Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

Four players from Mongolia became the World Champions of the Amateur Chess Championship www.gogo.mn

The World Amateur Chess Championship 2023 was held in Muscat, Oman. Six athletes from Mongolia competed. There is no previous history of winning four gold, one silver and one bronze medal.

Women U 1700 category:

Anujin Bat-Amgalan /Mongeni/

Anudari Tsogdelger /Sukhbaatar province/

Khuslenzaya Baldanjantsan /Lasker Club/

Men U 1700 category:

Danzanjunai Ganbat /Mongeni/

Men U 2000 category:

Amarsaikhan Dashtogtokh /Mongeni/

Women U 2000 category:

Badamkhand Norovsambuu

By taking the first three places in the category up to 1700, four players from our country became the world champions of the Amateur Chess Championship for the first time.

Prime Minister Oyun-Erdene: "Five Circles for Rural Revival" Project to be Implemented www.montsame.mn

Prime Minister of Mongolia Oyun-Erdene Luvsannamsrai attended the opening of the International Forum "Transport Week 2023" under the theme "Strengthening Regional Transport and Logistics” on November 6, 2023.

The Transport and Logistics Forum aims to present the policies and initiatives undertaken by the Mongolian Government in railways, civil aviation, highways, road transportation, maritime transport, and dry ports to foreign and domestic institutions and investors. The Prime Minister expressed his firm belief that this forum will foster joint deliberation and practical solutions to the challenges faced by the transport and logistics sector in its endeavor to contribute to regional integration. The Prime Minister underscored the critical need to enhance the effectiveness of regional economic cooperation in the transport and logistics sectors, including facilitating seamless cross-border transportation, strengthening adherence to customs regulations, tariffs, border procedures, documentation, and data exchange, developing transport corridors, and collaboratively addressing other sector-specific challenges.

Under the “Vision 2050” long-term development policy and the "New Revival Policy", the Mongolian government has actively engaged in the regional transport network, aspiring to become a transit country connecting Asia and Europe. To achieve this objective, three railway corridors linking Russia and China have been initiated. Notably, over the past three years, Mongolia has constructed a total of 950 kilometers of railways. Port infrastructure has previously posed a significant constraint on Mongolia's development potential. However, the government's concerted efforts have yielded tangible results. Four new export railway crossings have been agreed upon with China, and construction is proceeding at full speed. Enhancing the accessibility of border crossings will receive particular attention, thereby facilitating an increase in the volume of exported goods and products. In addition to the Tianjin port, the government intends to utilize the Jinzhou and Lianyungang ports in China, as well as seaports in Pakistan and Iran, to further expand trade routes.

"The 2024 budget year is being devoted entirely to supporting the Government's "Urban and Rural Revival." The Millennium Road project, which runs more than 7,000 km in Mongolia, was successfully completed last year. Construction of "Five Circles for Rural Revival" is about to start in the five regions of the west, east, central, west central, and south. We are planning to connect the centers of aimags and border ports by auto road," emphasized Prime Minister of Mongolia.

"The Mongolian Government's "Welcome to Mongolia" tourism policy has yielded positive outcomes in several areas. The liberalization of air transport regulations and the establishment of aviation agreements with 42 countries have facilitated direct flights to 115 destinations, significantly enhancing Mongolia's accessibility to international travelers. Addressing traffic congestion in Ulaanbaatar, the capital city, has emerged as a pressing issue. To tackle this challenge, a comprehensive feasibility study has been conducted, outlining various programs and projects aimed at reducing traffic congestion and constructing a ring road around the city. This study is now ready to attract foreign and domestic investors. According to the World Bank's Logistics Performance Index (LPI) 2022, Mongolia has made significant progress, climbing 33 places to rank 97th globally. This positive development is attributed to the implementation of comprehensive reforms aimed at establishing transparent and corruption-free governance. The country has also witnessed an improvement of 18 places on the Digital Development Index, further demonstrating its commitment to enhancing its digital infrastructure and capabilities," Mongolian Premier Oyun-Erdene said.

