Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

Toyota to invest $500m in Uber in driverless car deal www.bbc.com

Japanese carmaker Toyota is to invest $500m (£387m) in Uber and expand a partnership to jointly develop self-driving cars.

The firm said this would involve the "mass-production" of autonomous vehicles that would be deployed on Uber's ride sharing network.

It is being viewed as a way for both firms to catch up with rivals in the competitive driverless car market.

The deal also values Uber at some $72bn, despite its mounting losses.

That is up 15% since its last investment in May but matches a previous valuation in February.

According to a press release issued by the firms, self-driving technology from each company will be integrated into purpose-built Toyota vehicles.

Uber halts self-driving tests after death

Uber settles with Waymo on self-driving

The fleet will be based on Toyota's Sienna Minivan model with pilot trials beginning in 2021.

Shigeki Tomoyama, executive vice president of Toyota Motor Corporation, said: "This agreement and investment marks an important milestone in our transformation to a mobility company as we help provide a path for safe and secure expansion of mobility services like ride-sharing."

Both Toyota and Uber are seen as lagging behind in developing self-driving cars, as firms such as Waymo, owned by Alphabet, steam ahead.

Uber has also scaled back its self-driving trials after a fatal crash in Tempe, Arizona, in March, when a self-driving Uber SUV killed a pedestrian.

Since then, the ride-hailing giant has removed its autonomous cars from the road and closed its Arizona operations.

Uber's troubled self-driving car efforts are in need of external help, and this deal with Toyota might provide that expertise. It's of course a terrific opportunity for Toyota, too.

It was reported earlier this month that Uber was sinking around $1m-$2m into its autonomy work every single day. The results of that effort have not been something to be proud of - one fatal crash, one very expensive lawsuit, and not a lot of self-driving compared to the leader in this sector, Waymo.

Sharing the burden, and R&D cost, will delight Uber's investors as it aims for its initial public offering next year.

Meanwhile, shares in Toyota spiked at reports of the deal. Not surprising. Many analysts think personal car ownership will drop dramatically when the self-driving, ride-sharing future is fully upon us - with major companies instead purchasing enormous fleets of vehicles. Toyota, then, may have just secured its biggest ever customer.

The deal extends an existing relationship with Toyota, and furthers Uber's strategy of developing autonomous driving technology through partnerships.

The US firm has also teamed up with Daimler, which hopes to own and operate its own self-driving cars on Uber's network.

On Monday, Uber said it planned to focus more on its electric scooter and bike business in future, and less on cars - despite the fact it could hurt profits.

Revenue from its taxi business is rising but the cost of expansion into new areas such as bike sharing and food delivery has meant losses have grown rapidly.

...

Sultan of Malaysian state of Johor visits Mongolia www.akipress.com

The Sultan of Malaysian state of Johor Mr Sultan Ibrahim Almarhum Sultan Iskandar will visit Mongolia.

It is the Johor Sultan’s first official visit to Mongolia, which will not only enhance relations between Johor and Mongolia, but also explore investment opportunities for both sides, Bernama news agency reported.

Sultan Ibrahim’s visit to Mongolia is at the invitation of the President of Mongolia, Khaltmaa Battulga, which was conveyed to the sultan by Mongolian Ambassador to Singapore, George Lkhagvadorj Tumur, in June this year.

TRAM studies released: Exporters highlight difficulties in employing skilled staff www.zgm.mn

Report on the unified research of European Union funded project Trade Related Assistance for Mongolia (TRAM) was disclosed last week. According to Toby Philpott, Senior Private Sector Consultant and a key expert of TRAM, 60.8 percent of surveyees consisted of Mongolian private sector representatives considered the People’s Republic of China (PRC) as the best export market for Mongolia, followed up with European Union (34.2 percent). The project, which was launched on March 7, 2018, aims at strengthening the capacity to further develop appropriate export development strategies and translate this into actual implementation through inter-ministerial coordination and enhanced engagement with private sector organisations. A total of 132 respondents from the private sector participated in the study, of which 25 percent were from wool and cashmere industry, 9 percent - meat, 7 percent - tourism, 8 percent - leather, 7 percent - textiles and 9 percent from unidentified sectors. The research considered the general export markets, regulations, times spent on activities, exporters’ knowledge, skills and resources. Furthermore, 82 percent of the surveyees were exporters and the remaining consisted of entities interested in and/ or capable of exporting; however, the officials highlighted that the study could not identify the barriers to potential exporters. In terms of favorable export markets.

