Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

Apple launches MacBook laptops powered by its own computing chips www.reuters.com

SAN FRANCISCO (Reuters) - Apple Inc AAPL.O on Tuesday introduced a MacBook Air notebook and other machines with its first central processor designed in-house for Macs, a move that will tie its computers and iPhones closer together technologically.

The new chip, called the M1, marks a shift away from Intel Corp INTC.O technology that has driven the electronic brains of Mac computers for nearly 15 years.

It is a boon for Apple computers, which are overshadowed by the company’s iPhone but still rack up tens of billions of dollars in sales per year. Apple hopes developers now will create families of apps that work on both its computers and phones.

The MacBook Air will start at $999 (£754), the same as its predecessor, and have up to twice the battery life, Apple said. The M1 will also power the MacBook Pro notebook, which starts at $1299, and its $699 Mac Mini computer, which comes without a monitor.

The new products will be available from next week, executives said.

Shares of Apple were up about 0.2% as the event ended.

Patrick Moorhead, founder of Moor Insights & Strategy, estimated Apple will save between $150 and $200 per chip in costs by using its own central processors. “We didn’t see Apple add any expensive features,” he said. “They’re going with a much higher margin.”

In June, Apple said it would begin outfitting Macs with its own chips, building on its decade-long history of designing processors for its iPhones, iPads and Apple Watches.

Apple executives said on Tuesday that the M1 was intended to be efficient as well as fast, to improve battery life, and that Apple’s newest version of its operating system was tuned to the processor.

“This announcement underscores how important high-performance, custom processor designs will be to leading the next generation of client computing,” said Jon Carvill, vice president of Nuvia, a data center chip firm founded by former Apple executives. “We think a similar trend is playing out in the future of the data center as well.”

Apple executives made numerous performance claims against prior generations of Macs and Windows-based laptops, virtually all of which are based on Intel chips, though Apple did not directly name Intel.

“We believe Intel-powered PCs — like those based on 11th Gen Intel Core mobile processors — provide global customers the best experience in the areas they value most, as well as the most open platform for developers, both today and into the future,” Intel said in a statement.

Apple's phone chips draw on computing architecture technology from UK-based Arm Ltd, manufactured by outside partners such as Taiwan Semiconductor Manufacturing Corp 2330.TW.

Microsoft Corp MSFT.O and Qualcomm Corp QCOM.O have been working together for four years to bring Arm-based Windows laptops to market, with major manufacturers such as Lenovo Group Ltd 0992.HK, Asustek Computer 2357.TW and Samsung Electronics Co Ltd 005930.KS offering machines.

But for both Microsoft and Apple, the true test will be software developers. Apple is hoping that the massive group of iPhone developers will embrace the new Macs, which will share a common 64-bit Arm computing architecture with the iPhone and be able to use similar apps.

Apple software chief Craig Federighi said Adobe Inc ADBE.O would bring its Photoshop software to the new M1-based Macs early next year.

“The app ecosystem and the battery life are probably the two things people will gravitate to,” said Ben Bajarin, principal analyst for consumer market intelligence at Creative Strategies.

Apple has seen a boom in Mac sales due to the coronavirus pandemic, notching record fiscal fourth quarter Mac sales of $9 billion earlier this month - all of them Intel-based. In June, Chief Executive Tim Cook said Apple would continue to support those devices for “years to come” but did not specify an end-of-life date.

Reporting by Stephen Nellis in San Francisco and Peter Henderson in Oakland; Editing by Aurora Ellis and Rosalba O’Brien

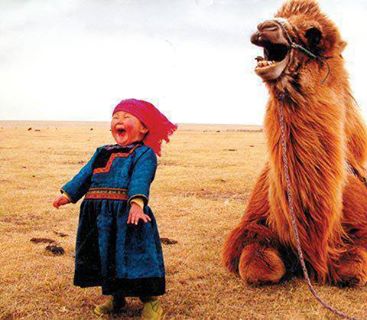

When and “ordinary Mongolian herdsman" defied a torn ACL to fight for Olympic glory www.olympic.org

The people of Mongolia had been waiting a long time for a gold medal-winning hero and, in judoka Tuvshinbayar Naidan, they found a man worthy of every accolade. Four years after “healing his nation” by securing a first-ever Olympic crown, Naidan simply refused to be beaten by serious injury.

