tourism manages the institute to support Korean linguistic education overseas.

Still, Mongolians believe that there is unexplored potential for synergy between Korea and Mongolia.

Sainbilegt said she hopes Korean influence will expand beyond consumer culture and the service industry as the traditional nomadic country urbanizes.

“I hope Korean corporations will actively participate in Mongolia’s infrastructure-building projects to transfer their expertise and train the Mongolian work force, ultimately strengthening bilateral ties between the two countries."

BY LEE SOO-JUNG [lee.soojung1@joongang.co.kr]

MSM Group became authorized dealer of Snap-on in Mongolia www.msmgroup.mn

MSM Group is pleased to announce that we have officially acquired the authorized dealership rights for the world-renowned Snap-on and its sub-brands in Mongolia, transitioning from the previous representative, “TES Industrial” LLC. This marks an exciting new chapter as we continue to expand and strengthen our operations within the industrial sector.

Snap-on was founded in 1920 and has since become a global leader in designing and manufacturing premium-quality hand tools, power tools, workshop equipment, diagnostic systems, and productivity solutions. Recognized for their precision, durability, and innovation, Snap-on products are trusted by professionals across various industries including automotive and heavy-duty equipment.

With this new partnership, MSM Group is committed to delivering Snap-on’s world-class solutions to the Mongolian market, further enhancing the efficiency and productivity of local industries and we look forward to serving our customers with the excellence and expertise that both MSM Group and Snap-on proudly represent.

Mongolian LGBTQ youth fight for recognition through music, comedy www.cbs19news.com

Mongolian influencer Anudari Daarya looks effortlessly glamorous and carefree in her social media posts -- but the classically trained pianist's road to acceptance as a transgender artist has been anything but easy.

She is one of a growing number of Mongolian LGBTQ youth challenging stereotypes and fighting for acceptance through media representation in the socially conservative country.

LGBTQ Mongolians often hide their identities from their employers and colleagues for fear of discrimination, with a survey by the non-profit LGBT Centre Mongolia showing that only 20 percent of people felt comfortable coming out at work.

Daarya, 25, told AFP she has faced discrimination since she began publicly living as a woman at her arts university, where she said fellow students shunned her and she graduated without a single friend.

"I naively believed future artists and art teachers would embrace my transition," she said.

After graduation, Daarya applied for multiple positions.

She said she waited to hear back about teaching hours at Mongolia's State Conservatory for three months before a contact told her that "the administration is saying someone like you can't work with children".

The Conservatory said in a statement to AFP they had realised they did not have a need to hire new teachers the year Daarya applied.

It selects staff "based on their skills and education without discriminating against religion, sexual orientation, and so on", it said.

Daarya's fortunes changed last year when a video of her giving a private piano lesson went viral.

The online attention transformed her career, with Daarya now working as a model for Mongolian fashion brands in addition to teaching and performing music.

- Power of storytelling -

For Khulan Batbaatar, a lesbian non-binary comedian who performs under the name Kena, performing on stage is a way to tell marginalised communities' stories.

Kena is a member of "Big Sistas", a comedy project founded by human rights activist Zolzaya Batkhuyag.

The Big Sistas are a rarity in the Mongolian comedy scene, which is dominated by men and often features sexist jokes.

Kena spends their time on stage telling relatable jokes about New Year's resolutions and financial troubles, while also sharing stories about their experiences of love and sex as a lesbian.

"When I was growing up, I never saw a happy LGBTQ person," Kena told AFP.

"Every person I used to see as a role model suffered and had a tough life because of homophobia."

As a comedian, Kena says they want to "show the teenagers who follow me as a role model that we can lead a happy and successful life".

Zolzaya said she started "Big Sistas" to raise awareness of gender diversity and the fight for equality.

"When we simply talk and innocently complain (about minorities' struggle), people don't really get it," Kena told AFP.

"But when we talk about our problems in jokes, when your storytelling is polished -- it really works."

- Tough reality -

While performers like Daarya and Kena help provide role models for LGBTQ Mongolians, the reality of life for many in the country remains bleak, activist Tseveenravdan Tsogbat told AFP.

Tseveenravdan is the director of Youth Lead Mongolia, which advocates for the health and rights of sexual minorities.

Discrimination in education settings often leads Mongolian LGBTQ teens -- especially transgender youths -- to drop out of school or be kicked out of their homes by their parents.

This limits their career prospects, forcing LGBTQ youths into minimum-wage jobs where they struggle to afford rent and food.

According to a 2022 survey by LGBT Centre Mongolia, 27 percent of LGBTQ Mongolians made less than the national minimum wage of 420,000 tugrik ($124) a month.

