Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

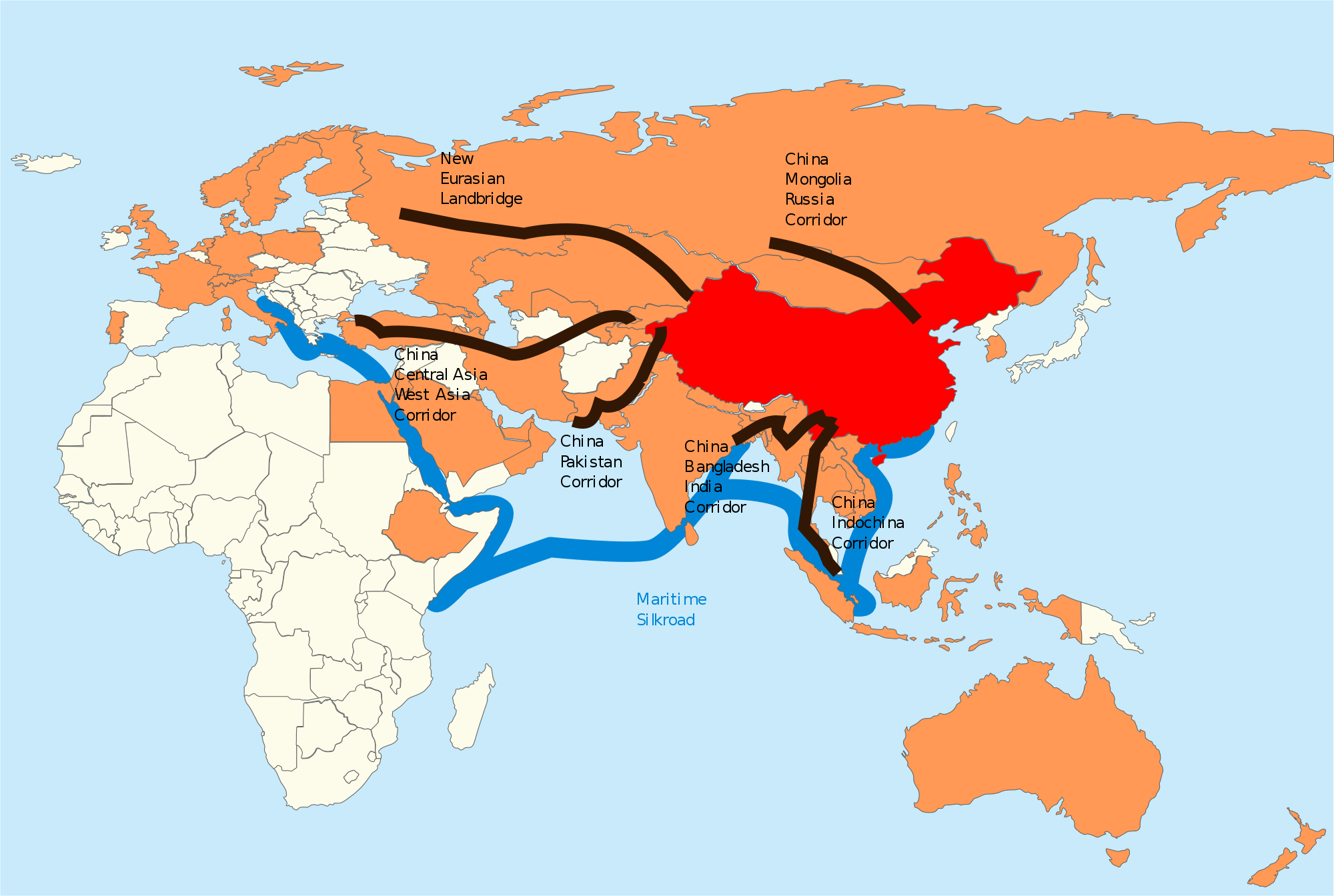

Belt and Road Inner Mongolia: Strategic Objectives and Key Deliverables www.economists-pick-research.hktdc.com

China’s Belt and Road Initiative (BRI) aims to promote economic links between countries along its routes, and integrate regional development strategies. China, Mongolia and Russia are building the China-Mongolia-Russia Economic Corridor in a bid to strengthen existing cross-border trade and investment between the three countries and turn the region into an integral part of the BRI. Inner Mongolia, a border province in northern China, acts as a bridgehead between China and its northern neighbours. It serves as a logistics centre and trade hub along the China-Mongolia-Russia Economic Corridor and plays an important role in China’s external-oriented economic development.

