Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

MCC completes bidding supervision tasks for Mongolian project www.chinadaily.com.cn

MCC Xibei Engineering &Technology Co, a subsidiary of China Metallurgical Group Corporation, has successfully completed the bidding supervision tasks for a project to renovate shanty towns in Mongolia, according to local media reports.

The company has been entrusted by the Baotou people's government to undertake management tasks of the project, and also to carry out limited supervision and management of the entire project process.

Due to the global COVID-19 outbreak, China and Mongolia had suspended personnel exchanges between the two sides. In July, the governments of China and Mongolia opened a "green channel", which provided a way to allow the continuation of the reconstruction project of Mongolia's shanty towns.

In early September, the company sent three experts and technicians to Mongolia to form a project bidding supervision team. After completing a 21-day medical isolation observation in Ulan Bator, the team conducted fruitful work exchanges with Mongolia.

Due to the impact of the epidemic, Mongolia has not yet opened customs. The project supervision team rushed to Zamyn-Uud to cooperate with Baotou city to "send" and "receive" tenders on both sides of the border between China and Mongolia.

Thanks to the efforts of all parties to coordinate and cooperate, on the morning of Oct 27, the three bidding documents entered Mongolia smoothly, which provided a guarantee for the bid opening of the project to be held as scheduled.

On Oct 28, the bid evaluation committee of the Ministry of Architecture and Urban Construction of Mongolia organized bid opening, bid evaluation, and bidding.

President Battulga vetoes 2021 state budget law and appropriation laws www.montsame.mn

Ulaanbaatar /MONTSAME/. President of Mongolia Battulga Khaltmaa has vetoed 2021 state budget law and appropriation laws. The notifying letter was submitted to Speaker of Parliament and Chairman of the State Great Khural of Mongolia G.Zandanshatar, yesterday, November 24.

The State Budget Bill for the fiscal year of 2021 was adopted at the State Great Khural’s plenary session of November 13th along with its appropriation bills, and was submitted to the President on November 18th, 2020.

The final readings of the State Budget Bill for 2021 coincided with the days, when Mongolia recorded its first domestic transmissions of COVID-19, which has been turning the people’s lives upside down and bringing with itself greater risks for the country’s economy.

However, the approved State Budget for 2021 is unfit for the current circumstances, given that the bill does not eliminate prodigal spending by setting strict criteria for cash flow and investment expenditure, and does not reflect realistic and versatile analysis of the national and global economic conditions, the President views.

