Events

| Name | organizer | Where |

|---|---|---|

| MBCC “Doing Business with Mongolia seminar and Christmas Receptiom” Dec 10. 2025 London UK | MBCCI | London UK Goodman LLC |

NEWS

Sludge Processing Plant Construction Set to Begin Next Year in Ulaanbaatar www.montsame.mn

Construction of a new facility to process, dry, and incinerate sludge from the Central Wastewater Treatment is scheduled to begin next year, according to the Office of the Mayor of the Capital.

The project is part of the 24 mega initiatives aimed at advancing the development of Ulaanbaatar. A feasibility study has been completed and approved by the Construction Development Center, and preparations are currently underway to announce a construction tender.

The plant will be built through a public-private partnership in the 20th khoroo of Songinokhairkhan District, occupying a 40,000-square-meter site located in front of the Ulaanbaatar city wastewater treatment facility. Designed to meet international standards and environmental regulations, the plant will be capable of processing an average of 250 cubic meters of sludge per day and incinerating up to 238 tonnes per day. Additionally, 843,200 cubic meters of sludge will be recycled annually. Emissions from the incineration process will be treated using a high-tech air purification system to minimize environmental impact.

Officials emphasized the importance of properly processing and disposing of sludge from the Central Treatment Plant to reduce soil, water, and air pollution. The project also aims to promote waste reuse, generate energy, and create new employment opportunities.

Asia holds the world’s hydrogen heart — 500,000 tons a year link two giants in a secret corridor www.ecoticias.com

Asia could be holding the world’s hydrogen heart since an underground corridor is being formed from Inner Mongolia to Beijing that will be used for the transportation of pure green hydrogen, defining the future of sustainable energy. With infrastructure spearheaded by Sinopec, almost 500,000 tons of hydrogen will be carried annually in this secret corridor. China surely is creating a national hydrogen economy, with Asia’s heart beating only for pure hydrogen.

China engaged in creating its very own hydrogen highway

It was back in July this year that China approved its inter-provincial hydrogen pipeline. The 400-kilometer pipeline would run from Ulanqab in Inner Mongolia to Beijing. The pipeline was a concept that had been in Sinopec’s pipeline, but this concept has now turned into reality, offering the prospect of carrying 100,000 tons of green hydrogen yearly in the first phase. The hydrogen being carried through the corridor comes from a 1-gigawatt wind-powered electrolysis plant. In the future, China wishes to transport 500,000 tons of green hydrogen annually.

The 100,000 tons of hydrogen amount is already shocking, as with that amount, over 3 million hydrogen fuel-cell vehicles can be powered. So far, this is the first and perhaps the largest transportation mission of green fuel across an intercontinental Asian corridor. However, this ambitious project will result in one of the largest hydrogen transportation initiatives throughout the entire world. This is also one of the first inland renewable hydrogen projects that China is engaging in, connecting Mongolia to Beijing through a vein filled with green hydrogen potential.

Understanding the core premises behind transporting green hydrogen

With hydrogen being produced using wind energy in Inner Mongolia through electrolysis, the wind energy is being split into hydrogen and oxygen through electricity. This hydrogen gets compressed and is then transported through a highly pressurized pipeline. The transported hydrogen finds its way to the Sinopec Yanshan Refinery in Beijing.

Having a direct pipeline transporting the hydrogen reduces costly carbon-incentive trucking and the need to amalgamate hydrogen with natural gas. At the same time, this initiative seeks to address the problem of wasted wind due to a lack of storage infrastructure. The pipeline serves the corridor that aligns the movement of clean energy from Mongolia to Beijing in somewhat of a cost-effective loop. In creating this corridor, China is working towards its mission of being a national hydrogen economy.

Asia’s hydrogen heart seems to be beating successfully

Thus far, Inner Mongolia serves as the testing grounds for China’s broader hydrogen strategy. In Inner Mongolia, the blueprint has been set out for the hydrogen infrastructure. With this blueprint in hand, the vision is to ensure that the country secures the largest green hydrogen production as well as an export base. By creating a hydrogen base, Northern and Eastern China will be provided with hydrogen so as to scale up sustainable initiatives.

