Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

Finance Minister presents on projected budget of 2020 www.montsame.mn

Ulaanbaatar /MONTSAME/. On September 27, Minister of Finance Ch.Khurelbaatar delivered a media presentation on bills on state budgets of Mongolia for 2020, which have been submitted to the Parliament for discussion.

Total budget revenue for next year is estimated at MNT 12.9 billion and total expenditure at MNT 13.8 billion. Taking into the consideration the total equilibrated revenue of MNT 11.7 billion from sources of tax revenues, nontax revenues, revenues from assistance, stabilization fund, future heritage fund as well as total expenditures, which include salaries, pensions, social benefits, subsidies, loan interest payment, investment, expenses of products and services, repayments of loans, the state budget balance is expected to fall short of MNT 2 trillion, which equals to 5.1 percent of GDP.

However, the Finance Minister Ch.Khurelbaatar noted that the state budget is likely to show profitability from 2023 and the government is taking measures to reduce budget deficit gradually so that business entities and citizens are not affected.

The economic growth for next year is projected at 7-8 percent (economic growth was 7.2 percent and 7.3 percent in the first half of 2019) and inflation rate to remain the same as this year at around 8 percent. According to Finance Minister, domestic risks to the state budget performance are the possibility of Mongolia being included in an international financial grey list, drop in mineral commodity price and a risk of severe wintering.

Some key highlights from the projected state budget for 2020 are;

- Tax refunds to be issued every quarter

- No domestic or foreign bonds to be issued in order to alleviate budget deficit

- MNT 200 thousand monthly-stipend to be issued to students of the vocational centers and colleges

- In terms of mining commodities, a total of 42 million tons of coal to be sold (coal energy at USD 75 and coking coal at USD 125) and total of 1225 thousand tons of copper concentrate to be sold.

- MNT 160 billion for salaries is allocated to the budget for coordination of salary and inflation rate.

- MNT 5.4 billion to be spent for “Healthy Teeth” program.

- MNT 53 billion for rebuilding the Natural History Museum

- MNT 30 billion for rebuilding the Grand Theatre of National Arts

- MNT 4 billion for rebuilding the National Academic Drama Theatre

- MNT 4 billion for rebuilding the National Library.

- MNT 20 billion for the participation in the Tokyo Olympics

- MNT 15 billion for development of Industrial Park of Darkhan

- MNT 137 billion for Air pollution reduction

- MNT 1.3 billion for drug control.

President of the Czech Senate to pay an official visit to Mongolia www.montsame.mn

Ulaanbaatar /MONTSAME/ President of the Senate of the Czech Republic Jaroslav Kubera is to pay an official visit to Mongolia accompanied by business delegation on September 29-October 2.

Mr. Jaroslav Kubera will hold meetings with President Kh.Battulga, Speaker of the Parliament G.Zandanshatar and other high-level officials.

Moreover, he will open a business forum, which will be held at the Mongolian National Chamber of Commerce and Industry and officially open the Czech Export Promotion Center. In frames of the visit, Mongolian and Czech companies running activities in infrastructure, energy, agriculture, mining, exploration, law and legislation, insurance and transport logistics fields will hold one-on-one meetings.

Besides meeting with Mongolian graduates of Czech universities and colleges and Mongolian businessmen, who are contributing in development of bilateral relations the President of Senate is expected to visit New Ulaanbaatar Airport to discuss new projects on development of general purpose air transport.

More direct flights to be conducted in route Ulaanbaatar-Istanbul www.montsame.mn

Ulaanbaatar /MONTSAME/ At the end of 2-day meeting of bilateral working group in charge of amendments on Intergovernmental Agreement between Mongolia and the Republic of Turkey on Air Relations, the sides signed the agreement on September 26.

The agreement will enable the number of aviation companies to be increased from Mongolian side and to conduct direct flights with frequency of 3 times a week from the two sides each with maximum of 800 seats.

Currently, only ‘Turkish Airlines’ aviation company is operating flights from Turkish side 3 times a week with maximum 500 seats and an intermediate stop in route Istanbul-Bishkek-Ulaanbaatar.

