Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

Mongolian Airways Cargo purchases 2 Airbus planes www.news.mn

The Mongolian air carrier Mongolian Airways Cargo purchased 2 Airbus A330-200 and A320-200 planes.

These planes landed at the former Buyant-Ukhaa airport on 2 December.

The planes will fly to transport hubs in Asia and Europe, such as Berlin, Moscow, Yekaterinburg, Singapore, Urumqi and Shanghai. In addition to meat, meat products, wool, cashmere and rare-earth elements, it is possible to transport mining equipment, large items and special cargo from Mongolia.

Mongolia has the exclusive rights to make frequent cargo flights to the Russian Federation and the People’s Republic of China, which have not been used until now.

With the completion of its cargo terminal, ‘Mongolian Airways Cargo’ will provide international express mail and a comprehensive logistics services to the customers.

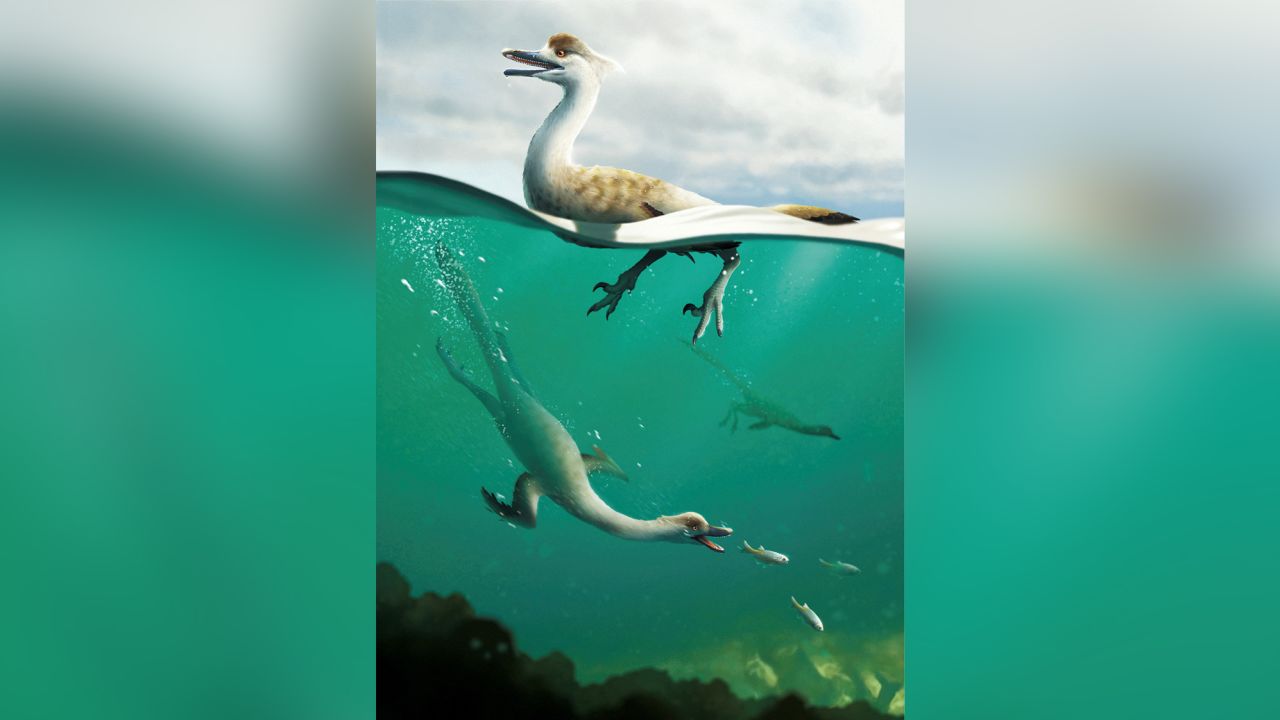

A new species of dinosaur might have dived like a duck to catch its prey www.cnn.com

A new study found evidence at least one species of dinosaur may have been an adept swimmer, diving into the water like a duck to hunt its prey.