• 60.8 percent considered the PRC as the best export market; •

• 34.2 percent - European Union;

• 30 percent - Japan;

• 28.3 percent - Russian Federation and Eurasian Economic Union;

• 21.7 percent - Republic of Korea;

• 16.7 percent - North America.

The survey participants also considered that the freight forwarders fall short of consistency to a single country and suggested to provide such services. As for the export regulations and legal impact, 70.2 percent of the respondents answered the time spend on export documentations take faster than the forecast of World Bank’s Doing Business report. In terms of exporters’ knowledge, skills and resources, the majority (81 percent) highlighted the difficulty of employing skilled staff as they prefer higher salaries and larger entities. The same results were shown in the capacity to conduct cooperation agreement with foreign consumers, agencies and intermediaries. 82 percent of the surveyees have difficulties in concluding a contract with foreigners. As one of the main beneficiaries of TRAM, the Mongolian National Chamber of Commerce and Industry pointed out that the report is yet to be made public and several suggestions on regulations and services will be prepared soon.

Mongolian and EU representatives discuss sustainable production www.gogo.mn

The Ministry of Nature, Environment and Tourism, in collaboration with the SWITCH-Asia Sustainable Consumption and Production Facility program of the European Union, held a consultative meeting on Sustainable Consumption and Production.

The meeting's participants highlighted that there is a tendency to squander natural resources in Mongolia. According to a 2017 report published by the United Nations Economic and Social Commission for Asia and the Pacific, Mongolia spends approximately 15 kilograms of natural resources for every 1 USD of goods produced.

Director of the ministry's Green Policy and Strategic Planning Department T. Bulgan said, “These figures illustrate Mongolia’s outdated technology development and extravagant spending. We spend five times as much as the average in the region, and 20 times as much as some developed nations.”

Personal accident insurance compensation up by 25.3 percent www.gogo.mn

Due to an increasing number of natural disasters and accidents, personal accident insurance compensation saw an increase of 25.3 percent, reaching 15.8 billion MNT in the first seven months of 2018.

Additionally, demands for personal accident and property insurance have been increasing. As of July 2018, premiums for insurance companies hit 164 trillion MNT.

Wool processing experience of Pakistan studied www.montsame.mn

Ulaanbaatar /MONTSAME/ A theoretical and practical training themed ‘Opportunities for introducing improved experience in procurement and production of sheep wool and wool products to Mongolia’ was held at the Ministry of Food, Agriculture and Light Industry within the framework of ‘Support to employment creation in Mongolia’ project of the United Nations Industrial Development Organization (UNIDO).

At the training, participants were introduced experiences of International marketing consultant Grant Winning, Australian herder Roven McDonald and former FAO Representative in Mongolia and Pakistan, international expert Kevin Gallagher. Mr. Grant, experienced in raising income through marketing sales of producers in the Asia-Pacific, accompanied the project team in Erdenet, Darkhan and Ulaanbaatar cities. They met with representatives of the domestic producers and identified some pressing issues regarding demand, requirements for raw materials and value-added network. Moreover, the project team met with the herders’ cooperative in Dundgobi aimag and evaluated activities of raw material processing and procurement.

During the training, Mr.Grant Winning shared his experience of increasing the cost of sheep wool in Balochistan province of Pakistan from USD 5 million up to USD 19.3 million by improving the skills and technologies of wool producers. Pakistan has similar climatic conditions and territory with Mongolia and practices pastoralism as well.

International experts emphasized that the important step in producing valuable wool is to keep the cattle in good condition, improve the quality of the wool, washing and wool shearing technologies and classified wool processing. In Pakistan, there are three main requirements for herders, including the sheared wool must be the same length, wool from top, back and belly must be separated and washed thoroughly. In order to meet the requirements Australian practice of washing the sheep before shearing and machine shearing was introduced to Pakistan. As a result, the wool yield from one sheep increased from 70 percent up to 90 percent and improved in quality.

