Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

Ulaanbaatar to Build, Upgrade 85.8 km of Roads in 2026 www.montsame.mn

This year, Ulaanbaatar plans to construct 52 kilometers of roads and road facilities at 13 locations, and to carry out repair and rehabilitation works on 33.8 kilometers of roads at five locations, according to the Governor’s Office of the Capital City Ulaanbaatar.

In total, construction, repair, and modernization works will cover 85.8 kilometers of roads and road facilities. In addition, pedestrian overpass bridges will be built at two locations, while street lighting covering 31 kilometers will be installed at two sites.

Under the road maintenance and improvement program, the following works are planned:

Maintenance and repair of main and auxiliary roadways, including road signs and traffic control devices;

Road marking works;

Colored pavement for dedicated public transport lanes;

Creation of a barrier-free environment for persons with developmental challenges;

Improvement of traffic safety around schools and kindergartens;

Construction of rainwater drainage systems;

Repair and expansion of wells.

Construction of the Tuul Highway, a six-lane, 32-kilometer expressway, will also begin this year. A contract with the contractor was signed in 2025, and preparatory works for the project have been completed at 80 percent. Of the 112 land parcels affected by land acquisition for the project, 10 have already been cleared.

The Tuul Highway is a strategically important project aimed at expanding Ulaanbaatar’s road network, reducing traffic congestion, and easing transit traffic passing through the city center.

Housing Projects to Advance, Construction Sector to Be Supported in 2026 www.montsame.mn

Construction of the Tuul Highway and the first Ring Road will begin in 2026, alongside efforts to advance housing projects and support the construction sector.

According to the Governor’s Office of the Capital city of Ulaanbaatar, the city has launched 16 mega projects this year to reduce air and environmental pollution and ease traffic congestion. Works have included the construction and rehabilitation of 190.8 kilometers of roads, installation of 16.3 kilometers of stormwater drainage, and the renewal of 95,000 square meters of sidewalks along major streets and roads.

Mayor of Ulaanbaatar Nyambaatar Khishgee said the capital city has carried out extensive work over the past two years in roads, bridges, and infrastructure. “As a result, road construction companies have become more self-reliant, operating their own pavers and asphalt concrete plants. In the coming years, the city will offer the construction sector planned land with cleared sites and installed infrastructure, and provide support for housing sales,” he said.

In addition, 2026 has been declared the ‘Year of Supporting Entrepreneurs,’ under which investment will be directed to the construction sector.

Over 20,000 Land Plots to Be Cleared This Year www.montsame.mn

A total of 20,218 land plots have been included in the 2026 land management plan for clearance in 2026.

According to the Capital City Governor’s Office, land clearance activities will be intensified through the implementation of 124 projects and programs, including six projects related to land clearance in sub-centers, three projects to relocate residents living in flood-prone areas, 46 projects for building construction, 43 projects for roads and road facilities, and 23 projects for the clearance of land designated for engineering infrastructure networks and their related structures.

Furthermore, land clearance carried out in 2025 created conditions for the construction of 11,575 housing units. Land was also cleared at 28 locations for the construction of 60.3 kilometers of roads, at 13 locations for upgrading engineering infrastructure networks, at five locations for the construction of flood protection embankments, at 14 locations for the construction of kindergartens and schools, as well as at sites for building 800 parking spaces near schools, three thermal power plants, and 21 additional locations for other essential social infrastructure facilities.

By order of the Mayor of Ulaanbaatar, land clearance activities continue across the capital in order to ensure a healthy and safe living environment for residents.

In 2025, land was cleared from 3,933 plots throughout the capital.

Mongolia’s influenza season now longer and cases higher over the past three years www.asianews.network

Over the past three years influenza seasons in Mongolia have lasted about twice as long and case numbers have risen by roughly 1.5–2 times, health authorities report.

This year the outbreak began earlier and spread more quickly, driven in part by the co-circulation and dominance of respiratory syncytial virus (RSV) and influenza A (H3N2) strains in the community.