Researchers captured footage of the black-naped pheasant-pigeon 140 years after the bird was last documented by scientists.

This bird hadn't been documented by scientists since 1882. Then they captured video of it in Papua New Guinea

The study, published in Communications Biology on December 1, describes a newly-discovered species, Natovenator polydontus. The theropod, or hollow-bodied dinosaur with three toes and claws on each limb, lived in Mongolia during the Upper Cretaceous period, 145 to 66 million years ago.

Scientists from Seoul National University, the University of Alberta, and the Mongolian Academy of Sciences collaborated on the paper.

The researchers pointed out Natovenator had streamlined ribs, like the those of diving birds.

“Its body shape suggests that Natovenator was a potentially capable swimming predator, and the streamlined body evolved independently in separate lineages of theropod dinosaurs,” wrote the authors.

The Natovenator specimen is very similar to Halszkaraptor, another dinosaur discovered in Mongolia, which scientists believe was likely semiaquatic. But the Natovenator specimen is more complete than the Halszkaraptor, making it easier for scientists to see its streamlined body shape.

Both Natovenator and Halszkaraptor likely used their forearms to propel them through the water, the researchers explained.

David Hone, a paleontologist and professor at Queen Mary University of London, told CNN it is difficult to say exactly where Natovenator falls on the spectrum of totally land-dwelling to totally aquatic. But the specimen’s arms “look like they’d be quite good for moving water,” he said. Hone participated in the peer review for the Communications Biology study.

Additionally, Natovenator had dense bones, which are essential for animals diving below the water’s surface.

As the authors wrote, it had a “relatively hydrodynamic body.”

The next step, Hone said, would be to perform modeling of the dinosaur’s body shape to help scientists understand exactly how it might have moved. “Is it paddling with its feet, a bit of a doggy-paddle? How fast could it go?”

Further research should also look at the environment in which Natovenator lived. The specimen was discovered in Mongolia’s Gobi Desert, but there is evidence there have been lakes and other bodies of water in the desert in the past.

“There is a real question of, OK, you’ve got a swimming dinosaur in the desert, what’s it swimming in?” he said. “Finding the fossil record of those lakes is gonna be tough, but sooner or later, we might well find one. And when we do, we might well find a lot more of these things.”

Nizar Ibrahim, a senior lecturer in paleontology at the University of Portsmouth, whose research has included findings indicating Spinosaurus was likely semiaquatic, told CNN he isn’t entirely convinced by the study’s findings yet. He argued more rigorous quantitative analysis would have made the findings more compelling.

“I would have liked to see, for example, a real solid description of the bone density, the osteohistology of the animal, within a larger data set,” he said. “Even the rib anatomy, if they had kind of put that into a larger picture – the big data set that would have been helpful.”

The “anatomical evidence is less straightforward” for a swimming Natovenator than it was for a swimming Spinosaurus, he said.

And like Hone, he’s also curious about which waters exactly Natovenator might have been swimming in. “The environment this animal was found in Mongolia, is kind of the exact opposite of what you would expect for a water-loving animal,” he said.

But he hopes the study can help open the door for more expansive ideas about dinosaur behavior. Dinosaurs were previously thought of as strictly terrestrial, but increasingly, evidence has emerged suggesting at least some species spent as much time in the water as they did on land.

“I’m sure that there will be many, many more surprises,” said Ibrahim. “And we’ll find out the dinosaurs were not just around for a very long time, but also, you know, really diverse and very good at invading new environment.”

Mongolia confirms 61 COVID-19 cases in past 24h www.akipress.com

61 new COVID-19 cases were confirmed in Mongolia in past 24 hours.

27 of them were contacts in Ulaanbaatar, and 34 were recorded in the regions. No imported cases were found.

The total number of deaths from coronavirus remained 2,135.

