Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

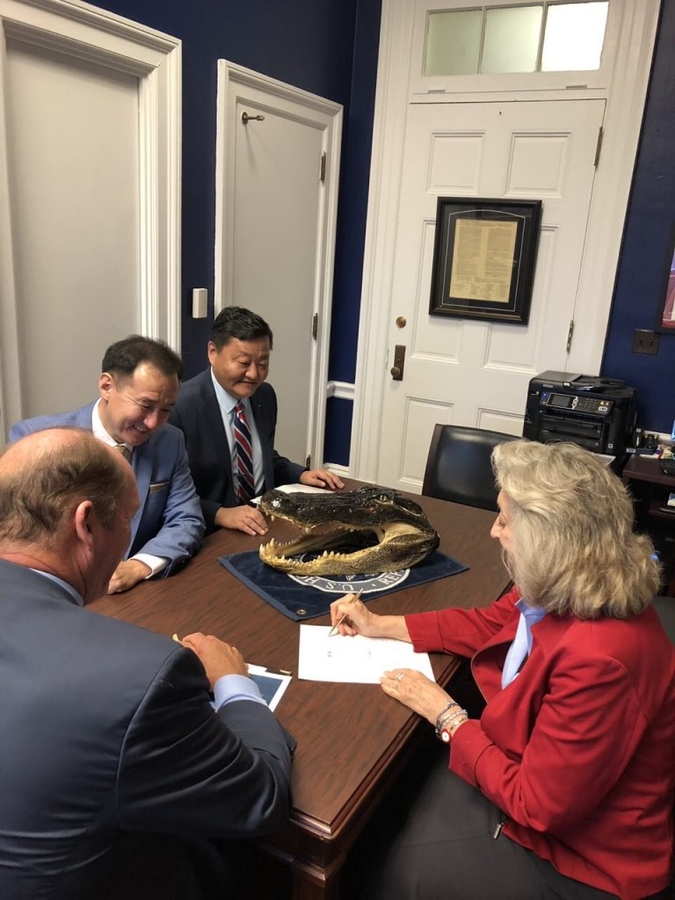

Bill on ‘Mongolia Third Neighbor Trade Act’ to be submitted to the US Congress www.montsame.mn

Ulaanbaatar /MONTSAME/ Minister of Foreign Affairs D.Tsogtbaatar who attended the First Ministerial Meeting on Religious Freedom on July 25-26 in Washington, D.C met with Co-Chair of US Congressional Mongolia Caucus Dina Titus and Ted Yoho, sharing views on bilateral relations and cooperation.

The Congress members highlighted that Mongolia is a country that consistently backs democracy and is an important partner of USA and briefed about their plan to submit a draft law on ‘Mongolia Third Neighbor Trade Act’ to the Congress in the near future which is about exporting Mongolian textile products to American market tariff free.

Minister D.Tsogtbaatar expressed his gratitude and said he is confident that the draft law which is a joint effort of the two parties of the Congress will give big stimulus to develop Mongolia-USA trade and economic ties as well as to increase jobs, supporting Mongolia’s economic development.

President of Mongolia Kh.Battulga had put a propasal to President of the United States Donald Trump on exporting Mongolian textile goods tax-free to the US and the draft law is the first step to the realization of the initiation.

B.Batchimeg

UNFPA donates "dignity kits" to females hit by flood in Mongolia www.xinhuanet.com

ULAN BATOR, July 26 (Xinhua) -- The United Nations Population Fund (UNFPA) on Thursday handed over "dignity kits" -- hygiene supplies for girls and women -- to Mongolia's National Emergency Management Agency (NEMA) for distribution among flood victims in Bayan-Ulgii Province.

Downpours from July 14-16 triggered massive flooding in the western province, affecting more than 2,500 people, including some 1,000 females of reproductive age, according to NEMA.

"Maintaining proper hygiene is a common problem in the aftermath of any disaster, especially for women and girls. Therefore, the UNFPA is distributing the dignity kits," UNFPA representative in Mongolia Naomi Kitahara said.

The kits, worth 24 million Mongolian tugriks (about 9,741 U.S. dollars), contain wet tissues, toothbrushes, toothpaste, shampoo, soap, sanitary pads and towel.

"Women and girls are at risk of gender-based violence and sexual harassment after disasters. So, the kits contain protection items including whistles and torches with batteries," she added.

Bayan-Ulgii, the worst affected province, has suffered direct economic losses worth 10 billion tugriks (about 4 million dollars) due to the floods.