To reduce severe illness and complications, the country began vaccinating high-risk groups on 12 September using 300,000 doses of vaccine manufactured in the Republic of Korea. The vaccine includes two influenza A and two influenza B strains. Authorities say higher vaccination coverage, 20–40% greater than in the preceding three years, helped blunt the peak of infections and reduce complications during the surge.

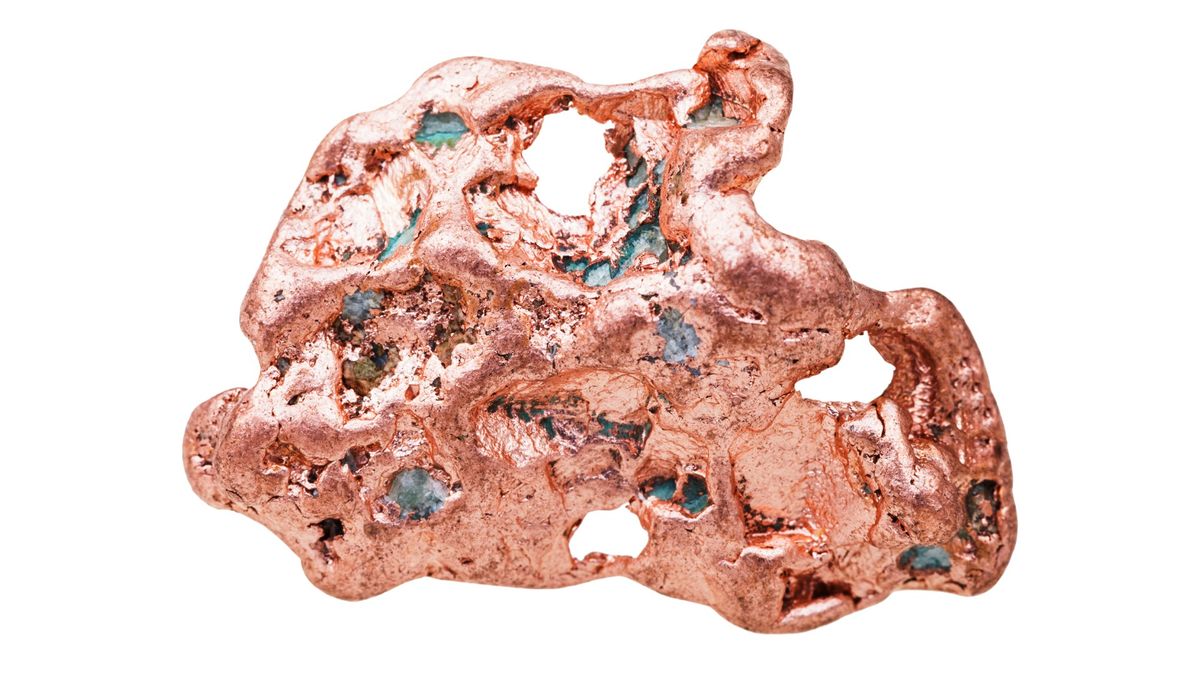

Copper price hits new record of $13,000 in London www.mining.com

Copper touched $13,000 a ton in London for the first time on Monday, extending last year’s scorching rally that was fueled by mine outages and trade dislocations.

Benchmark futures on the London Metal Exchange rallied as much as 4.3% to nearly $13,020/t, before pulling back to the $12,500 level.

Copper ended last year on a high, having notched a series of records on the LME. That resulted in its best annual performance since 2009 at more than 43%, making it the best-performing industrial metal on the bourse.

Mine disruptions

In 2025, output disruptions at major mines, such as the Grasberg in Indonesia and Kamoa-Kakula in the Democratic Republic of the Congo, raised concerns over the world’s supply of the metal, which is used in everything from data centers to electric vehicle batteries.

The same worries remain in the new year, exacerbated by a recent strike at the Mantoverde mine in Chile. According to Al Munro, senior base metals strategist at Marex, the work stoppage helped to fuel further speculative activity in the market.

“The reality is this is a speculative money-led bid as the market sees further topside, especially during the first quarter of 2026, with many having been sidelined hoping for a dip,” Munro said in a note.

