Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

Courtesy call on Parliamentary Vice-Minister Ikuina by Mr. Nyambaatar, Governor of the Capital City and Mayor of Ulaanbaatar www.mofa.go.jp

On December 16, for approximately 20 minutes commencing at 10:00 a.m., Ms. IKUINA Akiko, Parliamentary Vice-Minister for Foreign Affairs received a courtesy call from Mr. Khishgee Nyambaatar, Governor of the Capital City and Mayor of Ulaanbaatar, Mongolia. The overview is as follows.

At the outset, Parliamentary Vice-Minister Ikuina welcomed Mayor Nyambaatar’s visit to Japan and extended her congratulations on the 100th anniversary of the renaming of the capital city of Mongolia to “Ulaanbaatar.” Parliamentary Vice-Minister Ikuina emphasized that Japan will never forget the heart-warming assistance provided by the City of Ulaanbaatar to the victims of the 2024 Noto Peninsula Earthquake and stated that Japan will continue to make whole of government efforts towards the recovery and reconstruction of the affected areas.

Parliamentary Vice-Minister Ikuina welcomed the multifaceted progress in the cooperation between Japan and Mongolia under the “Special Strategic Partnership for Peace and Prosperity,” and stated that Japan seeks to continue to steadily promote cooperation based on the “Action Plan” in accordance with the “Joint Statement” issued by the two leaders of both countries in 2022. In addition, while mentioning the 50th anniversary of the exchange of diplomatic notes on cultural exchange between the two countries this year, Parliamentary Vice-Minister Ikuina expressed that she hopes that Mayor Nyambaatar would make efforts to further promote people-to-people exchanges between the two countries over the next 50 years.

In response, Mayor Nyambaatar expressed his gratitude for the assistance Japan had been providing over the years towards the various issues facing Ulaanbaatar, and introduced related efforts made by the City of Ulaanbaatar.

TMK fast-tracks Mongolia’s first coal seam gas-to-power generation www.smh.com.au

Gas pioneer TMK Energy has taken a major step toward commercial gas production at its mammoth Gurvantes project in Mongolia, signing a binding memorandum of understanding (MoU) with German-backed power generation provider Jens Energie LLC to import a gas fired power plant from Germany in early 2025 at no cost to TMK.

The agreement paves the way for TMK to become Mongolia’s first coal seam gas-to-power project, with electricity set to flow from TMK’s mammoth Gurvantes XXXV coal seam gas project to the local grid as soon as next year.

A gas-fired power plant in Germany similar to the one to be imported to begin production at TMK’s Gurvantes coal seam gas project in Mongolia.

A gas-fired power plant in Germany similar to the one to be imported to begin production at TMK’s Gurvantes coal seam gas project in Mongolia.

Under the MoU, Jens will pick up the cost of install a gas-fired power plant imported from Germany to TMK’s six-well Lucky Fox pilot production site. The generator is expected to be operational by April next year, converting pilot gas output into electricity for local customers.

In turn, TMK must deliver a minimum 5000 cubic metres of gas per day – or about 0.2 terra joules - by the end of financial year.

Under the terms of the agreement, TMK must deliver a minimum 5000 cubic metres of gas per day – or about 0.2 terra joules - by the end of financial year.

‘We will be working collaboratively with Jens over the coming months to put in place the pieces to allow the first coal seam gas production in Mongolia...’

TMK CEO Dougal Ferguson

When production milestones are met, Jens will purchase up to 15,000 cubic metres of gas per day for an initial two-year period, with the option to extend the contract for an additional two years.

Jens will handle all the necessary regulatory approvals to generate and supply electricity into Mongolia’s local grid. The arrangement means TMK can focus on its gas production while also generating early-stage revenue to offset any additional pilot well installation costs.

Jens Energie says it has successfully operated gas-fired power plants in Europe for more than 15 years and believes the quid pro quo agreement is a major milestone in establishing gas-fired power generation for the growing Mongolian market.

Advertisement

TMK CEO Dougal Ferguson said: “We will be working collaboratively with Jens over the coming months to put in place the pieces to allow the first coal seam gas production in Mongolia to be beneficially used for power generation, commencing the pathway to energy independence utilising Mongolia’s vast coal seam gas resources.”