Editor: Mu Xuequan

Mongolia and China on top as FIBA 3x3 U23 Nations League stops in Utsunomiya www.fiba.basketball

UTSUNOMIYA (FIBA 3x3 U23 Nations League) - Mongolia lead the men's category and China the women's at the 3x3 U23 Nations League Asian Conference before stops 3 & 4 in Utsunomiya, Japan on July 28-29.

Afte the first two stops held in Ulaanbaatar, Mongolia, the Mongolian team top the men's category of the Asian & African conference of the U23 Nations League with 50 points of advantage over China after winning the 2 first stages of the competition. The Mongolians defeated China in both tournaments, 1st in the final and then in the semi-finals. Indonesia reach the final in the 2nd stop.

Standings:

1. Mongolia - 200 points

2. China - 150 points

3. Indonesia - 140 points

4. Mongolia U18 - 120 points

5. Uganda - 105 points

6. Sri Lanka - 95 points

What’s Next for Philippines-Mongolia Defense Ties? www.thediplomat.com

Earlier this month, Philippine Defense Secretary Delfin Lorenzana paid a visit to Mongolia which included engagements tied to the defense realm of the bilateral relationship. Though Lorenzana’s interactions were part of a broader trip and few specifics have been publicly disclosed about what the two sides agreed to, his visit nonetheless shed some light on developments in the defense aspect of ties between the two Asian states under President Rodrigo Duterte.

Though the Philippine-Mongolia relationship technically dates back to 1973, until recently, ties had remained quite underdeveloped, including in more basic areas such as trade and investment as well as on the defense side. But bilateral relations have been getting gradually greater attention over the past few years.

That trend has continued on with Duterte’s presidency thus far. During a meeting between Duterte and Mongolian Prime Minister Jargatulgyn Erdenebat last May, the two sides agreed to develop several areas of cooperation, including trade, agriculture, and tourism, as well as enhancing and institutionalizing various engagements and mechanisms. There was also a focus on the significance of bilateral ties for the wider region, since the Philippines was at the time the holder of the annually rotating ASEAN chairmanship.

Earlier this month, the defense realm of the bilateral relationship was in the headlines when Philippine Defense Secretary Delfin Lorenzana visited Mongolia. The bilateral engagements Lorenzana had there were part of a broader trip that also included his participation in the Asian Ministerial Conference for Disaster Risk Reduction (AMCDRR) that was being held in the Mongolian capital of Ulanbaatar.

Lorenzana’s bilateral engagements included consultations with Mongolian defense officials including his Mongolian counterpart N. Enkhbold on July 6. According to local media reports, both sides reinforced the significance of their defense relations from a bilateral and regional perspective and also discussed the current state of their defense ties, including areas with which they could learn from and share experiences.

They also reportedly talked about ways they might broaden and deepen bilateral cooperation. These included areas such as training, peacekeeping operations, exercises at various levels, and information sharing on regional defense and security issues.

Few additional specifics were publicly disclosed by both sides in terms of what they had agreed to or what developments we could see thereafter. Nonetheless, the next steps that the two countries take on the defense side will be interesting to observe within the context of their broader bilateral relationship which still remains quite underdeveloped.

Inner Mongolia man suspected in blast outside US Embassy www.thestandard.com.hk

A man exploded a small homemade bomb outside the U.S. Embassy in Beijing today, injuring only himself, according to police and an embassy spokesperson.

Photos on social media showed a large amount of smoke and police vehicles surrounding the embassy shortly after the incident. Apart from a heightened security presence, the scene outside appeared to be normal by early afternoon.

The Beijing Police Department posted a statement on its website identifying the suspect only by his surname, Jiang, and said he was 26 years old and a native of Tongliao city in the Chinese region of Inner Mongolia. He was injured on the hand by the explosive device, which was made from fireworks and was detonated at about 1 p.m., police said.

There was no word on a motive and the statement said the investigation was continuing.

No damage was done to embassy property and no other injuries were recorded, a U.S. embassy spokesperson said, speaking on routine condition of anonymity.

Only one person was involved and police responded to the situation, the spokesperson said.

Neither the police nor the embassy had any comment on a report by the ruling Communist Party newspaper Global Times that said officers had earlier removed a women from outside the embassy who had sprayed gasoline on herself in a "suspected attempt at self-immolation” at around 11 a.m.