China-Mongolia-Russia Trade Hub

The Inner Mongolia Autonomous Region, on China’s northern border, is a major trading partner of neighbouring Mongolia and Russia. Trade with the two countries accounts for over 50% of Inner Mongolia’s import-export trade as well as a considerable share of China’s trade with both countries. Two of the region’s border cities, Erenhot and Manzhouli, are China’s largest trade hubs with Mongolia and Russia respectively.

Major Import & Export Trading Partners of Inner Mongolia, 2017

Total trade with Inner Mongolia

(US$m) Share of Inner Mongolia’s total exports (%) Share of Inner Mongolia’s exports in China’s exports to the country (%) Share of Inner Mongolia’s total imports (%) Share of Inner Mongolia’s imports in China’s imports from the country (%)

Mongolia 3,909 10.5 33.6 42.2 67.6

Russia 3,044 12.9 1.2 30.6 6.1

Australia 589

0.8 0.1 6.7 0.6

USA 539 6.8 0.1 3.3 0.2

Source: Inner Mongolia Autonomous Region Statistics Bureau, National Bureau of Statistics of China

Since Inner Mongolia’s foreign trade is mainly conducted with Mongolia and Russia, its export growth relies heavily on the economic conditions of the two countries. Between 2014 and 2016, falling commodity prices badly affected economic growth in Mongolia and Russia, which naturally led to a lacklustre performance by Inner Mongolia’s exports in that period. Inner Mongolia’s exports to Mongolia dropped by more than 40% in US dollar terms in 2016 from the year before, while its overall exports declined by 20% in the same year.

Despite being China’s base for trade with Mongolia and Russia, Inner Mongolia’s advantages as a border province have not been fully made use of. Currently its import-export trade is conducted mainly in the form of “general trade” and “small-scale border trade”.

Compared with other border provinces in the south, the share of Inner Mongolia’s total trade accounted for by processing trade using local or imported resources is relatively low. In Guangxi, for example, processing trade accounts for about 20% of its total trade; in Yunnan, the share is about 10%. In Inner Mongolia, processing trade accounts for less than 5% of its total trade. In other words, its trade structure can be improved.

In light of this, Inner Mongolia has been trying to develop its processing trade in recent years. Construction of import-export resources processing parks has begun in Erenhot and Manzhouli. Imported resources (such as wood and animal and agricultural products) are used for processing and the products are either exported to markets in Europe and America or sold domestically to other regions in China. With processing facilities in Inner Mongolia becoming better and more advanced, the potential for developing import-export processing trade in the autonomous region is vast.

China, Mongolia and Russia signed the Plan on Establishing the China-Mongolia-Russia Economic Corridor in 2016, the first multilateral co-operation plan launched under the BRI. It aims to expand tripartite trade, raise product competitiveness, improve cross-border transport, and develop infrastructure facilities. Taking advantage of its role in China-Mongolia-Russia trade, Inner Mongolia serves as a strategic nexus along the China-Mongolia-Russia Economic Corridor.

One of the key objectives in building the China-Mongolia-Russia Economic Corridor is to construct a logistics passageway crossing the three countries, which should promote tripartite trade between them. Of the seven railway routes outlined in the Plan, six will pass through Inner Mongolia. Two of the three China-Europe Railway Express (CR Express) routes connecting China with Europe leave Chinese territory via Inner Mongolia. Currently, about half of the trains running between China and Europe pass through Inner Mongolia.

In line with the objectives of the BRI, China, Mongolia and Russia are devoting resources to the construction of the Ulanqab-Ulaanbaatar-Ulan-Ude logistics channel. Comprehensive logistics parks are being built and business links strengthened to try to improve transport connections along the passageway, as well as linking the cities of Ulanqab and Ulaanbaatar in Inner Mongolia with the city of Ulan-Ude in Russia.