Nothing and nobody were going to stop judoka Tuvshinbayar Naidan from taking to the tatami at London 2012 for his second successive half-heavyweight men’s Olympic final.

Four men had tried and failed to stand in his way. And then, driven by desperate concern for his long-term well-being, those nearest and dearest to him pleaded with the Mongolian to take the silver in the -100kg event and forfeit the gold-medal match.

ALMOST ALL THE COACHING STAFF AND MY FAMILY MEMBERS WERE AGAINST ME TAKING PART IN THE FINAL. THEY WERE TAKING CARE OF MY HEALTH.

Tuvshinbayar Naidan

But the man himself was having none of it. Even if he did have a torn anterior cruciate ligament (ACL) in his left knee.

At this point it is worth considering the journey Naidan had already been on. Born to a family of nomadic herders on the Great Steppe in central Mongolia, Naidan grew up wrestling and was 18 when he tried judo for the first time, after seeing the Asian Championships on television. He was instantly hooked. Within five years, he was not only competing at International Judo Federation World Cup events; he was climbing onto the podiums.

A year later, he arrived at the Olympic Games Beijing 2008 as a fresh-faced, compact, 1.78m-tall judoka full of belief if not experience. First, he faced Athens 2004 heavyweight gold medallist Keiji Suzuki from Japan, most people’s favourite to win the half-heavyweight title in China. A big opponent but no big problem for Naidan, who registered an ippon just one minute and 26 seconds into the bout. In fact, he waltzed through to the final barely touched.

Once there, he faced Kazakhstan’s Askhat Zhitkeyev, and the weight of history. Mongolia joined the Olympic family in 1964 and, in their 10 Summer Games appearances prior to Beijing 2008, the nation’s athletes had claimed 15 medals but no golds. The opportunity was too good for Naidan to miss.

“It was my great honour and privilege, as the son of an ordinary herdsman, to [claim] the first Olympic [gold] medal for my motherland, a country with a population of three million,” Naidan said. “The whole nation celebrated proudly the first Olympic gold medal on 14 August 2008. The sport-loving Mongolian people had expected it for 44 years since our first [Summer Games] appearance at the Tokyo 1964 Olympic Games, and I am extremely happy I could fulfil the golden dreams of the Mongolian people.”

In the delirious aftermath of Naidan’s heroics, the international media made much of the fact that Mongolia’s historic first gold had “healed a nation”. It was, according to Naidan, true.

“Political riots and demonstrations had been disturbing the situation in the Mongolian capital city [Ulaanbaatar] since the parliamentary elections on 1 July 2008. A curfew had even been imposed due to the instability,” explained Naidan, whose barrier-breaking gold medal was followed 10 days later by another, this time for Mongolian bantamweight boxer Enkhbatyn Badar-Uugan.

“But brilliant success and an Olympic gold medal healed the nation and brought true peace, joy and satisfaction, and swept away the black shadow of political turmoil.”

While Mongolia bathed in his success, Naidan had to overcome a serious right-knee injury aggravated by his efforts in Beijing. After surgery, he fought his way slowly back to health. In July 2010, he finally won his first World Cup gold, taking the title in Ulaanbaatar. Two more World Cup wins followed in 2011, and he arrived in London in 2012 with one thought: to defend his longed-for Olympic crown.

But, this time, the stars did not quite align. The right-knee injury had forced Naidan to put more pressure than felt natural on his left leg, using it as a main offensive weapon. Agonisingly, it gave way in his semi-final versus the Republic of Korea’s Hwang Hee-Tae. Even eight years later, Naidan is not overplaying the severity of the injury when he labels it a “terrible moment”.