B.Misheel

Turkish educator Akçay in Mongolia applies to UN for urgent action against imminent abduction risk www.stockholmcf.org

Turkish educator Veysel Akçay, the general director of schools affiliated with the Gülen movement in Mongolia, who was abducted by the agents of Turkey’s notorious National Intelligence Organisation (MİT) on July 27, 2018, in front of his house in Ulan Bator, has called on the United Nations High Commissioner for Refugees (UNCHR) for urgent action against imminent abduction risk.

Writing a letter to UNCHR, Akçay’s lawyers requested on August 24, 2018, an urgent action to prevent his imminent illegal deportation to Turkey. The lawyers stated that the decisive actions by the UNHCR and the government of Mongolia on July 27, 2018, enabled timely release and prevented illegal transfer to Turkey of Mr. Veysel Akçay.

“We are, however, deeply concerned that initial encouraging steps by the government of Mongolia have been subsequently followed by actions, which have clearly exposed Mr. Akçay to the imminent risk of illegal transfer to Turkey. Namely, during this past week, Mr. Akçay was twice prevented from leaving Mongolia for safer third countries,” read the letter.

The lawyers added in their letter that “In addition, the authorities have also allegedly closed the investigation against the perpetrators of Mr. Akçay’s abduction on July 27, 2018. These actions are, inter alia, contrary to Mr. Akçay’s right to leave the country, including his country of residence, a right firmly embodied in the Universal Declaration of Human Rights (UDHR) and the relevant United Nations human rights treaties, voluntarily accepted and into force in the Republic of Mongolia.”

They also requested UNCHR to urge the authorities in Mongolia strongly, to ensure that Mr. Veysel Akçay, a victim of abduction under distress and at risk of another imminent abduction in Mongolia, be allowed to travel to a safe third country and until then he and his family are provided protection, necessary to deter any renewed attempt against his right to liberty and security. The lawyers also urged the UNCHR to take immediate action.

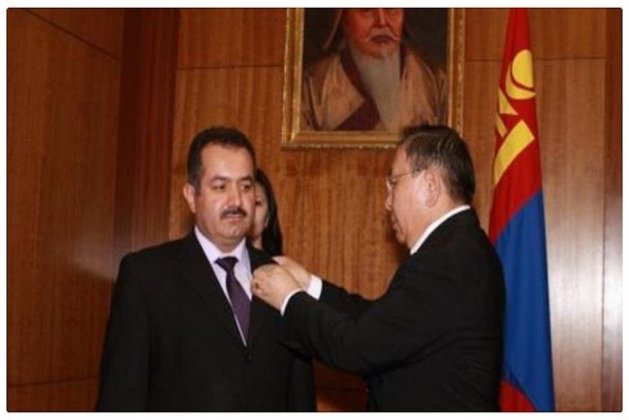

In order to take Akçay to Turkey after his abduction, a private plane was held at Ulan Bator Airport for all day on July 27. Akçay, who has worked at educational institutions in Mongolia for 24 years, is reportedly one of only a few Turkish nationals awarded the Mongolian Friendship Medal bestowed by the Mongolian state.

After reactions from Mongolian public and media, Mongolian authorities did not allow MİT agents to transfer Akçay from Ulan Bator to Turkey. The private plane had to depart the airport without Akçay.

The Mongolian Foreign Ministry had issued a statement on the abduction of Akçay and underlined that such an unacceptable act would be “a violation of Mongolia’s sovereignty and independence” and that Mongolia would strongly object to it.

The Mongolian Foreign Ministry statement had indicated that Deputy Foreign Minister Batmunkh Battsetseg met with a Turkish diplomat over the abduction case.

Akçay is married to Meryem Akçay and they have four children. Akçay works as general manager of the Empathy Worldwide Educational Institution, which has run the Turkish-Mongolia Schools (four high schools, one international school, one-day care center) established by the Gülen movement 25 years ago.