China, Mongolia and Russia have also prioritised working together to raise production capacity and investment, deepen economic and trade co-operation, and accelerate the synergy between China’s BRI, Russia’s Eurasian Economic Union, and Mongolia’s Prairie Road development initiatives.

As well as promoting foreign trade, Inner Mongolia is also actively pursuing the transformation and upgrade of its indigenous industries, which will help boost the BRI. With its rich energy resources, vast land size and abundant and cheap electricity, Inner Mongolia is ideal for the development of modern industries requiring high power consumption, such as cloud computing. Its climate, with its low temperatures, also offers a natural, cool environment for businesses to house their data centres at low cost.

Hohhot Shengle Modern Service Industry District is the largest cloud computing industry base in Inner Mongolia. It has put a lot of work into developing cloud computing data centres and big data projects. China’s top three telecommunications operators, China Telecom, China Mobile and China Unicom, have all established a presence in the park.

With its vast grasslands and well-developed animal husbandry industry, Inner Mongolia has also placed great emphasis on the reform, innovation and modernisation of animal husbandry. A large number of businesses in the Shengle district are engaged in collecting and analysing all kinds of data on sectors such as the dairy industry and grassland ecology. Others specialise in the ‘smart’ rearing of dairy cattle, providing services such as breeding and reproductive technologies to improve dairy cattle breeds.

...

Economists forecast meat price to increase due to higher global price www.zgm.mn

Mongolia exported USD 83 million worth meat, USD 80 million worth canned meat, ham and sausage last year. Compared to the same period of the previous year, meat export surged by 54 percent, in which heat-processed meat, ham and sausage export multiplied by nine times, according to the customs statistics.

In the first 11 months of 2018, prices of meat escalated by 15.5- 31.6 percent depending on the type according to the National Statistics Office. The impact of meat price increase was visible in the inflation as the Bank of Mongolia (BoM) announced that inflation exceeded the 8 percent target level, reaching 9.3 percent in November. According to the BoM, meat prices accounted for 1.3 percentage point for inflation. Meat and meat products make up over 10 percent of the basket of consumer goods in Mongolia. Ministry of Food, Agriculture and Light Industry (MFALI) informed that MNT 4.6 billion will be allocated for scarcity of meat in Spring from the 2019 State Budget. Within this frame, the ministry expects to reserve 10,000 tons of meat beforehand. Due to the surge in meat exports, the ministry also plans to take policy measures on increasing domestic supply of meat Regarding the matter, Economist Khaschuluun Chuluundorj said, “Meat export growth will increase domestic meat prices. Because higher global meat price will eventually pull up domestic price of meat. We have to be ready for this.”

Around 12-15 million heads of livestock are used for domestic needs. According to the MFALI, Mongolia has enough reserves to fully supply domestic demands, provide 9 million heads of livestock to economic circulation and export over 180,000 tons of meat.

MNT 4 billion project to increase flow of Ulz river to commence this year www.montsame.mn

Dornod /MONTSAME/ With state budget financing of MNT 4 billion, the project to increase the water flow in Ulz river will commence this year.

Ulz river flows through transboundary areas such as Norovlin soum of Khentii aimag, and Bayan-Uul, Bayandun, Dashbalbar and Chuluunkhoroot soums of Dornod aimag, taking its origin from Ikh and Baga Burd springs located in Norovlin soum of Khentii aimag. The length of Ulz river is 510 km, 90 percent of which belongs to Mongolian territory.

Although, numerous rivers including Duch, Turgen, Berkh, Khuurain valley, Ar bulag, Kharkhiraa, Ajnai used to flow in Ulz river, most of the rivers dried up in recent years, making Ulz River at risk of running dry too.

According to the numbers, about 15 thousand locals live near the basin of Ulz river. So, the locals expressing their concerns towards the issue, saying that measures need to be taken immediately,

Thus, MP N.Nomtoibayar initiated the project in order to increase the water flow of Ulz river. A feasibility study for the project will be formulated in the first phase.

ETT: Dividends for 1,072 shares will be decided by April www.zgm.mn

Erdenes Tavan Tolgoi JSC (ETT) presented its 2018 operational report yesterday. The report shows that ETT’s net profit doubled the previous year amount at MNT 720 billion. Also, Gankhuyag Battulga, CEO of ETT, announced that the company is now able to distribute dividends to 2,511,00 people that are holding 1,072 shares of ETT.