TMK says the milestone MoU further solidifies it as a frontrunner to deliver critical energy solutions for Mongolia as it transitions away from coal towards cleaner, gas-based power sources.

Located in the South Gobi desert, a region known for its mammoth coal deposits, the Gurvantes XXXV project holds a 1.2 trillion cubic feet (Tcf) contingent resource, with further upside potential from its 5.3Tcf prospective resource.

The company’s recent progress comes just 12 months after it acquired 100 per cent ownership of the Gurvantes project, which is seriously close to northern China’s gas pipelines and has mammoth development potential.

It offers TMK a platform to become a key player serving the broader Asian energy landscape.

Management maintains it can achieve the commercial gas rates required from the very thick coal seams at its Lucky Fox pilot area, which run up to 6om. It believes sustainable revenue and further positive reports are yet to come as TMK continues to accelerate its transformation from explorer to producer.

The rapid installation of the gas-fired power plant marks a critical next step in TMK’s path to production, offering a tangible revenue stream for more pilot wells while demonstrating the project’s broader commercial viability to organically grow.

Savings in the National Currency of Mongolia Increased by MNT 5.4 Trillion www.montsame.mn

The savings in Tugrug, the national currency of Mongolia, reached MNT 20.7 trillion as of the end of October 2024, an increase of MNT 94 billion (0.5 percent.) Compared to the same period of 2023, the total amount of Tugrug savings increased by 5.4 trillion, or 34.9 percent.

Of the total Tugrug savings, MNT 17.9 trillion (86.4 percent) is made by individuals, whereas MNT 2.8 trillion (13.6 percent) by enterprises.

Savings in foreign currency reached MNT 4.5 trillion, an increase of 5.3 billion (0.1 percent) compared to the previous month. However, savings in foreign policy decreased by an equivalent of MNT 445.1 billion (9.1 percent,) compared to the same period last year, according to the National Statistics Office of Mongolia.

Mongolian Aviation Sector Marks an Unprecedented Accomplishment in its History www.montsame.mn

With the improvement of the quality and standards of aeronautic services, the number of air passengers traveling through Mongolia in 2024 has approached 16 thousand, reflecting a 6.5 percent increase compared to the previous year.

In 2024, Mongolia marked an unprecedented accomplishment in its history of the aviation sector. Particularly, as of November 2024, the Chinggis Khaan International Airport has, for the first time in its history, welcomed over two million passengers, while Mongolia’s Flag Carrier, MIAT Airlines, transported one million passengers within a single year. With 47 Agreements on Aviation Relations established with 46 countries worldwide, Mongolia provided direct flights to 155 destinations this year.

In 2023, the total freight transport in the road and transportation sector reached its historical high of 107.4 million tons. As of December 8, 2024, the total freight transported by all modes of transport amounted to 122.2 million tons, representing a 20.4 percent increase compared to the same period of the previous year. Among this, the volume of exported freight reached 87.2 million tons, surpassing the total amount for the previous year’s end and achieving a 22.2 percent increase compared to the same period last year, making another historical record. Furthermore, the volumes of freight transported by roads and rails have also exceeded those of previous years, setting new historic benchmarks. Specifically, in 2023, 71.2 million tons of freight were transported by road, and 36.1 million tons by railway.

Global scramble for critical minerals fuelling protectionism www.mining.com

A growing wave of protectionism is sweeping across 72 nations, as governments scramble to secure access to critical minerals essential for strategic industries, new research by global risk intelligence firm Verisk Maplecroft shows.

The study reveals a surge in state intervention not seen in Western democracies since the early 20th century, driven by concerns over national security and supply chain stability.

Verisk Maplecroft’s Resource Nationalism Index (RNI), which measures protectionism and interventionism in the energy and mining space across 198 countries, highlights a sharp increase in protectionist policies over the past five years. The trend is most pronounced in Europe and North America, where geopolitical tensions and a fractured global landscape are reshaping economic practices.

Europe has been at the forefront of this shift, with major economies like Germany, Spain, the UK, and Poland showing significant declines in the RNI rankings. Germany, in particular, has plummeted 122 places in the index, reflecting its aggressive policies to reduce dependence on external energy and mineral sources.