Mongolia's inflation stands at 9 pct in October www.xinhuanet.com

Mongolia's inflation stood at 9 percent in October, as measured by the consumer price index, rising 9 percentage points year on year in October, data from the country's National Statistics Office showed Tuesday.

The increase was mainly driven by rising prices of imported goods, especially food products, the agency said.

More than half of over 400 items of the landlocked Asian country's consumer goods and services basket are imported, it said.

The inflation rate peaked at 16.4 percent in July 2022 due to higher prices for imports. The figure has been on the decline ever since.

The country aims to reduce its inflation rate to a single digit by the end of this year.

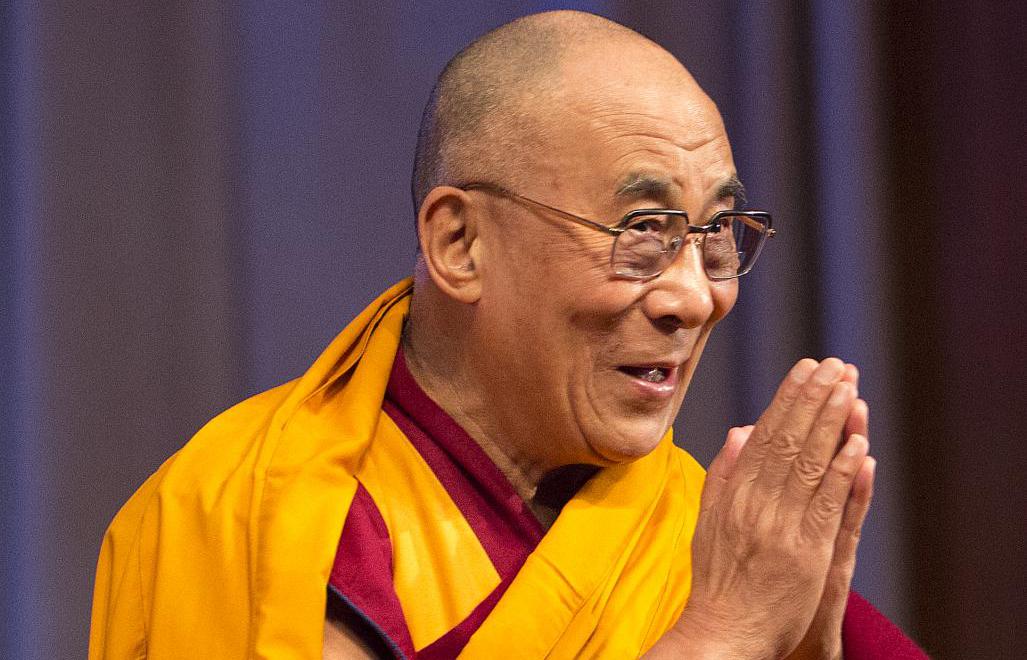

Congratulating the New Khamba Lama of Mongolia www.dalailama.com

Thekchen Chöling, Dharamsala, HP, India - His Holiness the Dalai Lama has written to the newly elected Khamba Lama of Gaden Thekchogling, the principal Buddhist Monastery in Mongolia, Geshé Jetsun Dorji (Javzandorj-Жавзандорж), to congratulate him on his new position.

Newly elected Khamba Lama of Gaden Thekchogling, the principal Buddhist Monastery in Mongolia, Geshé Jetsun Dorji (far right), outgoing Khamba Lama, Gabju Demberel Choijamts (far left), and His Holiness the Dalai Lama meeting with members of the media in Ulannbaatar, Mongolia on November 23, 2016. Photo by Tenzin Taklha

Newly elected Khamba Lama of Gaden Thekchogling, the principal Buddhist Monastery in Mongolia, Geshé Jetsun Dorji (far right), outgoing Khamba Lama, Gabju Demberel Choijamts (far left), and His Holiness the Dalai Lama meeting with members of the media in Ulannbaatar, Mongolia on November 23, 2016. Photo by Tenzin Taklha

In his letter His Holiness stated that the Dharma has great potential to contribute to the well-being of humanity because it is rooted in non-violence and compassion. However, this will only occur if those of us who have the opportunity to study and practise it. His Holiness added that when it comes to giving Buddhist teachings, it is important to keep in mind the aptitude and inclination of those being taught.