GETTY IMAGES

The then 28-year-old was heard screaming in pain by those inside London’s ExCel Centre. He had to be carried from the field of play by his coach. The agony was so intense that Naidan reportedly failed to even recognise his father. No one who witnessed any of this was in any doubt: the defending champion would not be back for the final later that day. It was impossible for anyone to conceive. Anyone but the defending champion, of course.

“I took the decision after careful discussion with the President of the Mongolian Judo Federation,” Naidan explained. “I fully understood that I had to overcome only five minutes of the hardest match [possible] to reach the top of the Olympics again and I could forget my injury, whatever it was.

“So, I went to the final bout to fight without any hesitation.”

LONDON 2012

There he stood, a man on one leg, facing Russia’s 2011 world champion Tagir Khaibulaev.

“I stood up firmly to win,” Naidan said. “I felt that Tagir was very nervous. My tactic was to be calm and mysterious, with a strong fighting spirit.”

He was all that and much, much more. For two minutes, he defied all convention, but ultimately Khaibulaev had too much and eventually took the Mongolian warrior down by ippon. Naidan’s reign as Olympic champion was over, but not only had he won a worldwide legion of astonished admirers; he had also become the first Mongolian to win two Olympic medals.

Naidan went on to appear at Rio 2016 and became a world championship bronze medallist in 2017 in the +100kg category. Now 36, he has served as an advisor to Mongolian President Khaltmaagiin Battulga since 2017, is the newly elected President of the Mongolia National Olympic Committee and is seeking a fourth Olympic appearance in Tokyo next year. Do not miss it if he qualifies; it is guaranteed to be box-office.

Green Climate Fund invests $23.1 million towards building the climate resilience of Mongolian herder communities www.reliefweb.int

Songdo, 10 November 2020 – At the 27th meeting of its Board, the Green Climate Fund (GCF) today approved a new US$23.1million grant towards strengthening the climate resilience of herder communities in Mongolia. Approximately 26,000 households (130,000 people), living across four of the country’s most remote and vulnerable Western and Eastern aimags (provinces) are set to benefit, with a further 160,000 households (800,000 people) to benefit indirectly – around one quarter of Mongolia’s national population.

The project brings together climate-informed natural resources management and sustainable livestock practices, building on traditional cooperative approaches among herders while also introducing innovative technologies for traceability of sustainably sourced livestock products.

It will enhance the generation and use of climate prognosis data in decision-making; rehabilitate degraded land and catchment areas; improve herders’ water and grazing land management practices; and strengthen herders’ access to markets for sustainably sourced livestock products. Crucially, it will also support the policy transformations needed to promote sustainable livestock and pasture management practices.

Mongolia is subject to a range of natural disasters, including harsh winters, drought, snow and dust storms. Climate change is multiplying the challenges: over the last decade, the magnitude and frequency of such disasters have increased several fold, with estimated economic costs around $10-15 million annually. The disasters take a heavy toll on livestock and rural livelihoods.

Increased temperatures, coupled with decreased precipitation, have resulted in a drying trend affecting pastures and water sources, and shifting natural zones – in turn impacting the natural resources on which herders and livestock rely.

COVID-19 has further exposed the vulnerability of the livestock sector to shocks, with the fluctuations in demand compounding existing challenges, and reinforcing the importance of green recovery and resilient growth.

“The impacts of climate change are a major concern in Mongolia, contributing to land degradation and desertification,” said Minister for Environment and Tourism, H.E. Ms. Sarangerel Davaajantsan. “With the grant from the Green Climate Fund complementing $56.2 million from the Government, this project will contribute to a paradigm shift towards more climate-resilient sustainable development, particularly with focus on disaster risk reduction.”