Berlin has implemented short-term measures, including the seizure of Russian energy assets after the Ukraine invasion, alongside long-term strategies such as subsidies for domestic manufacturing and partnerships with resource-rich nations like Canada and Australia. These efforts aim to secure access to essential minerals like lithium and cobalt while bolstering domestic processing capabilities.

The European Union is also ramping up its initiatives through frameworks like the European Raw Materials Alliance (ERMA) and the Critical Raw Materials Act, which focus on sustainable mining, recycling, and reducing reliance on non-European sources.

North American allies

In North America, policies to safeguard critical minerals have led to tightening trade and investment rules. The US has enacted the CHIPS and Science Act and the Inflation Reduction Act to boost domestic production while restricting Chinese involvement in key sectors. Initiatives like the Mineral Security Partnership have strengthened collaboration with allied nations, further entrenching trade barriers with geopolitical rivals.

Canada, meanwhile, has adopted a multi-faceted approach through its Critical Minerals Strategy and the Investment Canada Act. These measures not only limit foreign investments, particularly from China, but also encourage sustainable resource development under strict environmental and labour standards.

In 2022, Ottawa ordered three Chinese investors to sell their stakes in a trio of Canadian lithium firms. This was part of a wider push to block Chinese firms from delving further into Canada’s critical minerals sector.

In June, Ottawa stepped in to block a potential deal that would have seen Australia’s Vital Metals selling its stockpiled rare earth material, which it mines in Canada, to China’s Shenghe Resources Holding Co. Prime Minister Justin Trudeau’s administration offered a higher sum for Vital to sell its rare earths to the Saskatchewan Research Council.

Canada has also partnered with nations like Australia and the US to strengthen critical mineral supply chains through agreements that prioritize resource access.

The country is also part of the Five Eyes Alliance, which includes the US, Britain, Australia and New Zealand, which aim to tackle the price manipulation of critical metals.

The US has created several groups, such as the Committee on Foreign Investment (CFIUS), to increase scrutiny on foreign acquisitions of critical mineral assets. Early this month, the US also introduced restrictions on exporting semiconductors and critical materials to China, limiting Beijing’s ability to develop advanced technologies. The Asian giant responded by banning exports of gallium, germanium, antimony, and other key high-tech materials with potential military applications to the US.

Fragmented global economic

The rise in resource nationalism, described by Verisk Maplecroft as “strategic,” underscores the challenges posed by a fragmented global economic order. Jimena Blanco, the firm’s chief analyst, noted that supply chain security has become a top priority for states, opening doors for incentive programs while also narrowing opportunities to “friendly” jurisdictions.

The report warns of increased trade tensions as nations like China and the US engage in tit-for-tat measures.

The study also identifies the top 10 highest-risk jurisdictions, including long-standing resource nationalists like Venezuela, Russia, and Zimbabwe. These countries continue to use policies such as nationalization and resource rent hikes to exert control over their mineral wealth.

As resource nationalism becomes more sophisticated, Western economies appear poised to deploy a mix of trade barriers, investment controls, and sustainability standards to maintain strategic autonomy.

For investors, the evolving policies signal a complex landscape with potential risks throughout the global supply chain.

“Western nations will likely increase localized supply chains and stricter trade policies, adding layers of complexity for global businesses,” Blanco said.

The race for critical minerals, a cornerstone of green energy and advanced technology, seems destined to deepen economic divides worldwide.

24 Million Tons of Mining Products Traded Since the Beginning of the Year www.gogo.mn

90.6% of the total trade consists of coal.

As of December 13, 2024, a total of 24.55 million tons of mining products have been traded for 8.85 trillion MNT, according to the Mongolian Stock Exchange. Coal accounts for 90.6% of the total trade, 9.2% is iron ore, and the remaining portion consists of products like fluorspar and copper concentrate.

It was noted that sellers have gained an additional income of 796.1 billion MNT due to price increases. Looking at last week’s trade, iron ore with 52% purity was the most traded product. However, the majority of the traded value still comes from coal transactions.