In a separate letter to the outgoing Khamba Lama, Gabju Demberel Choijamts, who is retiring due to his advanced age, His Holiness expressed admiration for the way he has promoted an approach to the Buddha’s teachings founded on study, reflection on what has been learned, and meditation on what has been understood. His Holiness wrote that the Khamba Lama had lived a meaningful life and that he had been happy to count him his friend for many years.

His Holiness assured both Khamba Lamas of his prayers and good wishes.

Mongolia’s banks have listed – now for the hard part www.euromoney.com

Mongolia’s five big lenders have successfully completed their IPOs, doubling the size of the local stock market. But the challenge of attracting more foreign institutional investment remains.

A landlocked Asian frontier state squeezed between a former global power at war with its neighbour and a modern superpower suddenly lacking economic momentum would seem an unlikely place to go looking for ambitious policymakers bent on transforming an archaic banking sector.

But then Mongolia always did do things a little differently. In January 2021, when the central bank published an amended banking law, two particular demands stood out.

First, it required each of the five domestic systemically important banks (D-Sibs) to list a minimum of 5% of their shares on the local stock exchange by June 2022. Second, it told all lenders to dilute ownership by the end of 2023, to ensure that no individual owned more than 20% of a bank’s total shares.

It was always going to be a big ask to get each of the big-five operators – Khan Bank, Trade & Development Bank (TDB), XacBank, Golomt Bank and State Bank, which at the end of 2022 together controlled a little over 90% of all banking assets – to complete initial share offerings in just 18 months, in the teeth of the worst pandemic in a century.

BY

Elliot Wilson is Asia editor and Global Private Banking and Wealth Management editor. He joined the magazine in 2020 having been a regular contributor focusing on China and the Indian subcontinent, Russia and Eastern Europe/the CIS. He is based in Hong Kong.

Czech Relations with Mongolia www.mzv.cz

Czechia is one of the most traditional partners of Mongolia, having established diplomatic relations since 1950 as the fourth country in the world and soon becoming Mongolia’s second largest trading partner. Prague implemented a number of projects that still have significant importance and visibility nowadays. Its geologists helped to discover the giant copper and molybdenum deposit mine in Erdenet (now 13.5% GDP), invested in other mines (tungsten, tin or fluorite), lead comprehensive geological mapping projects, build the „1st Hospital“, still the largest in Mongolia, and helped to establish a whole range of industries (leather, shoes, concrete …).

Though trade exchange collapsed after the fall of communism in 1989, the embassy has never closed and the development aid continued. In 1996-2017 (phasing out), the Czech development assistance to Mongolia ranged from power plants upgrades to forestry sector modernization. Nowadays, the biodiversity protection – from forestry (working with the EU and German GIZ) to the popular wild Przewalski horses (with horse being a symbolic animal in Mongolia) reintroduction programs lead by ZOO Prague belong among the most popular projects.

More than 1% of the Mongolian population passed through Czechoslovakia and it is common to meet Czech-speaking locals on the streets nowadays as well as to have a Czech speaker on Mongolian side during the official meetings. Many Czech industry employees now come from Mongolia (most frequently in its automotive sector). From January 2024, the quota of accepted applications will increase from 1,000 to 3,000 per year.