“Years of underinvestment and ongoing mine disruptions have left the market with little buffer, while tariff policy uncertainty and stockpiling are intensifying the squeeze on available metal,” said Ewa Manthey, commodities strategist at ING Groep NV.

Tariff threat

In recent weeks, the renewed threat of US tariffs on copper has again led traders to ramp up shipments of the metal to American shores, reducing supplies elsewhere. President Donald Trump’s investigation into copper tariffs had already rocked the market once in 2025, sending prices in New York to records.

“We estimate the global refined copper market was in surplus in 2025, but metal/inventory flows were distorted by US tariffs that resulted in a material lift in US imports,” UBS Group analysts, including Daniel Major, wrote in a note Monday.

The US holds roughly half of global inventories, but only accounts for less than 10% of global demand, according to UBS. That means there is a risk of lower supplies elsewhere. The cash-to-three month spread in London remains firmly in backwardation, a pattern that points to near-term tightness, the bank said.

“Overall supply shortfalls, coupled with regional dislocation caused by US tariffs, are propelling copper,” China Securities Co. analysts led by Wang Jiechao wrote in a note. “The global copper market will see a shortage of more than 100,000 tons in 2026,” they said.

(With files from Bloomberg)

Most mineral and metal prices to edge higher in 2026, Fitch forecasts www.mining.com

BMI, a unit of Fitch Solutions, holds a cautiously optimistic outlook for 2026, with analysts expecting most mineral and metal prices to edge higher, supported by declining tariff uncertainties, robust demand from sectors linked to the transition to net zero and tighter supply.

“In 2026, we forecast that most minerals and metals will average higher than in 2025, as the global economy stabilizes with easing trade frictions,” analysts said in BMI’s year-end report.

Tariff uncertainty peaked in August 2025, and while the firm said it could see flare-ups between the US and individual economies over the coming quarters, its country risk team expects broad tariff uncertainty to continue to decline over 2026.

This will support demand for commodities in general, the firm noted, adding that it does not rule out bouts of volatility, especially as certain metals might face renewed US tariff pressures in the attempt to protect critical domestic industries.

“In particular, we see copper on the cards for further tariffs, with the US Secretary of Commerce required to provide an update on the domestic copper market by June 30 2026, to determine whether to implement a universal duty on refined copper of 15% from 2027 and 30% from 2028,” analysts said.

While China’s domestic housing market remains under pressure, weighing on industrial metals consumption, Fitch analysts expect this is likely to be partially offset by robust growth in green energy transition sectors, which is particularly supportive of critical minerals, including copper, aluminum, lithium and nickel.

“That said, Mainland China’s property market weakness is set to remain a drag on industrial metals price growth,” the firm noted.

Precious metals promising

In regards to precious metals, while gold prices will average higher in 2026 compared to 2025, prices will ease later in the year as monetary easing loses momentum, in particular as the US Fed eventually stops cutting rates, analysts said.

“Prices are likely to moderate later in 2026, falling below $4,000/oz as the monetary easing cycle that began in 2024 starts to lose momentum, and in particular as the US Fed eventually pauses rate cutting.”

With the global economy set to stabilize further in 2026, tariff uncertainty receding and most of the downside to the US dollar behind us, gold’s historic rally is likely to lose its shine by Q3 2026, Fitch noted.

“Our country risk team believes the US dollar index (DXY) is unlikely to experience the same amount of volatility in 2026 as it did in early 2025, inherently capping both industrial and precious metal price growth.

“While we still expect the DXY to trade within a wide range of around 95-100 over the coming quarters, we do not rule out a move to slightly stronger levels, particularly if the US economy outperforms. This will cap the extent of rise in gold prices.”

Fitch also noted that the balance of risks to its 2026 metals price outlook remains tilted to the downside, given challenging external demand dynamics and risks of weaker-than-expected global growth, particularly in China, the world’s largest consumer of industrial metals, with its domestic property sector being a major source of demand across a broad spectrum of the metals market.

