Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

Frozen mummies reveal Mongolians’ Drink of Choice www.news.mn

Scientists have analyzed the remains of high-ranking individuals from the Mongol Empire, who were buried in graves with luxury items such as leather, silk, and gold, and had been preserved in permafrost for 800 years. By studying their dental calculus, scientists found evidence that they had a preference for consuming yak milk.

The study, published in the journal Communications Biology , explains that the question of yak domestication had long been unresolved owing to a lack of data. The only archaeological specimen found so far has been a yak cranium recovered from the Late Bronze or Early Iron Age Denjiin Navtan site, the Heritage Daily reports. Other archaeological and historical records of yak domestication in the region are equally hard to come by.

Using paleoproteomics, the study of ancient proteins , to make up for this absence, the investigation has concluded that yak milk was being consumed by Mongolian elite at least as early as the 13th century.

This makes it the first archaeological discovery of yak milk, according to a University of Michigan College of Literature, Science and the Arts (LSA) newsletter . There is plenty of evidence establishing that milk has been vital to Mongolian society for 5,000 years. Researchers have been able to determine the historical consumption of cattle, sheep, goat, and even horse milk, but evidence of early yak milk consumption has been elusive until recently. The discovery was made during the excavation of the Khorig cemetery in the Khovsgol mountains of northern Mongolia, which is located at a high elevation.

The Khorig—meaning taboo—cemetery is in a high-altitude location, situated in the permafrost and, as a Miami Herald article reports, this has meant that human remains dating back to 1206 AD found there, have remained remarkably well preserved. Researchers spent years collecting and conserving bits of leather and silk strewn across the surface of the burials.

However, recent global-warming induced thawing has started exposing the burials not only to the elements but also to looters and vandals. Excavations at the site were therefore speeded up in the nature of salvage operations to rescue the archaeological remains from the dangers of atmospheric and human-induced degradation.

The excavations revealed that the individuals buried in the cemetery were members of the Mongolian aristocracy , with some evidence of links even to the ruling elite.

Tencent’s WeChat Pay launches in Mongolia www.shanghaiist.com

China’s Tencent’s WeChat Pay, a mobile payment service, can now be used in Mongolia as it expands its reach beyond China. This move is aimed at making it easier for Chinese tourists to travel to Mongolia and conduct transactions using their WeChat accounts, says Mongolia’s state-owned television MNB. The service is available in hotels, restaurants and convenience stores in the southeastern province of Dornogovi’s Zamiin-Uud soum and in Ulan Bator, the capital city.

Benefits for Mongolian tourism industry

Tencent’s WeChat Pay, which has over one billion active users, is expected to promote tourism in Mongolia

The country aims to attract at least one million foreign tourists and earn $1bn from tourism during 2023-2025

The Chinese tourists are the primary target group and WeChat Pay transaction service is expected to make it easy for them to enjoy their stay

WeChat Pay aims to strengthen its position in the mobile payment market as it expands beyond its home country into new markets.

BY:

Cheyenne Dong

Cheyenne Dong is a senior tech journalist at Shanghaiist. With her expertise in e-commerce and retail, blockchain, and Web3, she provides readers with the latest news from these fields. She has a knack for uncovering stories that provide readers with comprehensive analysis of the ever-evolving dynamics of technology in China.

Tesla to Build New Megapack Battery Factory in Shanghai: Xinhua www.bloomberg.com

Tesla Inc. will build a new battery factory in Shanghai that will start production in the second quarter of next year, the official Xinhua News Agency reported.

The company led by Elon Musk, who is visiting China this weekend, made the announcement at a signing ceremony for the project in Shanghai, the report said.

Tesla will manufacture its Megapack large-scale energy-storage unit in the new facility, which adds to the company’s Gigafactory for electric vehicles in Shanghai and deepens its investment in China. Construction is scheduled to begin in the third quarter of this year and the plant will commence in the second quarter of 2024.

Tesla didn’t immediately respond to a request for comment

The Megapack is intended as a massive battery to help stabilize energy grids, with the company saying each unit can store enough energy to power an average of 3,600 homes for one hour.