‘Sharing a bed with a bear and a dragon’, Mongolia aims closer ties with Australia www.smh.com.au

Singapore: Mongolia’s deputy prime minister has called for closer ties between Canberra and Ulaanbaatar as the central Asian country finds itself wedged between the geopolitical ambitions of Russia to its north and China to its south.

Declaring Mongolia shared “common values with Australia, such as democracy and human rights”, Amarsaikhan Sainbuyan said the former Soviet satellite state would “not support forceful actions, whether it is China, Russia or any other country around the world”.

Mongolia has been largely neutral in its positions on Russia’s war in Ukraine and China’s threats toward its democratic neighbour Taiwan because of its economic dependence on the two powers. But as tensions grow stronger, it has started carving out deeper relations with third countries and a more independent foreign policy.

“Being directly situated in between these two big neighbours, whether it is on the China side, or the Russian side it directly affects Mongolia’s economy. It is one of our main concerns,” Sainbuyan told The Sydney Morning Herald and The Age.

“Instability in the region will affect all countries, especially Mongolia. That’s why we believe this should be resolved peacefully.

Sainbuyan reiterated Mongolia’s support for the one-China policy but criticised Beijing’s actions in Inner Mongolia, the northern Chinese province that abuts its southern border. Chinese authorities placed restrictions on Mongolian language learning in schools in 2020 and activists warned the cultural crackdown on the region is intensifying after Beijing’s suppression of Xinjiang. A joint United States and the European Union statement released on Friday criticised China’s “human rights violations” in the region.

“We respect and also value this human right of freedom of speech and freedom of learning, especially having this issue related to mother language and culture,” Sainbuyan said.

“Culture should be respected and treated fairly. We have ethnic groups like Kazakhs in Mongolia. We do not restrict their freedom of learning their native language. This is an international human rights issue, and it should be maintained and protected.”

Mongolian President Ukhnaagiin Khurelsukh visited his Chinese counterpart Xi Jinping in Beijing last week, when Xi urged him to pursue “integrated development”. Khurelsukh described their friendship as “ironclad”.

“We have witnessed a fast development in trade and political relations between the two countries,” Teng Jianqun from the China Institute of International Studies told CGTN in Beijing.

But Sainbuyan raised concerns about China’s trade strikes on Australia. The sanctions have covered $20 billion in exports across half-a-dozen industries following disputes with Beijing over national security, human rights, and COVID-19.

”International trade should be based on basic principles, international rules, and international law. It should be fair and competitive. Whether it’s China or Mongolia or Australia, we all have our own interests in economic and national, and international co-operation. So, everything should be based on basic international rules and principles.”

The sanctions were a key point of discussion between Sainbuyan, Foreign Minister Penny Wong, and Deputy Prime Minister Richard Marles when he visited Canberra in September.

Australia was China’s largest supplier of thermal coal and a significant player in its coking coal market until Beijing imposed the restrictions in 2020. In March 2021, Mongolian coking coal exports grew by more than 4270 per cent compared to the previous year as it displaced the $10.4 billion Australian coal export market. Mongolia has continued to be the dominant supplier since but that could shift as relations between Beijing and Canberra show signs of a thaw.

Sainbuyan said Mongolia did not see Australia as a competitor. “We see it in different ways,” he said. “Instead, we are trying to make better infrastructure environmentally friendly and economically competitive, while also working towards increasing the export volume as much as possible.”

Mining accounts for 26 per cent of Mongolia’s economy, damaging its environment and leaving it heavily dependent on fossil fuels as climate change targets put pressure on developing countries to diversify their resource base. Australia’s Climate Change and Energy Minister Chris Bowen led negotiations over payments from wealthy economies to developing countries at COP27 in November after a $148 billion funding target in 2020 was never met, fuelling tensions during discussions in at Sharm el-Sheikh.

“Developed countries have already used coal as much as they could. At the same time, they are moving rapidly to wind energy and other sources,” Sainbuyan said. “But that does not mean Mongolia can keep up with them unless they support Mongolia. Mongolia has hard and harsh climates, it is -40 degrees in winter. Imagine if we only have solar power. It is not easy.