“We expect Western investment to ramp up across the value chain both at home and in resource‐rich markets in 2026, alongside new strategic partnerships to secure future supply. Industrial policy has become the primary mechanism through which countries are achieving resource security as the race for critical minerals intensifies.”

M&A momentum

Fitch analysts expect robust M&A momentum in the metals and mining sector to continue into 2026, fueled by the accelerated race for critical minerals, with industry players prioritizing opportunities that strengthen their exposure to minerals essential for the energy transition, including but not limited to copper, lithium and rare earths.

Large-scale capex projects still remain in focus, yet risk-averse developments are coming to the forefront, the report said.

“We expect continued investment in mining projects across frontier markets in 2026. While resource nationalism has been a key concern for a while, we believe governments and local populations in regions including Africa now have more awareness and bargaining power over their mineral resources.

“This will enable more progress to be made on mineral beneficiation compared to previous years, with global mining investors having little choice but to comply with mineral policy changes in these jurisdictions.”

The firm forecasted metals and mining projects will benefit from partnerships with tech, autos and aerospace companies in 2026, including through offtake agreements, as supply bottlenecks threaten to derail key growth sectors like AI, robotics and defense.

G.Zandanshatar: Mongolia aims for 1 million tourists and USD 1 billion in tourism revenue www.gogo.mn

Prime Minister G.Zandanshatar said Mongolia plans to receive one million tourists and generate USD 1 billion in tourism revenue next year as he attended regional meetings in Khuvsgul province ahead of a national leaders’ summit.

The Government secretariat is preparing a joint meeting of provincial and Ulaanbaatar city governors and heads of local administrations for January 15, 2026, at which a results agreement will be signed. On January 5, Prime Minister Zandanshatar took part in an online briefing with government members and more than 300 soum and district leaders; representatives from 21 provinces and the capital also joined.

“The concept of a golden triangle of tourism has emerged,” the prime minister said, describing a development region comprising Khuvsgul, Arkhangai, Selenge and Bulgan. He said the area has strong potential for both agriculture and tourism and can generate significant foreign-exchange earnings. “This year the tourism sector earned USD 700 million; next year we aim to host one million tourists and earn USD 1 billion from tourism,” he said.

To reach these targets, G.Zandanshatar said the government will prioritise infrastructure in Khuvsgul province. Planned and ongoing works include continuing the Khankh-direction road, launching the Shine–Ider route, and building the Khankh–Khatgal road, with the Khankh–Khatgal project to be implemented from the east. He said these investments will support an integrated, environmentally friendly eco-tourism policy around Khuvsgul province.

Immigration Agency Issues Visas to 124 Thousand Foreign Nationals Last Year www.montsame.mn

In 2025, the Immigration Agency of Mongolia (IAM) received 128,949 visa applications, approving 96.9 percent (124,945) and rejecting 3.1 percent (4,004).

Most of the approved visas were tourism visas. A total of 85,690 applicants from 75 countries were issued visas through evisa.mn, and 3,913 applicants were rejected, resulting in a visa approval rate of 95.7 percent. The majority of visa rejections were due to reasons such as the applicant still being within the period of a previous visa or visa permit refusal, as well as incomplete documentation. Compared to some other countries, Mongolia’s visa issuance rate is notably high.

Mongolia issues visas based on the purpose of travel, categorized into nine main groups and 64 subcategories. These include diplomatic, official, investment, employment, study, family, migration, personal, religious, and temporary stay visas. Of these, the IAM processes 58 subcategories, while the Ministry of Foreign Affairs is responsible for the remaining six.

Construction of ‘Nairamdal-2’ Camp at Lake Khuvsgul to Begin Next Year www.montsame.mn

A working visit by Prime Minister Zandanshatar Gombojav to Khuvsgul aimag is ongoing.

During the visit, Prime Minister Zandanshatar Gombojav met with government officials of Khuvsgul aimag to present government policies and decisions, the 300-day action plan, and the main directions for Mongolia’s development for 2026–2030.

