Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

China and Mongolia sign major infrastructure deal www.news.mn

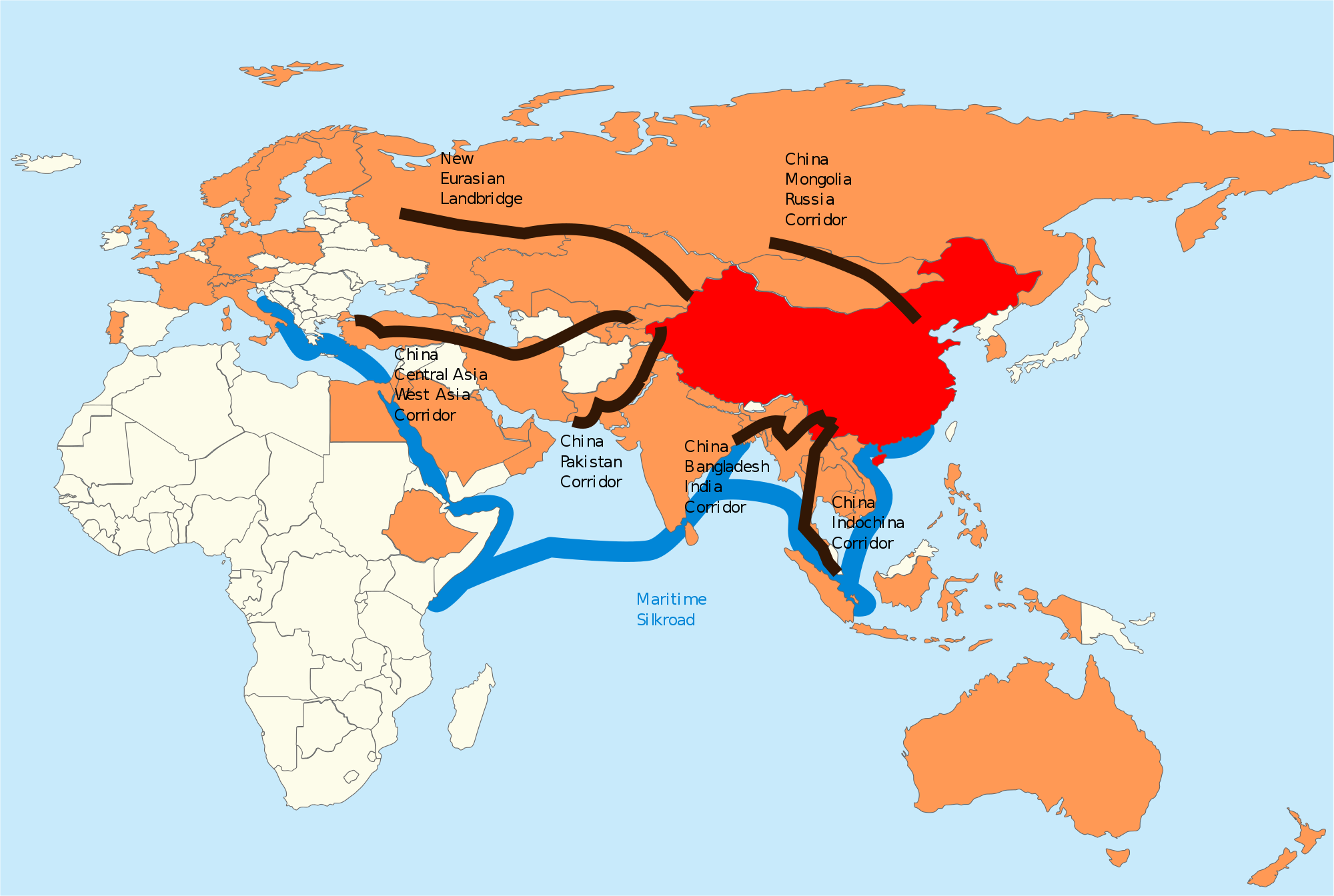

China and Mongolia have signed a cooperation plan on promoting the alignment of the China-proposed Belt and Road Initiative (BRI) with Mongolia’s Development Road Programme. The signing ceremony took place in Beijing on Thursday 25 April.