Since the beginning of December, "Mongolrostsvetmet" SOE has sold 19,800 tons of iron ore with 52% purity. At the start of the month, the price per ton of 52% purity iron ore was $65, but by December 12, the price had decreased to $63.5 per ton.

Translated by ChatGPT

How Marc Rich’s Former Haven Put a Commodity Trader on Trial www.bloomberg.com

When Trafigura Group director Mark Irwin stood up earlier this month to give evidence in a Swiss criminal court, it represented a pivotal moment in the relationship between the world’s commodity traders and the country that many of them call home.

Until now, Swiss prosecutors had never put a commodity trading house on trial. In fact, they’d never tried any company for corruption at all.

Irwin, who was one of Trafigura’s earliest employees, was the company’s official representative at the federal criminal court in the picturesque alpine town of Bellinzona, where Trafigura and three individuals — including former chief operating officer Mike Wainwright — faced charges of bribery in a landmark case. All four defendants denied the charges against them.

The testimony from a procession of current and former senior figures at Trafigura meant the case has provided an unprecedented glimpse into decision making at one of the world’s biggest commodity traders, a company that handles enough oil every day to meet the combined demand of Germany, France and Spain. But it’s also served to highlight a shifting stance in Switzerland, which has long been known for its light-touch regulation.

Instead, federal prosecutors were accused by Trafigura’s lawyers of being on a “crusade,” while a lawyer for Wainwright argued his client was being unfairly made an example of to show the country was cracking down on the sector.

“Switzerland became a leading commodities hub thanks to a unique combination of tax privileges, its financial industry, weak regulation and a lax embargo policy,” said Adrià Budry Carbó of Swiss NGO Public Eye. “In the Trafigura trial, federal prosecutors are for the first time opening up and scrutinizing a corruption machinery in a public trial, in order to establish the responsibility of individuals.”

It’s a far cry from the not-so-distant past, when commodity traders from all over the world flocked to Switzerland, lured by low taxes, political neutrality and business-friendly laws.

In the 1960s, Egyptian cotton merchants relocated to Geneva. Later, industry godfather Marc Rich chose the town of Zug for his eponymous trading house when fleeing US justice. He was followed by Russian oil and metals merchants in the 1990s.

But in recent years, mirroring a crackdown on corruption and market manipulation by commodity traders from US authorities, Swiss prosecutors have launched several cases against the industry.

Both Glencore Plc and Gunvor Group have been fined for historical corruption, though the cases were resolved without going to trial. Trafigura has said it had been willing to settle, but the Swiss prosecutors “decided to send the case to court.”

And so, over the past fortnight, a small army of lawyers descended on Bellinzona. On trial were not just Trafigura, but also Wainwright, the former COO, Thierry Plojoux, a former Trafigura employee who was an alleged middleman for bribe payments, and Paulo Gouveia Junior, an Angolan oil official who allegedly received the bribes.

At times, the court — which last saw major corporate action when Credit Suisse Group AG was convicted for laundering a cocaine dealer’s cash in 2022 — didn’t seem equipped to handle the volume of lawyers, public relations officials, observers and journalists.

On the first day of the trial, prosecutors complained that Trafigura’s vast team meant there wasn’t enough space in the courtroom. During breaks, defendants and witnesses, some of them multimillionaires, queued along with everyone else for the courthouse’s two toilets and one coffee machine.

The crackdown on corruption is happening at a time when Switzerland’s position as an epicenter for much of the world’s physical commodities trade is under increasing threat.

Singapore has wooed many of the world’s commodity traders with tax breaks — including Trafigura, which reorganized itself under a Singapore parent company in 2015, although its top executives are still based in Geneva. And Switzerland’s decision to mirror EU sanctions on some Russian commodities since 2022 has resulted in a significant shift in the companies handling those trade flows to Middle Eastern hubs like Dubai and Abu Dhabi.

Still, Switzerland doesn’t look like losing its status as a key hub for commodity trading any time soon. Swiss-based trading companies handle a third of the world’s trade in crude and oil products, according to the Swiss Commodity Trading Association SUISSENÉGOCE. In return “fiscal contributions” from trading represent 22% of Geneva’s budget, 10% in Zug and around 19% of Lugano’s income, according to the body.