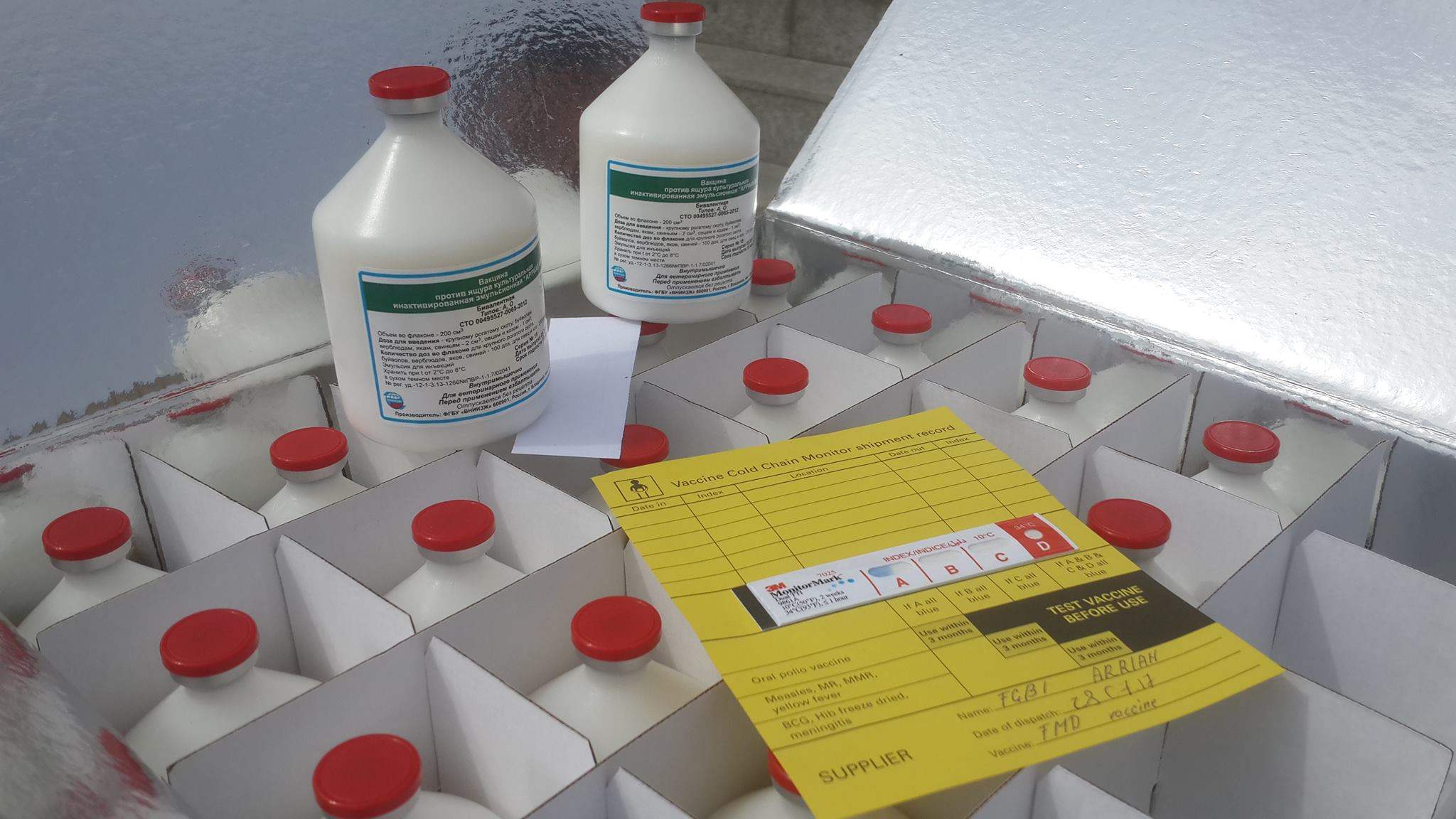

For instance, the crucial issue of procurement of vaccines has been overlooked by the Members of Parliament, who are clearly aware of the fact that this is a matter of protecting the people’s lives and wellbeing. The procurement of vaccines has not been reflected in the State Budget Bill, with vague hope for foreign assistance, says the President.

Hence, President of Mongolia Khaltmaagiin Battulga deems necessary that the following changes to be included in the 2021 State Budget Law:

- To cut total budget expenditure by 20 percent, and set up an emergency fund designed for overcoming problems and challenges;

- To develop a program on providing 1.0 million MNT assistance per household, consisting of 200,000 MNT as cash and 800,000 MNT as vouchers for food items produced by only national companies;

- To spend a certain amount of money saved from budget cuts for procurement of COVID-19 vaccines and protect the population’s health; and

- To develop a master plan to support enterprises, companies and businesses, and to carry out policy to pay particular attention on small and medium sized enterprises and self-employed individuals with irregular income, such as hairdressers, carpenters, taxi drivers, etc.

Considering that a necessity has arisen to accomplish these objectives, President of Mongolia Khaltmaagiin Battulga has imposed a veto on the entire 2021 State Budget Bill and appropriation bills, in compliance with the Article 33.1.1 of the Constitution of Mongolia and Article 12.8 of the Law on President of Mongolia.

The Office of President of Mongolia

COVID-19: 13 new cases confirmed www.montsame.mn

Ulaanbaatar /MONTSAME/ Laboratories nationwide conducted the coronavirus tests on 4176 people yesterday, November 25, resulting in the detection of 13 positive cases.

Of the newly confirmed COVID-19 cases, three new cases have been recorded in Ulaanbaatar, two --in Darkhan-Uul aimag and four -- in Selenge aimag and four -- in Orkhon aimag. No new infection has been recorded in Dornogobi and Gobisumber aimags in the last 24 hours.

As of today, the number of confirmed COVID-19 cases in Mongolia has reached 712, of which 275 are local infection cases; 63 in Ulaanbaatar, 148 in Selenge, 22 in Darkhan-Uul, 21 in Orkhon, 18 in Dornogobi and 3 in Gobisumber.

