Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

India extends $1 billion credit to Mongolia for its first refinery www.pennews.net

New Delhi, May 14: India has extended a $1 billion Line of Credit to Mongolia to help set up its first ever grass-root refinery in Sainshand, Dornogobi province.The funding has been provided through the Exim Bank. Prime Minister Narendra Modi during his visit to Ulan Bator in 2015 had announced a credit line of $1 billion for infrastructure sector in Mongolia. This is currently being utilised by Mongolia to build the oil refinery.

The1.5 MMTPA refinery is expected to be completed by 2022.Ties between India and Mongolia date back centuries with Buddhism seen as a major binding factor between the two countries. In recent years, the two countries have set up mechanisms like the India-Mongolia Joint Working Group for Defence and the “India-Mongolia Joint Committee on Cooperation (IMJCC)" chaired at ministerial level besides others to cement cooperation.

“For Mongolians, India is one of counter-weights to their neighbours (Russia and China), a 'spiritual neighbour,' a declared third neighbour and strategic partner and centre for pilgrimage," says a Ministry of External Affairs background note on bilateral ties.

In April last year, during External Affairs Minister Sushma Swaraj's visit to the country, it was agreed to intensify cooperation in energy, trade and economy, IT, healthcare, animal husbandry, infrastructure development and other developmental sectors. (UNI)

Mining income up by 41.2 percent www.montsame.mn

Ulaanbaatar /MONTSAME/ As reported by the Ministry of Mining and Heavy Industry, MNT 981 billion has been accumulated to the state budget from the mining sector in the first four months of 2019.

Accumulated income to the state budget rose by MNT 286.1 billion or 41.2 percent comparing to the previous year. Collected taxes and duties from minerals such as gold, coal, copper and spar have increased while tax income from zinc and iron have decreased.

Export of mining products reached USD 2.5 billion in the last 4 months. It is an increased performance by 18.2 percent or USD 386.6 million comparing to the same time of the last year. Iron ore, coal, copper, zinc and molybdenum concentrate and crude oil made up 83.2 percent of the total export.

Coal export reached 11.4 million tons or USD 961 million as a sum in the first 4 months of this year. The coal price per ton has been an average of USD 84.4 this year.

As of the first 4 months of 2019, 489.1 thousand tons of copper concentrate was exported, showing an increase of 30.5 thousand tons comparing to the previous year. For copper, average price per ton reached USD 1434 or upped by USD 65.4, reports the Ministry of Mining and Heavy Industry.

Bitcoin hit $8,000 again. What's behind the rise www.cnn.com

New York (CNN Business)Bitcoin just surged past $8,000 on Tuesday, hitting its highest mark since last July. It tapered off slightly by mid-afternoon, but is still trading at its highest level in nearly a year.

What's going on?

Bullish experts say the strong showing could signal that bitcoin has a future as a worthy investment opportunity. But the currency's volatile and controversial history has prompted plenty of skepticism.

Bitcoin has typically been regarded as risky, said Dan Held, co-founder of Interchange, a company that advises businesses on how to manage their crypto assets. But he said the currency's resurgence might be the first inkling that it holds weight as a "risk off" trade — an investment treated as a safer bet when markets are tumultuous, like bonds or gold. After all, the currency skyrocketed in value Monday when the Dow plunged 617 points, perhaps suggesting that investors turned to bitcoin as a safe haven asset.

"It's bitcoin's moment to shine when people momentarily give up on the government or the banking system," Held added.

But the bitcoin rally didn't end when the markets were plunging. The currency continued to climb early Tuesday even as the major indexes did well, and it held steady for much of the day.

That could have been because Monday's bitcoin trading frenzy spurred additional investor interest, said James Putra, head of product strategy at brokerage firm TradeStation Crypto.

"When the market started to rise, it drew more people in," Putra said. "Larger players started to take bites out of the marketplace; it's a common and familiar approach."

