Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

Role of education in reducing poverty discussed www.montsame.mn

Ulaanbaatar /MONTSAME/ Asia-Pacific regional seminar on Achieving SDGs being held in Ulaanbaatar continued with the session titled ‘Education as a critical precondition to break the cycle of poverty’. The session was moderated by MP N.Uchral, Member of the Bureau of the Standing Committee on UN Affairs, IPU.

Sustainable Development Goal 4 aims to ensure inclusive and equitable quality education and promote lifelong learning opportunities for all. Director of the UNESCO Beijing Cluster Office Ms. Marielza Oliveira noted that education is key to achieving all the SDGs. She highly appreciated Mongolia’s achievement in education sector and expressed gratitude for introducing new approach to educational services suitable for herders. In her presentation, Ms. Marielza Oliveira highlighted the link between progress in education and sustainable way of living, poverty reduction and economic growth that does not leave anyone behind. Investing in education will help raise climate change awareness, prevent violence, reduce crime, improve health, nutrition and gender equality, innovate and transform economies, providing skills for green jobs. For education to be transformative in support of the new sustainable development agenda, ‘education as usual’ will not suffice, she noted.

Minister of Education, culture, Science and Sports Yo.Baatrabileg delivered presentation on ‘Challenges and Implementation of the SDGs’. As reflected in the Government Action Plan for 2016-2020, Mongolia aims to provide every child with preschool education, develop secondary education system in line with international standards, ensuring quality, improve the vocational education and higher education system and develop lifelong education system. He also emphasized that Mongolia’s investment in early childhood education is among the highest rate in the world, according to the global report by UNICEF ‘A world Ready to Learn’. However, children of remote rural areas, suburban districts and newly settled residents still not fully enrolled in schools and kindergartens.

Following the presentations, representatives of the IPU member states shared the challenges they face in education sector, measures taken in this regard and their experiences in reducing poverty through education.

EU Day Mongolia takes place www.montsame.mn

Ulaanbaatar /MONTSAME/ On the occasion of the 30th Anniversary of the establishment of diplomatic relations between Mongolia and European Union, the Delegation of the European Union to Mongolia hosted the EU day Mongolia on May 26 at the Sukhbaatar square. Present at the event which was organized for the first time, were Ambassador Extraordinary and Plenipotentiary of the European Union to Mongolia Traian Laurentiu Hristea, Ambassadors and diplomats of 15 EU member states to Mongolia, Deputy Minister of Foreign Affairs B.Battsetseg and Governor of the capital city and Mayor of Ulaanbaatar S.Amarsaikhan.

Ambassador Traian Hristea said “EU and Mongolia have traveled a long road over the past three decades. In 1989 when diplomatic relations were officially established between the two sides, EU was a small Union with no common currency, unified foreign policy or even a single market and Mongolia was on the threshold of democracy. The sides have established stronger partnership with common fundamental principles. EU is the third biggest trade partner of Mongolia although we are geographically very distant. As the Ambassador of EU to Mongolia, I will provide consistent support to the reforms of the judicial and legal systems and civil service, and develop projects mainly on promoting SMEs, ensuring inclusive growth through mining revenues, and combating climate change”

The event provided the public with an opportunity to get to know the EU member states through their tradition and culture, receive detailed information and advice on studying and travelling in the countries and getting Schengen visa, visit a trade fair of EU countries' entities, as well as to enjoy the countries’ cuisine and art performances. Moreover, during the event, information was given on over 20 EU-funded projects being implemented in Mongolia.

EU is Mongolia’s third neighbor, according to the Concept of Mongolia’s foreign policy. Thus, Mongolia has been working on intensifying its relations with EU and its member states in all possible areas. For instance, a meeting of the Ambassadors of EU member states has been taking place regularly in Ulaanbaatar since 2009. Establishment of the Office of the Delegation of the European Union to Mongolia in 2017 opened up an opportunity to elevate bilateral relations and cooperate more efficiently in many more areas.

President checks infrastructure construction process of oil refinery www.montsame.mn

Ulaanbaatar/MONTSAME/. On May 24, President Kh.Battulga got acquainted with the process of infrastructure construction of the oil refinery being built in Altanshiree of Dornogobi aimag.

The works to construct oil refinery in Altanshiree launched in June, 2018 and infrastructure constructions started. On May 24, 2019 the construction of 27-km railway between Sainshand and the construction site of oil refinery has been completed, reported D.Jigjidnyamaa, chief of Ulaanbaatar Railway JVC.

