Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

AI: Which jobs are most at risk from the technology? www.bbc.com

As the man widely seen as the godfather of artificial intelligence (AI) warns about growing dangers from how it is developing, businesses are scrambling to see how they can use the technology to their advantage.

Geoffrey Hinton, 75, who used to work for Google has warned that AI chatbots could soon be more intelligent than humans.

Many businesses bosses are telling me that the hot topic presented at board meetings is how to deploy ChatGPT style technology across their businesses as quickly as possible.

A few weeks ago, I watched as the boss of one of Britain's biggest consumer-facing companies looked at his computer, entered the transcript of a customer complaint call, and asked ChatGPT to summarise it and respond to it based on set of rules he made up on the spot.

In about a minute it came up with a very credible answer, with no need for any coding.

The end result was, I'm told, about 85% accurate. That is a bit less than human call centre staff, but it cost a fraction of a percentage point of the cost of deploying staff.

The good news for all, the pure enhancement to productivity, would occur if all the staff were now focused on the 15%, that could not handled by AI. But the scope to go further, and cut back on staff, is clearly there.

AI Large Language Models are, however, getting more powerful. Not yet quite as capable as an intelligent adult, but not far off.

Advances are occurring faster than expected, and could be reaching the point where they become exponential.

The pace of change and adoption means there is scope for an economic and jobs shock to the economy as soon as this year.

The moment it becomes cleverer than the cleverest person, in pretty short order, we could get to "runaway capability" - more advanced than the entirety of humanity, on the way to what has been described by another former Google AI insider Ray Kurzweil as the "singularity". Are we at the start of that exponential moment right about now?

AI has the possibility of taking a bunch of sectors of the economy, which have been immune to productivity improvements up until now, because they were time and knowledge intensive sectors, and transforming them.

Technology has given us lots of improvements in the quality of life. All of our smartphones now have all the content we could want, always instantly available on streaming services.

One top policymaker told me that "a lot of that innovation has made our leisure time more enjoyable. It's not made our working time, more productive. It may have eradicated boredom as a human experience. But has it made you more productive at work?"

The real shock has been that these technologies are usable in a commercial context, not just for "low-cognitive, repetitive" - i.e. robotic - tasks, long thought susceptible to automation.

The surprise has been how deployable these technology is to highly creative, high-value work, which had been assumed to be relatively protected from competition.

The Open AI/ ChatGPT founder Sam Altman has himself expressed his surprise at the use so far. Specifically, the "blank page" or "first draft" stage at the start of the creative process of writing copy, creating an image, or music, or coding a programme can be achieved in seconds rather than weeks of briefing and refining.

Again this is what is possible with AI's not-yet-as-intelligent-as-an-adult human. So the good news is that rapid deployment of this technology, faster than the rest of the world, could solve the UK's longstanding productivity crisis.

The bad news is that it could occur so rapidly as to overtake workers' ability to adapt in time, creating social and economic crises. Could we face in call centres and creative studios in the 2020s, the equivalent of what happened in the coal mines in the 1980s?

Some of the people most reluctant about the size of government in Silicon Valley have started to suggest that states might need to provide a basic income. The response of techno enthusiasts is the mantra: "You wont be replaced by an AI, but you might be replaced by someone who knows how to use AI".

But they used to say that's why everybody should learn how to code. That might not be such sage career advice any more.

Over 359,500 hectares of land destroyed in wildfires in Mongolia this year www.xinhuanet.com

Forty-nine forest and steppe fires have ripped across Mongolia since the beginning of this year, destroying 359,505 hectares of forest and grassland, the country's National Emergency Management Agency (NEMA) said Tuesday.

In addition, 20 homes and a vehicle were burned, and 3,273 heads of livestock were killed in the wildfires, NEMA said in a statement.

The emergency agency said negligence was the leading cause, urging citizens not to make open fires or throw cigarette butts on the ground.