The country’s famously low taxation rates mean it is still an attractive location for many trading businesses. Trafigura itself had an effective tax rate of just 2.8% on profits of $2.8 billion in its most recent financial year, it said in its annual report on Friday. Moreover, many traders receive the lion’s share of their compensation through the rise in value of their shareholdings in their companies — which, as capital gains, are not subject to Swiss tax.

Even Swiss corruption cases remain relatively easy for the traders to brush off. The country has a maximum corporate fine of 5 million francs ($5.6 million) on top of disgorgement of profits made in corrupt acts — a rounding error for companies that make billions of dollars in profits a year.

The Swiss trial comes at a sensitive time for Trafigura. The company is preparing for the second CEO handover in its history next month, when gas boss Richard Holtum will take over from Jeremy Weir. It has also this year pleaded guilty in a US court to historical corruption in Brazil, settled allegations it manipulated oil prices, and on Friday confirmed it took $1.1 billion in losses related to alleged employee misconduct in its Mongolian oil business.

In the case that concluded last week, the charge against Trafigura is that it allegedly failed to take the necessary measures to prevent bribes being paid. Much of the trial focused on the adequacy of the company’s compliance function during the period of 2009 to 2011, when it made payments to intermediaries, which paid around $5 million to Gouveia.

Irwin, who attended the trial as Trafigura’s representative, told the court that the company’s compliance team had been “very independent” in the period when the alleged bribes were paid.

Asked by the judges to explain the payments, he replied: “I cannot explain the payments to Mr. Gouveia.”

Prosecutors are seeking a total penalty of $157 million from Trafigura. Judges in the Bellinzona court usually take several months to deliver their verdict.

By: Archie Hunter and Jack Farchy

— With assistance from Hugo Miller

Modern defence technology, equipment to be transferred from Japan to Mongolia www.asianews.network

The Minister of Defense, S. Byambatsogt, and the Ambassador Extraordinary and Plenipotentiary of Japan to Mongolia, Masaru Igawahara, signed an agreement on the transfer of defense technology, equipment, and technology between the governments of Mongolia and Japan.

During President U. Khurelsukh’s official visit to Japan in 2022, it was announced that Mongolia and Japan had reached the level of a “Special Strategic Partnership for Peace and Development,” and they mutually agreed to develop cooperation on the transfer of defense technology, equipment, and technology between the two countries at this level.

Working groups were established, and the agreement on the transfer of defense technology, equipment, and technology was discussed and supported during a government meeting of Mongolia on September 18 of the past year.

With this agreement, the activities of the “Special Strategic Partnership for Peace and Development” between the two countries will be implemented.

The cooperation in the defense sector will enter a new phase, strengthening military trust in the region, creating an opportunity to receive modern defense technology and equipment from Japan, and enhancing the capacity of the Mongolian Armed Forces to carry out its duties. This agreement has significant importance.

The agreement will be submitted to the State Great Khural (Parliament) for ratification under the Law on International Treaties.

Thailand and Mongolia aim to boost trade to $100 million by 2027 www.nationthailand.com

Commerce Minister Pichai Naripthaphan eyes rapidly growing market for Thai food, vehicles and investment

Commerce Minister Pichai Naripthaphan invited the Mongolian ambassador to Thailand for a discussion on trade cooperation on Monday morning, aiming to increase bilateral trade value to 3.1 billion baht within three years.

After meeting with Mongolian Ambassador Tumur Amarsanaa at the Commerce Ministry, Pichai stated that the discussion focused on expediting trade negotiations through the Thai-Mongolian Joint Trade Committee.

Pichai announced that Thailand is ready to host a meeting of the trade committee early next year, with the goal of boosting bilateral trade value to 100 million USD (approximately 3.413 billion baht) by 2027.

Thailand and Mongolia aim to boost trade to $100 million by 2027

The committee is also set to discuss plans to increase bilateral investment between the two countries to 1.5 billion USD by 2027.

Pichai noted that Mongolia, as a developing economy, is projected to experience GDP growth of 7% this year, making it a potential market for Thai products. He added that Thai goods are gaining greater acceptance among Mongolian consumers, who have expressed interest in importing more fruits and seafood from Thailand.