By increasing number of flights, seats and aviation companies to operate flights in route Ulaanbaatar-Istanbul-Ulaanbaatar, numerous opportunities such as save time to travel to European countries and reduce ticket price, will be opened. The agreement will come into effect when the sides exchange notes.

Mongolian delegation headed by Head of Air Transport Policy Coordination Department of the Ministry of Road and Transport Development D.Myagmarsuren and Director of the Civil Aviation Authority L.Byambasuren and Turkish delegation led by Director General of Directorate General of Civil Aviation of Turkey Mr. Bahri Kesici attended the bilateral meeting.

‘Our Creations in Space’ : launch planned from UB! www.news.mn

This year, Mongolia is marking the 380th anniversary of the foundation of its capital Ulaanbaatar. To mark this important event, a competition entitled ‘Our Creations in Space’ has been announced for school children aged 12-15. The youngsters can compete with any works that they think the work should be sent to space. The event is co-organised by Governor Office of the capital city and Ulaanbaatar City Tourism Department in collaboration with Mongolian Aerospace Research and Science Association (MARSA).

On 29 October, the works selected by children will be sent to 38 thousand meters above the centre of Ulaanbaatar with a special high-altitude balloon. The balloon will also carry the official crest of Ulaanbaatar and the names of 380 randomly selected citizens of the capital. The balloon will also have some proper work to do including collecting information on air quality above the capital and performing other scientific task.

Ulaanbaatar cwill be the second capital in the world to launch a high-altitude balloon from its central square. A joint team from the Mongol Koosen College of Technology and Japan’s Chiba Institute of Technology will launch the balloon.

China now produces 56% of the world’s steel www.mining.com

Data released on Monday showed Chinese steel output rebounded in August rose 9.3% from the same month a year before to 87.3m tonnes; not far off the record set in May this year, according to the World Steel Association.

Chinese furnaces now produce 56% of the world’s steel despite pollution-related output cuts mandated by Beijing over the winter months and a slowdown in construction activity.

This is due to blast furnaces in the rest of the world being idled, notably in Japan where August saw a 7.8% drop in crude steel leaving mills. US output was flat while Europe marked a 2.2% decline. Production in the rest of the world outside China is now down for three straight months.

Benchmark iron ore prices were flat on Friday with the Chinese import price of 62% Fe content fines exchanging hands for $90.91 per dry metric tonne, according to Fastmarkets MB, after coming close to triple digits a fortnight ago.

Iron ore remains in a bull market for 2019, up 25% on the back of supply disruptions from top miner Vale following a deadly dam burst in January.

The Australian export price of metallurgical coal (FOB hard coking coal Fastmarkets MB) used in steelmaking eased again on Friday to $121.50 a tonne. That’s down almost $70 a tonne compared to the start of the year amid oversupply and import restrictions imposed by Beijing.

The United States Should Help Mongolia Stand Up to China www.foreignpolicy.com

It would be hard to find a country that has more at stake in the outcome of U.S.-China strategic competition than Mongolia—or that better demonstrates why that competition is not a lost cause. With only some 3 million citizens occupying a large territory rich in natural resources sharing a long land border with under-resourced China’s population of 1.4 billion, Mongolia’s security situation is “intense,” in the words of the commander of its armed forces. But Mongolians will not bend to Chinese domination.

Mongolia is bent on resisting Chinese economic, cultural, and political domination. Tour guides, statues, currency, museums, and beer brands all remind the Mongolian people of their national narrative: sovereignty established in the 13th century by Genghis Khan, whose descendants would go on to conquer China—not the other way around. History aside, Mongolians point to democracy as their greatest source of national pride, according to government polls I reviewed with permission. (Mongolian scholars try to connect the two by pointing out that Genghis Khan was an advocate of freedom of religion and trade and that nomads are inclined to personal freedoms.) And many Mongolians are deeply suspicious of communist China after having suffered under seven decades of Soviet rule until the country’s transition to democracy 30 years ago. It is no wonder that then-U.S. National Security Advisor John Bolton and Defense Secretary Mark Esper have both seem to have felt at home there during recent visits.