Chinese President Xi Jinping and Mongolian President Kh.Battulga witnessed the signing after their talks. Kh.Battulga is in China for a state visit and attending the Second Belt and Road Forum for International Cooperation (BRF) scheduled for April 25-27.

Xi called for more efforts to align the BRI with the Development Road Programme and promote the building of the China-Mongolia-Russia economic corridor.

Proposed by Xi in 2013, the BRI comprises the Silk Road Economic Belt and the 21st Century Maritime Silk Road, and aims to build trade and infrastructure networks connecting Asia with Europe and Africa along and beyond the ancient Silk Road routes.

Under the BRI, China, Mongolia and Russia signed an agreement in 2016 to build an economic corridor linking the three neighbours and boost transportation connectivity and economic cooperation in border regions.

The Chinese and Mongolian governments signed a memorandum of understanding on BRI cooperation during the first BRF in May 2017.

Beijing defends Huawei amid row over role in UK's 5G network www.bbc.com

The UK should make "independent" decisions about whether to let Huawei help build its 5G network, according to China's ambassador in London.

The US, Australia and New Zealand say the Chinese firm is a security risk because of its ties to the state.

But writing in the Sunday Telegraph, Liu Xiaoming said Britain should resist pressure from other nations.

He said risks should be taken seriously but added the company had enjoyed a "good track record on security".

Last week, the Daily Telegraph reported the UK had agreed to allow Huawei limited access to help build Britain's new 5G network, amid warnings about possible risks to national security.

The paper also reported that various ministers had raised concerns about the plan.

But defending Huawei, Mr Liu said: "Countries of global influence, like the UK, make decisions independently and in accordance with their national interests.

"When it comes to the establishment of the new 5G network, the UK is in the position to do the same again by resisting pressure, working to avoid interruptions and making the right decision independently based on its national interests and in line with its need for long-term development."

Meanwhile, Britain's top civil servant has demanded ministers co-operate with his inquiry into the leaking of discussions about Huawei at the National Security Council.

Sir Mark Sedwill wrote to ministers on the council and their special advisers after details of the meeting appeared in the media.

Much of the attention has focused on five ministers who were said to have voiced objections to the Huawei decision - Home Secretary Sajid Javid, Foreign Secretary Jeremy Hunt, Defence Secretary Gavin Williamson, International Development Secretary Penny Mordaunt and International Trade Secretary Liam Fox.

All five, however, have either publicly denied being the guilty party or let it be known through aides that they were not responsible.

Cabinet Secretary Sir Mark, who is also the National Security Adviser, is leading the internal inquiry.

Putin vows to connect Russia’s Northern Sea Route with China’s Maritime Silk Road www.rt.com

A global shipping lane could connect East Asia and Europe if China’s Maritime Silk Road joins Russia’s Northern Sea Route, Vladimir Putin told world leaders as they gathered for a Belt and Road meeting in Beijing.

Russia is doing its utmost to invest in its Northern Sea Route, a major maritime lane spanning between the Atlantic and Pacific oceans, but much more could be done in the future, Putin said. “We are considering connecting it with the Chinese Maritime Silk Road,” the president explained.

If that ambitious effort succeeds, “a global and competitive route connecting northeastern, eastern and southeastern Asia with Europe” will emerge. All countries taking part in the Belt and Road Initiative are therefore encouraged to embark on the project.

Inspired by the historic trade routes that connected Europe to East Asia, Beijing’s Maritime Silk Road project makes up the overseas portion of its Belt and Road Initiative by linking Chinese ports to ones in Europe, Southeast Asia, the Middle East, and East Africa. However, routes passing through disputed territories in the South China Sea could potentially raise geopolitical tensions with neighboring Vietnam, the Philippines Malaysia, and Taiwan if left unresolved. The waterway sees $5 trillion in trade pass through it every year.

UN expert to visit Mongolia to assess situation of human rights defenders www.ohchr.org

GENEVA (26 April 2019) – The UN Special Rapporteur on the situation of human rights defenders, Michel Forst, will undertake his first official visit to Mongolia from 30 April to 13 May 2019.

"As the Government of Mongolia is considering a draft law to protect human rights defenders, my visit is particularly timely," said the UN expert. "I look forward to fruitful discussions with executive representatives, as well as officials from the legislative and judicial branches.