According to D.Jigjidnyamaa, the railway is to play an important role in supplying Mongolia’s fuel needs and is a start of the horizontal axis railroad.

Now, it will be continued by constructions of more infrastructure works, such as auto roads and towers and electrical cables of high tension along the railway. Soldiers of military unit No: 7780 are now working on the construction of 18.8 km high-capacity road.

During his rural trip, President Kh.Battulga visited the military unit No:7780 where he wished success to their works.

EBRD spends EUR 70 million this year www.montsame.mn

Ulaanbaatar /MONTSAME/ Prime Minister U.Khurelsukh today received Alain Pilloux, Vice President of the European Bank for Reconstruction and Development (EBRD). PM U.Khurelsukh expressed his gratitude to the EBRD on spending EUR 1.7 billion for developing private sector in Mongolia over the past 20 years.

The EBRD has made financing of EUR 70 million to Mongolia since the beginning of 2019 and several projects and programs will be carried out in rural areas, said EBRD Vice President Alain Pilloux.

The sides agreed that reconstruction of the road Ulaanbaatar-Darkhan, which takes important position in cooperation, should be completed in the scheduled time. Moreover, the sides shared opinions on upgrading governance in mining sector and cooperating in the areas of infrastructure, agricultural processing industries, farming, animal husbandry, energy, heat supply and tourism in the future.

Innovative technology and social interaction oriented Nest High School opens soon in Ulaanbaatar city www.mongolianbusinessdatabase.com

Infinite Solutions LLC in collaboration of specialists from Stanford University, Facebook, and Amazon opens Nest High School. Nest is striving to provide in-depth knowledge with a prime focus on not only theoretical knowledge, but also hands-on practical experience on AI, blockchain, and software programming.

Open door event was held on May 25, 2019 at Chinggis Khan hotel last week. The event covered information about the school, education program, and other technology trend discussions

Mongolia green lights Aspire’s coal reserve estimates www.thewest.com.au

Metallurgical coal developer Aspire Mining has received the thumbs up from the Mongolian Mineral Reserve Council, which approved the total ore reserves estimate for its Ovoot Early Development Project, or “OEDP”.

In a comprehensive update, the company also outlined that approvals for its Mongolian-compliant Ovoot Feasibility Study updated with the OEDP PFS results were also expected shortly from the same Government agency.

These milestones form the technical basis for all other project permitting and enable Aspire to commence the related environmental studies.

The company has also initiated community engagement and public consultation works as part of the wider environmental and social impact studies and project management plans.

Critically, community stakeholders have combined the Erdenet to Ovoot haul road construction as part of the OEDP mine development works in their broader considerations for support of the project.

Given these developments, Aspire revealed that the OEDP DFS is now expected to hit the streets by the end of 2019 and that it was still on track for the first production of washed coking coal in the first half of 2021.

The company has also entered into a Cooperation Agreement with Ulaanbaatar Tumur Zam Joint Stock Company, or “UBTZ”, who is the operator of the Trans Mongolian rail network, which will guarantee rail capacity for Aspire’s OEDP coal transportation to the Mongolian-China border, 1,500km to the southeast.

Supporting this development, company management recently visited several coal handling and preparation plants in China, which outlined some efficient and low water and power consuming options to treat its Ovoot products.

Aspire has also met with the Mongolian Government owners of the large Tavan Tolgoi coking and thermal coal deposits in the southern part of the country, where synergies may exist for the blending of Tavan’s non-coking coal resources with Ovoot’s premium coking coals.

Preliminary work showed that an attractive value adding opportunity exists for combining the products from both deposits, which will also benefit from a recent initiative to construct a rail line from Tavan Tolgoi to an existing railhead at Sainshand to the east northeast.

The beauty is that Aspire’s Ovoot coal products will travel through Sainshand on route to China, which makes the small city an ideal location for blending of the future coal products from the separate mines, where an industrial park development has been touted.

During April, Aspire said that Chinese State-owned enterprise China Gezhouba Group had provided a Letter of Interest to construct the critical haul road that will link the OEDP to an existing railhead at Erdenet.