“It will reap multiple benefits, including supporting vulnerable herder families’ livelihoods by offering more options but also improved access to markets in which they can sell their products – a significant socio-economic benefit. At the same time, it will also bring considerable long-term environmental benefits, including more resilient rehabilitated land and river basin areas, and improved conservation of water resources while strengthening disaster management and development planning to build forward Mongolia better.”

Developed over several years with the support from the United Nations Development Programme and in close consultation with the Government of Mongolia, communities, development partners and academia, the new 7-year project will be led by the Ministry of Environment and Tourism, with the Ministry of Food, Agriculture and Light Industry as a key partner.

Among its key focuses will be to:

Work with the National Agency Meteorology and the Environmental Monitoring, and National Emergency Management Agency, towards climate risk-informed planning

Work with herder communities to enhance cooperation on the sustainable use and stewardship of shared land and water resources

Support the rehabilitation of degraded areas, including 2,500 hectares of catchment reforestation

Improve water access through protection of natural springs, construction of new water wells, rehabilitation of existing wells and water harvesting measures

Identify public-private-community partnerships for sustainably sourced, climate-resilient livestock products;

And work with the Ministry of Food, Agriculture and Light Industry to improve traceability for sustainably sourced, climate-resilient livestock products.

The project will also place a strong emphasis on the voices of female herders and female-headed households in decision-making, ensuring equal representation in training and community activities, and access and control over resources.

“As a trusted partner of the Government of Mongolia, UNDP is pleased to co-implement this transformative cross-sectoral project which comes at a critical time – a time in which the challenges of realizing SDGs have doubled due to the adverse impacts of COVID-19, especially, for marginalised and rural communities.” said Resident Representative for UNDP Mongolia, Elaine Conkievich.

“Taken together, the interventions will help to reduce volatility – and thus loss from climate shocks – help diversify households’ incomes, reduce pressure on rangelands resources, and promote responsible and fair usage of the limited resources.”

The project’s design links closely with Mongolia’s National Action Program on Climate Change, Vision 2050, and policies related to the livestock sector, as well as its Nationally Determined Contributions under the global Paris Agreement.

Implementation is expected to begin mid-2021. For more information, please visit the project page https://www.adaptation-undp.org/.../improving-adaptive......

***

About the United Nations Development Programme

UNDP is the leading United Nations organization fighting to end the injustice of poverty, inequality, and climate change. Working with our broad network of experts and partners in 170 countries, we help nations to build integrated, lasting solutions for people and planet. www.undp.org

About the Green Climate Fund

The Green Climate Fund (GCF), the world’s largest fund dedicated to climate finance, supports developing countries to reduce their carbon emissions and strengthen their resilience to climate change. Set up by the United Nations Framework Convention on Climate Change (UNFCCC) in 2010, GCF is an operating entity of the UNFCCC’s Financial Mechanism that also serves the Paris Agreement. GCF drives climate finance to where it is needed most: in the Least Developed Countries, Small Island Developing States, and African States.

IFC provides loan for Mongolian company to help micro, rural entrepreneurs amid pandemic www.xinhuanet.com

The International Finance Corporation (IFC), a member of the World Bank Group, has provided a local-currency loan equivalent of around 12 million U.S. dollars to a Mongolian company, the World Bank's country office in Mongolia said Tuesday.

The move is part of IFC's strategic efforts to boost resilience in Mongolia's financial sector amid COVID-19. About 15,000 micro, rural and women entrepreneurs in the next three years are set to benefit from the loan in the Mongolian tugrik for Transcapital, a leading non-bank financial institution in Mongolia.

The financing package includes a three-year loan of about 8.4 billion Mongolian tugriks (about 3 million U.S. dollars) from the IFC's own account and a syndicated loan of about 25.2 billion Mongolian tugriks (about 9 million dollars) from Impact Investment funds, including Invest in Visions, the Microfinance Initiative for Asia by BlueOrchard Finance, ACTIAM, and Developing World Markets, according to the World Bank.