China is ambitious in terms of its blueprint and its futuristic vision; however, China will also face competition from what was said to be the largest hydrogen highway to link America to Europe, ensuring 10 million metric tons and an entirely new color of hydrogen is being transported. The question is, can Asia’s secret corridor compare with the likes of the largest hydrogen highway?

China’s heart continues to beat for clean power and hydrogen

China has always been at the very forefront of discovering energy to power the Earth, so much so that China even found 1,800 tons of clean potential between the mountains. China has now shown its commitment towards national energy goals and is looking to expand on clean hydrogen production.

While China’s secret corridor does hold promise, experts warn that the success of the project is ultimately based on market demand and price competitiveness. Although certain industries will embrace hydrogen readily, clear policy incentives may be required should China wish to up its hydrogen transportation game.

TMK turns up the gas with record Mongolian pilot flows www.thewest.com.au

TMK Energy has notched up a 60 per cent month on month jump in gas output from its flagship Gurvantes XXXV coal seam gas project in Mongolia, setting the stage for a ramp-up in activity as it shifts into full field development planning.

The company says the project’s September gas tally hit nearly 10,000 cubic metres, just shy of a monthly record, with standout flows coming from its most recent well, LF-07, which is producing at strong rates even at low pump speeds. TMK says the strong flow rate is a clear sign the company’s updated drilling and reservoir management techniques are paying off.

Water production across the pilot field also held steady at about 500 barrels per day, a critical metric that indicates good potential for future gas flows as the wells continue to dewater.

Notably, LF-02, which has been long regarded as one of the best gas producers in the program, was shut in for much of September for testing, but still managed to produce about 30 cubic metres of gas per day during that period. This suggests some of the coal seams are already releasing gas under their own pressure, a process known as desorption - a big step forward for the pilot project.

From a production operations perspective, the Pilot Well project has continued to perform in line with expectations and is currently producing gas at near record levels.

TMK Energy chief executive officer Dougal Ferguson

Gurvantes spans 8400 square kilometres in the South Gobi Desert, less than 50 kilometres from China’s Shivee Khuren border crossing and close to important Chinese gas infrastructure.

The area is known for its enormous coal deposits and therefore ideal for coal seam gas production. The gas field contains a 1.2 trillion cubic feet (Tcf) contingent resource and offers further significant upside potential from a 5.3Tcf prospective resource still to be explored.

TMK Energy has now drilled seven operational wells at its Lucky Fox pilot project within the Gurvantes XXXV coal seam gas field and has been steadily turning up the dial on production since Christmas.

With LF-07 now online and flowing strongly, management says every well in the program is performing in sync with its revamped reservoir management plan - a playbook designed to protect the wells and coax the best gas flow from the coal seams.

Through September, the company deliberately kept the pumps running at low speeds to fine-tune its approach, ensuring the seams stay healthy while its newly appointed coal seam gas reservoir engineer analyses how to extract gas more efficiently.

The updated strategy has been designed to focus on drawing out as much water as possible - the key to freeing up gas pressure - while curbing the build-up of troublesome coal dust, or “fines,” that can clog pumps and slow output.

Every barrel of water and cubic metre of gas produced is adding valuable insight. The data is being used to build a predictive model, or “type curve,” showing how a standard production well is likely to behave over time.

The company says that model will then become a cornerstone of TMK’s full-field development plan as the company prepares to scale Gurvantes into a commercial gas project.

In August, Management also announced a strategic alliance with Beijing-based J-Energy to harness the gas specialist’s technical expertise and regional connections to quickly advance the project should commerciality be proven.

Despite some unexpected power outages affecting operations in September, TMK remains upbeat about the direction of the pilot campaign and is now pushing ahead with a broader 2025 exploration program, backed by a recently oversubscribed $3.5 million placement.

To support this next phase of activity, it has also hired a full-time Operations Superintendent who will take up the role in early November.