"That's why we seriously tell each other not to come out in the winter," Tseveenravdan said, when temperatures in the country can drop to minus 40 degrees Celsius (minus 40 Fahrenheit).

"When the public sees Daarya, they think the life of transgender people must be gorgeous... but people have no clue about the reality for sexual minorities," he added.

But Anuka Anar, a 22-year-old non-binary resident of Ulaanbaatar, was grateful that there are now a few public figures open about their gender identity.

"Some parents get worried and tell their children to hide who they are," Anuka told AFP.

"They assume homophobia will make their children's lives miserable forever, but when they see public figures from our community, they realise their children can be loved too."

The Cabinet of Mongolia Adopts Resolution on Measures to Increase Coal Exports www.montsame.mn

During its regular session on April 16, 2025, the Cabinet of Mongolia adopted a Resolution on Measures to Increase Coal Exports.

Under the Resolution, Minister of Mongolia and Chair of the National Committee for Port Revival Tulga Buya, the Minister of Road and Transport Delgersaikhan Borkhuu, and relevant officials were instructed to promptly organize the immediate passing of coal, purchased by enterprises that have signed a long-term Coal Sale and Purchase Agreement with "Erdenes Tavan Tolgoi" JSC, through a special gate. The management of "Erdenes Tavan Tolgoi" JSC was also assigned to prepare coal for sale to enterprises that have signed the Agreement, increase production, and carry out shipments smoothly and promptly.

The coal loading and unloading area of Mongolia's main export port, the Gantsmod Port, has been overloading due to enterprises not wishing to sell their coal due to declining coal prices and uncertainty, which is causing the slowdown of exports. In the first quarter of this year, coal exports of Mongolia amounted to 17.5 million tons, a decrease of 3.3 percent compared to the same period last year. In addition, the decline in coal prices is negatively affecting the trading of mining products on the exchange. “Erdenes Tavan Tolgoi” JSC held a total of 47 exchanges on the exchange in the first quarter of this year, of which 12 were successful and 35 were unsuccessful.

Therefore, the Resolution on Measures to Increase Coal Exports was issued by the Cabinet so that the coal sold under the long-term Coal Sale and Purchase Agreement, concluded by the “Erdenes Tavan Tolgoi” JSC, promptly passes through a special border crossing.

Trump’s Second Coming: Mongolia Watches the Chaos With Caution www.thediplomat.com

For Mongolia – a small democracy navigating life between two resurgent authoritarian powers – Trump’s worldview poses a silent but serious challenge.

As the world is grappling with the shocks of Donald Trump’s return to the White House, Mongolia finds itself reflecting on the implications of a second Trump presidency – not as an abstract geopolitical puzzle but as a small democracy navigating life between two resurgent authoritarian powers.

Trump’s first presidency was not merely unorthodox; it disrupted decades of assumptions about U.S. global leadership. His transactional view of alliances, affection for strongmen, and erratic policies deeply unsettled many in Washington and abroad. For Mongolia, a country whose foreign policy is anchored in its “third neighbor” strategy to diversify relationships beyond China and Russia, Trump’s worldview posed a silent but serious challenge.

Mongolia has no illusions about its geographic constraints. Our two neighbors – Russia and China – have increasingly aligned in opposition to the Western liberal order. Trump, however, seems determined to exploit perceived rifts between them. His desire to court Russia in a bid to isolate China ignores the reality that Moscow and Beijing are now, for all practical purposes, strategic brothers. Their coordination – from military exercises to diplomatic posturing – has only deepened since Trump first took office. To many Mongolian observers, it is clear that Trump has misread the nature of their partnership. Worse, his misreading carries global consequences.

Trump’s foreign policy seems to be often guided less by doctrine than impulse. His open admiration for leaders like Russia’s Vladimir Putin, his public disdain for multilateralism, and his skepticism toward traditional alliances all suggested a United States increasingly willing to retreat from its global responsibilities. For Mongolia, that raised concerns. Our survival strategy hinges on an engaged international community and a predictable rules-based order. The Trump-era unpredictability shook that foundation.

Beyond geopolitics, Trump’s economic nationalism is rattling small economies worldwide. His tariff wars and contempt for trade agreements are injecting needless volatility into global markets. Mongolia, a resource-exporting nation vulnerable to external shocks, is watching warily as China-U.S. tensions escalate under Trump’s leadership. If such conflicts continue to intensify without an off-ramp for either side, Mongolia’s economic stability could again be collateral damage.

Moreover, Trump’s personal style – marked by grievance, vengeance, and nostalgia – invites comparisons to autocrats. His continued insistence that the 2020 election was stolen, his attacks on institutions, and his disdain for critics reflect not democratic resilience but democratic backsliding. To those of us in Mongolia working to preserve democratic gains, Trump’s behavior is a cautionary tale.