The new factory will initially produce 10,000 Megapacks every year, equal to around 40 GWh of energy storage, Xinhua said, adding the products will be sold worldwide.

BY: ByVlad Savov

— With assistance by Jessica Sui

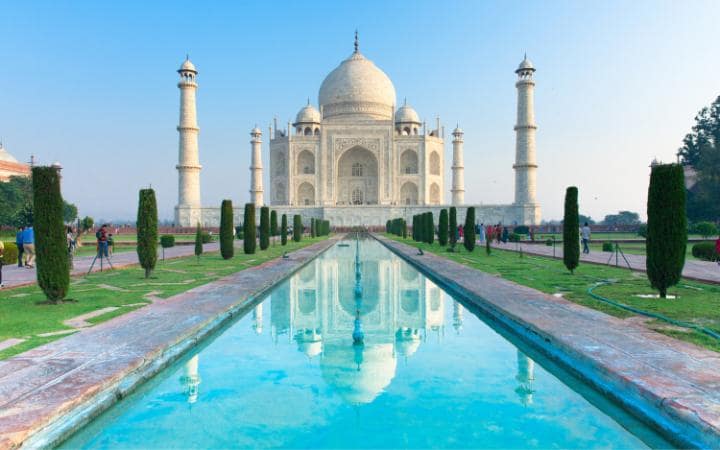

Mongolian delegation praises India for promoting Buddhism to bring about global peace www.thenewsmill.com

A delegation from Mongolia, which visited several Buddhist pilgrim sites in India has praised India for promoting peace through spiritualism that can help resolve ongoing wars and conflicts in the world.

Headed by 7th Naro Banchen Rinpoche, head of Naro Banchen Trust and founder of Naropa Monastery, the delegation met with Indian Buddhist scholars and officials of the International Buddhist Confederation (IBC) in New Delhi.

The 40-member Mongolian delegation comprises artists, journalists, businessmen, anthropologist, historian and others.

Naropa Rinpoche told ANI, “We have so many things to learn from India. It’s peaceful, calm and very tolerant to one another. These good qualities inspire us”.

He added, “Mongolians appreciate India’s ancient wisdom and India is a country where from ancient times people come to learn how to train a mind, how to analyse and how to train our mind from a logical perspective using concrete methodologies. And this is our inspiration. We take spiritual inspiration from our Indian brothers and sisters. This ancient Buddhist knowledge offers very comprehensive methodologies that can be used to solve the problems in current days humanity is facing, war and conflicts”.

This delegation from Mongolia will also participate in the upcoming Global Buddhist Conference in New Delhi.

Naropa Rinpoche added, “The upcoming Global Buddhist Conference, I am expecting to be very beneficial because Buddhism teaches us that happiness should come from within ourselves. Although we have many materialistic progresses that make our life very comfortable but they cannot guarantee a happy life. That’s why this symposium is going to discuss about the wellbeing of the world and how Buddhist knowledge and tradition can help us to solve conflicts and problems we have been facing.”

Deputy General Secretary of IBC, Jangchup Choedon Rinpoche said, “India and Mongolia have had strong relations for a long time. Naropa Rinpoche has come to India with a delegation and visited several Buddhist spiritual sites in the country. They met His Holiness the Dalai Lama also”.

He added, “We are organising Global Buddhist Summit in which a delegation from Mongolia is also participating along with delegates from 32 countries. They will discuss about global issues and will implement them for the wellbeing of the global community”.

Odzaya Deremchimed, a news anchor from Mongolia, praised India and said, “Indian people are very kind and nice. It was a nice experience visiting Dharamshala and meeting His Holiness the Dalai Lama”.

Prof Ranjana Mukhopadhyaya, a member of the Indian delegation said, “It is important to have these kinds of interactions because Buddhism is one of the strongest links that India has with the rest of Asia. And it is one of the longest, oldest and one of the most enduring links”.