So far, 345 patients have already recovered and 360 people are being treated at the NCCD and the Military Central Hospital.

Analysis: Questions over AstraZeneca's COVID-19 vaccine data risk delaying approval www.reuters.com

LONDON (Reuters) - Days after grabbing headlines with its COVID-19 “vaccine for the world”, AstraZeneca is facing tricky questions about its success rate that some experts say could hinder its chances of getting speedy U.S. and EU regulatory approval.

Several scientists have raised doubts about the robustness of results showing the shot was 90% effective in a sub-group of trial participants who, by error initially, received a half dose followed by a full dose.

“All we have to go on is a limited data release,” said Peter Openshaw, a professor of experimental medicine at Imperial College London. “We have to wait for the full data and to see how the regulators view the results,” he said, adding that U.S. and European regulators “might possibly take a different view” from each other.

British drugmaker AstraZeneca said on Monday that its experimental vaccine, developed with Oxford University, prevented on average 70% of COVID-19 cases in late-stage trials in Britain and Brazil.

While the success rate was 90% in the sub-group of volunteers, the efficacy was 62% if the full dose was given twice, as it was for most participants.

That is well above the 50% efficacy required by U.S. regulators. Europe’s drug regulator has said it will not set a minimum level of efficacy for potential vaccines.

At the heart of concerns, however, is that the trial’s most promising result of 90% comes from a sub-group analysis - a technique many scientists say can produce spurious readings.

“Sub-group analyses in randomised controlled trials are always fraught with difficulties,” said Paul Hunter, a professor of medicine at Britain’s University of East Anglia.

He said, in particular, such analyses increase the risk of “type 1 errors” - in other words, where an intervention is considered to be effective when it is not.

“In order to have faith in the results,” Hunter said, any sub-group analysis “should be sufficiently powered” with large numbers of volunteers to take readings from.

Only 2,741 volunteers were in the sub-group that gave the 90% efficacy read-out, a fraction of the tens of thousands in trials that resulted in the above 90% efficacy data released earlier this month for Pfizer-BioNTech’s and Moderna’s vaccines.

‘DEVIL IN THE DETAIL’

ADVERTISEMENT

AstraZeneca said the administering of the half dose was reviewed and approved by independent data safety monitors and the UK regulator, adding that the regulator publicly confirmed there was “no concern”.

“We are in discussions with regulators around the world to evaluate these findings and we look forward to the publication of the peer-reviewed results, which has now been submitted to the journal,” a spokesperson added.

Oxford University did not respond immediately to a request for comment.

The U.S. regulator, the Food and Drug Administration (FDA), has not commented on AstraZeneca’s vaccine trial results. The European Medicines Agency said on Thursday it would “assess data on the efficacy and safety of the vaccine in the coming weeks once they have been received from the company”.

The regulatory process has nonetheless been clouded, according to experts, who note crucial gaps in the data AstraZeneca has made public so far.

“The devil is in the detail,” said Danny Altmann, a professor of immunology at Imperial College London. “We’re trying to assess really quite complex trial designs on the basis of little press releases.”

Beyond headline efficacy rates, AstraZeneca’s data release gave little for scientists to work on. It did not say how many infections occurred in the sub-group, for example, or in the group that got two full doses, or in the placebo group.

“A lot of questions are left unanswered,” said Morgane Bomsel, an expert at the French National Centre of Scientific Research, adding: “We are under the impression they (AstraZeneca) are selectively picking out the data.”

Moncef Slaoui, chief scientific adviser for the U.S. government’s vaccine programme Operation Warp Speed, also highlighted gaps.

He said no-one in the subgroup that got the initial half dose was older than 55 - suggesting the regimen’s efficacy in crucial older age groups is unproven in this interim data.

In the group that received a correct full dose followed by a full dose, he noted, older people were included.

Such concerns, and the possible consequences for the speed of regulatory approval, helped AstraZeneca shares hit their lowest level since April on Thursday, having fallen 7% since the company released the data on Monday.

By contrast, Moderna has rallied 22% since releasing its vaccine trial data on Nov. 16 and Pfizer and BioNTech are up 6% and 14% respectively since announcing their successful data on Nov. 9.

“There are a number of variables that we need to understand, and what has been the role of each one of them in achieving the difference in efficacy,” Slaoui told a briefing on Tuesday.