MİT abducted journalist Yusuf İnan and Salih Zeki Yigit in Ukraine, and İsa Özdemir in Azerbaijan early in July. They were transported by MİT agents to İstanbul by private plane. MİT agents had abducted six teachers in Kosovo on March over their alleged links to the Gülen movement. In cooperation with Kosovar intelligence, MİT’s abduction of the teachers sparked widespread debate and drew ire from around the world.

According to a statement made by Turkish Foreign Minister Mevlüt Çavuşoğlu, over 100 alleged members of the Gülen movement have been abducted by MİT agents abroad and brought back to Turkey as part of the Turkish government’s global manhunt.

“We have been watching these traitors for two years and have brought the leading figures of FETÖ to our country. Some of these cases were covered by the press, while others weren’t at the request of the countries involved. I can frankly say that more than 100 FETÖ-affiliated people have been brought to Turkey,” Çavuşoğlu said in an interview with Turkey’s pro-government CNN Türk.

“FETÖ” is a derogatory term coined by ruling Justice and Development Party (AKP) led by Turkish President Recep Tayyip Erdoğan to refer to the Gülen movement.

Turkey survived a controversial military coup attempt on July 15, 2016, that killed 249 people. Immediately after the putsch, the Justice and Development Party (AKP) government along with President Recep Tayyip Erdoğan pinned the blame on the Gülen movement.

Fethullah Gülen, who inspired the movement, strongly denied having any role in the failed coup and called for an international investigation into it, but President Erdoğan — calling the coup attempt “a gift from God” — and the government initiated a widespread purge aimed at cleansing sympathizers of the movement from within state institutions, dehumanizing its popular figures and putting them in custody.

Turkey has suspended or dismissed more than 150,000 judges, teachers, police and civil servants since July 15. On December 13, 2017, the Justice Ministry announced that 169,013 people have been the subject of legal proceedings on coup charges since the failed coup.

Turkish Interior Minister Süleyman Soylu announced on April 18, 2018, that the Turkish government had jailed 77,081 people between July 15, 2016, and April 11, 2018, over alleged links to the Gülen movement.

...

Kincora Announces New High-Grade Targets at Bronze Fox, Mongolia www.investingnews.com

Kincora Copper (TSXV:KCC) has outlined recent extensive exploration activities at its wholly owned Bronze Fox project and planned activities for the remainder of the current field season.

According to the company the focus of these activities are multiple new target zones proposed for drilling at, or on the margin of, the western license relating to the western zone or south-western periphery of the West Kasulu target and Bronze Fox Intrusive Complex, where Kincora previously has had only one field season of unimpeded drilling activities.

As highlighted in the press release:

Drilling to test new infill and extension high-grade targets within western zone of the West Kasulu exploration target and newly identified southerly western zone

Three of the only four holes previously drilled by Kincora in the western zone intersected higher grade zones, with a >1km strike identified, benefiting from significant advancements in exploration activities since limited prior drilling

Exploration target supports one of largest copper-gold systems in Mongolia

IP survey commences to further refine targets to the west and advance pipeline of targets across second intrusive complex

When paper money goes to zero value: Venezuelan hyperinflation explained www.rt.com

Inflation in Venezuela this year could top one million percent, the International Monetary Fund (IMF) predicts. This gallery puts the buying power of today's bolivar into perspective.

A kilogram of meat costs 9,500,000 bolivars, or the equivalent of $1.45.

A 2.4 kg chicken is worth 14,600,000 bolivars, or $2.22.

A 1kg packet of rice costs 2,500,000 bolivars ($0.38)

A kilogram of cheese? Prepare to fork out 7,500,000 bolivars ($1.14)

A toilet roll costs 2,600,000 bolivars ($.040)

Pasta? 2,500,000 bolivars ($0.38)

A kilogram of carrots costs 3,000,000 bolivars ($0.46)

The current price for a kilo of tomatoes now stands at 5,000,000 bolivars, or $0.76.

A kilogram package of corn flour costs 2,500,000 bolivars, or the equivalent of $ 0.38.

A bar of soap reached the price of 3,500,000 bolivars, or $0.53.

Hyperinflation destroys purchasing power of money and encourages hoarding of goods, as people and businesses wait for further price increases. When there is a loss of confidence in a currency's ability to maintain its value, sellers demand a risk premium to accept the currency; they do this by raising their prices.