“It takes time, and it needs investment, international policy, and financial support.”

In February, his government signed a deal to build the Soyuz–Vostok gas pipeline, which will carry natural gas from Russia to China via its territory. Sainbuyan said it would help wean Mongolia off coal, but critics argue it will make it more dependent on Russian energy while also helping it find the world’s largest alternative markets as Europe shuns Russian gas over the war in Ukraine.

“Mongolia sits in a particularly precarious situation with China and Russia as its only neighbours, one that is sometimes described as sharing a bed with a bear and a dragon,” said Julian Dierkes, an associate professor at the University of British Columbia in analysis published by Foreign Policy.

“As much as Mongolia has sought to chart its own course for the last three decades, the walls have been closing in as China and Russia’s partnership deepens.”

Sainbuyan defended the pipeline.

“It’s not only about Mongolia-Russia relations, trade, or economic issues,” he said. “We consider this regional infrastructure and energy supply mega project will not only benefit Russia and Mongolia but the whole region should be benefitting from this project.”

Sainbuyan said the drawings and technical details of the pipeline had been completed, and it had now been moved to a state tender. He said construction on the project, which will bring 50 billion cubic metres of gas to China annually, was expected to begin by the northern spring.

BY: Eryk Bagshaw

Eryk Bagshaw is the North Asia correspondent for The Sydney Morning Herald and The Age.

3x3 basketball: can Hong Kong follow Mongolia’s route to the Olympics? www.scmp.com

As basketball stars departed last week following the FIBA 3x3 World Tour Hong Kong Masters, they left behind the question of whether the city could become a force in the sport’s shortened form – and the answer may lie in Mongolia.

The best-performing Asian team at the Masters were Mongolian side Ulaanbaatar, in keeping with their country’s progress in the format since it actively developed 3x3 a decade ago. Some believe Hong Kong could aim to follow the template of the continent’s now leading nation, perhaps all the way to the Olympics.

Latvia and the United States won the men’s and women’s gold respectively when 3x3 made its Olympic debut in Tokyo last year, with Russia taking silver in both, but Mongolia’s women’s team were a notable inclusion, too.

Their appearance at the Games was the consequence of decisions and funding in Mongolia that grew 3x3 rapidly – something that Hong Kong could emulate, according to Kenny Wong, CEO of Masters organiser M1 and vice-president of the Hong Kong Basketball Association (HKBA).

“There has been no shortage of great players in Hong Kong over the years, but to assemble a team of 12 to 15 players [for full-court basketball] is way more difficult than four to six [for 3x3],” Wong said.

“Mongolia were my inspiration from day one. I think in [about a decade], we could compete like them if we devote ourselves to 3x3.”

Wong said Mongolia was a realistic comparison because its traditional basketball was at a similar level to Hong Kong’s.

He added that one next step would be to seek help from more advanced countries to develop coaching specific to 3x3.

“That is the root of everything – a complete system is essential,” Wong said. “That is also why we hosted the tournament, to help players to familiarise with the game and establish contacts with world elites.”

It looks a long road, with Hong Kong ranked 21st in the region and 85th in the world, but the Olympics may not be an unattainable dream if the HKBA allocates time and investment.

Bryant Austin, who led invitation side Team Hong Kong at the Masters and plays for Shung Tak Alumni Eagles in the local A1 Division, believes the city “can make an impact in 3x3”.

“We have lots of talented players in the A1 Division,” said the 35-year-old from Ohio. “We have tall players as well as small players with outstanding quickness. [If 3x3 is developed here] Hong Kong have a great chance.”

Echoing him was Tyler Kepkay, who led Team Hong Kong’s scoring against Riga – made up of Latvian Olympic champions – in the Masters.

“You have to be able to shoot, be physical and be agile,” the Winling ace said, adding that Hong Kong players already play in a physical league with “lots of fouls going on”.