“It is still possible that the difference (in efficacy) is a random difference,” he added. “It’s unlikely, but it’s still possible.”

Reporting by Kate Kelland in London; Additional reporting by Matthias Blamont in Paris, Ludwig Burger in Frankfurt, and Francesco Guarascio in Brussels; Editing by Josephine Mason and Pravin Char

Russia-China trade turnover to exceed $100 BILLION despite pandemic www.rt.com

Bilateral trade between China and Russia has “undoubtedly” been affected by the Covid pandemic but is expected to surpass $100 billion by the end of the year, according to the China Overseas Development Association (CODA).

Its secretary general, He Zhenwei, told RIA Novosti that "although the epidemic is currently affecting cooperation, trade between the two countries will show significant growth, particularly in the second half of the year.”

Domestic demand in China is continuously increasing and Russia is boosting exports to the country, he said. He also noted that Russia produces environmentally friendly non-GMO products.

Trade between the two countries has been growing, and in 2019 Moscow and Beijing said they had eliminated all barriers that could impede their fast-developing cooperation. The two sides also announced the ambitious goal of doubling the volume of trade to $200 billion by 2024.

China’s new ambassador to Russia, Zhang Hanhui, said that Beijing considers Moscow a trusted partner and is opening its markets more and more to Russian goods. The diplomat added that while Beijing was embroiled in an escalating trade war with Washington and was cutting imports from the US, especially agricultural products, it needed new suppliers, and sees Russia as a good replacement.

“We will choose a new supplier. And Russia is the most reliable one,” said Zhang.

Turquoise Hill says Odey’s letter contains false assumptions www.mining.com

Turquoise Hill said on Thursday hedge fund Odey Asset Management’s letter to its majority owner Rio Tinto contained a number of false assumptions and misinformation about the company and its funding plan.

“Odey has a clear financial motive to depress Turquoise Hill’s share price,” Turquoise Hill said.

Shares of Turquoise Hill sank on Wednesday after the hedge fund said it did not believe the $4.4 billion project finance package related to the Oyu Tolgoi copper mine in Mongolia is accurately described as “project” finance.

Turquoise Hill, a subsidiary of Rio Tinto, owns two-thirds of the Oyu Tolgoi giant copper mine with the rest owned by the Mongolian government. The mine is Rio’s biggest copper growth project, but it has faced geological challenges and legal setbacks.

Odey said Rio Tinto was allowing a false market for Turquoise Hill’s shares with a rights issue from the Canadian company on the horizon. The hedge fund owns shares in Rio Tinto and has a short position in Turquoise Hill.

In a letter to Rio Tinto’s finance chief Jakob Stausholm, the fund said Turquoise Hill would require an $8.9 billion rights issue after delays and budget overruns at Oyu Tolgoi.

“Indeed, Odey has sought to ask questions on both Rio Tinto’s and Turquoise Hill’s public earnings calls, but Odey has not been given the opportunity on these calls to propose any such questions, limiting the opportunity for greater public scrutiny of the Oyu Tolgoi investment case,” the investment firm said.

In July, Rio Tinto said it cut estimated reserves at its underground copper mine extension of Oyu Tolgoi and confirmed it would face delays and higher costs after ground instability forced it to redesign the mine plan.

Turquoise Hill said Thursday that an additional $1.1 billion would need to be sourced with further bank debt, bonds or a metal stream should it and Rio re-profile existing debt and raise an additional $500 million of debt as contemplated.

The company said it would need to raise additional equity of at least $3 billion if neither the re-profiling nor additional debt or hybrid financing is completed.

Midday Thursday, Turquoise Hill’s stock was down 9.8% on the NYSE. The company has a $1.94 billion market capitalization.

(With files from Reuters)

China to donate medical supplies worth CNY 4 million to Mongolia www.montsame.mn

The 16th meeting of Mongolia-China Intergovernmental Commission for Trade, Economic, Scientific and Technical Cooperation was held online on November 23. The meeting was co-chaired by Deputy Prime Minister of Mongolia Ya.Sodbaatar and Chinese Minister of Commerce Zhong Shan and attended by delegates from corresponding ministries and authorities of the two countries.