China and the U.S. are in the middle of a trade dispute, but America remains a hugely popular destination for travel, education and immigration for Chinese citizens.

On weekdays, large lines of visa applicants form outside the embassy, which sits in a busy corner of the city hosting numerous diplomatic installations as well as hotels and stores. -AP

GoM bond auctioning platform is in place at the MSE www.zgm.mn

All necessary infrastructure is in place at the MSE to auction Mongolian government bond at the primary market, says a source at the exchange. High ranking officials in charge of Mongolia’s fiscal policy previously said that the Ministry of Finance plans to auction Mongolian government bond at the bourse. Between 2014 and 2017, the Government of Mongolia auctioned the security on the interbank market through Mongolbank and traded at the Mongolian Stock Exchange. The money raised was used to cover budget deficit. The Ministry of Finance ended such transaction in October 2017. But in early 2018, Deputy Finance Minister Bulgantuya Khurelbaatar admitted that the authorities were working on an auctioning platform at the Mongolian Stock Exchange for sovereign bond primary market trading. With the new system in place, the ministries will no longer have to depend on commercial banks.

ZGM sat down with specialist at the Public communications division at the MSE, P.Nyamdorj.

-Minister of Finance previously announced the plan to resume sovereign bond auction on the domestic primary market on MSE. We know the infrastructure was being tested. Has it been finalized?

-All preparatory work is completed. All issues related to the auctioning platform have been solved. Government bond was a major player at Mongolia’s securities market in 2017. As for 2018, sovereign bond is only being traded at secondary market. Sovereign bond is attractive as it offers a variety of possibilities to investors, including low risk, high liquidity and immunity from taxation.

-So government bond was not auctioned on primary market in 2018?

-Between 2014-2017, Mongolbank and the Mongolian Stock Exchange actively conducted government bond offering at the domestic market, following the decision of Ministry of Finance. But primary market auction didn’t take place at the MSE since October 2017. Fiscal regulations in place limited government bond issuance this year due to its high yield.

-How much sovereign bond was traded at the MSE last year? How did the yield differ?

-In total, MNT 772.5 billion worth of sovereign bond was traded at the MSE. After re-introducing auctioning system for sovereign bond primary market offering, a total of MNT 9.3 billion bond was traded at MSE on three separate offerings. During the first auction, investors ordered to buy 124,900 sovereign bond which was twice the offered amount, and the asking yield fell from 11.7 percent to 10.3 percent.

-We’ve been seeing that government bond was being traded at the secondary market at the MSE?

-Yes. Secondary market offering is taking place almost every week. But the volume is inconsistent. We’re seeing seasonal influence affecting the trading volumes. We’re also seeing great interest from international investors for Mongolia’s sovereign bond. The increase became more notable in late 2017. We expect trading volumes to pick up this fall. Mongolia’s sovereign bond will not mature until 2020. Therefore, until then, we’ll see it change hands between investors. So far, sovereign bond is not being offered on primary market.

...

Brics back 'open world economy' that benefits all nations www.bbc.com

The leaders of the Brics emerging economies have signed a declaration stressing the importance of an "open world economy", in which all countries benefit from globalisation.

Brazil, Russia, India, China and South Africa also backed an "open and inclusive" multilateral trading system under World Trade Organization rules.

But they said the multilateral trading system faced unprecedented challenges.

Their comments come amid mounting trade tensions sparked by US tariffs.

The leaders have been meeting at the 10th Brics summit in Johannesburg.

"We reaffirm the centrality of the rules-based, transparent, non-discriminatory, open and inclusive multilateral trading system, as embodied in the World Trade Organization, that promotes a predictable trade environment and the centrality of the WTO," the declaration signed by the five leaders said.

However, they added: "We recognise that the multilateral trading system is facing unprecedented challenges.

"We underscore the importance of an open world economy, enabling all countries and peoples to share the benefits of globalisation, which should be inclusive and support sustainable development and prosperity of all countries.

"We call on all WTO members to abide by WTO rules and honour their commitments in the multilateral trading system."

'Reject protectionism'

The Brics summit is the first since US President Donald Trump placed tariffs on billions of dollars' worth of goods from around the world, in particular China.

He has promised further levies on $200bn (£150bn) worth of Chinese products in September.

Mr Trump also wants to cut the trade deficit with China - a country he has accused of unfair trade practices since before he became president.

Mr Trump made a big point on the campaign trail about cutting the country's trade deficits.