She added, “I think we should use these ties to re-establish and reaffirm our relationship with Buddhist countries such as Mongolia because we should realise that although Mongolia is so far from India, Buddhism at that age had travelled there so obviously this was the medium through which people of rest of the world came to know about India. So, it is very important for India that we should capitalise on this goodwill that we have about India and further strengthen it.” (ANI)

From Concept to Construction: Designing Mongolia’s Steppe Arena www.montsame.mn

Only three years ago in Mongolia, children who were passionate about ice skating and playing ice hockey, and anyone with a strong interest in the winter sport, would eagerly await the arrival of the winter season, which typically lasts only three to four months.

Mongolian Ice Hockey has been developing for 60 years. However, the athletes trained most of the time in freezing cold winters in outdoor rinks or on the ice of the frozen rivers due to the lack of an ice arena. It was a challenge that was stopping the advancement of our hockey athletes. In 2021, the Steppe Arena was constructed in the vast land of Mongolia, fulfilling a century-long dream not only for hockey players, children, and youths but also for adults throughout the country.

On March 24, 2023, MONTSAME Mongolian National News Agency interviewed two distinguished architects from Canada who served as advisors for the historic development of Steppe Arena in Ulaanbaatar, Mongolia.

Good afternoon, Mr. Mark Hentze and Mr. Kevin Klippenstein. Can you give us a brief introduction of yourself before we begin the interview?

-Mark: My name is Mark Hentze. I'm an architect. I have specialized in sports facilities my whole career, and this is my true passion. I've always loved that kind of work. It's a way for me to continue in sports architecture because I have a background as an athlete and was fortunate enough to play professional hockey. Being a sports architect allows me to continue pursuing my passion for sports. No one makes me go to work every day. It's just a joy to be there most of the time.

-Kevin: My name is Kevin Klippenstein. I am also an architect and have a specialty in sports architecture. It is a little bit different from Mark’s experience, but there are a lot of similarities at the same time. Working with Mark is really fantastic. As we complement each other's weaknesses, we are able to fill in gaps where one of us may be less experienced in a particular area, thus allowing us to work together effectively. So, we end up being a well-rounded team. I have been working as an architect for a number of years now. My favorite aspect of sports architecture differs from Mark's perspective as an athlete. While he approaches it from an athletic standpoint, I come at it from a community point of view, aiming to give something special and unique back to the location it's in.

Mr. Mark Hentze with Honorary Gold Medal of Mongolian Olympic Committee

Steppe Arena opened a new opportunity for Mongolia. For the first time in its history, Mongolia is hosting two world ice hockey championships after constructing Steppe Arena, Olympic standard arena. Specifically, the IIHF World Championship Division IV and the 2023 IIHF Ice Hockey U18 Asia and Oceania Championship. What was your role in designing Steppe Arena?

-Mark: Most importantly, I think that we can say collaboratively together is that our role was we got to be part of a design team. We got to work with Tsagaan, Munkhbat, and Zolboo as a team to create the Arena that picks up some of the features typically found in the Canadian arena. Therefore, we collaborated extensively with our Mongolian colleagues and friends to ensure their valuable inputs were considered.

We were working as a team on a design project and came up with the initial concept together over the course of a week. Zolboo, Batmunkh, and Tsagaan had to do a lot of work to complete the project. But I think that was the role of trying to give a sensibility around creating a great Ice Arena experience.

-Kevin: That is an excellent way of putting it in. Our role was crucial as we were involved in the first indoor ice arena in Mongolia. A large part of our role was to show the Mongolian team what made a successful arena and what were some things to avoid. To bring the best design to Mongolia, we successfully showed what we had done in other places and the lessons we had learned.

-Mark: When the Mongolian team came to Canada with their initial concept, there were many great ideas in it. But there were also some things that we could help improve on. The original design of the ice arena has seating further back from the ice rink. What we're interested in is trying to create a really exciting atmosphere. For Steppe Arena, we pushed the seating right up against the edge of the hockey boards. The specter is almost on top of them, and the spectators feel like they're a part of the game.