A total of 210 civil servants from 63 government organizations attended the meeting and expressed their opinions. The Governor of Murun soum said that between 2010 and 2024, the soum experienced eight major floods, causing damage estimated at between MNT 400 million and 900 million. However, funding has not yet been secured for the construction of a 15.4-kilometer embankment; thus, the governor asked the Prime Minister for financing to construct a flood protection embankment. In response, Prime Minister G. Zandanshatar instructed relevant ministries and local authorities to work together and include the necessary funds in the 2027 state budget.

The PM also said that construction of the “Nairamdal-2” children’s camp near Lake Khuvsgul had been delayed due to land disputes, but the project is now scheduled to begin next year.

Khuvsgul aimag has a population of 137,000 and is one of the three aimags of the so-called “Golden Triangle” of tourism. The Prime Minister emphasized that the Government plans to implement a comprehensive tourism policy. During the peak tourism season from June to October last year, a total of 157,562 foreign and domestic tourists visited the aimag.

Following the meeting, Prime Minister G. Zandanshatar headed to visit Shine-Ider soum of the aimag.

Mongolian vodka: A modern industry in an ancient world www.drinksint.com

Susan Zimmerman peels back the layers on Mongolia’s affinity with vodka and the rituals surrounding its consumption.

Mongolia is known as the Land of Horses due to the five million that roam its vast wilderness. But a lesser-known fact is that vodka is as deeply ingrained in the land and people as airag, the fermented mare’s milk that is considered the national drink. It was consumed during the 13th and 14th centuries of the Great Mongol Empire and was the drink of choice for the country’s celebrated warlord Chinggis Khan (Genghis in the western world) and his warriors, fuelling his famous land grabs that stretched from eastern Europe to the Pacific Ocean. The importance of this beloved beverage never tailed off.

Wheat grains and horse tails

There’s a Mongol saying, if there is no horse, it means there is no airag and if there is no airag it means there is no joy. It takes some elbow grease to produce this joy. During the summer airag-making season, the mares need to be milked up to nine times a day before the liquid is churned up to 4,000 times over several days to ferment before drinking. From this revered beverage comes shimiin arkhi (or simply arkhi), a homemade mare’s milk vodka (typically 12% abv) that is airag once distilled.

Wheat vodka is a horse of another colour. Though not as numerous as the equines that roam the steppes, at least 44 different Mongolian vodkas line the shelves at the Emart hypermarket in the capital city Ulaanbaatar. This spirit is as much a part of the social fabric as airag, though making wheat vodka is a different animal. Mongolia’s introduction to this spirit arrived courtesy of the Soviets during their almost 70-year occupation of the country from 1921 to 1990. The Mongolians didn’t drink much vodka at the time, but their occupiers taught them well and, once free of their overseers, their vodka industry blossomed.

The pearly gates

The country’s first and largest distillery APU Company (APU) – which stands for Absolute, Pure, Unique – opened in 1924 and, along with the country’s other large-scale distilleries, has carried on a vodka-making tradition that would have made the Soviet mentors proud. In 2001, 51% of APU Company was privatised and in 2017 Heineken became a minority shareholder. Today the company makes up about 30% of the country’s capital market.

Vodka is the most consumed alcoholic drink in the country and APU currently produces some 28 brands. Premium-luxury brand Soyombo and its other top-shelf vodkas are made with wheat from the Mongolian steppes and spring water that comes from the sacred Bogd Khan Mountain, while the distillation maxes out at six times. The filtration is where the high-stakes game for purity is played out with diamonds, then APU ups the ante with silver, quartz and pearls. Ulaanbaatar is burgeoning with high rise blocks, high fashion and the headquarters of APU. Inside the blending room, opera music blares out from Mongolian composer Sharav along with Bach, Beethoven and Mozart.

APU’s blending team leader Enkhamgalan Boldbat explains: “The music lulls the distilled alcohol and water mixture in the tanks to rest by calming the water molecules to create a smoother taste. You can’t take the science out of vodka production because it is fully based on facts and numbers and chemistry, but infusing it with our culture makes it more artistic.”