"Micro, small and medium-sized enterprises (SMEs) are the backbone of the Mongolian economy, providing over 50 percent of all jobs. They are also the ones hardest hit by COVID-19," said Zorigt Altanzul, CEO of Transcapital.

"IFC's innovative financing will allow us to expand our support to Mongolian micro and small enterprises while contributing to the nation's effort to rebound from (the) COVID-19 effect," Altanzul said.

In Mongolia, about 90 percent of SMEs do not have regular access to bank lending, with the financing gap estimated at 1.29 billion dollars, the bank said.

"This innovative investment will address some of the challenges faced by Mongolian businesses, especially micro and women-owned enterprises in rural and semi-urban areas," said Rufat Alimardanov, IFC's resident representative for Mongolia.

"This marks the first time IFC has invested in a non-banking financial institution in Mongolia and it's also our first local currency syndication in Mongolia. The financing signals our strong commitment to helping Mongolian enterprises in the recovery and rebuilding process in the wake of COVID-19," Alimardanov said. Enditem

Six new COVID-19 cases detected in Mongolia, total reaches 374 www.montsame.mn

Ulaanbaatar /MONTSAME/. The Ministry of Health has reported through its official social media page that 6 new COVID-19 cases detected in Mongolia.

Thus, Mongolia now has 374 confirmed COVID-19 cases, with 317 recoveries. Currently, 54 people are undergoing treatment at the National Center for Communicable Diseases, of which 44 are in mild, 9 are in serious and 1 is in critical health condition.

Citizens are recommended to avoid crowded places, follow precautionary regimes and wear masks as the risk level is still high.

Pfizer, BioNTech initial vaccine results impress, but scientists remain cautious www.reuters.com

The drugmakers said their vaccine was more than 90 percent effective at preventing COVID-19, based on data from the first 94 people in the trial to become infected with the coronavirus.

The efficacy rate means that the overwhelming majority of infections occurred among people who received a placebo rather than the vaccine.

The 44,000-volunteer study was initially designed for a first interim analysis of whether the vaccine was working after 32 participants developed COVID-19.

Dr. William Gruber, Pfizer’s senior vice president of vaccine clinical research and development, said in an interview the companies changed the study plan after discussions with U.S. regulators and ultimately ended up with data on 94 people.

“It gives you more power and more confidence,” said John Moore, a professor of microbiology and immunology at Weill Cornell Medical College in New York. “When you triple the numbers and you get a large difference between them, it’s much more likely to be real.”

ADVERTISEMENT

Others cautioned that many questions remain, including whether the vaccine can prevent severe disease or complications, how long it will protect against infection and how well it will work in the elderly.

They noted that required safety data will not be available until later this month. In addition, Pfizer and BioNTech have yet to submit their data for peer review by other scientists, a key step in determining the quality of the results.

‘REALLY ENCOURAGING’ BUT EARLY

“These are really encouraging but they are the earliest of results possible,” said Dr Gregory Poland, a virologist and vaccine researcher with the Mayo Clinic in Rochester, Minnesota.

The full study is designed to show the vaccine is effective after 164 people fall ill. Pfizer said that may happen in the first or second week of December, when a panel of outside advisors to the Food and Drug Administration reviews the study results and decides whether to recommend authorizing its use.

Gruber said he did not yet have a breakdown of how many of the first 94 infections occurred among Black or Latino participants, two communities hit hard by the disease. He also did he know exactly how many elderly people in the trial got sick. Older people with weakened immune systems are particularly vulnerable to severe COVID-19

So far, none of the 94 people in the initial analysis developed severe COVID-19. The FDA initially had requested that the interim data include at least five severe cases, but recently relaxed that requirement, Gruber said.

“If a vaccine is to reduce severe disease and death, and thus enable the population at large to return to their normal day-to-day lives, it will need to be effective in older and elderly members of our society,” said Eleanor Riley, professor of immunology and infectious disease at Edinburgh University.