The company distributed 1072 shares to the public at MNT 933 per share respectively and has been running on deficit since 2013. However, the company managed to settle most of its debt in 2017.

The amount of dividends will be set after an audit on its 2018 financial report. After that, the board will hold a meeting to submit its request for the distribution to the Cabinet for suggestions. Preliminary schedules of the final decision has been set in April. “This matter is different from the upcoming potential initial public offering (IPO). Dividends will be distributed regardless of the IPO process,” explained Mr. Gankhuyag.

IPO financing to be spent on improving profitability and infrastructure

According to officials, 1.3 million citizens who own ETT shares have not yet opened brokerage accounts. Since the establishment of ETT information center in May 2018, over 500,000 people have opened brokerage accounts. If the ETT board decides to distribute dividends to the public, people with the account will have instant access to the financing.

Mr. Gankhuyag also informed that the preparatory works of the IPO are mostly complete. The company is ready to present a bill to the Parliament if five investment banks and an audit firm are selected.

Initially, ETT will offer 30 percent of its stake at the Hong Kong Stock Exchange and could potentially seek dual-listing at the New York Stock Exchange later on. According to Mr. Gankhuyag, the company is requiring USD 1 billion to increase profitability, such as continuing the railroad construction and establishing coal preparation plant, while the necessary nationwide infrastructure is estimated to total USD 2 billion.

Last year, the company reportedly improved its governance, financial and human resource policies, as well as redetermining its reserves and completing the IPO preparation.

With the Australian Joint Ore Reserves Committee (JORC) Code, ETT’s coal reserve was confirmed to be 7.3 billion tons. Thus, international organizations view that the company is fully capable of raising the necessary financing, noted Mr. Gankhuyag.

EAM Swaraj meets overseas ministers of Iran, Mongolia www.videostreet.pk

New Delhi [India], Jan nine (ANI): India held bilateral meetings with Iran and Mongolia respectively, on the sidelines of the Raisina talk, which became inaugurated on January eight with the aid of Norwegian prime Minister Erna Solberg within the presence of top Minister Narendra Modi and numerous other excessive-degree dignitaries.

external Affairs Minister Sushma Swaraj held a meeting with her Iranian counterpart, Javad Zarif right here on Wednesday wherein the 2 aspects mentioned essential bilateral problems, such as the situation in Afghanistan.

"EAM @SushmaSwaraj met Iranian overseas Minister @JZarif who is in Delhi for the @raisinadialogue. Held extensive ranging discussion on vital bilateral issues and shared perspectives on the local scenario," Raveesh Kumar, the Spokesperson for the Ministry of outside Affairs (MEA) tweeted.

Swaraj also met with Mongolian foreign Minister Damdin Tsogtbaatar, in which both the perimeters took inventory of the "fantastic trends" in relationship in areas of energy, renewable energy, improvement partnership, capacity constructing & tradition, consistent with the MEA.

both Zarif and Tsogtbaatar are slated to supply ministerial addresses at the continuing Raisina talk- "a multilateral convention devoted to addressing the maximum hard issues facing the worldwide network." (ANI)

Prosecutor requests stripping Mongolian MPs of immunity www.news.mn

The State General Prosecutor’s Office of Mongolia has submitted a request for stripping four parliament members of immunity. According to one source, MP’s B.Undarmaa, G.Soltan, D.Damba-Ochir and L.Enkhbold are facing prosecuted over the ongoing scandal of the Small and Medium Enterprises Fund. However, the parliamentary standing committee on immunity has been delayed twice due lack of attendance.

In 2009, the Mongolian government developed a fund to support small and medium enterprises (SME’s). This provided companies with low-interest loans at 3 percent interest for up to five years and contained 2 billion Mongolian Tugrik (roughly USD 780,000 at today’s exchange rate). The fund is reported to have dispersed loans, totalling nearly 700 billion tugrik, or several hundred million U.S. dollars. The fund was created under – and continues to be overseen by – the Ministry of Food, Agriculture, and Light Industry.

China gets go-ahead for 6GW onshore wind farm in Inner Mongolia www.asian-power.com

It could be the world’s largest onshore wind project.