As of Tuesday, firefighters are working to contain two steppe fires in Choibalsan and Bulgan soums (administrative subdivisions) in the eastern province of Dornod, it said.

China pledges closer ties with Mongolia on trade, train links, tackling sandstorms www.scmp.com

China and Mongolia are “good neighbours, good friends and good partners”, Chinese Foreign Minister Qin Gang said, agreeing to deepen ties on issues ranging from the economy, railways and other infrastructure to fighting sandstorms.

Meeting his Mongolian counterpart Batmunkh Battsetseg in Beijing on Monday, Qin said China was ready to synergise development strategies and promote its Belt and Road Initiative with Mongolia.

The pledge comes as China seeks to diversify its trade routes and boost ties with Russia via its landlocked northern neighbour. Ulaanbaatar also plays a pivotal role in a joint 2016 plan to develop the China-Russia-Mongolia economic corridor, a key segment of Beijing’s belt and road strategy.

Qin told Battsetseg that China would further enhance mutual political trust with Mongolia and “pursue mutual support on issues concerning each other’s core interests and major concerns”.

He also highlighted bilateral cooperation on mining and interconnectivity towards building “a China-Mongolia community with a shared future”, according to an official Chinese readout.

Battsetseg expressed support for Beijing on Taiwan, Hong Kong and Xinjiang, saying they related to its “internal affairs”, the Chinese readout said. She also hailed China’s recent series of foreign policy documents, including last year’s Global Security Initiative.

“Mongolia is willing to deepen mutual political trust and expand practical cooperation with China, and make bilateral ties a model for the region,” Battsetseg, who wrapped up a two-day visit to Beijing on Tuesday, was quoted as saying.

The two sides also agreed to strengthen cooperation on the prevention and control of sandstorms.

Sandstorms originating in the Gobi Desert, which straddles northern China and southern Mongolia, are a regular feature in the spring and send pollution levels soaring in the region. But their frequency and intensity have increased in recent years.

As many as 12 sandstorms had already hit China this year, state news agency Xinhua said, and some of them even crossed into Japan and South Korea.

According to the Mongolian foreign ministry, a joint research team would be deployed in Beijing and Ulaanbaatar over May and June to study how to tackle sandstorms caused by worsening desertification in Mongolia and some parts of northern China.

The two foreign ministers also touched upon a list of planned cooperation projects, mostly related to upgrading Mongolia’s outdated rail links, as agreed upon during Mongolian President Ukhnaagiin Khurelsukh’s state visit to China in November.

Sandwiched between China and Russia, landlocked Mongolia depends heavily on energy supplies from Russia and trade with China – its largest investor and trading partner for nearly two decades.

China buys up to 95 per cent of Mongolian exports, mostly coal, copper and other minerals. Bilateral trade volume crossed US$9 billion in 2021, up by more than 35 per cent from the previous year, according to China’s Ministry of Commerce.

Around 90 per cent of freight transport between China and Russia passes through Mongolia, according to the Organisation for Economic Cooperation and Development.

Improved railway systems and other infrastructure in Mongolia – such as under the tri-nation belt and road economic corridor – are also expected to help boost trade links between China and Russia, as Moscow grapples with Western sanctions imposed after its invasion of Ukraine.

According to the Mongolian readout, Battsetseg urged China to help speed up the construction of a railway at the Gashuunsukhait-Gantsmod border checkpoint, which handles over half of Mongolia’s copper and coking coal exports.

She also called on China to renew a 1955 bilateral agreement on border railway crossings – something Beijing has repeatedly pledged to do since Xi’s 2014 state visit to Ulaanbaatar – and help ensure stable exports of mining and agricultural products so that annual bilateral trade could rise to US$20 billion.

Mongolia has also pinned its hopes on China to help tap its potential in the renewable energy sector, such as solar and wind power.