Still, bitcoin has been here before. It hit $20,000 in December 2017 before crashing the next year. Some experts called the downturn a correction after a period of "speculative mania."

Bitcoin has soared 60% this year. Meet the new buy-and-hold investment

Bitcoin has soared 60% this year. Meet the new buy-and-hold investment

The currency also faced accusations of price manipulation: Two academics at the University of Texas at Austin studied the possibility bitcoin had been manipulated and said they found evidence that it had been during its massive 2017 run-up. The shadow of price manipulation continues to loom over bitcoin.

"Manipulation could very well be behind the recent market moves. To act like bitcoin and crypto currency prices are purely driven by supply and demand of little traders ... ignores the specific mechanics of this marketplace," said John Griffin, a finance professor at the University of Texas at Austin and one half of the duo that penned the paper on price manipulation last year.

"It would not be a stretch nor surprising to find that manipulative activity is behind the recent runup when the underlying market mechanics are similar to before," Griffin added.

Griffin isn't the only one with that suspicion.

"I don't think anyone really knows what this is due to," said Tim Massad, former chairman of the US Commodity Futures Trading Commission, speaking about the latest rally. "But you worry that manipulation could be a contributing factor given the lack of regulation and transparency in this market compared to other markets."

Massad said he lauded the Securities and Exchange Commission for stepping up oversight of cryptocurrency, but added that "you still have gaps in regulation."

Another, simpler explanation for the price rise: It's Blockchain Week, an unofficial holiday for bitcoin. The event, which is also called Consensus 2019, draws in more buyers for bitcoin and other major currencies, according to Lennon Sweeting, the director and head trader of Coinsquare, a Canadian cryptocurrency trading platform.

There's also the fact that bitcoin and blockchain — the underlying technology that acts as a public ledger — have steadily become more mainstream. JPMorgan Chase (JPM), the nation's largest bank, announced a new digital coin earlier this year. JPMorgan and Microsoft (MSFT) recently announced plans to partner and expand on blockchain platforms. And ICE (ICE), the owner of the NYSE, launched a futures exchange for bitcoin and other cryptos.

All of that could make the digital currency and its technology appear more credible to investors. And it gives bitcoin's backers a reason to remain optimistic.

"The $10,000 mark remains firmly in sight over the coming months," said Vaibhav Kadikar, founder and CEO of a decentralized prediction market platform, CloseCross. "And the possibility of surpassing the previous high in the coming half year still remains."

-- CNN Business' Anneken Tappe and Paul La Monica contributed to this report.