At home, Trump fractured his nation, remade U.S. politics in his image, and encouraged political violence. Internationally, he pulled the U.S. from key agreements, alienated allies, and undermined trust. As one American analyst put it, Trump left the world with a sense that the U.S. could no longer be counted on.

In Mongolia, we understand the cost of global disarray. We rely on steady diplomacy, open markets, and consistent rules. Trump’s brand of disruption shakes those very pillars. It is emboldening the forces that want to see small democracies like ours squeezed, silenced, or sidelined.

And yet, Mongolia remains pragmatic. We do not choose sides in partisan battles abroad. We will work with any administration that respects our sovereignty, supports our development, and values our democratic voice. But we can only perceive Trump’s adventurism not with enthusiasm, but with unease.

By Bayarkhuu Dashdorj

Mongolia Considers Acquiring 34% Stake in Eight Potential Strategic Deposits www.news.mn

Mongolia may take a 34% stake in Xanadu Mines Ltd.’s Kharmagtai copper-gold project after a proposal to classify the asset as a strategic deposit was submitted to the government, according to Government’s Plenipotentiary Representative Batzandan Jalbasuren. The move, announced on April 15, could bring the ASX-listed explorer’s flagship asset under partial state ownership if approved.

Strategic deposits in Mongolia are defined as mineral resources critical to national economic and developmental interests. Under existing law, the government can acquire a 34% to 50% stake in such deposits without compensation. Of the 16 deposits currently designated as strategic, seven are state-owned. Lawmakers are now pushing to expand the list to include high-potential assets such as Kharmagtai, and authorities are working to formalize and enforce these rights more actively.

Plenipotentiary Representative Batzandan, appointed to lead the initiative, is focused on expanding the strategic deposit list and determining the appropriate level of state ownership in each case.

Zijin Mining, which owns 19.4% of Xanadu and holds a 50% stake in the Kharmagtai joint venture, had been expected to increase its involvement through a proposed transaction. However, that plan now appears to be on hold as discussions continue.

Under Mongolia’s Mineral Law, no entity may hold more than 34% of the shares in a company that owns a strategic deposit, either directly or through related parties. If Kharmagtai is classified as strategic, this restriction could complicate the existing partnership between Zijin and Xanadu.

According to Batzandan, the proposal includes a total of eight deposits for strategic designation. Alongside Kharmagtai, the list features Bayan Khundii and Altan Nar – two projects owned by Toronto-listed Erdene Resource Development.

Price of Gold Jumps by USD 693.9 per Ounce Compared to 2024 www.montsame.mn

In the first quarter of 2025, Mongolia traded with 128 countries, with exports reaching USD 3 billion and imports USD 2.5 billion, gaining USD 465.1 million in profit, according to the National Statistics Office of Mongolia.

In the first three months of 2025, imports rose by USD 133.4 million compared to the same period last year. This increase was driven by purchases from foreign countries., These include USD 73.6 million on passenger vehicles, USD 21.9 million on diesel fuel, USD 21.3 million on auto parts, USD 18.3 million on trucks, and USD 11.7 million on cell phones.

Imports consisting of mineral products, vehicles and mechanical products, consumer electronics, vehicles, and spare parts make up 74.5 percent of total imports.

Copper ore and copper concentrate ore exports rose by USD 291.8 million, zinc ore and zinc concentrate by USD 39.7 million, and fluorite and fluorspar by USD 29.3 million.

The price of gold rose by USD 693.6 per ounce and copper ore and copper concentrate by USD 291.5 per ton compared to the same period in 2024.

Coal made up 48.3 percent of exports to the People's Republic of China, and copper and copper concentrate made up 33.5 percent. Raw and refined gold constituted 99.3 percent of total exports to Switzerland.

Iron ore and iron concentrate prices fell by USD 7.6 per ton and coal by USD 47.1 per ton.

In the first three months of 2025, Gashuun Sukhait cross-border railroad port was the main gateway for coal exports, amounting to 49.1 percent. This is down by 3.4 percentage points compared to the same period in 2024. Six countries make up 86.3 percent of the total imports to Mongolia. Specifically, 33.1 percent from China, 27.6 percent from Russia, 13.8 percent from Japan, 4.9 percent from the U.S., 4 percent from Korea, and 2.9 percent from Germany.

Of the total imports from Russia, oil accounted for 76.7 percent. Vehicles made up 81.4 percent of imports from Japan and 10.2 percent from China.

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- 1715

- 1716

- 1717

- 1718

- 1719

- 1720

- 1721

- 1722

- 1723

- 1724

- 1725

- 1726

- 1727

- 1728

- 1729

- 1730

- »