Second Range States Meeting of the CMS Central Asian Mammals Initiative www.cms.int

The CMS Secretariat is very pleased to announce that the Ministry for Environment and Tourism of Mongolia has kindly offered to host the Second Range States Meeting of the CMS Central Asian Mammals Initiative (CAMI) on 28-30 August 2019 in Ulaanbaatar, Mongolia as part of the Mongolian Wildlife Week.

The main objectives of this Range States Meeting are

to discuss and review the findings of the above-mentioned study, and to develop a set of recommendations to promote transboundary conservation in those areas,

to review implementation of the current Programme of Work 2014-2020; and

to develop and agree on a new Programme of Work for CAMI covering the period 2020-2026 and update Resolution 11.24 for submission to CMS CoP13 which will take place in February 2020 in India.

The meeting is jointly organised by the CMS Secretariat, the Mongolian Government, the International Academy for Nature Conservation of the German Federal Agency for Nature Conservation (BfN INA) as well as the Michael Succow Foundation with funding from the German Ministry of the Environment, Nature Conservation and Nuclear Safety (BMU).

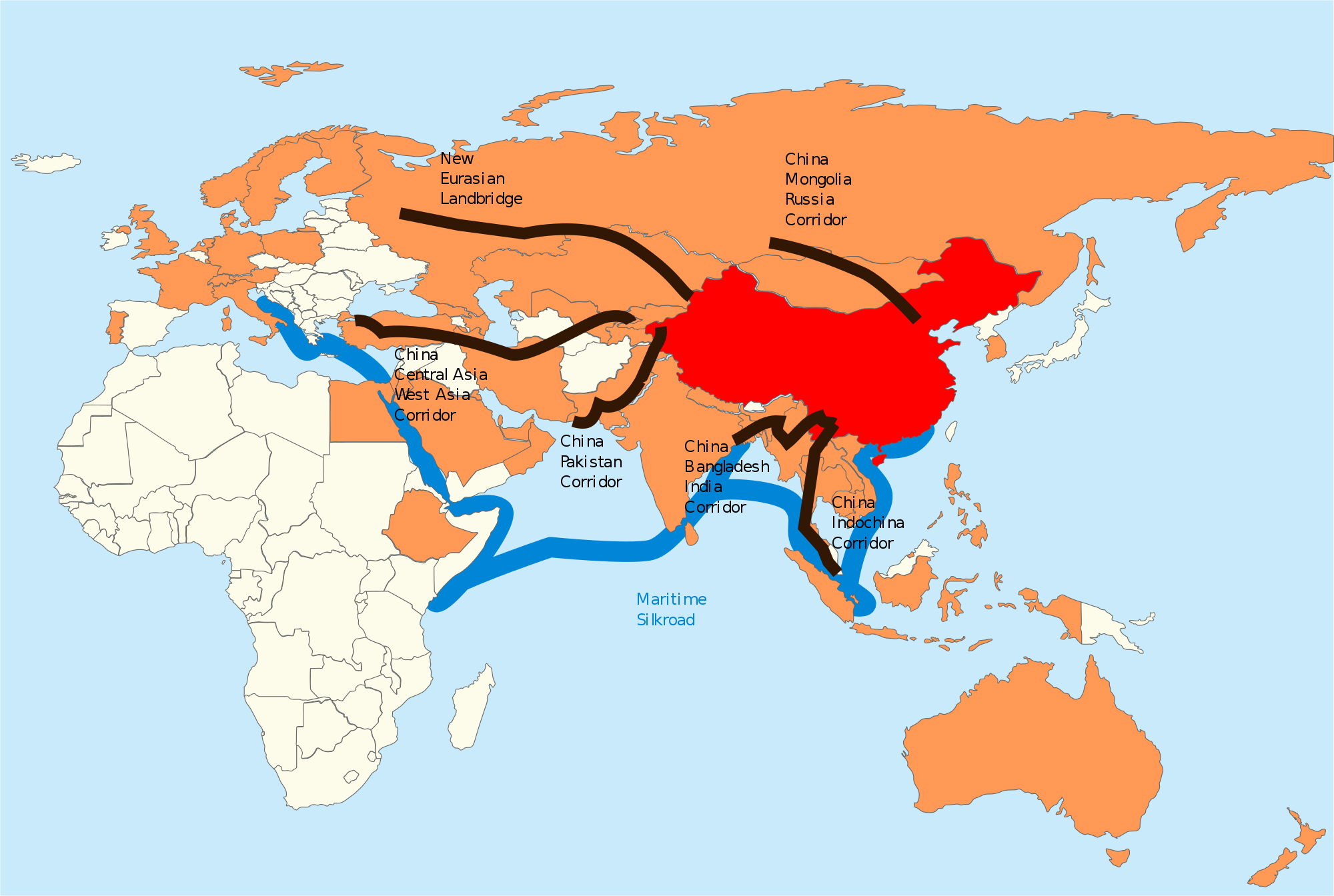

Belt and Road to boost China’s growth over next four decades www.rt.com

China’s Belt and Road Initiative (BRI) will likely provide significant business opportunities to global economies, according to participants of the 8th China Business Forum in London.