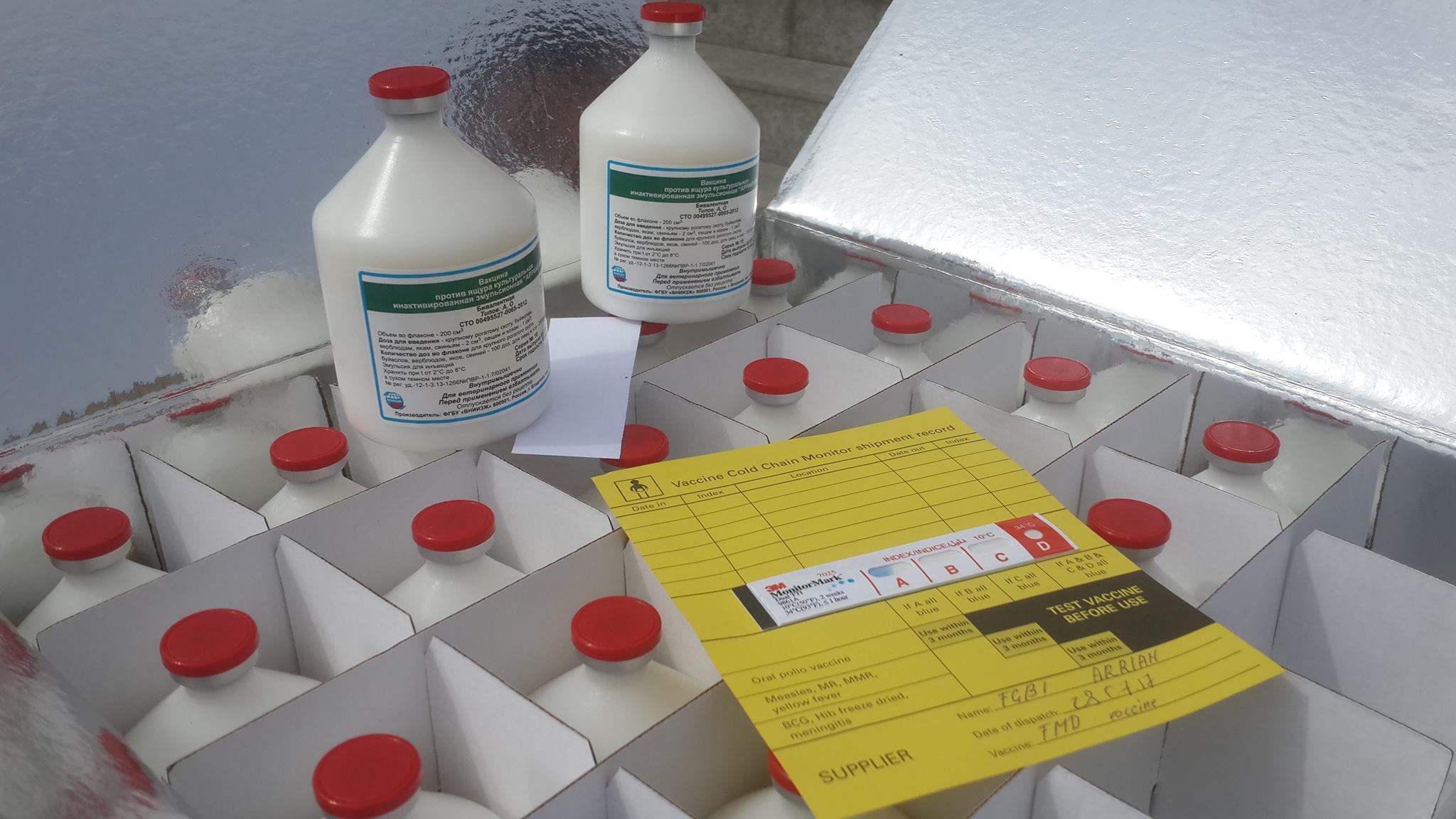

UNICEF donates measles vaccines to Mongolia www.news.mn

The United Nations Children’s Fund (UNICEF) in Mongolia has donated 577,000 doses of measles vaccine, syringes and safety kits worth USD 500,000 the Health Ministry reported on Tuesday.

The vaccines should reach children aged 5-18 in Bayan-Ulgii, Zavkhan, Khovd, Uvs and Govi-Altai provinces in the west and Bayankhongor province in the southwest from 15-25 May. In addition, the vaccines should cover those aged 10-18 in other provinces and the capital Ulaanbaatar.

Mongolia was declared free of measles by the World Health Organization in 2016. Since then, however, a new outbreak was reported in March; evidently, the disease was brought by a foreign worker.

Measles is a highly contagious viral disease transmitted by respiratory droplets and direct contact. The disease can be prevented by immunization. Common complications include fever, dry cough, runny nose, sore throat and inflamed eyes.

There is no specific treatment for measles, and most people recover within two to three weeks.

Engineers India Ltd secures order from Mongolia www.equitybulls.com

Engineers India Limited (EIL) has signed a contract with 'M/s Mongol Refinery, State Owned LLC' for providing its PMC Services for Construction of a Crude Oil Refinery Plant in Mongolia. The Contract was signed in the presence of Mr. D. Sumyaabazar, Hon'ble Minister of Mining and Heavy Industry of Mongolia.