He and Austin cited Ricky Yang, Simba Pok, Tsai Choi-kwan and Leung Shiu-wah as local names to watch.

However, investment is needed. Mongolia’s 3x3 system is sponsored by the Mongolian Mining Corporation, a public company listed on the Hong Kong stock exchange. The country is set to host FIBA’s Women’s Series Final and Nations League next year, as well as the FIBA 3x3 U23 World Cup in 2024, and is ranked in the top six in all 3x3 age groups for men and women.

Smart recruitment helps, too. Among the quartet playing in Hong Kong for Ulaanbaatar was player-coach Steve Sir, a Canadian 3x3 legend who is No 25 in FIBA’s individual rankings. He is also coach and director of player development for Mongolia’s men’s and women’s national 3x3 teams.

South China player Tommy Nixon said Sir “was recruited to help guide their team and put them forth to compete in as many global events as possible”.

Learning from the best is essential, Kepkay said. “Watch how the best play, figure out what style suits the players and work on those skills, then in five, six or seven years they can compete at that level.”

Mike joined SCMP in 2022 as a senior reporter with 20 years of experience in sports journalism across various platforms including print, TV & online media. He previously worked in Singapore as a show producer with global sports network ESPN, before relocating back to Hong Kong with a local newspaper. Mike is a true sports lover with particular interest in basketball and football, and has been rooting for Liverpool FC since 1988.

Chinese astronauts return to Earth after six-month mission www.bbc.com

Three Chinese astronauts have returned to Earth after completing a six-month mission aboard China's space station.

They left for space on 5 June to oversee the final construction stage of the Tiangong space station, which was completed in November.

The crew touched down on board the Shenzhou-14 spacecraft on Sunday in China's autonomous region of Inner Mongolia.

China's space agency declared the mission a "complete success".

Commander Chen Dong and teammates Liu Yang and Cai Xuzhe said they were feeling well after landing, in audio aired by state broadcaster CCTV.

Staff at the landing site carried the crew out of the exit capsule, which landed shortly after 20:00 local time, about nine hours after undocking from the space station.

Ms Yang, China's first female astronaut, said she had an unforgettable memory in the space station and "is excited to return to the motherland," Xinhua state news agency reported.

While in space, the three astronauts oversaw the arrival of the second and third modules for Tiangong and carried out three spacewalks to check and test the new facilities.

Liu Yang, who took part in the mission, is China's first female astronaut

A new crew of three Chinese astronauts arrived at the space station to make its first in-orbit crew handover on Wednesday.

The new crew lifted off in the Shenzhou-15 spacecraft from the Jiuquan Satellite Launch Centre in the Gobi Desert in north-west China.

They will live on the station for six months. It will be the second permanently inhabited space outpost, after the Nasa-led International Space Station from which China was excluded in 2011.

It is the last of 11 missions required to assemble the station that is expected to operate for around a decade and run experiments in near-zero gravity.

The new crew will focus on installing equipment and facilities around the space station, a spokesperson for the China Manned Space Administration said.

China is only the third country in history to have put both astronauts into space and to build a space station, after the Soviet Union and the US.

Tiangong space station, or "Heavenly Palace", is China's new permanent space station. The country has previously launched two temporary trial space stations, named as Tiangong-1 and Tiangong-2.

Over the next decade of the Tiangong's operation, it is expected China will launch two crewed missions to the station each year.

China has opened the selection process for astronauts for future missions to applicants from the "special administrative regions" of Macau and Hong Kong, who have previously been excluded.

China put its first satellite into orbit in 1970 - as it went through massive disruptions caused by the Cultural Revolution.

In the past 10 years, China has launched more than 200 rockets.

It has already sent an unmanned mission to the Moon, called Chang'e 5, to collect and return rock samples. It planted a Chinese flag on the lunar surface - which was deliberately bigger than previous US flags.