However, neither side mentioned the new China-Mongolia-Russia natural gas pipeline project, dubbed the “Power of Siberia 2”. China and Russia agreed to “promote studies and consultations” on the project during Xi’s visit to Moscow in March.

Both Ulaanbaatar and Moscow have high hopes for the mega project, with Russian officials expecting it to replace the Europe-bound Nord Stream 2, which has been put on hold due to the Ukraine war.

In a delicate balancing act, Mongolia has avoided openly condemning Moscow for its invasion of Ukraine, and sought close economic ties with both giant neighbours China and Russia, while seeking constructive ties under its “third neighbours” foreign policy with countries including the United States, Japan and European Union members.

In an interview with the Post in March, Mongolian Prime Minister Luvsannamsrain Oyun-Erdene, who is planning a visit to China this year, praised bilateral ties but at the same time voiced hopes of diversifying the country’s economy to reduce its dependence on Beijing.

BY:

A former diplomat, Shi Jiangtao has worked as a China reporter at the Post for more than a decade. He's interested in political, social and environmental development in China.

Foreign Minister B. Battsetseg Visits iFLYTEK www.montsame.mn

During her working visit to China, Minister of Foreign Affairs of Mongolia Batmunkhiin Battsetseg visited Beijing branch of the Chinese company iFLYTEK yesterday and got familiarized with the company's AI-based voice, speech recognition and translation software, digital audio language translation equipment, and smart computer software.

iFLYTEK develops a variety of artificial intelligence products and applications in the fields of education, health, urban planning, and manufacturing.

Since 2010, iFLYTEK Open Platform has been developing a one-stop artificial intelligence solution focused on intelligent voice and human-computer interaction.

Minister of Foreign Affairs B. Battsetseg expressed an interest in cooperating with iFLYTEK company saying that it is possible to seek opportunities to fill the shortage of staff in health and educational institutions in rural areas of Mongolia using the company's technology, organize international conferences, meetings, and events simultaneously without the need for interpreters in foreign languages using artificial intelligence-based translation and interpreting equipment, introduce it in some government services for foreign citizens. The Foreign Minister invited iFLYTEK company management to visit Mongolia in the near future for cooperation.

In 2017 and 2019, iFLYTEK was selected as one of the top 50 global technology companies by MIT, ranked first in China and sixth in the world in 2017. In 2016, iFLYTEK translation equipment was introduced to the Chinese market.

Speaker of Hungarian Parliament László Kövér to Visit Mongolia www.montsame.mn

A delegation led by Speaker of the National Assembly of Hungary László Kövér will pay an official visit to Mongolia on May 4-7, at the invitation of Chairman of the State Great Khural of Mongolia Gombojaviin Zandanshatar.

During the visit, Speaker of the Parliament of Mongolia G. Zandanshatar and Speaker of the National Assembly of Hungary László Kövér will hold official talks and exchange views on bilateral relations, inter-parliamentary cooperation, and other issues of mutual interest. Prime Minister of Mongolia L. Oyun-Erdene will pay a courtesy call on Speaker László Kövér.

Mongolia established diplomatic relations with Hungary on April 28, 1950. This visit is the second visit of the Head of the National Assembly of Hungary to Mongolia, and will be of considerable significance for the expansion of relations between the two countries and the development of inter-parliamentary cooperation.

Egg exports to Mongolia increased 1.7-fold www.alekseev.biz

The export volume of edible chicken eggs from Novosibirsk Region to Mongolia has reached 8 million 953.3 thousand eggs since the beginning of the year. This was reported on the regional Rosselkhoznadzor website.

Compared to the same period last year, this figure has increased by 1.7 times. A total of 32 batches of eggs, mostly of the first category, were shipped to the Mongolian recipients in 2023 under the supervision of the Ministry’s specialists.

The agency specified that all of the prepared batches met the requirements of the importing country in terms of product quality and safety.