I

The enormous geopolitical pressure from China is not immediately apparent when one walks the streets of Ulaanbaatar, with its combination of gritty Soviet-era architecture, sparkling new high-rises, and the occasional yurt. There are few of the large advertisements for the Chinese telecommunications giants Huawei or ZTE one finds in Eastern Europe or other targets of Beijing’s Belt and Road Initiative development scheme. Indeed, the government has limited participation in Belt and Road, and one finds few supporters of the initiative among the public, even though Mongolia desperately needs new roads and infrastructure. Mongolians’ consensus seems to hold that Chinese development funds are worth avoiding, because China would use state-owned enterprises and debt traps to swallow Mongolia’s land and freedom. A refrain I heard more than once over the summer, some of which I spent in Mongolia, runs: “First they will take Hong Kong, then Taiwan—and then they will come for Mongolia.” Scholars and officials in Ulaanbaatar say they can point to numerous Chinese government speeches and documents that set 2049, the 100th anniversary of the Chinese Revolution, as the deadline for absorption of their country.

As a landlocked nation, Mongolia depends on China to buy more than 90 percent of its exports, and Beijing has used that leverage to punish Ulaanbaatar in the past.As a landlocked nation, Mongolia depends on China to buy more than 90 percent of its exports, and Beijing has used that leverage to punish Ulaanbaatar in the past. A majority of Mongolians are Buddhists in the Tibetan tradition, and temples and some restaurants are adorned with shrines to the Dalai Lama. When the Tibetan spiritual leader visited the country in 2016, Beijing blocked trade and forced the government to agree there would be no future visits. Now, Beijing is quietly threatening further sanctions if Mongolia does not turn to the Chinese Communist Party’s eventual choice of the next Dalai Lama—something devout Buddhists in the country would never accept. When Mongolian President Khaltmaagiin Battulga announced a strategic partnership with the United States during a visit to Washington in July, Chinese media warned that Mongolia would inevitably fall under Chinese suzerainty, and a handful of political leaders in Ulaanbaatar unexpectedly condemned the government’s enhanced friendship with Washington—criticism that many in the Mongolian government believe was funded by Beijing in a pattern of political interference seen elsewhere in Asia.

It would be hard to envision a scenario in which the United States could defend Mongolia militarily, but the fact is that Washington has a stake in Mongolia’s sovereign democracy surviving Chinese pressure, along with the tools to help. Mongolians call the United States their “third neighbor,” and the sentiment is heartfelt if at times a bit desperate. Esper’s August visit was a symbolic demonstration that the Trump administration will not let its friends be bullied with impunity. Legislation called the “Mongolia Third Neighbor Trade Act” is pending in on Capitol Hill. It’s intended to reduce U.S. tariffs on cashmere products from Mongolia, which would increase the country’s economic independence from China, where almost 90 percent of Mongolian cashmere is now shipped for export. Mongolia’s government hopes that U.S. strategic competition with Russia will not push Russian President Vladimir Putin into Chinese President Xi Jinping’s arms at Mongolia’s expense, and senior officials argue that there is room for the Trump administration to punish Putin for election interference without completely closing off some level of strategic dialogue on the future of East Asia, where Russia’s depopulation puts Moscow in the same position as Ulaanbaatar in regard to Beijing.

Mongolia, like so many other small nations on China’s periphery, needs the United States to lead. Credit is due to Bolton and Esper for standing by the country, but if President Donald Trump ever follows through on his stated desire to save money by withdrawing U.S. troops from the Korean Peninsula, the jarring shift in geopolitics on the continent would be catastrophic for Mongolia. Similarly, the lack of a coherent U.S. multilateral trade strategy with Asia and Europe leaves Beijing with far greater latitude to pursue predatory economic policies that hurt countries whether they are in the Trans-Pacific Partnership trade deal or not. And more robust and consistent U.S. support for democracy, governance, and human rights touches on Mongolia’s survival.

Mongolia is the strongest democracy in the belt of countries stuck between Russia and China and is at the top of most indexes in Asia for women’s empowerment, but it still struggles with corruption and polarizing debates over the limits of presidential power to fight that corruption. Trump did not discuss any of these issues with Battulga in Washington in July, but he should have. When the United States and other like-minded countries demonstrate a commitment to advancing democratic governance, they help empower civil societies and keep national discourses on an arc toward greater accountability and thus resilience against Chinese-funded corruption and interference. When the United States gives countries a pass just because they do not trust China, it leaves them more vulnerable.