Central bank purchases 2.4 tons of precious metal in November www.montsame.mn

In November, the gold purchase of the Bank of Mongolia (BoM) was 2,667.0 kg, raising the BoM’s total precious metal purchase of 2022 to 19.9 tons.

Since the beginning of this year, the BoM branches in Darkhan-Uul and Bayankhongor aimags have bought 2,780.1 kg and 1,332.0 kg of precious metals respectively.

In November, the average price of BoM’s purchase of 1 gram of gold was MNT 197,545 last month.

Mongolian President Says He Supports Russia-China Oil And Gas Piplines Through Mongolia www.reuters.com

Mongolian President Ukhnaagiin Khurelsukh said on Thursday that he supports the construction of oil and gas pipelines from Russia to China via Mongolia.

Speaking via translator at a trilateral meeting with Russian President Vladimir Putin and Chinese President Xi Jinping at a summit of the Shanghai Cooperation Organisation in the Uzbek city of Samarkand, Khurelsukh backed the plans, proposing studies of their economic feasability.

Khurelsukh said: "We also support the construction of oil and gas pipelines to supply natural gas from Russia to China through the territory of Mongolia and propose to study this issue from the viewpoint of technical and economic justification".

Russian energy giant Gazprom hopes to build the Power of Siberia 2 gas pipeline via Mongolia to China with a view to exporting 50 billion cubic metres of gas per year via the route by 2030. No plans for an oil pipeline via Mongolia have yet been formally proposed.

Talon raises cash as it takes stake in Mongolian project www.miningweekly.com

PERTH (miningweekly.com) – Oil and gas explorer Talon Energy will raise A$12-million in a share placement and will acquire a 33% participating interest in a production sharing agreement over the Gurvantes coal seam gas project, in Mongolia.

The ASX-listed Talon on Thursday announced that it would place some 85.7-million new shares at a price of 14c each, with the placement well supported by existing institutional and sophisticated investors.

“The success of the placement has provided Talon with a sound financial footing as it moves into its next phase of growth, the development of its portfolio,” aid MD Colby Hauser.

“With the success of placement the company has been able elect to take a 33% participating interest in the Gurvantes XXXV joint venture (JV), where our election to commit to the JV required the company to commit to fund the first $3.15-million of expenditure of the Stage 2 pilot well program, and 33% of ongoing expenditure at Gurvantes, as well as pay an additional $809 333 to TMK, based on the recently announced 1.2 Tcf 2C contingent resource for Gurvantes.

“The placement has also removed the uncertainty around funding for the coming months as the company works towards finalising negotiations to secure a debt facility to fund the development at Walyering, which will only become available to draw on following the achievement a near term project milestones.”

Commercial production from the Walyering project is planned for the first quarter of 2023.

Talon said on Thursday that In conjunction with the funds received through the placement, discussions on a debt facility to fund the development of Walyering, are continuing, and are well advanced. Once finalised, the company will be fully funded for forecasted activities through to first revenues at Walyering, and Gurvantes activities to the end of the 2023.

EDITED BY: CREAMER MEDIA REPORTER

Mongolia’s Efforts Toward Ensuring Implementation of BWC Presented www.montsame.mn

A conference to review the implementation of the Biological Weapons Convention (BWC) is being held in Geneva between November 28 and December 16.

During the General Debate which took place on the first day of the conference, Mongolia’s Ambassador and Permanent Representative to the United Nations Office and other international organizations D. Gerelmaa delivered remarks, presenting the measures taken by the Government of Mongolia in ensuring the implementation of the BWC.

In her remarks, she reiterated that the Government of Mongolia stands committed to implementing the BWC within the framework of its peace-loving foreign policy. While stressing the importance of mutually sharing knowledge and experience within the framework of realizing the BWC and further consolidating cooperation between the member states while giving details on the measures carried out by the Government of Mongolia in this sphere.

The BWC is a key element in the international community’s efforts to address weapon of mass destruction proliferation and it has established a strong norm against biological weapons. The Convention has reached almost universal membership with 184 States Parties and four Signatory States.

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- »