Gruber expects there will be some cases of severe disease before the trial ends.

“Bottom line is we’re going to have to use the data we have and the high efficacy to give us confidence that we’re going to prevent severe infection,” he said.

Scientists also want to understand whether the Pfizer vaccine fully prevents people from getting infected with the new coronavirus - a huge advantage in reducing transmission - or if it simply reduces the degree to which they become ill.

“Ideally, we want to be able to completely protect from infection, but I think we all accept that these so-called first generation vaccines are more likely to prevent disease,” said Lawrence Young, a professor of molecular oncology at Britain’s University of Warwick. “And the subtlety there, which is important, is if you’re infected then you can still transmit the virus.”

Pfizer intends to seek a broad approval for individuals aged 16 to 85, but the FDA and an advisory group to the U.S. Centers for Disease Control and Prevention would make decisions about who should be first in line to get the initial doses, which will be scarce.

If Pfizer wins emergency use authorization, Gruber said the company feels ethically bound to inform eligible trial participants who received a placebo that they are not protected against infection, and to offer them the vaccine in hopes of keeping them from dropping out of the trial.

Reporting by Julie Steenhuysen in Chicago and Kate Kelland in London; additional reporting by Michael Erman in New York; Editing by Bill Berkrot

China’s Australian copper ban seen hurting smelters in TC/RCs talks www.reuters.com

An unofficial Chinese ban on Australian copper concentrate imports could hurt Chinese smelters in their negotiations with miners on benchmark treatment charges for 2021, traders and analysts said.

Australian media reported that Chinese importers have been informally warned by Chinese customs officials that a range of Australian goods, including copper concentrate, will be targeted for increased inspections from November 6 amid a diplomatic row between the two countries.

The orders had already forced traders to divert some small shipments bound for China, two traders told Reuters on Friday.

While Australia is not a big supplier of copper concentrate to China, the row comes as supplies from South America have been disrupted by the coronavirus epidemic which looks set to erode the bargaining power of smelters in China to buy for next year.

“On the face of it, the market tightens for the Chinese, so ultimately they will have to push their prices on the offer a bit lower to get that security of supply,” said analyst Daniel Hynes of ANZ in Sydney.

Miners pay treatment and refining charges (TC/RCs) to smelters to process concentrate into refined metal. When supply is scarce, refiners have to charge less to attract what they need.

Chinese smelters and global miners meet every November to negotiate the annual benchmark for the following year’s TC/RCs.

“The timing couldn’t have been worse. The one area that is not struggling with covid-19 impacts to logistics is Australia, and that’s the place they have banned. The South Americans will use this as leverage,” said a copper concentrate trader based in Australia. Chile and Peru are China’s biggest suppliers.

Spot TCs plumbed an eight-year low of $50.50 a tonne this week, a 30% drop from the 2020 high hit in March and well below the annual benchmark of $62 a tonne, Asian Metals data showed.

“The ban may drive the spot market lower for China. For the 2021 benchmark, a slide is fair but I think it will actually settle near $60 a tonne and 6 cents per pound,” said a Singapore-based trader.

A second Australia-based trader forecast the benchmark in the mid $50s a tonne.

Diversion

In the short term, traders are scrambling to redirect Australian shipments.

“If you had a ship full of copper concentrate floating offshore, you’re rapidly trying to find a home,” a second Australia-based trader said.

Traders said Australian shipments meant for China could divert to Japan, Korea, India, or to blending facilities in Taiwan or Malaysia.

Australian producers of lead and zinc concentrates and precious metals are also making back-up plans in case the ban broadens, two traders said.

“We have no idea how long (this will last). It’s subject to the relationship between governments,” added a trader with a Chinese smelter.

The ban is expected to have only a limited impact on the Chinese concentrate market’s supply-demand balance, as Australia accounts for just less than 5% of China’s concentrate imports.