They said that the world’s second largest economy, China, is poised to grow strongly in the next two to four decades thanks to the BRI.

“Growth is going to continue to come from China for the next 20, 30, maybe 40 years ... The greatest growth opportunity in the world is the Belt and Road Initiative,” Stephen Perry, chairman of the 48 Group Club, was cited as saying by China Daily. Perry made a keynote speech at the forum which was organized by London Business School.

“What China is trying to do is to free the productive capacity and consumer demand from China, across Central Asia, central Europe, and down into Africa,” he said, adding it is in the United Kingdom's interests to take part in the initiative.

Participants of the forum discussed key developments of the Chinese and European economies, including Italy joining the BRI. They also talked about trade deals and innovative business practices between China and Europe.

China’s BRI megaproject (dubbed the new Silk Road), which was announced six years ago by President Xi Jinping, covers 152 countries in Europe, Asia, the Middle East, Latin America, and Africa. It is expected to significantly boost global trade, and cut trading costs by half for the countries involved.

The International Monetary Fund has recently called the trade route a “very important contribution” to the global economy, saying that it promotes regional cooperation and connectivity in trade investment, human mobility, and finance.

President visits Zuunbayan for upcoming railroad project www.zgm.mn

President Battulga Khaltmaa visited the Zuunbayan railway station in Dornogovi province to get an au fait with the construction of the railroad. The 336th Armed forces have received the president. The Zuunbayan station was built in 1984 and has three lanes that are 8501,100 meters in length and operates with eight staff.

The total length of the Tavantolgoi-Zuunbayan railroad is 414.6 km and the opening was held at its 290th km checkpoint. From this point, the first 50 km railway in the Tsogttsetsii direction of Umnugovi province construction will be situated, said the Chief Executive Officer of the Mongolian Railways SOE.

However, due to the increased traffic pressure caused by the Tavantolgoi railroad, it is necessary to reform the Sainshand-Zuunbayan 47 km railroad. According to the development plan, it will start its maintenance next year. Ulaanbaatar Railway JV will fund the required MNT 37.7 billion of the construction.

The groundbreaking ceremony of the Tavantolgoi-Zuunbayan railway that will be built under the “State railway policy” in Mandakh soum, Dornogobi province took place on Friday. President of Mongolia emphasized at the ceremony, “In this land-locked country, this infrastructure is important to the economy. Erdenes Tavan Tolgoi JSC is investing in this project from its profits of 2018. This investment is not a foreign project, it is our income earned without a burden on foreign workers. This is what we are giving to ourselves.”

Zuunbayan is a village in Dornogovi province and is one of Sainshand soum's administrative districts. Currently, more than 3,000 people live in the area. It is expected that the population will grow 2-3 times and will become a major settlement center when the railway is completed.

Former Mongolian President to run in Khentii by-election www.news.mn

Former President N.Enkhbayar has been nominated as the Mongolian People’s Revolution Party candidate for the forthcoming Khentii by-election. The nomination was approved earlier today (24 May) at a congress of the party. Over 91 percent of members who attended the congress backed his nomination. N.Enkhbayar served as Prime Minister of Mongolia from 2000 to 2004, as Speaker of Parliament from 2004 to 2005, and as President of Mongolia from 2005 to 2009.

A total of 11 parties have registered to participate in the by-election in Khentii Province, which will be held on 30 June. Before this, all parties must submit their nominations to the General Election Commission.

The previous incumbent, D.Gantulga from the Mongolian People’s Party, won his seat in the State Great Khural from the 42nd parliamentary district in June 2016. However, he was accused of raping a 25-year-old female student at her home in June 2017. D.Gantulga denied the accusation saying that everything was consensual and the rape allegation was ‘politically’ motivated. Nevertheless, he tended his resignation in 2018.

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- »