Furthermore, canned and processed foods from Thailand are also in high demand in Mongolia.

Thailand and Mongolia aim to boost trade to $100 million by 2027

The Commerce Minister extended an invitation to Mongolian businesspeople, through the ambassador, to attend trade fairs organized by the Commerce Ministry next year. These include THAIFEX-ANUGA Asia in May 2025 and the Bangkok Gems & Jewellery Fair in February and September 2025.

During the meeting, Pichai urged the ambassador to encourage the Mongolian government to facilitate Thai investors operating in Mongolia. He highlighted that Thai investors are already engaged in various sectors in Mongolia, including coal mining, healthcare services, and solar farms.

Pichai also emphasized the ongoing negotiations between the two nations on trade and investment protection, as well as a treaty to avoid double taxation, to bolster investor confidence.

Marking the 50th anniversary of diplomatic ties between the two countries, the Commerce Ministry has appointed an honorary trade envoy for Mongolia.

Last year, bilateral trade between Thailand and Mongolia amounted to 88 million USD, with Thailand exporting goods worth 21 million USD to Mongolia. Key exports included paper and paper products, beverages, vehicles and auto parts, and sugar.

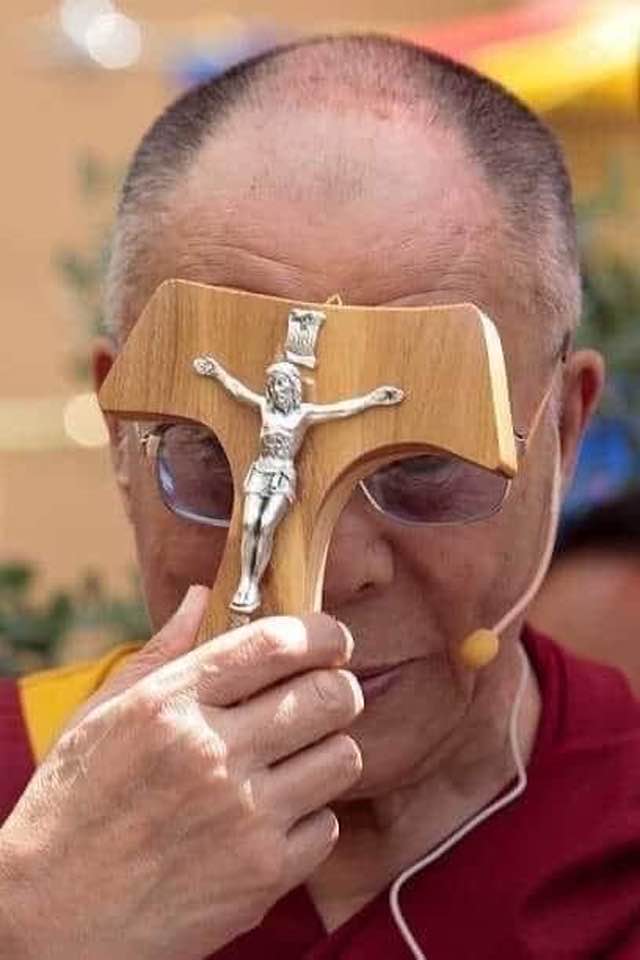

Mongolia, the Next Dalai Lama, and the Shadow of Global Politics www.mongoliaweekly.org

Mongolia’s strategic position, between two geopolitical giants—China and Russia—has long made it a fascinating subject of international interest. However, its historical and spiritual ties to Tibetan Buddhism place it in an even more complex situation, particularly as succession of the next Dalai Lama approaches. With its economic ties to China, growing engagement with India, and cultural connections to Tibet, Mongolia now finds itself at a crucial juncture where religious, economic, and geopolitical interests intersect.

Mongolia is not simply a passive observer in the Dalai Lama’s succession but an active participant by default. The recent recognition of the 10th Jebtsundamba Khutuktu—a spiritual leader who holds dual citizenship in Mongolia and the U.S.—illustrates Mongolia’s commitment to preserving its deep-rooted spiritual heritage.