Australia’s two biggest copper producers, BHP Group and trading house Glencore, are also unlikely to be affected. BHP does not export copper concentrate and Glencore can divert material to its two smelters, each in Australia and the Philippines, they said.

Glencore and BHP declined to comment.

(By Melanie Burton, Mai Nguyen and Tom Daly; Editing by Richard Pullin)

Total COVID-19 cases reach 368 www.montsame.mn

Ulaanbaatar/MONTSAME/. At today’s press briefing of the Ministry of Health D.Nyamkhuu, Director of the National Center for Communicable Diseases (NCCD), reported that twelve positive cases were detected in Mongolia after a total of 1816 tests were carried out between November 6 and 8.

In detail, five people, who arrived on a charter flight from Seoul on October 19, and one person, who arrived from India on October 20, were diagnosed with the coronavirus after their repeated testing.

In addition, a Russian freight truck driver, who entered the country through the Altanbulag border checkpoint on November 7, was tested positive. Upon his request, the freight truck driver was returned to the home country after consulting with Russian relevant officials.

Moreover, two freight truck drivers /56-year old Belorusian and 52-year old Mongolian/, who entered the country through the Altanbulag border checkpoint on November 8, were confirmed having been infected with the coronavirus.

Three freight truck drivers- all Mongolians, who entered through the Altanbulag border checkpoint on October 17 and 18, were also diagnosed with the coronavirus after their repeated testing.

Five health workers, who worked together with the infected nurse, have been tested negative.

As of today, the total case of COVID-19 in Mongolia has reached 368, with 317 recoveries. Three patients made recoveries and are moving to the next stage isolation. There are 49 patients undergoing treatment at the NCCD, of whom 41 are in mild and 7 are in moderate condition.

China-funded children's hospital begins operation in Mongolia www.english.www.gov.cn

A China-funded children's hospital equipped with 50 beds and advanced medical equipment opened in the Bayanzurkh district of Mongolia's capital Ulan Bator on Nov 9.

Mongolian Health Minister Togtmol Munkhsaikhan and Chinese Ambassador to Mongolia Chai Wenrui attended a ceremony to mark the opening of the hospital.

"This is the fifth children's hospital built in Ulan Bator with the support of the China Foundation for Peace and Development. I am confident that the hospital will make a significant contribution to improving the quality of healthcare for children," Chai said at the ceremony, adding that the Chinese government and the Chinese embassy in Mongolia will continue to always support this kind of work.

Improving hospital care for children is one of the most pressing issues in Mongolia, especially in Ulan Batar which is home to nearly half of the country's child population.

As well as children in the Bayanzurkh district, those from Mongolia's eastern provinces can also receive medical care and services at the new hospital, Munkhsaikhan said, expressing his sincere gratitude to the Chinese side.

China's Hubei sends trucks for Mongolia-donated sheep www.xinhuanet.com

WUHAN, Nov. 9 (Xinhua) -- Central China's Hubei Province on Monday sent the first batch of 10 container trucks to pick up Mongolia-donated sheep in north China's Inner Mongolia Autonomous Region.

The first batch of 4,000 sheep, donated by Mongolia in support of China's COVID-19 epidemic fight, arrived in the China-Mongolia border city of Erenhot on Oct. 22.

The trucks, each loaded with a 40-foot refrigerated container that can contain 1,200 slaughtered sheep, were sent by Wuhan Asia-Europe Logistics and are scheduled to arrive in Erenhot Wednesday.

For epidemic control, all trucks and containers had been disinfected a week before departure, and all the drivers, as well as relevant trip riders, had gone through nucleic acid tests.

Mongolian President Khaltmaa Battulga in February visited China at the critical stage of China's COVID-19 epidemic prevention and control and promised to offer 30,000 sheep as a token of support.

According to a bilateral agreement, the sheep will be transported in batches to Erenhot before mid-November, where they will be slaughtered and processed before being sent to Hubei. Enditem

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- 1715

- 1716

- »