China’s State Power Investment Corp (SPIC) got the go-ahead for a 6GW onshore wind project in Inner Mongolia worth $6.2b, Recharge News reports. SPIC said the project will be the world’s largest.

The Ulanqab wind project will sell power with no subsidies. The report adds that it will compete with coal-fired power’s price benchmark in the region at $41.26/MWh.

The renewables director of China’s National Energy Administration (NEA), Liang Zhipeng, said zero-subsidy wind is feasible in some regions of the country, especially pointing to projects in Ulanqab – the “wind capital of China.”

According to SPIC, it is ensuring grid transmission for the project. The State Grid revealed plans to build 12 new ultra-high-voltage (UHV) transmission grids, including one from western Inner Mongolia to Shanxi.

"Doing business with Mongolia”, “UK Investors show” business program March 27-April 02 London UK www.mongolianbusinessdatabase.com

Mongolian Business Database with the support of the British Embassy in UB and Mongolian-British Chamber of Commerce is starting to register the participant for “MBCCI’s Doing Business with Mongolia” seminar and “UK Investors show” in London UK between March 27-April 02. 2019.

The delegates will visit the House of Commons by the special invitation of Mr.John Grogan, MP of UK and the Chairman of Mongolian-British Chamber of Commerce etc.

The MBCC is a not-for-profit membership organisation established in 2009 to foster strong business links between Mongolia and the UK. It aims to provide a professional and social environment for business people who wish to be introduced to, and become part of, the British-Mongolian business culture and community.

Please review the information in details on the following link and contact at contact@mongolianbusinessdatabase.com or/and 976 99066062 for the registration and related inquiry

http://mongolianbusinessdatabase.com/base/eventsdetails…

A Debilitating Corruption Scandal Threatens More Damage to Mongolia’s Economy www.worldpoliticsreview.com

Mongolia has been rocked in recent months by a series of corruption scandals that have prompted large-scale demonstrations in the capital, Ulaanbaatar. The government of Prime Minister Ukhnaagiin Khurelsukh has been paralyzed by revelations that senior government officials, including members of his Cabinet, misused funds that were intended to assist small and medium-sized enterprises. In an interview with WPR, Morris Rossabi, a professor of East Asian history at Columbia University, explains why corruption is so widespread in Mongolia and why the current wave of scandals comes at a particularly bad time for its economy.

World Politics Review: Why is corruption such a pervasive issue in Mongolia, and how did it motivate so many people to take to the streets last month?

Rossabi: Corruption has accelerated dramatically in Mongolia’s “wild ride to capitalism” since 1990. The country was plagued by minor levels of bribery and graft from its empire stage in the 13th and 14th centuries to its communist period from 1921 to 1990, but corruption was not a pervasive part of Mongolian political culture. The post-communist era, however, has witnessed an increase in corruption in politics, business and the educational and medical systems.

To be sure, corruption existed in the communist period, but there were checks on such illegal activities. In an ostensibly egalitarian state with a population as small as Mongolia’s, displays of ill-gotten wealth—in the forms of big houses, fancy clothing and elaborate parties—were both readily noticeable and perilous. The authorities were capricious but had the power to inflict severe punishments for malfeasance. Fear of such reprisals would frequently prevent overt, large-scale corruption.

That changed in the post-communist era, as officials emerged relatively unscathed from accusations and even convictions of accepting bribes or kickbacks. Nambaryn Enkhbayar, a prominent politician who served as both prime minister and president of Mongolia during the 2000s, was found guilty of corruption in 2012 but was pardoned after serving one year in prison. He is now active in politics again, as leader of the small Mongolian People’s Revolutionary Party.

In another well-known case, former Prime Minister Sanjaagiin Bayar was repeatedly accused of accepting bribes in exchange for his signature on a 2009 agreement with a foreign company to extract gold and copper from Mongolia’s largest mine. He and several other officials were finally arrested in 2018, but further legal action has yet to be taken.