The opening ceremony of the IIHF World Championship Division IV and the opening game with Mongolia and Kuwait were great. I hope people loved experiencing ice hockey at a high level for the first time in Mongolia. I have to say one thing that really impressed me about the Mongolian people. The Opening Ceremony started at 5 pm. We arrived at the Arena at 4 pm. The Arena was 2/3 fulled already. In Canada, people show up 10 minutes before the game starts.

"It was a very pleasant surprise to see how enthusiastic the Mongolian fans were," said Kevin.

Yesterday, it was fantastic to see both of you dressed in hockey jerseys of the Mongolian Team.

-Kevin: Yes! We both bought jerseys last night. It was fabulous.

-Mark: Hopefully, everybody in Mongolia is really proud of Steppe Arena. Also, we're proud and privileged to be a part of it. So, when we walked over, we saw the jersey. We just looked at them and said we should support Mongolia because we really felt like a part of your team too.

Mr. Kevin Klippenstein during interview

How did you feel about working with Mongolian architects?

-Mark: They are fabulously talented design architects.

-Kevin: As Mark was saying, they are extremely talented. It was a pleasure working with them. Also, it was a seamless experience as far as we were concerned.

-Mark: Zolboo and his team are very talented. When we started working together in Vancouver on the original concept designs, it was clear Zolboo was a very skilled architect at the world-class level. I think our collective skills created an arena with a very unique look.

How many times have you visited Mongolia? What are your first impressions?

-Mark: This is our first trip. We had hoped that we were going to be a part of the delivery of the building during construction. But, of course, we weren't able to continue due to the COVID-19 pandemic. We kept in touch with the group, and stayed connected after following the Instagram account of Steppe Arena and its website.

-Kevin: Mongolian winter is much like Canada.

-Mark: Maybe this is a good reason for the partnership. If they chose different architects from another country, Mongolian winter might be a little bit cold for them. But in reality, we are Canadian, a land of winter, hockey, ice arenas, and figure skating. So, the weather is fine.

You worked on many projects for Ice Arenas. So, which one was the hardest to accomplish the desired results?

-Mark: I was privileged enough to be a part of the architectural team that designed Canada’s National Hockey Training Center. It was really hard for me because the expectations were so high. You know, hockey in Canada is a religion. If you get a chance to design the National Hockey Training Center in Canada, there are many eyes on you. There are a lot of people that know a lot about ice arenas. So, this was the hardest one for me. If somebody from Ulaanbaatar went to the WinSport facility in Calgary, they would see some similarities between what Kevin, I, Zolboo, Batmunkh, Tsagaan, and the whole team came up with here at Steppe Arena. Yeah, I find this to be the most difficult challenge for me.

What are the unique features of the Steppe Arena in your opinion?

-Kevin: I think unique features are the things that the Mongolian team brought to the project. There will be water fountains for the summer and an outdoor plaza that will be an outdoor skating. They will have skate rentals. It's kind of a tricky site because there's a big elevation difference. I think handling it largely through Zolboo and how he fitted it onto the site was magnificent.

One of the unique things about this arena is not just about what's on inside but how it relates to the Plaza and the other things around it.

-Mark: I agree with that. I think there are a few other things that stick out to me. Last night, we observed the Opening Ceremony, which was the pregame show with all the lighting projecting onto the ice and stuff. Then, I told Batmunkh that this is as good as Canada and USA for NHL professional hockey. During our conversation, we noted how the seating is situated remarkably close to the ice surface and how the steep angle of the seats adds to the excitement of the experience. So, the sightlines are way better than in standard arenas. I think the other neat thing about the Steppe Arena is the curved roof design. What we were trying to do together was to create an atmosphere that would feel as if you were in a crowd of way more people than you were in.

On March 24, 2023, Honorary Gold Medals of the Mongolian Olympic Committee were conferred upon Mark Hanson and Kevin Klippenstein for their valuable contribution to constructing Steppe Arena in Mongolia. We asked them for their impression of the medals, and they answered:

-Kevin: This morning, we received these medals for our contributions to the sport. Mark and I were very touched. We did not know that we were going to get these medals. It is a great honor for us and very humbling.