This recognition, while undoubtedly religious, is also a clear assertion of Mongolia’s autonomy in its spiritual decisions, signaling its resistance to external pressures, particularly from China, which seeks to control Tibetan Buddhism’s future.

Historically, Mongolia has resisted external interference in its religious institutions, maintaining ties to Tibetan Buddhism despite external pressures, such as during the Soviet era. This long-standing stance continues as Mongolia navigates the complexities of its spiritual and geopolitical landscape.

India’s increasing presence in Mongolia is more than just economic. The $1.2 billion investment in an oil refinery is part of India’s broader “Act East” policy, which aims to counterbalance China’s economic dominance in the region. While this economic support is crucial for Mongolia’s energy security, it also intersects with India’s strategic interest in Tibetan Buddhism.

By supporting the Dalai Lama’s religious authority, India positions itself as a counterpoint to China’s growing influence over Tibetan Buddhism. India’s role in promoting Tibetan Buddhism, particularly through Dharamshala, aligns with its broader foreign policy goals to increase influence in Central Asia and reduce China’s geopolitical sway. However, this soft power strategy raises questions about whether India’s engagement in Mongolia is purely economic or subtly entwined with religious diplomacy aimed at weakening China’s grip over Tibetan Buddhism.

China’s economic dominance in Mongolia, facilitated through its Belt and Road Initiative (BRI), gives it significant leverage. Yet, economic power alone does not explain Beijing’s approach to Tibetan Buddhism. The introduction of Order Number Five, which mandates Chinese state approval for the reincarnation of Tibetan Buddhist leaders, underscores China’s intent to control not just the economic but also the spiritual future of the Tibetan Buddhist community.

For China, the Dalai Lama’s succession is not just a religious issue—it’s a national security concern and a strategic opportunity to exert cultural and political influence over Mongolia. By attempting to assert control over Tibetan Buddhism, Beijing hopes to extend its reach into Mongolia’s spiritual institutions, thereby consolidating its influence over the country’s religious and cultural identity.

Mongolia’s leadership is caught between two powerful forces: the economic and political pull of China and the spiritual and strategic support offered by India. While Mongolia’s ties to Tibetan Buddhism are crucial to its cultural identity, its economic reliance on China makes it highly sensitive to Beijing’s demands. This delicate balancing act is even more complicated by Mongolia’s growing ties with the United States, which has increasingly engaged with Ulaanbaatar in recent years, potentially providing an additional counterweight to Chinese influence.

Mongolia’s challenge is to preserve its religious and cultural heritage while ensuring its economic survival. The decision to recognize the 10th Jebtsundamba Khutuktu, despite potential Chinese opposition, highlights Mongolia’s determination to maintain its spiritual independence. This stance not only reflects Mongolia’s desire to preserve its religious traditions but also signals its intent to navigate a path that protects its sovereignty.

The finding of the next Dalai Lama is more than a transition of spiritual authority; it is a moment of critical geopolitical significance. For Mongolia, how it handles this transition will have far-reaching implications. Its decision or non-decision will shape not just its own future but could influence the broader balance of power in Asia.

The involvement of external actors—India, China, the U.S., and even Russia—complicates the picture. While the U.S. has not explicitly intervened in Mongolia’s religious matters, its growing relationship with Ulaanbaatar suggests that it may be indirectly influencing outcomes. Similarly, Russia’s historical ties to Mongolia add another layer of complexity to the situation.

Mongolia’s ability to maintain its cultural identity while managing economic dependencies and navigating the competing influences of China and India will set a precedent for other small nations facing similar pressures from great powers. The stakes are particularly high for Mongolia, and its choices in the coming years will have lasting consequences for its role in the region and beyond.

Mongolia’s path forward is one of careful diplomacy and strategic maneuvering. As it faces growing pressures from China and India, it must balance its economic needs with its cultural and spiritual identity. The recognition of the 10th Jebtsundamba Khutuktu is just one example of Mongolia’s determination to assert its religious and cultural autonomy in an increasingly polarized geopolitical environment. How Mongolia handles the Dalai Lama’s succession—and the competing interests of regional powers—will determine its future as a sovereign and independent actor in the heart of Asia.

BY: Zhamsrangin Sambu is a freelance writer based in Seoul.

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- »