Russia faced hyperinflation after the collapse of the Soviet Union, while the economic crisis in Zimbabwe made the country ditch its domestic currency in 2009 in favor of the US dollar and other stable currencies.

Commercial banks in Mongolia are to disclose more about the full cost of borrowing to customers www.market-intel.mn

Key event: The Central Bank of Mongolia revised the regulation of transparency of information on banking charges, fees and the methods of calculating interest rates on 23 July 2018. These newly enforced regulations can now be found on the Central Bank’s website.

Implications: As per the regulation, the Mongolian commercial banks are now to include insurance cost, any third-party charges, and other banking fees into the cost of borrowing and fully disclose it to a borrower. In compliance with common practice in the international banking, Mongolian banks will present all interest rates to customers on an annual basis as opposed to a monthly basis.

Outlook: These new regulations are aimed at helping protect consumers from potential debt burden and become aware of true the cost of borrowing going forward. However, as the impact of these regulations is limited to commercial banks only, it may create additional compliance and marketing related costs for the banks and create a less competitive environment for them compared to the other financial institutions such as non-banking financial institutions and credit unions that are not subject to these regulations.

The Central Bank of Mongolia ordered commercial banks to fully disclose any cost(s) related to obtaining loans under MNT 100 million to customers. Previously, commercial banks stated only monthly and annual interest rates and excluded other costs such as origination fees and insurance fees from financing cost in a loan agreement. The misleading nature of this practice was criticized by customers as they were unable to discern the true cost of financing. As a result, bank regulators are now taking measures to cease the practice.

However, costs pertaining to non-banking related activities and financial discipline of a borrower are excluded from the cost of borrowing, regulations state. For instance, state registration fees, notary fees, and penalty fees caused by the borrower’s default on loan repayments are not considered in the financing cost.

According to the Financial Stability Report by the Central Bank of Mongolia published in June 2018, in Q1 2018 nominal spending of Mongolia’s average household increased by 13.3% year over year (YOY) and the debt amount per household increased by 20.9% YOY to MNT 8.0 million. Further, the report revealed that, in terms of annualized household income and debt amounts, the debt burden of the average Mongolian household reached 63.1% for the period.

This signaled an alarm to regulators and as a result, the Central Bank issued another regulation on maintaining household debt-income ratios in order to prevent households from defaulting on their bank loans. The regulation will be effective from next year.

As of now, there are 14 banks with 1525 branch offices in Mongolia providing banking services, in aggregate terms, to 927,000 borrowers and 9.1 million customers (Financial Stability Report, 2018).

In addition, there are 539 non-banking financial institutions (“NBFIs”) in Mongolia providing financial services to around 150,000 customers and their total outstanding loan amount reached MNT 768.3 billion in Q2 2018. As it is not uncommon that customers who are not qualified for bank loans go to NBFIs, the cost of borrowing from NBFIs is higher than banks and those institutions look to remain exempt from the new regulations.

Therefore, even though the banking sector is accountable for 95% of the financial sector of Mongolia, these regulations may lead to additional compliance and marketing related costs to the banks and create a less competitive environment for them in terms of profitability compared to the other financial institutions such as non-banking financial institutions and credit unions.

DISCLAIMER

This information has been produced by MarketIntel and is solely for general information purposes only. This information is provided on an "as is" basis. Recipients of this information assume the entire risk of any use made of this information (the “Report”). The report is not intended to be a complete description of the markets or developments to which it refers and MarketIntel hereby expressly disclaims all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of this report. Without limiting any of the foregoing, in no event shall MarketIntel have any liability for any damages of any kind. Any unauthorized use, duplication, redistribution or disclosure of this report, including, but not limited to, redistribution of the report by electronic mail, posting of the report on a website or page, and/or providing to a third party a link to the report, is strictly prohibited. The information contained in the report is intended solely for the recipient and may not be further distributed by the recipient to any third party. Without prior written permission from MarketIntel, this report and any other MarketIntel intellectual property may not be reproduced, redisseminated for any commercial purpose.

...- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- »