-Mark: Beyond all of its impressive features, what sets it apart is its ability to make a meaningful contribution to the community. But what’s really exciting about it is that the Arena opened the opportunity to all boys and girls in Mongolia to become hockey players, figure skaters, and speed track skaters in their lives. As a result of it, Mongolian Olympic Committee recognized us for that. We are very humble and unexpected.

Did you face any challenging situations while working on the project of Steppe Arena?

-Mark: No, this is exactly the point we are talking about. The Mongolian team visited Canada and toured various arenas across the country. Then, we worked altogether in my office. So, all of us were around the table together. I think this made it cohesive because we all understood together, such as the goals and objectives for Steppe Arena. Zolboo had to take two or three years to finish the design and construction. But as a concept, it came together very cohesively because of successful teamwork.

I would work with these guys anytime and anyplace since they are fabulous. They listen very well and have really good key ideas.

Mark also has a history as a hockey player, playing both for his universities in Calgary and British Columbia and professionally for HC Zweirbruken in Germany from 1984 – 1986. During the interview, Mark said about Mongolian Hockey Team:

-Mark: While watching the game with my son, who is also a hockey player, we were impressed by the Mongolian team's exceptional skating skills and intuitive understanding of the game. We discussed the team's impressive performance throughout the game. Given that ice hockey is still an emerging sport in Mongolia, it is understandable that the Mongolian team aims to further improve their shooting and stick-handling skills. Mongolian ice hockey players have had to train on rivers and frozen lakes in bitterly cold winters. It was hard to get better at their skills. But they were impressive. We interviewed last night on TV, and the guy asked me at the end of the interview, he asked, "What do you think the score is going to end up like?” Then I said 7-0. But the moment the eighth goal was scored, I felt a rush of joy.

From an architect's perspective, how do you see the Mongolian landscape, especially of the capital city Ulaanbaatar?

-Kevin: It is such a beautiful setting here. We really enjoyed touring around. We haven't been here very long yet. Despite it being the second half of the day, we keep commenting on the breathtaking natural beauty surrounding us - the vast steppes stretching out before us and the majestic mountains rising up in the distance. We are thoroughly enjoying our time here, particularly enjoying the impressive architecture of some of the buildings. I am already looking forward to returning when the weather is warmer, eager to explore more of this stunning place.

-Mark: The landscape reminds me of where we live in British Columbia. It is just like the way that the hills jot up into the sky. The architecture has been interesting to see here. Yesterday, we had a chance to go to Chinggis Khaan Museum, which is a stunning building.

In addition, do you have something to say to Mongolians?

-Mark: Yes, now you have Steppe Arena in Mongolia. Try hockey, speed skating and figure skating because you will love them.

-Kevin: As the community becomes familiar with the new Arena, I have no doubt that they will come to appreciate and enjoy its fantastic facilities. From hockey and skating enthusiasts to families seeking fun and recreation, the Arena is something for everyone to enjoy.

As Mark said earlier, I was humbled and appreciated having had this opportunity. Our visit to the Arena was truly memorable, and a number of Mongolians shared with us their enthusiasm for this new addition to the Mongolian sports culture. The ice arena is very rare in Mongolia. In Canada, hockey and arenas are ubiquitous, and it is true that building a new arena might not be the most remarkable event in Canada. However, in Mongolia, where winter sports are still emerging and developing, the construction of the Steppe Arena was a significant and exciting milestone. To be a part of it is very humbling, and we enjoyed it very much.

-Mark: Normally, when we finish a project, people are generally pretty happy, and the owners and the clients shake hands and say thank you, well done, and it is a great project. Yesterday's event at the Steppe Arena was truly special, as we saw three thousand people come together to cheer on Team Mongolia. The energy and excitement in the Arena were palpable, and it was a real joy to see so many smiling faces there. As for the unexpected honors and recognition that we have received, it is certainly a surreal experience. While we are humbled and grateful for the recognition, we are also somewhat uncomfortable with the attention, as we are not accustomed to being in the spotlight. But we are deeply touched by the warmth and generosity of the Mongolian people and will cherish these memories for years to come. That’s been fantastic!

Thank you!