Shares of ENGINEERS INDIA LTD. was last trading in BSE at Rs.103.9 as compared to the previous close of Rs. 109.2. The total number of shares traded during the day was 101714 in over 915 trades.

The stock hit an intraday high of Rs. 109 and intraday low of 103.5. The net turnover during the day was Rs. 10740460.

Source: Equity Bulls

Mongolia attaches great importance to Mongolia-China expo: agriculture minister www.xinhuanet.com

ULAN BATOR, May 14 (Xinhua) -- Mongolia attaches great importance to the biennial Mongolia-China expo, which is a great platform to showcase Mongolian products to Chinese consumers, Agriculture Minister Chultem Ulaan said Tuesday.

"The third Mongolia-China expo will be held in Hohhot, capital of China's Inner Mongolia Autonomous Region, in September. Preparation work for the expo is underway," he told Xinhua, noting that the Mongolian side "attaches great huge importance to the expo."

He said that the biennial expo has provided Mongolian businesses with a huge opportunity to promote their products, especially organic food products to Chinese consumers.

"Many companies have expressed their willingness to participate in the expo. Our officials are now working to provide them with all the information they need," the minister added.

Ulaan said he hoped this year's expo would be bigger in size.

More than 380 Mongolian businesses participated in the second Mongolia-China expo held in Hohhot in 2017, exhibiting products in around 400 categories, showed data from the department of foreign trade and economic cooperation at the Mongolian Foreign Ministry.

Working group on ‘World Expo 2020’ holds meeting www.montsame.mn

Ulaanbaatar /MONTSAME/ The Government made a decision regarding Mongolia’s participation in the ‘World Expo 2020’ to be held in Dubai, the United Arab Emirates. A working group was established with Foreign Minister D.Tsogtbaatar as Commissioner-General and T.Duuren, CEO of Mongolian National Chamber of Commerce and Industry, as Deputy Commissioner.

The first meeting of the working group on preparation for the World Expo 2020 was held on May 13 at the Ministry of Foreign Affairs. Deputy Commissioner T.Duuren introduced the details of preparation, financing and budget proposal made by MNCCI. Foreign Minister proposed to take into account the country’s benefits from participation in the expo and make detailed budget proposal immediately.

World Expo 2020 will take place in Dubai between Ocotber 20, 2020 and April 10, 2021.