"I will also meet with human rights defenders to understand the situation they face in Mongolia and to explore how my mandate can better support their work."

Highlighting the recently adopted Human Rights Council’s resolution which recognises the key role played by human rights defenders in the protection of the environment, the Special Rapporteur said that his visit would also allow him to look into the specific situation of environmental human rights defenders.

"During my visit, I intend to analyse how the government of Mongolia is ensuring that people and communities can safely promote and defend human rights and the environment," said Forst. "This seems particularly important in a country where the population has historically always lived in harmony with nature, but is now facing rapid industrial growth, urbanisation, mining and other extractive activities that impact on their rights."

During his two-week visit, at the invitation of the Government, the human rights expert will meet Government officials, human rights defenders and representatives of civil society, and the business sector, in Ulaanbaatar areas and Dornogovi aimag.

Forst will present his preliminary observations on the visit at a press conference on Monday 13 May 2019, at 11 am local time, in the UN Auditorium, UN House, UN Street-14, Sukhbaatar District, Ulaanbaatar. Access will be strictly limited to journalists.

The Special Rapporteur will present a comprehensive report of this visit to the UN Human Rights Council in March 2020.

ENDS

Mr. Michel Forst (France) was appointed by the Human Rights Council as the UN Special Rapporteur on the situation of human rights defenders in 2014. Mr. Forst has extensive experience of human rights issues and specifically of the situation of human rights defenders. He was the Director General of Amnesty International (France) and Secretary General of the first World Summit on Human Rights Defenders in 1998. He is a former UN Independent Expert on the human rights situation in Haiti.

The Special Rapporteurs are part of what is known as the Special Procedures of the Human Rights Council. Special Procedures, the largest body of independent experts in the UN Human Rights system, is the general name of the Council’s independent fact-finding and monitoring mechanisms that address either specific country situations or thematic issues in all parts of the world. Special Procedures’ experts work on a voluntary basis; they are not UN staff and do not receive a salary for their work. They are independent from any government or organization and serve in their individual capacity.

UN Human Rights, Country Page: Mongolia

The Special Rapporteur is mandated to conduct official visits to States on their invitation. These visits provide an opportunity to examine in detail the role and situation of human rights defenders in the country, to identify particular problems and to make recommendations on how these could be resolved. By the nature of the mandate, the Special Rapporteur is required to look critically at the situation of human rights defenders in a country. Nevertheless, the process is intended to provide an independent and impartial assessment which will be of use to all actors in strengthening both the contribution of defenders to human rights and their protection.

Issues raised during such visits include: violations committed against human rights defenders; challenges to the "environment" within which defenders conduct their human rights work, including freedoms of association and expression, access to funding and the support to defenders provided by domestic legislation; and efforts undertaken by the authorities to protect human rights defenders from violations.

A few months after each visit, the Special Rapporteur issues a report on the visit indicating, among other things, main concerns and recommendations for action. The report is then formally presented by the Special Rapporteur at the Human Rights Council.

For additional information, please contact: Thibaut Guillet (+41 22 917 9158 / +41 22 79 752 0486 / tguillet@ohchr.org)

For media inquiries related to other UN independent experts: Jeremy Laurence (+ 41 22 917 9383 / jlaurence@ohchr.org)

...

Cooperation agreements signed between Mongolian and Chinese companies www.montsame.mn

Beijing /MONTSAME/ Within the framework of the President’s state visit to the People’s Republic of China, private entities of Mongolia and China signed following agreements.

- Special credit agreement on the construction of 20.9 km road from Gachuurt crossroad to Nalaikh-Choir crossroad

- Memorandum of Understanding between the Ministry of Education, Culture, Science and Sports of Mongolia and the National Radio and Television Administration of China

- Agreement between ‘Ulaanbaatar Railway’ JCS and China Railway General Company on exchange of digital data on international freight forwarding

- General Cooperation Agreement between Erdenes Steel LLC and Sinosteel Equipment and Engineering Co., Ltd. on the Coke and Steel Plant project in Mongolia

- Agreement between Tsetsens Mining and Energy LLC and Sinosteel Equipment and Engineering Co., Ltd. on the construction of the Buuruljuut coal power plant

- ‘New Amgalan town’ project agreement between Gangar Invest LLC and SAMS Engineering China LLC

- Cooperation agreement between Moshea Eco energy LLC and China National Technical Import and Export Corporation

- Cooperation and trade agreement between Ish Noyon Badrakh LLC and Haifu Accumulator LLC of Hebei province of China

- MoU on cooperation between the New World Union and Gobi Bear Foundation

$13.6B record-breaking solar park rises from Dubai desert www.cnn.com

Under the Arabian sun, a monumental construction effort is making headway. Located deep within Dubai's desert interior, the Mohammed Bin Rashid Al Maktoum Solar Park -- named after the emirate's ruler and the UAE's vice president and prime minister -- continues to grow and has just passed another milestone.