Well, if “music has charms to soothe a savage beast” in the often-misquoted words of a 17th-century playwright, then it must work on water. Putting the theory to the test seemed apropos in the blending room where a tasting table awaited with its premium Chinggis Khan, The Original Mongolian Vodka. The taste was over the top and smooth as silk – those diamonds, silver, quartz and pearls were doing their job, but left a question. Why did APU also have filters filled with beads of garnet, turquoise, lapis lazuli, red coral and black pearls, along with steel, silver and gold strands?

A treasured twist

Nansalmaa Sharavdorj, head of the vodka plant at APU, adds: “You know about the nine gems of Mongolian culture, right? That is why we had those filters made.” The semi-precious gemstones in the filters were inspired by a concept rooted in traditional Mongolian culture represented by nine auspicious materials (gold, silver, red coral, pearl, copper, turquoise, lapis lazuli, steel and quartz crystal) believed to bring luck, while the number nine symbolises longevity, happiness and prosperity. Those filters were used in various other APU vodka brands. The symbolism of the nine gems, coupled with airag’s sacred use, highlighted the practice of paying homage to the past.

According to The Secret History of the Mongols, written in 1227, the oldest surviving literary work in the Mongolic languages which recounts the life of Chinggis Khan, the Great Khan sprinkled mare's milk on the ground to honour a mountain for protecting him. Before battle, his men would sprinkle mare’s milk on the ground to ensure victory. This tradition lives on in a variation with the present-day practice of sprinkling mare’s milk on a horse before a race. The culture is also honoured by APU’s use of copper pots during distillation. According to Sharavdorj, this stems from ancient Mongolian practices where water was stored in copper and silver pots overnight to reduce bacteria and improve taste.

Sharavdorj explains: “When we refer to ancient traditional methods we mean the pot boiling method used for generations by nomadic herders for distilling spirits from fermented milk. APU’s cow milk vodka Shiguderi incorporates this practice.”

Distilling the drinking

Vodka is a staple of everyday life and with it comes ancient libation practices that have evolved over the centuries. When offered a drink always take it in your right hand and dip the tip of your ring finger into the liquid. Then, using the ring finger and thumb flick up towards the clouds, dip again then flick down to the ground and again towards yourself. This gesture of offering a taste to the sky, earth and ancestors is symbolic of the culture of respect that permeates Mongolian life.

“The Mongolian tradition is one of respect. When someone respects you they offer you the best of their food and the best of the food is vodka. There is always vodka on the table,” says Munkhtuul Erdenebat, a sustainability manager at APU. There is polite protocol when visiting a ger (nomadic home similar to a yurt). Foreign guests are directed to the left to sit down. Low-to-the-ground stools are a long-standing custom. Then, instead of shaking hands, the head of the household offers guests a tiny bottle called a khoorog (made of precious stone) containing powdered tobacco. Proper etiquette is to raise the cap halfway and take a sniff. The vodka ritual follows, paying homage to the sky, the earth and the ancestors.

When people drink vodka, according to Dulguun Altangerel, a university lecturer in Ulaanbaatar, they say: “Let’s drink the white thing.” The term refers to airag’s colour, associated with purity and good fortune in nomadic culture.

Altangerel adds: “The vodka tradition is to be comfortable when drinking – it’s a bad omen to eat and drink while standing or lying down.” Another ancient tradition, nowadays done as a joke, was for the husband to serve vodka to his wife first in case it was poisoned. Traditionally the male is always served first, be it food or drink, while an old hangover cure is pickled sheep eyeballs. Traditions are profuse, especially in nomadic life where rituals rule.

Marco Polo wrote that Mongolian vodka was “similar to wine” in his 13th-century account The Travels of Marco Polo, while Flemish Franciscan monk William of Rubruck dittoed that sentiment in his 13th-century Account of the Mongols. Ingrained in these ingredients are deeply-rooted rituals and traditions that are solely Mongolian, something no other vodka can claim.

By Susan Zimmerman

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- 1715

- 1716

- 1717

- 1718

- 1719

- 1720

- 1721

- 1722

- 1723

- 1724

- 1725

- 1726

- 1727

- 1728

- 1729

- 1730

- »