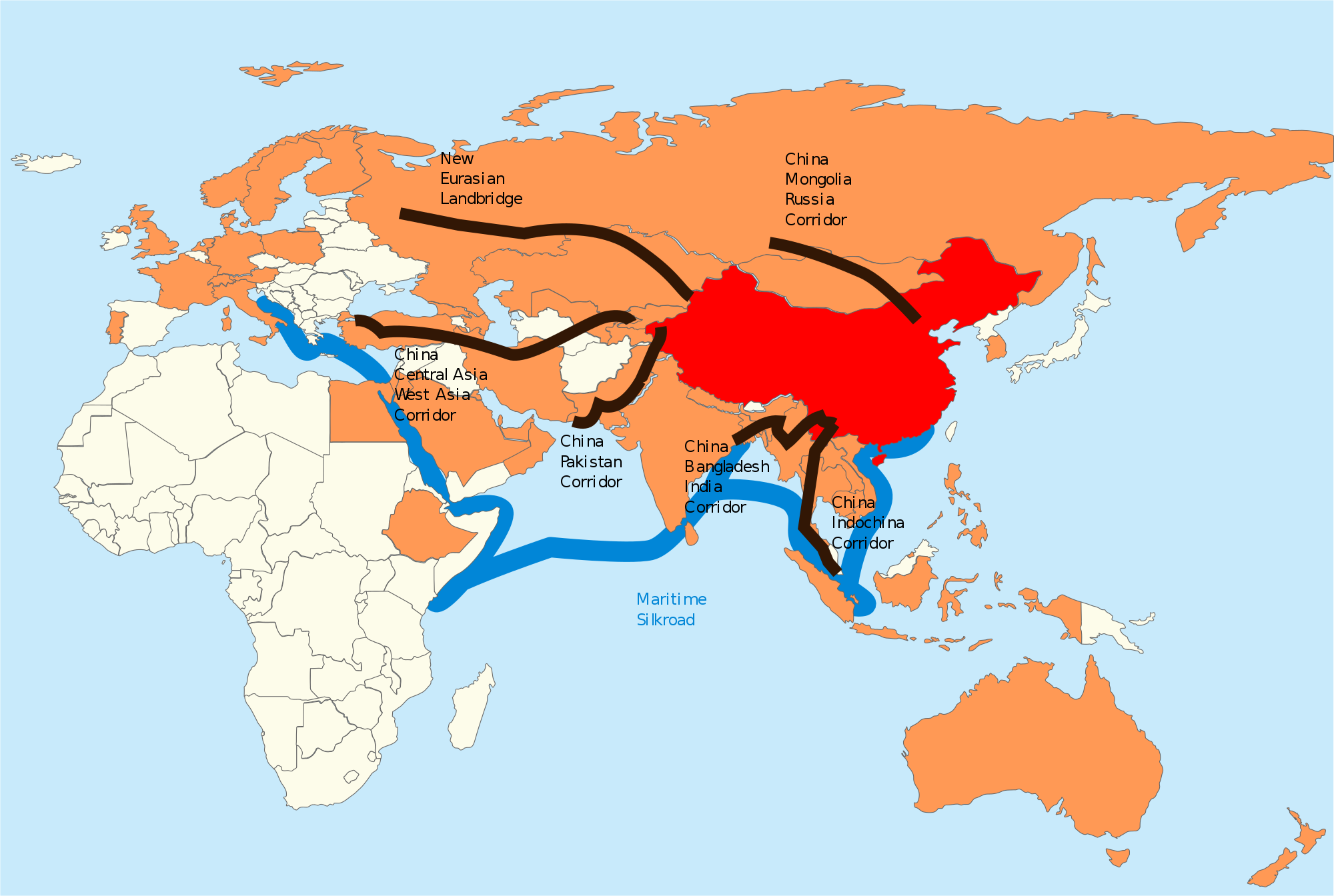

Inner Mongolia’s Trade with Belt & Road Countries up 13.6% www.beltandroad.news

North China’s Inner Mongolia Autonomous Region saw a year-on-year foreign trade growth of 13.6 percent to 23.8 billion yuan (about 3.48 billion U.S. dollars) with countries along the Belt and Road in first four months of 2019.

The region’s import volume with Belt and Road countries rose 21.2 percent year on year to 16.51 billion yuan, while it’s export volume reached 7.29 billion yuan, down 0.5 percent, according to the Hohhot customs.

The total foreign trade volume of the region reached 36.02 billion yuan over the same period, up 11.9 percent year on year.

The region’s foreign trade with Mongolia and Russia, its major trade partners, grew 32.4 percent year on year to 11.31 billion yuan and 1.1 percent year on year to 6.36 billion yuan respectively from January to April.

Last year, the import and export volume of the region hit a record high of 103.44 billion yuan, a year-on-year increase of 9.9 percent

Indian leading companies introducing their products and services www.montsame.mn

Ulaanbaatar /MONTSAME/ India-Mongolia Oil and Gas Exhibition yesterday opened at Buyant Ukhaa Sport Palace. Present at the opening ceremony were Cabinet Secretariat of the Government L.Oyun-Erdene, Minister of Foreign Affairs D.Tsogtbaatar, MP L.Bold and representatives of some Embassies in Mongolia.

The Embassy of India in Mongolia, the Ministry of Mining and Heavy Industry of Mongolia, the Mongolian Oil Refinery state-owned company and Engineers India Limited Company are jointly organizing the exhibition in connection with the construction of the first ever oil refinery in Mongolia being built with over USD 1 billion soft loan from the Indian Government.