Almost 13.000 Mongolians, the largest community within the European Union and one of the largest in the world after South Korea and USA lives in Czechia. Vast majority of them are newcomers, unrelated to the pre-1989 era. Thanks to controlled labor migration, the Asian community including a growing number of students from Vietnam, Mongolia and the Philippines, is gaining importance in Czechia .

Czechia has also been involved in the NATO DEEP mission and in 2023 also renewed its observer level peacekeeping military exercise Khaan Quest. Its companies have provided the civil aviation control systems for the new Chingiskhan airport as well as the wastewater treatment plants for both the airport and the large Oyu Tolgoi mine.

B.Bat-Erdene: Information about tourism in Mongolia reached about 500 million people around the world www.gogo.mn

B.Bat-Erdene, Minister of Environment and Tourism, gave the following information related to Mongolian tourism in 2023.

Information about tourism in Mongolia reached about 500 million people around the world, and the number of tourists who came this year exceeds the record of 2019.

At today's cabinet meeting, major decisions related to the development of winter tourism were made, such as maintaining international and domestic flights and implementing "Mongolian winter" marketing activities.

This month, we are also preparing to bring a team of influencers to promote winter tourism in Mongolia. In 2023-2024, it is planned to bring a total of six teams who work in the influencing sector.

UN expert to assess independence of Mongolia’s justice system www.news.mn

The UN Special Rapporteur on the independence of judges and lawyers, Margaret Satterthwaite, will conduct an official visit to Mongolia from 6 to 15 November 2023.

During her visit, Satterthwaite will assess the measures taken by the Government to ensure the independence and impartiality of the judiciary and prosecutors, as well as the independent exercise of the legal profession.

The Special Rapporteur will address issues related to the structure, organisation and functioning of the judiciary; the administration of justice; the protection of the actors of the justice system; fair trial, including from a gender perspective. She will also examine equal access to justice and legal assistance, seeking to understand how ordinary people in Mongolia experience the judicial system.

The expert will meet Government officials and members of the Parliament, judges, prosecutors and lawyers. She will also meet representatives of civil society, academia, UN agencies, donors and the diplomatic community.

Satterthwaite will hold a press conference on Wednesday 15 November at 11:30 local time at the UN House. Access is strictly limited to journalists.

The Special Rapporteur will present her report to the Human Rights Council in June 2024.

IFC Appoints Jack Sidik as Country Manager for China, Mongolia, and Korea www.ifc.org

IFC, a member of the World Bank Group, has appointed Jack Sidik as Country Manager for China, Mongolia, and Korea. This move reassures IFC's commitment to drive sustainable and inclusive private sector solutions with clients and partners in the three countries.

Based in Beijing, Sidik will manage investment and advisory programs that support climate projects, micro, small, and medium-sized enterprises (MSMEs), women and farmers. In Mongolia, he will especially focus on promoting sustainable mining and economic diversification. In Korea, his priorities include engaging with Korean development partners and encouraging sustainable cross-border investments in emerging markets.

"Overlapping global crises have deepened inequalities and erased years of development gains in our region. The green transition in China, Mongolia, and Korea is critical to the region's growth and prosperity," said Kim-See Lim, IFC's Regional Director for East Asia and the Pacific. "Sidik's leadership and extensive experience will be key to implementing our strategies and supporting the countries in achieving their ambitious climate and development goals."

An Indonesian national, Sidik brings about 30 years of professional experience in the financial sector. He first joined IFC in 2008 as Investment Officer in the infrastructure department and rejoined IFC as Senior Country Officer for Indonesia and Timor-Leste in 2018. Prior to IFC, he held various senior positions in leading financial institutions such as Natixis and DBS. Sidik has also served as Financial Advisor to the Indonesian Bank Restructuring Agency during the 1998 Asian Financial Crisis

"While China has achieved tremendous development gains, a significant number of people remain vulnerable. Climate change also poses a significant threat to China's long-term growth and prosperity, "said Sidik. "IFC has a strong track record of promoting innovations that address some pressing development challenges in China, Mongolia, and with Korean partners in emerging markets. I look forward to working with our teams to expand sustainable solutions for those who need them the most."