...

‘Doing Business with Mongolia Guide’ launch www.export.org.uk

27th September 2019 – The ‘Doing Business with Mongolia Guide’ is now officially live and can be accessed via: www.Mongolia.DoingBusinessGuide.co.uk.

The main objective of this Doing Business with Mongolia Guide is to provide you with basic knowledge about Mongolia; an overview of its economy, business culture, potential opportunities and to identify the main issues associated with initial research, market entry, risk management and cultural and language issues. We do not pretend to provide all the answers in the guide, but novice exporters in particular will find it a useful starting point. Further assistance is available from the Department for International Trade (DIT) team in Mongolia. Full contact details are available in the guide.

To help your business succeed in Mongolia we have carefully selected a variety of essential service providers as ‘Market Experts’; 4u Mongolian Company Formation LLC, Cashmere Holdings Mongolia, IARUDI Financial Consultancy TMZ LLC, Mongolian Business Database/B2B Mongolia, The English School of Mongolia, Trade and Development Bank of Mongolia (TDB) LLC.

The guide has been produced by International Market Advisor, in partnership with the Institute of Export & International Trade, and with support from the British Embassy Ulaanbaatar and Mongolian British Chamber of Commerce (MBCC).

Five things to know about exporting to Mongolia:

• Since 1991, Mongolia has transformed into a vibrant parliamentary democracy, with rule of law and a free, lively media, three times the level of GDP per capita and vast agricultural and mineral resources including major deposits of coal, gold, copper, iron ore and uranium.

• The Mongolian Government is keen to develop its industry, and there are opportunities for UK companies in many areas, such as the mining and oil and gas industries, the supply of equipment and expertise, financing, and other professional, legal and consulting services.

• Mongolia has a younger generation with an increasing number of English language speakers who are open to new products, services, and ideas.

• China provides a ready market for much of Mongolia’s mineral exports as there are no duties, and with no taxes on exports, Mongolia can serve as a gateway to nearby markets provided you have a Mongolian partner or are part of a joint venture.

• Mongolia's GDP growth rate increased from 1.2% in 2016 to 5.3% in 2017 and 6.9% in 2018 and the outlook remains positive in 2019, with the IMF having now raised its projections for Mongolian economic growth for 2019 from 1.5% to 1.8%. Supported by robust growth in private consumption as well as private investment in mining and manufacturing. The country is expected to be one of the world’s fastest-growing economies in the next few decades.

Chinese Inner Mongolia to spur innovation in efforts to combat desertification www.chinadaily.com.cn

The Inner Mongolia autonomous region will encourage innovative ways to control desertification and contribute its experiences to more regions in the country as well as around the world.

"In past decades, Inner Mongolia has witnessed a green miracle. In the future, we will conduct strict surveillance of the grassland via satellite remote sensing technology," said Mu Yuan, head of the region's forestry and grassland bureau.

He also said the forestry department will promote the technological transformation of grassland recovery and help other regions at home and abroad to fight desertification, bringing more green to the world.

"More innovative ways are encouraged to control the sand for a better ecological system. We will also support cooperation between organizations in Inner Mongolia and other regions both at home and abroad," Mu said.

With 88 million hectares of grassland accounting for 74 percent of the region's area, Inner Mongolia is an important ecological shelter in North China.

However, the region is also home to China's seventh-largest desert - the Kubuqi Desert - which covers 13,900 square kilometers.

Over past decades, more than 6,000 sq km of desert in the Kubuqi have been turned green due to collective efforts from local governments, enterprises and other organizations. Led by a local enterprise, Elion Resources Group, the greening campaign created wealth of more than 500 billion yuan ($70.2 billion) and provided about 1 million jobs to locals.

A "Kubuqi Model" in desertification control has gradually taken shape over the past 30 years, featuring balanced development of ecology, economy and livelihood. Elion's anti-desertification experiences have benefited Beijing, Qinghai province and the Xinjiang Uygur and Tibet autonomous regions.

In addition, the group's techniques have also been used in many massive ecological programs, including Yangtze River Ecological Park and Qilian Mountain National Park.

The Kubuqi Model is highly appreciated by international communities.