“In 2018, the Government of Mongolia commenced infrastructure construction works of the oil refinery and the works are running with fulfillment of over 90 percent now. We have already received comprehensive feasibility study of the project and now working on establishing a contract with the Indian company that was selected as the project management advisor. By contracting with the advisor, works on formulating blueprint of the oil refinery and its construction will begin immediately. The oil refinery has significant importance to the society and economy of Mongolia and I believe that the project will strengthen friendly ties of the two countries more,” Minister of Mining and Heavy Industry D.Sumiyabazar said.

More than 30 Indian public and private largest companies such as Tata group, Afkons Limited, ISGEC Industry and Engineers India Limited are participating in the exhibition.

Director of Tema India Company Rajesh Kulkarni said " Our company is receiving orders for supplying heat exchanger tubes for aluminum processing industries and mining industries. The heat exchanger tubes are needed for the oil refinery to be built in Mongolia. I came to Mongolia to establish partnership with partners and purchasers for supplying low cost and effective products.

The exhibition will close today.

WhatsApp discovers 'targeted' surveillance attack www.bbc.com

Hackers were able to remotely install surveillance software on phones and other devices using a major vulnerability in messaging app WhatsApp, it has been confirmed.

WhatsApp, which is owned by Facebook, said the attack targeted a "select number" of users, and was orchestrated by "an advanced cyber actor".

A fix was rolled out on Friday.

The attack was developed by Israeli security firm NSO Group, according to a report in the Financial Times.

On Monday WhatsApp urged all of its 1.5bn users to update their apps as an added precaution.

The attack was first discovered earlier this month.

How was the security flaw used?

It involved attackers using WhatsApp's voice calling function to ring a target's device. Even if the call was not picked up, the surveillance software would be installed, and, the FT reported, the call would often disappear from the device's call log.

WhatsApp told the BBC its security team was the first to identify the flaw, and shared that information with human rights groups, selected security vendors and the US Department of Justice earlier this month.

"The attack has all the hallmarks of a private company reportedly that works with governments to deliver spyware that takes over the functions of mobile phone operating systems,” the company said on Monday in a briefing document note for journalists.

The firm also published an advisory to security specialists, in which it described the flaw as: "A buffer overflow vulnerability in WhatsApp VOIP stack allowed remote code execution via specially crafted series of SRTCP packets sent to a target phone number.”

Who is behind the software?

The NSO Group is an Israeli company that has been referred to in the past as a "cyber arms dealer".

Its flagship software, Pegasus, has the ability to collect intimate data from a target device, including capturing data through the microphone and camera, and gathering location data.

In a statement, the group said: "NSO's technology is licensed to authorised government agencies for the sole purpose of fighting crime and terror.

"The company does not operate the system, and after a rigorous licensing and vetting process, intelligence and law enforcement determine how to use the technology to support their public safety missions. We investigate any credible allegations of misuse and if necessary, we take action, including shutting down the system.

"Under no circumstances would NSO be involved in the operating or identifying of targets of its technology, which is solely operated by intelligence and law enforcement agencies. NSO would not or could not use its technology in its own right to target any person or organisation."

Who has been targeted?

WhatsApp said it was too early to know how many users had been affected by the vulnerability, although it added that suspected attacks were highly-targeted.

According to Facebook's latest figures, WhatsApp has around 1.5bn users worldwide.

Amnesty International, which said it had been targeted by tools created by the NSO Group in the past, said this attack was one human rights groups had long feared was possible.

"They're able to infect your phone without you actually taking an action," said Danna Ingleton, deputy programme director for Amnesty Tech. She said there was mounting evidence that the tools were being used by regimes to keep prominent activists and journalists under surveillance.

"There needs to be some accountability for this, it can't just continue to be a wild west, secretive industry."

On Tuesday, a Tel Aviv court will hear a petition led by Amnesty International that calls for Israel's Ministry of Defence to revoke the NSO Group's licence to export its products.

...- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- »