The recent street demonstrations, in protest of a Cabinet minister and other senior officials illegally obtaining low-interest loans from a fund allocated for small and medium-sized enterprises, follow in a long line of such efforts. Mongolians took to the streets in 2005 to protest the leasing of land with valuable mineral deposits to Robert Friedland, an American-Canadian financier whose record on environmental protection is so abhorrent that he earned the nickname “Toxic Bob.” In 2008, demonstrations over alleged improprieties in that year’s legislative elections resulted in a number of deaths and in damage to buildings in the center of Ulaanbaatar. These efforts, however, did not lead to significant reforms, and it remains to be seen whether the current protests will be more effective.

WPR: What actions have been taken by the government so far in response to the current loan scandal, and what further measures could officials take to restore public confidence?

Rossabi: The government has been compelled to act in light of the seriousness of the accusations. Twenty-one members of parliament and several Cabinet ministers are confirmed to have profited from low-interest loans designed to assist small and medium-sized enterprises. The Economist Intelligence Unit, citing local press reports, notes that 124 out of 134 firms that received loans from the fund in 2016 were connected to government officials or their families. For example, the roads and transport minister requested and received a loan of $371,000 for his wife’s high-end postoperative medical center. Meanwhile, small business owners with no political connections frequently reported that they had received no responses or were denied loans.

In response to the scandal, the head of the fund in question has been arrested and a Cabinet vice minister, as well as at least two other officials, have been detained. The minister for food, agriculture and light industry, Batjargal Batzorig, resigned over the revelation that members of his family had received a loan for a transport company they owned. Khurelsukh appears to not have been involved, but many lawmakers thought he should accept some of the blame. Nonetheless, he survived a vote of no confidence in November. Mongolian media outlets speculated about the deals he made with other members of parliament to retain his post, but no evidence of such backroom dealing has emerged.

The government will require significant reforms to restore public confidence. First, it is notable that this widespread corruption scandal was revealed by local investigative journalists and not by the government’s own anti-corruption agency. This is a sign that the agency needs more personnel, resources and authority. Second, the accused government officials must be prosecuted and, if found guilty, must serve significant prison sentences. Finally, in the future, international aid funds should be overseen by a special agency, shielded from interference by senior politicians. Without these measures, corruption in government will persist.

WPR: How is the ongoing furor over corruption and the related political dysfunction likely to affect Khurelsukh’s policy agenda?

Rossabi: Khurelsukh was elected in 2017 after his predecessor was caught on tape requesting payment for an appointment to a position in government. It is a sad irony that someone who took office partially as a response to corruption now finds himself mired in a corruption scandal.

The current president, Khaltmaa Battulga, is a political rival of Kurelsukh’s and has called for his resignation, but Battulga’s criticisms were seen as lacking credibility due to his own history of profiting from the poorly administered sale of state assets during the 1990s. Still, the scandal-ridden Cabinet and the power struggle with Battulga has crippled Khurelsukh’s ability to govern effectively.

This plague of scandal and dysfunction comes at a particularly bad time for Mongolia’s economy. In 2017, the International Monetary Fund provided a $5.5 billion guarantee for unpaid Mongolian loans, rescuing the country from a sovereign debt default. But the current scandal has no doubt undermined confidence in the Mongolian government on the part of the IMF and other international financial institutions, potentially affecting their future approach toward Ulaanbaatar.

More broadly, the government needs new economic policies to diversify away from mining. Mongolia’s reliance on the extraction of metals and minerals to power its economic growth subjects it to the vagaries of world commodity prices. A drop in these prices over the past four years has dealt a devastating economic blow. Reformers in government, as well as international financial institutions and development banks, had plans to promote other sectors, such as manufacturing and eco-tourism. But corruption scandals have diverted attention from these efforts. As if that wasn’t bad enough, the National Chamber of Commerce and Industry, fed up with pervasive graft, has urged its members not to pay taxes until corruption is rooted out and the government has stabilized.

Clearly, a full recovery from these scandals will require considerable time and persistent effort. It may even require drastic reforms to Mongolia’s political and economic systems.

...

Religious organisations in Mongolia under inspection www.news.mn

Mongolia’s National Emergency Management Agency has been holding an inspection of all monasteries, churches and religious organisations which are currently active in Ulaanbaatar. The inspection is aimed at preventing fire and identifying any other possible health risks in places where many people gather.

According to national statistics, there are over 370 monasteries, churches and other religious organizations in Ulaanbaatar.

The inspection began on 4 January and will last until 25 January.

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- 1715

- 1716

- »