Toronto, Ontario--(Newsfile Corp. - April 18, 2022) - ION Energy Limited (TSXV: ION) (OTCQB: IONGF) (FSE: 5YB) ("ION" or the "Company") is excited to provide an operational update, while our team conducts site visits in Mongolia.

ION Energy's CEO, Ali Haji, is in Mongolia for strategic site visits from April 16th to 26th, in anticipation of sharing plans with the market for our pending drilling programs. He will be accompanied by senior technical team members, including: ION Director, Enkhtuvshin Khishigsuren, with 30 years of Mongolian mineral discovery experience, Don Hains, P.Geo, MBA, Lead Technical Advisor, and Dr. Mark King, PhD, PGeo.

"Now that borders are fully open, I'm delighted to have foremost industry experts see our projects firsthand and work with our Mongolian team to kick off the next phase of our fully-funded exploration programs. Our preliminary results have reinforced the long-term lithium potential at our Baavhai Uul project and Urgakh Naran projects, as we strive to play a pivotal role in Asia's battery metals supply hub. I'm really excited to provide updates from Mongolia, over the coming days," says Ali Haji, CEO & Director of ION Energy Ltd.

This visit also provides ION's CEO the opportunity to personally thank the dedicated exploration team members for their commitment and flexibility since the onset of the pandemic, in furthering our maiden drilling program at the flagship Baavhai Uul lithium brine site, while keeping each other safe and healthy.

ION's Exploration Programs:

This in-country visit is a significant milestone for ION Energy, after two years of pandemic-related delays and border closures. The following highlights how the Company plans to advance each of these programs:

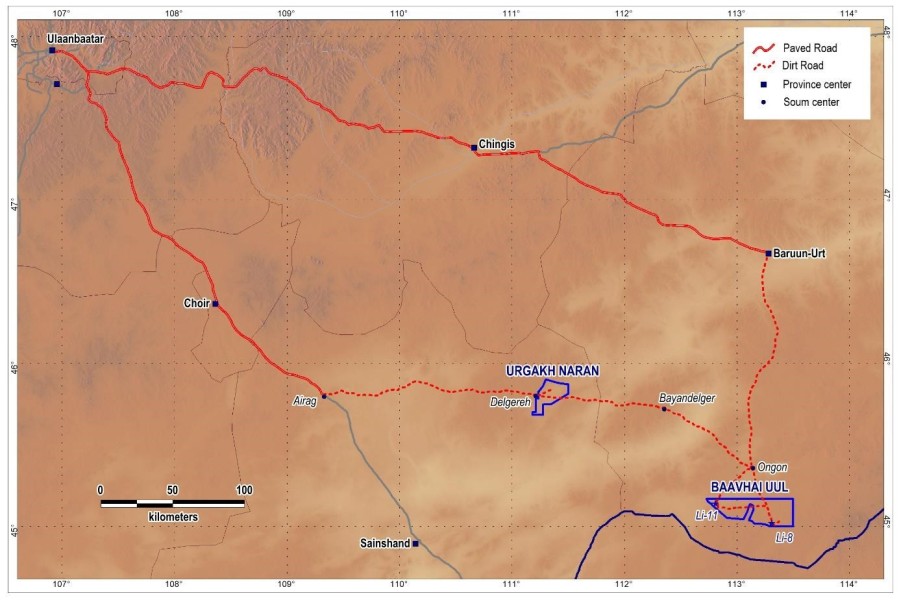

- TEM Geophysics; and

- Hydrogeological Sampling

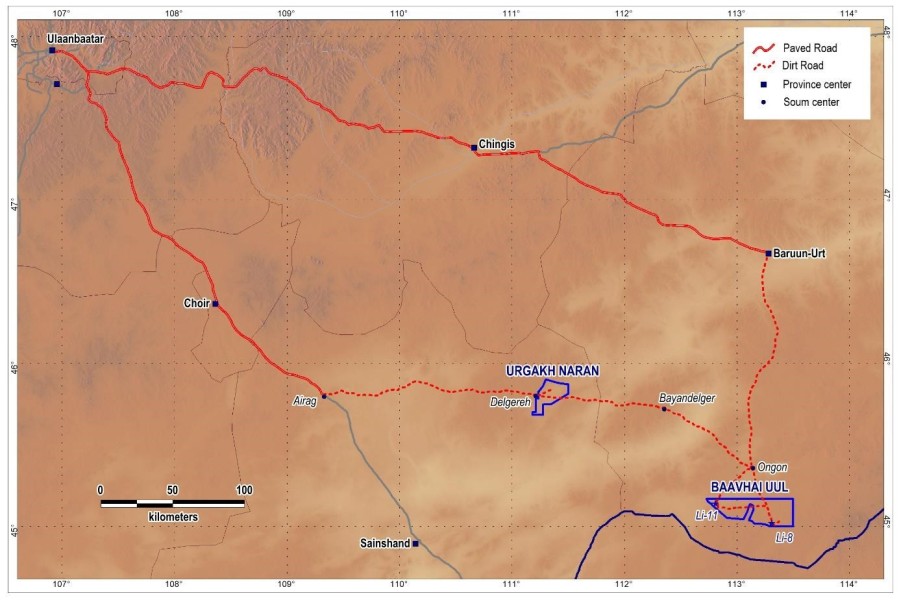

Figure 1. Baavhai Uul and Urgakh Naran Projects' Site Visit.

Figure 1. Baavhai Uul and Urgakh Naran Projects' Site Visit.

Figure 2. Urgakh Naran 2022 Exploration Plans: Already Commenced

Figure 2. Urgakh Naran 2022 Exploration Plans: Already Commenced

"Live from Mongolia": 15 minute Shareholder Summit - April 25th:

Save the Date, and Join Us on April 25th at 8:30 am EST.

ION Energy's CEO will provide a quick update following the site visits, and you'll have an opportunity to ask him questions about our next key milestones. Register HERE.

About ION Energy Ltd.

ION Energy Ltd. (TSXV: ION) (OTCQB: IONGF) (FSE: 5YB) is committed to exploring and developing Mongolia's lithium salars. ION's flagship, 81,000+ hectare Baavhai Uul lithium brine project, represents the largest and first lithium brine exploration licence award in Mongolia. ION also holds the 29,000+ hectare Urgakh Naran highly prospective Lithium Brine licence in Dorngovi Province in Mongolia. ION is well-poised to be a key player in the clean energy revolution, positioned well to service the world's increased demand for lithium. Information about the Company is available on its website, www.ionenergy.ca, or under its profile on SEDAR at www.sedar.com.

For further information:

COMPANY CONTACT: Ali Haji, ali@ionenergy.ca, 647-871-4571

MEDIA CONTACT: Siloni Waraich, siloni@ionenergy.ca, 416-432-4920

Cautionary Note Regarding Forward-Looking Information

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Information set forth in this news release contains forward-looking statements. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, statements, potential mineralization, exploration and development results, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Important factors that could cause actual results to differ materially from ION Energy's expectations include, among others, uncertainties relating to availability and costs of financing needed in the future, changes in equity markets, risks related to international operations, the actual results of current exploration activities, delays in the development of projects, conclusions of economic evaluations and changes in project parameters as plans continue to be refined as well as future prices of lithium, and ability to predict or counteract potential impact of COVID-19 coronavirus on factors relevant to the Company's business. There can be no assurance that forward-looking statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

...