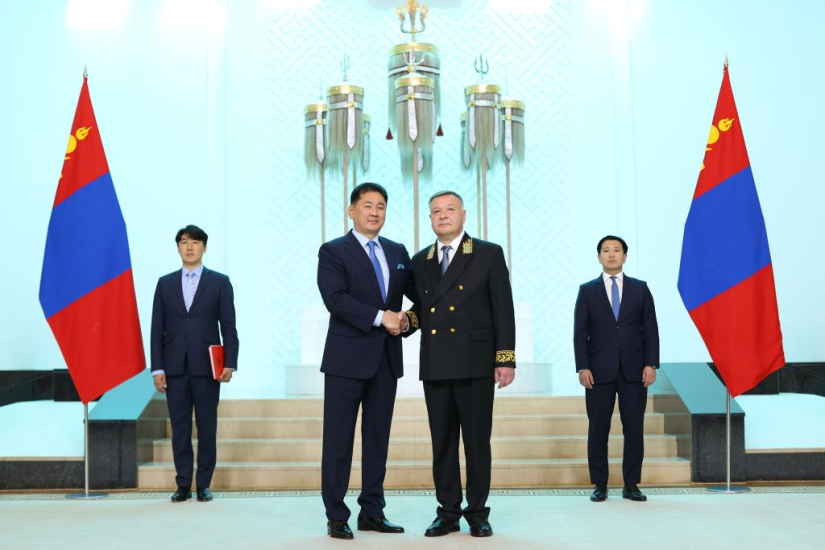

Ambassador of the Russian Federation to Mongolia presents his Letter of Credence www.montsame.mn

Yevsikov Alexei Nikolaevich, Ambassador Extraordinary and Plenipotentiary of the Russian Federation to Mongolia, today has presented his Letter of Credence to President Ukhnaagiin Khurelsukh, who extended his felicitations on the ambassador's appointment and wished him success in his future endeavors. The President noted that the Mongolian government pays great attention to expanding the Friendly Relations and Comprehensive Strategic Partnership and mutually beneficial cooperation with the Russian Federation and expressed Mongolia’s aspiration to strengthen the 100-year-old relations by jointly implementing large programs and projects.

Emphasizing that Mongolia is not only a close neighbor but also an essential partner of the Russian Federation, Ambassador Yevsikov A.N. expressed his commitment to expanding the relations and cooperation between the two countries. He expressed his intention to give emphasis on the project of developing natural gas infrastructure and improving the efficiency of the "Ulaanbaatar-Railway" joint venture.

The parties also exchanged views on relations and cooperation in the fields of trade, investment, energy, border ports’ development, education, culture, environment, and youth exchange.

The centenary commemoration of diplomatic relations between Mongolia and Russia was celebrated throughout 2021. In 2019, President of Mongolia Ukhnaagiin Khurelsukh, who was Prime Minister at the time, paid a working visit to the Russian Federation and secured a guarantee from President V.V. Putin for the project of developing natural gas infrastructure from Russia to China through Mongolian territory.

Additionally, during the President's official visit in 2021, the parties reaffirmed their commitment to strengthen ties and cooperation in areas such as trade, economy, reliable supply of petroleum products, education, and culture, concluding pertinent documents.

During the meeting of the Council of Heads of State of the Shanghai Cooperation Organization (SCO) member states held in Samarkand, Republic of Uzbekistan in 2022, the President of Mongolia, together with Russian President V.V. Putin and Chinese President Xi Jinping, convened a tripartite meeting. At this meeting, the leaders reached an agreement on the implementation of the "China-Mongolia-Russia Economic Corridor. "

Ambassador Extraordinary and Plenipotentiary of the Russian Federation to Mongolia, Yevsikov Alexei Nikolaevich, is a professional diplomat with 39 years of experience in Foreign Affairs.

Employee of UNICEF Mongolia Back Home Safe from Sudan www.montsame.mn

An employee of UNICEF Mongolia S. Moiltmaa, who was working on a temporary assignment in Sudan, landed at "Chinggis Khaan" International Airport this morning.