During the meeting, Chinese side informed the decision of Hubei prefecture and Inner Mongolia Autonomous Region of China to donate medical equipment and items worth CNY 4 million to Mongolia to help fight the COVID-19 pandemic.

Furthermore, the sides concurred to enrich Intergovernmental Cooperation Plan to forward Mongolia’s Steppe Road plan and China’s Belt and Road initiative with new content and implement it as well as to renew mid-term program for Mongolia-China trade and economic cooperation.

While expressing commitment to actively cooperate for achieving a goal to bring bilateral trade turnover to USD 10 billion, the sides voiced to closely collaborate for ensuring normal bilateral trade and economic cooperation as much as possible amid the pandemic situation and to continue measures such as “Green Gateway”, Mongolia-China temporary regulation on border crossing ports further.

In the frameworks of deepening railroad cooperation with a view to support trade and transit transportation between the two countries, the delegates also exchanged views on matters including defining railway border crossing point at the Gashuunsukhait-Gantsmod border crossing port, renewing Mongolia and China Border Railway Agreement and opening of Khangi-Mandal railway border checkpoint

US coal miners call on Trump to move on www.mining.com

Support from coal miners helped Donald Trump win the US presidency four years ago. Now, the leader of the nation’s top mining union is calling on Trump to “move on”, adding that ongoing efforts to challenge vote counts and pressure state elections officials are a “threat to our entire form of government and the American way of life.”

While the US General Services Administration — the federal agency that allows the transition process to begin — said late on Monday President-elect Joe Biden’s team could get in touch to begin changeover, Trump continues to hold on to power.

Trump tweeted on Tuesday he would soon present evidence of widespread ballot fraud and other wrongdoing in “great detail” in a “big lawsuit”.

The president of the United Mine Workers of America International (UMW or UMWA), Cecil E. Roberts, said Trump’s relentless denial of Biden’s victory is putting the US on a path to subvert “the very foundation of what actually does make America great — government of, by and for the people.”

“The cockamamie notion that there was some plot launched in a failed state in South America that somehow affected the count of millions of voters is just absurd,” Roberts said in a statement issued Friday.

“Whether you like the outcome or not, the American people have spoken, and their will must now be placed ahead of everything else.”

The union, which represents around 80,000 mine workers, did not endorse a presidential candidate this year.

Digging coal, but down

Trump’s campaign vowed to “give back” coal miners their lost jobs, but that promise was never fulfilled. During the July-September period, the coal sector recorded a new low in average employment with just 40,458 posts, according to data from S&P Global Market Intelligence.

“Despite a slight increase in coal production in the third quarter compared to the previous one, average coal mining employment fell 23.6% from the first quarter of 2017, when Trump took office, to the most recent quarter,” S&P Global reported.

While Trump stocked his administration with coal-industry executives and lobbyists, took hefty donations from the industry and rolled back environmental regulations, coal’s decline only accelerated in recent years.

Production of the commodity was down 31.5% in the third quarter of the year compared to the first quarter of 2017, when Trump took office.

Total production in 2020 is expected to decline to 511 million tonnes, down from 775 million tonnes in 2017. That 34% fall is the largest four-year production drop since at least 1932, data from the US Energy Information Administration (EIA) shows.

Exacerbated by the effects of disruptions related to the spread of covid-19 , the industry downturn has translated into 5,300 coal mining jobs, or nearly 10%, being eliminated during Trump’s administration.

Boeing’s troubled 737 MAX could soon return to European skies after deadly crashes www.rt.com

European Union Aviation Safety Agency (EASA) published a proposed airworthiness directive on Tuesday that could see Boeing’s 737 MAX aircraft cleared within weeks after a 20-month grounding over two deadly crashes.

The publication of the directive opens a 28-day public consultation period after which the agency will review the input and then approve the aircraft for flight. According to the agency, the step signals “its intention to approve the aircraft to return to Europe’s skies within a matter of weeks.”

The move by EASA follows last week’s flight clearance for the 737 MAX in the US by the Federal Aviation Administration (FAA). FAA chief Stephen Dickson said that he was “100 percent comfortable with [his] family flying on it.”

EASA’s Executive Director Patrick Ky said in a statement on Tuesday: “EASA made clear from the outset that we would conduct our own objective and independent assessment of the 737 MAX, working closely with the FAA and Boeing, to make sure that there can be no repeat of these tragic accidents, which touched the lives of so many people.