During the 7th Kubuqi International Desert Forum held in Ordos, Inner Mongolia, in July, countries involved in the Belt and Road Initiative including Pakistan, Saudi Arabia and Kazakhstan negotiated with Elion to help them improve their local ecological systems through greening.

"We will exploit new ways to enhance our ability to control the sand with the help of modern technologies, such as drones, AI, big data and internet of things," said Ao Baoping, chief executive officer of Elion Green Land Technology.

Tsetsenbileg, mayor of Ordos, said that the city will continue to build itself into an innovative model realizing sustainable development, strengthening the ecological construction efforts and contributing to the country's aim of achieving its sustainable development goal by 2030.

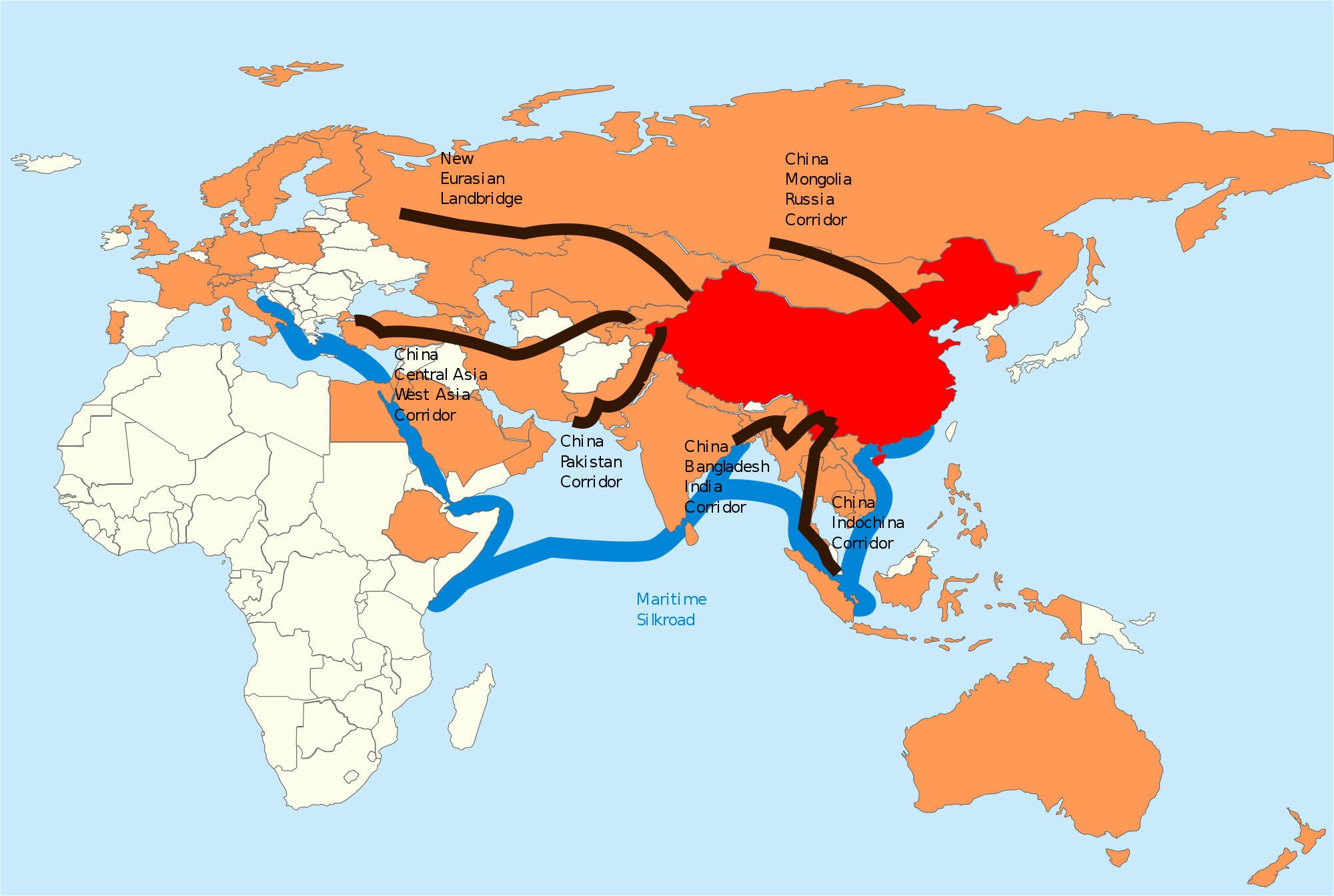

Japan Frets ‘Belt and Road’ Could Give Cover to China’s Military www.bloomberg.com