Her family and the United Nations Resident Coordinator for Mongolia Tapan Mishra, and the UNICEF Representative in Mongolia Evariste Kouassi-Comlan welcomed her on arrival. The UN representatives expressed their happiness that she had returned home safe from the armed conflict region.

The United Nations, the Ministry of Foreign Affairs, and the Ministry of Defense provided her support to transfer from the hot spot of the armed conflict to a safe place.

Three-month long NZ shearing tour provides Mongolian herders with life-changing skills to take back home www.rabobank.co.nz

After three months working in shearing gangs across New Zealand, four Mongolian sheep herders will soon return to their homeland with new knowledge and skills that have the potential to change their lives and reshape the shearing scene in their native country.

The four Mongolians herders - Budee, Baaska, Ama and Khanda – arrived in New Zealand in early January having done all their previous shearing using scissors, a time-consuming practice which limits the number of sheep that can be shorn in a day to about 30. With their trip wrapping up shortly, each of the herders is now shearing competently using an electronic handpiece and all four have achieved shearing personal bests of more than 250 sheep in a day – a feat which has previously only been achieved by one other Mongolian.

The visit to New Zealand was undertaken as part of the Share Mongolia programme – an initiative to introduce modern shearing techniques and equipment into Mongolia that took flight following a chance encounter between Rabobank agribusiness manager Paul Brough and local Mongolian farmers in 2019.

“While I was trekking through Mongolia in 2019, I came across a group of farmers who were shearing a herd of about 900 using scissors and they told me it would take them about a month to complete the job,” Mr Brough said.

“This really blew my mind given how much quicker this can be done with electronic equipment, and I thought to myself, there must be something I can do to help. So once I got back to New Zealand, I had a few discussions with some work colleagues and clients, and we looked into running some training that would help develop Mongolian shearers skills with modern equipment.”

With additional help from Zoe Leetch and Enkhnasan Chuluunbaatar from Golden Bay, and Roy Fraser from Colville – who have previously lived in Mongolia and provided valuable local insights – the Share Mongolia initiative was established in 2020 and an initial idea hatched to run some courses with visiting New Zealand shearers in Mongolia.

“These courses first took place in 2022 and worked out pretty well, and then we figured it might also be of benefit to get some of the Mongolians over this way so they could develop new skills and then take these back home,” Mr Brough said.

“With funding support from the Rabobank Community Fund, we were able to get the four herders over here and tee them up with work, lodgings and shearing gear. And it really has been quite phenomenal to see how quickly their shearing skills have progressed over the last few months.”

While the Mongolians were quick to adapt to their new role as international shearers, Mr Brough said, there were some initial challenges given the language barrier and the significant differences between everyday life in New Zealand and Mongolia.

“They come from a region in Mongolia that is one of the coldest places on earth – dropping to temperatures as low as -60 degrees Celsius in winter – and is more than 1000 kilometres from the nearest coastline,” he said.

“Prior to the tour, none of the group had been on a plane or a boat, used modern appliances like a dishwasher or washing machine and only one had ever been in water above their knees,” he said.

“So the first few days here there was definitely a bit of a culture shock. But with the help of an interpreter as well as from local farmers who gave up their time to show them around and get them familiar with New Zealand woolsheds, they adjusted pretty rapidly.”

During the trip, the Mongolians spent time working as part of shearing gangs in Piopio, Hawkes Bay and Wairoa.

“The modern shearing gear, sheep size and wool quantity on the New Zealand sheep were very new to these guys, but they had great support from their fellow shearers and shed hands which helped them progress,” Mr Brough said.

“At the weekends they entered shearing competitions, including the recent New Zealand championships in Te Kuiti and, towards the last part of the tour, they achieved some really impressive results.