In its eighth year of development, satellite images give a sense of scale already: miles of photovoltaics arranged along neat east-west lines, their uniformity at odds with the creases and crinkles of the sands surrounding the energy plant. Once finished, Dubai Energy and Water Authority (DEWA) told CNN the 50 billion-dirham ($13.6 billion) investment could power as many as 1.3 million homes, reducing carbon emissions by 6.5 million tonnes annually.

First announced in 2012 and with a scheduled completion date of 2030, the 5,000-megawatt solar park will take three times as long to finish as the Burj Khalifa. Phases one and two, which are already complete, comprised 2.3 million photovoltaic panels with a capacity of 213 megawatts. Phase three, deep in construction, adds over 3 million photovoltaics and another 800 megawatts, and will be completed in 2020, say DEWA.

The untold story of Dubai's first skyscraper

But after years of spreading out across the desert floor, the solar project is now rising upward with phase four -- perhaps the most ambitious development yet.

After breaking ground in March 2018, the base is now complete for what DEWA claims will be the tallest concentrated solar power (CSP) tower in the world.

It will use mirrors called heliostats to focus sunlight at the top of the tower, in order to heat up a flow of molten salts. The heat is used to power steam turbines, generating electricity.

"Typically, CSP will have efficiencies which are slightly higher than photovoltaics (PVs)," Christos Markides, professor of clean energy technologies at Imperial College London, told CNN. CSP stores energy as heat rather than in batteries. "Thermal energy storage is something like 10-times cheaper than electrical energy storage," he explained. "That gives that particular technology an advantage."

Expo 2020 Dubai plans to bring sustainable architecture home

Practically speaking, it means CSP can continue to create electricity even without the sun and well into the night. Dubai's tower can store heat for 15 hours and will be able to provide power 24 hours a day, said DEWA. The CSP tower will top out at 260 meters (853 feet) when completed, DEWA added, and will be surrounded by 70,000 heliostats.

In addition to the 100-megwatt CSP tower, phase four will supply another 850 megawatts of power via parabolic troughs (another form of CSP) and photovoltaics. It was recently announced that phase five's 900 megawatts of photovoltaics will be commissioned in stages starting 2021, while remaining installations to bring the park up to its end goal of 5,000 megawatts are still in planning.

With a capacity of 1,963 megawatts, phases one to four alone put the Mohammed Bin Rashid Al Maktoum Solar Park high on the list of largest-capacity solar parks in development around the world. The Ladakh Solar Farm in India will produce 3,000 megawatts when operational in 2023, per the World Economic Forum. At the time of writing, the 1,547-megawatt Tengger Desert Solar Park in Ningxia, China is considered the largest operating photovoltaic park in the world.

But building to these colossal proportions is only part of the battle. Resilience -- combating hostile climates and the ravages of time -- is also key.

$5 billion Dubai megaresort rises from The World

"Dust remains a significant challenge," DEWA told CNN via email, "as dust accumulation on modules can substantially reduce the power generation of those modules." The government department said as well as studying panel coating technologies it is implementing "a dry robotic cleaning system to clean the whole plant in a very short time."

Markides also said temperature is an important factor: "(Photovoltaics) degrade faster if the temperatures swing wildly between, say, very cold and very hot -- and they also degrade if the temperatures particularly become very hot." In Dubai, summer temperatures can move from the high-40s Celsius in the day to mid-teens at night.

The Dubai Clean Energy Strategy 2050 is working towards generating 25% of its energy output from clean sources by 2030, and 75% by 2050 -- equivalent to a capacity of 42,000 megawatts.