“I am confident that we have left no stone unturned in our assessment of the aircraft with its changed design approach,” he added.

According to EASA, the “fundamental problem” of the 737’s new software function program, which was intended to make the aircraft easier to handle, was that many pilots did not even know it was there.

Regulators grounded the troubled Boeing aircraft worldwide in March 2019, after two almost-new 737 MAX planes crashed within five months of one another. The crashes, which occurred in Indonesia and Ethiopia, killed all 346 people on board. They prompted a lengthy safety review that was met by numerous delays, driving up losses and costs for Boeing.

In both crashes, the new flight control software caused the aircraft to unexpectedly nosedive shortly after takeoff.

Mongolian tech company prepares to hit the big time www.mongoliaweekly.org

A Mongolian tech start-up is preparing to expand through a pioneering new method of attracting investors.

erxes is a software company that merges multiple tools into one application. (image via erxes)erxes is a software company that merges multiple tools into one application. (image via erxes)

erxes is a software company that merges multiple tools into one application. (image via erxes)

Erxes (stylized as erxes, all lower case) is a software company that merges marketing, sales and customer service tools into one application. It was founded by three Mongolian entrepreneurs in 2017; Mend-Orshikh Amartaivan (MJ), Bat-Amar Battulga and Naran Batjargal, who are now the company’s chief executive officer, chief technical officer and chief operating officer respectively.

The trio aim to take market share from companies that offer marketing and management software individually, such as Mailchimp (email marketing) and ConvertFlow (website conversion). According to its website, erxes says its single application, which costs $29 per month for five people, could save small marketing teams thousands of dollars every year.

“We have 18 staff in three offices,” MJ said to Mongolia Weekly. “Due to these challenging times, we're operating from the Mongolia office, as all core members are Mongolian nationals. We have a few remote staff working from the US and France.

"In 2021, we're planning to set up our US office.”

The idea started after the founders had worked in tech for a while but couldn’t find software that could wrap different services into one application.

“We couldn't find a complete solution that addressed our needs,” MJ said. “That's when we decided to create a customizable customer engagement platform. The main goal was to meet the unique needs and requirements of each startup or company at a reasonable price.”

In the three years since it started, the company’s software has been picked up by KFC, Xerox, Toyota, Volkswagen, Toto, Pizza Hut and others.

In order to fund more growth, erxes has chosen to undertake what’s known as a Continuous Agreement for Future Equity (CAFE), which is based on the continuous securities offering (CSO) approach. It allows investors to make cash investments in a company at any single time to get company equity at a later date.

This means erxes will put 9 percent of their equity on the market, allow the market to say what it thinks the company is worth, and raise money when that valuation goes up.

According to Fairmont, this approach avoids some of the barriers associated with traditional public offerings, such as issuing a fixed number of shares and negotiating their price with investors.

Another key difference is that erxes won’t be listed on any public stock exchange. Instead, it will simply have an ‘Invest Now’ button on its website.

The CSO model doesn’t necessarily mean the company won’t hold a traditional IPO sometime in the future, although Amartaivan said that the approach isn’t on the cards for now.

“We're still open to any opportunity that might arise in the future,” he said. “But we're not expecting to launch a traditional IPO anytime soon, as it does not align with our current focus.”

Over the next two years, Amartaivan says the company is focused on setting up shop in the US to improve their customer experience.

“We're planning to set up our US team in the upcoming year. This will allow us to provide faster and smoother customer service,” he said. “It's kind of a no-brainer considering more than 40 percent of our existing 1 million downloads and the majority of our SaaS customers are from the US.”

Even though erxes is now hitting the big time, it remains keenly focused on its Mongolian roots and the role it plays in diversifying the Mongolian economy beyond mining. Amartaivan told Mongolia Weekly that he’s optimistic about the tech industry in Mongolia.

“People are getting hired as remote engineers for foreign tech companies,” he said. “Some are setting up offices in Mongolia as a gateway to other Asian markets. So, I think this is proof that there is a bigger potential in Mongolia.

“One of our goals is to bring forth Mongolian engineers on the global tech stage. Once we pass this benchmark, hopefully, it will set the path and make it easier for other Mongolian startups to follow.”

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- »