Mongolia-South Korea Joint Tourism Forum to be Held in September www.montsame.mn

During the 2024 Winter Olympics in South Korea, this country will participate in the promotion of Mongolia's history and culture, and organize the "Welcome to Mongolia" event. This was agreed upon at a meeting of Minister of Environment and Tourism B. Bat-Erdene with the representatives of the tourism organizations of the Republic of Korea during the "KOPIST-2023" High-Level Conference held in South Korea.

The parties also agreed to hold a joint international tourism forum between Mongolia and the Republic of Korea in the coming September in Ulaanbaatar. In addition, they will focus on restoring flexible entry and exit conditions during transit flights that existed before the pandemic.

Director of Mongolian Tourism Development Center S. Enkhchimeg and other officials participated in the meeting.

Citizens of 61 Countries Are Visa Free www.montsame.mn

At the session of the State Great Khural of April 7, Minister of Foreign Affairs B. Battsetseg informed about the policies and strategies to promote Mongolia abroad, and the measures to intensify international cooperation.

In her speech, the Minister said that the Strategic Plan for Foreign Promotion was approved last February. The document was developed and presented to the Government’s meeting in the scope of four directions: firstly, investment, secondly, tourism, thirdly, human rights, democracy, and fourthly, good governance and digital development. The National Tourism Committee holds its meetings every week to inform the plan’s progress.

As part of the “Years to Visit Mongolia,” announced by the Government, citizens of 61 countries have been exempted from the visa requirements. Previously, citizens of 30 countries were exempted from visa requirements. Now with the addition of 31 countries, citizens of the above number of countries can travel to our country without a visa. In other words, the fees charged for citizens of the EU countries have been cancelled. Citizens of our country pay 60 euros to travel to Europe.

Currently, citizens of 99 countries have an opportunity to obtain electronic visa. The Minister noted that they are working to make all countries, considered possible, visa-free in the future. As for the two neighbors, citizens of the Russian Federation are not required visa. Citizens of the People’s Republic of China get visa. However, as part of the development of border tourism, group of tourists is allowed to travel without a visa for a certain period. Besides, the Chinese citizens are getting their visas online.

Two Ministers Appointed www.montsame.mn

On April 7, Member of Parliament Kh. Bulgantuya was appointed as a Cabinet Member and Minister of Labor and Social Protection and B.Tulga as a Cabinet Member and Chair of the National Commission of Border Port Recovery.

Former Labor and Social Welfare T.Ayursaikan was released from his post at his request as having alleged for a corruption case. MP Kh. Bulgantuya was working as Minister of Border Port Recovery since January of this year.

During his presentation on the appointment proposal to the State Great Khural Prime Minister L. Oyun-Erdene noted that it is proper to replace Kh. Bulgantuya considering to use her working experience as a Member of Cabinet and Finance Deputy Minister in development of package Laws on Social Security, the Unified Savings Fund, and the Wealth Fund at the Parliament; bringing the National Tripartite Agreement on Labor and Social Consensus to a new level in line with international standards; and making comprehensive reform to eliminate the gap in salaries and pensions of public employees. The Prime Minister also emphasized that it is progressive to have a female politician in charge of labor and social protection issues.

As for Mongolian People's Party Secretary B.Tulga, his working experience in government as the Deputy Minister of Environment and Green Development and the Deputy Minister of Education and Science was taken into account. In addition he took part in advancing the economic corridor dialogue between Mongolia, Russia, and China.

Foreigners Can Obtain Residence Permit Inquiries Online www.montsame.mn

In connection with the approval of "Procedures for Issuing, Possession, Storage, and Use of Residence Permit for Foreign Citizens and Stateless Persons, and Travel Permit for Stateless Persons," the residence permit card of foreign citizens has been updated.

Specifically, the residence card conforming to international standards and meeting the structure and standards of travel documents with NFC technology, MRZone, QR code, F-register, or non-repeating 13-digit number issued to foreigners, has been issued since April 1.