“Another highlight of the trip was their visit to west Otago in early February where they participated in Shear 4 A Cause – an event run to raise money for a host of rural community-focused charities. They also got to experience a number of activities for the first time, including riding the luge in Rotorua and giving surfing a crack at Raglan as part of the weekly Surfing for Farmers programme.”

Mr Brough said he was really amazed at the Mongolians resourcefulness and how incredibly focussed on learning to shear and making money they were.

“While here, they saved every cent they made with two giving up smoking when they found out the price of our cigarettes compared to the price they pay at home. They didn’t once complain and only one has missed a day’s work – due to a sprained ankle,” he said.

“With their families tucked up in their Gers (traditional Mongolian tent) back home in -40-degree temperatures, it was pretty clear at times they were terribly missing them. But they stuck with it, and they’re very excited about the opportunities their new skills will open for them and their loved ones once they are back in Mongolia.”

Mobile shearing trailers

Mr Brough said the four herders were due to depart in the coming days and their prospects on their return would be greatly enhanced by the construction of two mobile shearing trailers which are currently being built for them in Mongolia.

“The Share Mongolia team are currently undertaking a fundraising drive to help buy shearing equipment for these trailers,” he said.

“We’re hoping to raise $8,000 for this equipment, and the plan is to set the four of them up so they can have their own business as travelling shearers.

“Even though the Mongolian shearing season is relatively short, they should be able to work for about 60 days per year making $100 a day – significantly more than their previous best day where they made just $15.

“And, of course, there is potential for the farmers to further share their skills with local farmers so that they too can learn to use modern equipment.”

Mr Brough said the Share Mongolia programme would continue to support Mongolian herders and a number of further activities were planned for the coming months.

“In June of this year, a team of Rabobank clients and staff will travel to Mongolia to hold eight more shearing courses funded by the United Nations, the NZ Embassy (Beijing) and the Rabobank Community Fund,” he said.

“The goal is to train and equip another 120 herders to shear using electric machines. Other goals are to introduce wool sorting and wool presses to improve wool quality and transport. And we’re also planning a trail to test if electric shearing machines can be used to shear camels in the Gobi desert!.”

Rabobank New Zealand is a part of the global Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 40 countries, servicing the needs of about 10 million clients worldwide through a network of close to 1000 offices and branches. Rabobank New Zealand is one of the country's leading agricultural lenders and a significant provider of business and corporate banking and financial services to the New Zealand food and agribusiness sector. The bank has 32 offices throughout New Zealand.

The Korean historical series to be shot in Mongolia www.gogo.mn

Deputy Governor in charge of the Social Sector, Green Development, and Air and Environmental Pollution Z.Tumurtumuu met with the representatives of KBS-Project of the Republic of Korea. The meeting was attended by relevant officials of the capital city and representatives led by KBS-Project General Director in Mongolia Ko Sung-hun.

This year marks the 50th anniversary of KBS, South Korea's leading public television. In this regard, the television is planning to produce a historical series. The film group has arrived in Mongolia to do research because the series will include Kidan, or Khitan of Mongolian origin.

During the meeting, Deputy Governor Z.Tumurtumuu said, "Mongolia and South Korea have a history of mutual support at the international level as well as the friendly relations of the third neighbor.

The relation is successfully developed in the fields of economy, trade and services, culture, art and humanitarianism within the framework of comprehensive partnership. Moreover, since the establishment of sister-city relations between Ulaanbaatar and the cities of the Republic of Korea, the parties have expanded and developed mutual cooperation in all social and economic fields. I am happy to see the development of the world-famous Korean cinematography closely, and the beautiful nature and people of my country are immortalizing themselves in one of its parts.”

KBS-Project General Director in Mongolia Ko Sung-hun said, "We want to shoot some parts of the series in Mongolia, so please help and support us. It will be a pleasure to promote the beautiful nature of Mongolia to Koreans through the film."

At the end of the meeting, the capital city expressed its pleasure to support the film group.

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- »