China is IFC's fourth largest portfolio country and one of IFC's largest syndication partners. As of September 30, 2023, IFC's committed portfolio in China stood at $3.4 billion across key sectors, such as blue and green finance, microfinance, waste management, agribusiness, and health care. In Mongolia, IFC's committed investment portfolio stood at around $671 million across key sectors such as mining, banking, microfinance, green finance, and service. Since IFC re-established its presence in Korea in 2014, IFC has provided financing worth over $7 billion to over 140 cross-border projects involving Korean partners and banks.

About IFC

IFC — a member of the World Bank Group — is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2023, IFC committed a record $43.7 billion to private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity as economies grapple with the impacts of global compounding crises. For more information, visit www.ifc.org.

Mining, coal-fired power plants responsible for sevenfold increase in atmospheric mercury – study www.mining.com

Researchers at the Harvard John A. Paulson School of Engineering and Applied Sciences estimated that emissions from coal-fired power plants, mining and waste incineration have increased the concentration of potentially toxic mercury in the atmosphere sevenfold since the beginning of the modern era around 1500 C.E.

To reach this conclusion, the scientists developed a new method to accurately estimate how much mercury is emitted annually from volcanos, the largest single natural emitter of mercury. The team used that estimate—along with a computer model—to reconstruct pre-anthropogenic atmospheric mercury levels.

SIGN UP FOR THE ENERGY DIGEST

Their calculations show that before humans started pumping mercury into the atmosphere, it contained on average about 580 megagrams of mercury. However, in 2015, independent research that looked at all available atmospheric measurements estimated the atmospheric mercury reservoir was about 4,000 Mg—nearly seven times larger than the natural condition estimated in this study.

“Methylmercury is a potent neurotoxicant that bioaccumulates in fish and other organisms—including us,” Elsie M. Sunderland, senior author of the Geophysical Research Letters paper that presents these findings, said. “Understanding the natural mercury cycle driven by volcanic emissions sets a baseline goal for policies aimed at reducing mercury emissions and allows us to understand the full impact of human activities on the environment.”

Satellites to the rescue

Sunderland explained that the challenge with measuring mercury in the atmosphere is that there is not much of it despite its outsized impact on human health. In a cubic meter of air, there may be only a nanogram of mercury, making it virtually impossible to detect via satellite. Instead, the researchers needed to use another chemical emitted in tandem with mercury as a proxy. In this case, the team used sulphur dioxide, a major component of volcanic emissions.

“The nice thing about sulphur dioxide is that it’s really easy to see using satellites,” Benjamin Geyman, first author of the article, said. “Using sulphur dioxide as a proxy for mercury allows us to understand where and when volcanic mercury emissions are occurring.”

Using a compilation of mercury to sulphur dioxide ratios measured in volcanic gas plumes, the researchers reverse-engineered how much mercury could be attributed to volcanic eruptions. Then, using the GEOS-Chem atmospheric model, they modelled how mercury from volcanic eruptions moved across the globe.

The team found that while mercury mixes into the atmosphere and can travel long distances from its injection site, volcanic emissions are directly responsible for only a few percent of ground-level concentrations in most areas on the planet. However, there are areas— such as in South America, the Mediterranean and the Ring of Fire in the Pacific—where levels of volcanic emissions of mercury make it harder to track human emissions.

“In Boston, we can do our local monitoring and we don’t have to think about whether it was a big volcano year or a small volcano year,” said Geyman. “But in a place like Hawaii, you’ve got a big source of natural mercury that is highly variable over time. This map helps us understand where volcanos are important and where they aren’t, which is really useful for understanding the impact of humans on long-term mercury trends in fish, in the air and the ocean. It’s important to be able to correct for natural variability in the volcanic influence in places where we think that influence may not be negligible.”

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- »