Japan believes China could use its global “Belt and Road” infrastructure initiative to push its People’s Liberation Army into the Indian and Pacific Ocean regions, a move that could shake up regional security.

The “Defense of Japan” white paper released Friday said, “China engages in unilateral, coercive attempts to alter the status quo based on its own assertions that are incompatible with the existing international order.” Tokyo also stood firmly behind its sole military ally, the U.S.

Japan’s worries about one of the signature projects of Chinese President Xi Jinping come as other major powers, including the U.S., have raised concerns that Belt and Road port construction in places such as Djibouti and Cambodia could have a dual military use.

The U.S. Fears a Cambodia Resort May Become a Chinese Naval Base

China’s Belt and Road

“It is possible that the construction of infrastructure based on the initiative will further promote the activities of the PLA in the Indian Ocean, Pacific Ocean and elsewhere,” the paper said. Japan and China, the two largest economies in Asia, have long been rivals in terms of economic and strategic influence.

Since 2013 more than 130 countries have signed deals or expressed interest in Belt and Road projects geared to spurring trade along routes reminiscent of the ancient Silk Road. The World Bank estimates some $575 billion worth of railways, roads, ports and other projects have been or are in the process of being built. Critics contend projects can be debt traps that leave host countries with white elephant infrastructure and bills they can’t repay.

Other points raised in the military paper are:

Japan sees a regular projection of force by China’s navy and air force around islands claimed by both countries known as Senkaku in Japan and Diaoyu in China

It says North Korea possesses and deploys several hundred ballistic missiles capable of hitting all parts of Japan. Military assessments indicate North Korea has miniaturized nuclear weapons to fit ballistic missiles as warheads.

Japan’s military expects North Korea to work to increase the firing range of its ballistic missiles and step up its ability for a surprise attack through advancement in mobile missile launchers and submarines.

It sees Russia stepping up military activities in the Far East.

South Korea’s decision to withdraw from an intelligence-sharing pact known as GSOMIA was “extremely regrettable,” the paper said

— With assistance by Emi Nobuhiro

Foreign Minister addresses UN Security Council ministerial debate www.montsame.mn

Ulaanbaatar /MONTSAME/. Within the framework of the General Debate of the seventy-fourth session of the United Nations General Assembly, Security Council ministerial-level debate: Cooperation between the United Nations and regional and sub-regional organizations in maintaining international peace and security was held on September 25.

At the debate chaired by Russian Foreign Minister Sergey Lavrov, United Nations Secretary-General António Guterres as well as heads of Shanghai Cooperation Organization, Collective Security Treaty Organization and Commonwealth of Independent States delivered remarks, presenting cooperation activities between them for maintaining peace and security in the region.

Foreign ministers of UN Security Council's 15 permanent and nonpermanent members, Mongolia, India, Iran, Pakistan, Kazakhstan, Belarus, Azerbaijan, Tajikistan, Armenia and Afghanistan took part in the debate to express their positions on ways of building effective cooperation between the UN and regional organizations in combat against terrorism.

In his speech, Minister of Foreign Affairs of Mongolia D.Tsogtbaatar highlighted the importance of collaboration between the United Nations and regional organizations to tackle global challenges, in particular, terrorism, extremism and transnational organized crimes.

After informing that Mongolia has joined the UN Conventions against international terrorism and transnational organized crimes and established agreements with Russia and Kazakhstan on fighting terrorism and with China to fight against crimes, Foreign Minister D.Tsogtbaatar reaffirmed the significance of building countries’ capacity to combat against terrorism, drawing attention on the growing link between terrorism and transnational crime and organized crimes, including trafficking of drugs, weapons and humans, and involving young people in preventing and countering terrorism and extremism.

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- 1715

- 1716

- »