Also, according to section 1.3 of the Procedure, " A reference for a residence permit can be issued from the Integrated Database of Visa and Registration of Foreign Citizens to foreign citizens who have obtained a residence permit in Mongolia for official or personal purposes”, it has become possible to receive and use digital inquiries from the page https://eimmigration.mn The above electronic reference will only be used as a residence permit on the territory of Mongolia, and the original residence permit will be required in case of crossing the state border when entering into or leaving the country.

In connection with the revision of the regulations, seven types of residence permit services are available online from April 10. These services include applying for a residence permit, changing the form of a residence permit, extending a residence permit, canceling a residence permit, registering a change in passport information, registering a change in residence address, and requesting to retrieve a discarded or lost residence permit. The Immigration Agency of Mongolia extends this digital service on the website at https://immigration.gov.mn/mn/residence-permit/.

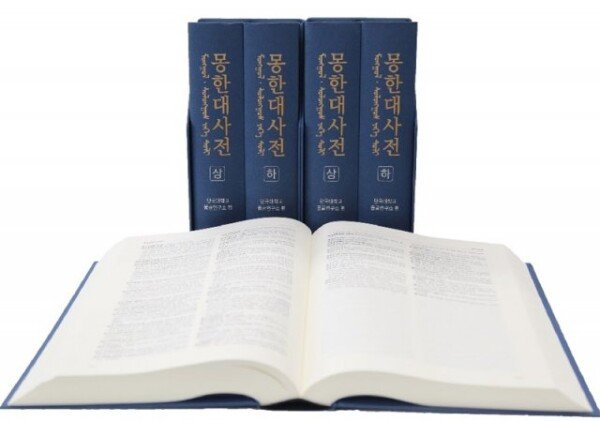

The world’s largest Mongolian dictionary published www.news.mn

Dankook University-affiliated Mongolian Research Institute announced on the 4th that it had compiled the world’s largest Mongolian dictionary, ‘Mongolian Dictionary’. It has been 15 years since I started compiling the dictionary in 2009.

The Monghan Dictionary consists of two volumes, the top and the bottom, and contains about 85,000 words of headings on 3090 pages. After 10 years of basic work and translation, it was completed in the middle of last month after typesetting, correction and supplementary work.

In the meantime, scholars and students studying Mongolian in Korea have used Mongolian dictionaries in English, Japanese, and Chinese. In order to eliminate this inconvenience, Dankook University’s Mongolian Research Institute carried out translation, error correction, and supplementary work, focusing on the ‘Mongolian Language Detailed Dictionary’ (2008) published by the Mongolian Language and Literature Research Institute under the Mongolian Academy of Sciences. Professor Shin Kang of Mongolian Studies, who participated in the compilation, died in a sudden traffic accident, and the work was temporarily suspended.

The Mongol Korean Dictionary contains idioms, proverbs, riddles, aphorisms, and archaic words collected from all Mongolian literature written since Genghis Khan in the 12th and 13th centuries. The headwords of the text were introduced in the following order: Cyrillic (modern Mongolian) Traditional Mongolian (Uighur) Korean -Cyrillic example, Cyrillic example translated Korean sentence. An appendix contains a brief Mongolian grammar.

In celebration of the 33rd anniversary of Korea-Mongolia diplomatic ties this year, Dankook University donated the ‘Monghan-Korean Dictionary’ to the Mongolian Embassy in Korea, the Korean Language Department of the National University of Mongolia, the Korean Language Department of the University of Ulaanbaatar, the Mongolian Academy of Sciences, and the Korean Embassy in Jumong in order to promote friendship between the two countries.

Dankook University established the Department of Mongolia in 1993, the first among domestic universities. Song Byung-goo, director of the Institute of Mongolia Research, emphasized, “The compilation of the Great Dictionary of Mongolia has made it possible to conduct in-depth research on the Mongolian language and Mongolian culture, as well as comparative research with Korean. This is a very meaningful progress in the field of humanities.”

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- 1715

- 1716

- 1717

- 1718

- 1719

- 1720

- 1721

- 1722

- 1723

- 1724

- 1725

- 1726

- 1727

- 1728

- 1729

- 1730

- »