He is convinced that they hurt US manufacturing, and has said repeatedly while campaigning and on Twitter that the US must do more to tackle them.

Speaking in Johannesburg on Thursday, Chinese President Xi Jinping said: "We must work together... to safeguard the rule-based multilateral trading regime, promote trade and investment, globalisation and facilitation, and reject protectionism outright."

On Wednesday, he said there would be no winner in a global trade war.

Facebook market value shrinks by $119 billion in biggest single day loss www.rt.com

Facebook shares have fallen 19 percent, wiping $119 billion off the social media giant's value. The one-day percentage drop, the biggest ever for any US traded company, comes after it forecast months of lower profit margins.

Facebook shares closed at $176.26 on Thursday, down from $217.50 the day before.

"We expect our revenue-growth rates to decline by high-single-digit percentages from prior quarters sequentially in both Q3 and Q4,” Chief Financial Officer David Wehner said on the investor conference call that sent the stock tumbling. The company's sales and user growth numbers for the second quarter fell short of analysts’ projections.

Wehner explained that Facebook intends to promote experiences that “currently have lower levels of monetization” and give users more choices about data privacy, “which may have an impact on our revenue growth.”

It’s the second time this year that Facebook’s stock has taken a dramatic plunge. Its shares also fell off the cliff in March in the wake of the Cambridge Analytica scandal. The UK-based company had gained access to the personal data of tens of millions of Facebook users through a third-party application, and some of that data was reportedly used to target advertising during the 2016 Brexit referendum and the US presidential election.

As a result of the stock tumble, Facebook CEO Mark Zuckerberg’s net worth dropped by more than $16 billion.

One of the Facebook investors, Trillium Asset Management, has reportedly filed a proposal to remove Zuckerberg as chairman, according to Business Insider. Trillium holds $11 million worth of Facebook shares, and blamed Facebook for “missing, or mishandling, a number of severe controversies, increasing risk exposure and costs to shareholders” because of Zuckerberg’s control.

Data suggests Mongolia budget investment freeze www.zgm.mn

Recent statistics released by the Ministry of Finance and the National Statistics Office suggest government has curbed budget investment dramatically in the 2nd quarter of this year. To be exact, only 60 percent of planned government investment was realized in the first half of 2018. This means MNT 300 billion development projects that should have started or even completed in the first half according to the Budget Law were held back. Budget implementation data on the Ministry of Finance’s web site show that no investment was released since February 23, this year. According to the approved budget law for 2018, the Ministry of Finance expects to collect MNT 3.4 trillion in budget revenue and spend MNT 4.8 trillion in budget expenditure with MNT 1.4 expected deficit. Thanks to higher commodity price, budget revenue exceeded the expected level by MNT 150 billion. But officials were not available to explain why the expenditure fell MNT 930 billion short of the plan. Mongolia issues MNT 1-2 trillion government bond domestically to cover budget deficit, but the GoM made a conscious decision to not raise capital with high interest rate. This came at a time when IMF required the country to cut budget deficit. But little did we know that this would mean budget freeze.

...

Russia building gigantic railroad artery to connect Arctic regions www.rt.com

An additional 686km of railroad will soon link Russia’s Arctic regions. The railway will provide logistics for the Northern Sea Route to boost commerce between Europe and Asia and Russian energy projects in the Arctic.

The project, named the Northern Latitudinal Railway, is planned to be completed by 2023, authorities say. It requires the building of 350km of track and modernizing the existing infrastructure. The volume of traffic on the route is estimated at 23.9 million tons a year.

The Northern Latitudinal Railway will connect Russia’s Ural and West Siberian regions with the Northern Sea Route and prepare the ground for additional big out-shipments through Arctic waters. The project’s cost is estimated at around 200 billion rubles ($3.6 billion).

The railway is crucial for another Russian mega-project in the Arctic. The Northern Sea Route, which stretches the entire length of Russia’s Arctic and Far East regions, is expected to become a major trade route for goods shipped between Europe and Asia.

The Arctic route from Southeast Asia to Europe cuts transportation time in half compared to traditional routes through the Suez and Panama canals. In Soviet times, it was used mainly to supply goods to isolated settlements in the Arctic.

With the collapse of the Soviet Union, the Northern Sea Route was opened for international cargo traffic. However, President Vladimir Putin has said the country is weighing a ban on foreign-flagged ships from the strategically critical route across Russia’s Arctic waters.

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- 1715

- 1716

- »