Belt and Road to make Russia-China trade more balanced – experts to RT www.rt.com

Russia and China complement one another economically, according to political scientist Joseph Cheng. He said the two countries’ trade could become even more balanced with the help of the Belt & Road Initiative.

Speaking to RT ahead of Russian President Vladimir Putin’s arrival to Beijing on Thursday, he said that Russia’s role is very important, particularly due to its significant natural resources.

“Certainly, Russia is a major exporter of natural resources, especially energy resources. And China needs that badly,” the retired professor of the City University of Hong Kong said.

He explained that Russia’s supplies of natural resources reduce China’s dependence on the Middle East, on trade routes from the Mediterranean, the Red Sea, and across the Indian Ocean to China’s coast.

“[The] Belt and Road project gives a lot of opportunity for the trade to become balanced,” he said.

International financial expert Andrew Leung also spoke to RT, saying that “Right from the start, Russia features significantly in the Belt and Road…”

According to him, “Russia is important as a large energy supplier and as a geopolitical counterweight to America's global pushback against China.”

There is much synergy with the Russia-led Eurasia Economic Union (EEU), he said. The Belt and Road links virtually all countries in the EEU, including land-locked nations in the Shanghai Cooperation Organization co-founded by Russia and China. “The B&R (Belt and Road) regional infrastructural links are set to unlock the economic and human potential of the Eurasia Economic Union, to the benefit of all,” said the strategist.

The second Belt and Road Forum for International Cooperation will be held in China on April 25 – 27. The Russian president, who arrived in Beijing on Thursday, will hold a series of meetings, including with his Chinese counterpart Xi Jinping. Putin told China’s Renmin Ribao newspaper ahead of his visit that “The ties between Russia and China are at their highest point in the entire 70-year history of diplomatic relations and will continue to develop steadily.”

Former Spymaster held over ‘Torture to Confess’ scandal www.news.mn

The Chingeltei District Court decided (25 April) to extend the detention of B.Khurts, the controversial former director of Mongolian’s General Intelligence Agency (GIA) for 15 days at the request of the prosecutors. He has been detained by the Criminal Police Department over the ‘torture to confess’ case. B.Khurts was taken to the 461st Detention Centre on 23 April. While in custody, he refused to give a statement without formal approval of D.Gerel, the current director of GIA.

B.Khurts was accused of breaching of laws on intelligence procedures for having used torture to obtain a confession from defendants of the much-publicised murder case of the politician S.Zorig, who one of the heroes of Mongolia’s peaceful transition to democracy and a likely future prime-minister. Following an investigation lasting two decades – in which there have been accusations of cover-ups and during which numerous people, including the victim’s wife, have been detained – Ts.Amgalanbaatar and two others were sentenced to 24-25 years in prison for the murder of S.Zorig.

The murder of S.Zorig case was transferred to the Criminal Police Department from Independent Authority of Anti-Corruption due to the lack of human resources on 19 March.

Exporting to Mongolia after EU Exit www.gov.uk

Guidance explaining changes for UK exporters to Mongolia if we leave the EU with no deal.

Leaving the EU with a deal remains the UK government’s top priority. This has not changed. However, the government is continuing with no deal preparations to ensure the country is prepared for every eventuality.

The UK does not have a trade agreement with Mongolia.

Please review the full guidance at https://www.gov.uk/guid…/exporting-to-mongolia-after-eu-exit

U.S. and Mongolia Hold Bilateral Consular Engagement www.state.gov

Deputy Assistant Secretary for Visa Services Edward Ramotowski hosted a bilateral consular discussion with the Government of Mongolia, represented by State Secretary D. Davaasuren and Director General of the Department of Consular Affairs L. Munkhtushig. The engagement advanced issues of mutual interest and served to highlight the successes of the #TravelResponsibly consular outreach campaign, an ongoing collaboration between the Mongolian government and the U.S. Embassy in Ulaanbaatar. We look forward to continued cooperation and progress towards shared goals of facilitating responsible travel and protecting our citizens abroad.

For press inquiries please contact CAPRESSREQUESTS@state.gov or (202) 485-6150.

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- 1715

- 1716

- 1717

- 1718

- 1719

- 1720

- 1721

- 1722

- 1723

- 1724

- 1725

- 1726

- 1727

- 1728

- 1729

- 1730

- »