With near-record gas now flowing, new exploration kicking off and field-wide planning entering high gear, TMK Energy looks to be shifting gears in Mongolia’s South Gobi Basin. The project is edging closer to becoming a commercial-scale producer and the market will no doubt be watching closely.

Mongolia's foreign trade drops 5.7 pct in first 9 months www.xinhuanet.com

Mongolia's foreign trade turnover totaled 19.2 billion U.S. dollars in the first nine months of 2025, a 5.7 percent decrease compared to the same period last year, according to the National Statistics Office (NSO) on Tuesday.

During the period, exports fell 9.1 percent to 10.7 billion dollars, while imports dropped 0.9 percent to 8.5 billion dollars.

The reduction in exports is attributed mainly to the decline in supply of coal, crude oil, sheep and goat meat and washed cashmere from Mongolia to foreign countries.

The landlocked country traded with 160 economies worldwide in the January-September period.

President of Mongolia U. Khurelsukh to Pay a State Visit to the Republic of India www.president.mn

At the invitation of Her Excellency Droupadi Murmu, President of the Republic of India, and His Excellency Narendra Modi, Prime Minister of India, His Excellency Khurelsukh Ukhnaa, President of Mongolia, will pay a State Visit to India from 13 to 16 October 2025.

This visit is of particular significance as it is being undertaken within the framework of the 70th anniversary of the establishment of diplomatic relations between Mongolia and the Republic of India.

During the visit, President Khurelsukh Ukhnaa will hold meeting with President Droupadi Murmu and official talks with Prime Minister Narendra Modi to discuss the further expansion and development of the “Strategic Partnership” between Mongolia and India, as well as a broad range of regional and international matters.

As part of the visit, a Mongolia–India Business Forum will be organized, along with a cultural performance titled “Beautiful Mongolia” and exhibitions showcasing Mongolian fine art and the traditional Morin khuur (horsehead fiddle).

Prime Minister of the Republic of India, His Excellency Narendra Modi, paid an official visit to Mongolia in 2015, during which the relations between the two countries were elevated to the level of a “Strategic Partnership”.

Hotel Mongolia: You can check out of jail, but can’t leave the country www.afr.com

Mo Munshi walked from Prison 421 in mid-summer to be greeted by howling winds and sleet prickling his face. The weather was grim for that time of year, even for Ulaanbaatar. It was June 2024, and he carried his meagre possessions – a tracksuit, a jacket, a pair of shorts and a few T-shirts – in a small plastic bag.

In a couple of large plastic bags, stuffed full, were his papers: deeds, money transfers, contracts, bank statements, copies of emails, legal letters. The many hundreds of pages of documents told the story of how the Australian geologist and businessman had come to Mongolia as a very wealthy man, seeking to build a mining business in the former Soviet outpost. They drew lines to those in power in Ulaanbaatar that, to him, clearly explained why he’d been arrested and thrown into a fetid Mongolian jail for seven years. They outlined how he’d been stripped of tens of millions of dollars worth of assets. They explained why he was walking out the gates of Prison 421 as a pauper.

He’d walk from one cell to another.

The 65-year-old was taken from jail that day to the immigration department, where officials asked to see his passport. “It was pointless because my passport had expired,” he tells AFR Weekend when we visit him in Ulaanbaatar. And it was pointless also because even a valid, up-to-date passport wouldn’t have helped. He was handed another document to add to his depressing pile of papers, a notice that he’d been placed on a travel ban and could not leave the country, even though he’d served his prison term.

That was 16 months ago, and he’s still stuck in Mongolia, living in a tiny one-bedroom flat, surviving on what little money his family can send from Perth. He’s severely ill with various serious ailments and needs urgent medical attention. And the Australian government appears powerless, or unwilling, to help.

Kylie Moore-Gilbert knows some of what he is experiencing, having spent 804 days in an Iranian jail. She believes the Australian government has washed its hands of Mo Munshi. “Once someone is out of prison, the Australian government kind of says, ‘All right – job done. We don’t need to concern ourselves with this travel ban,’ and it backs off.”

“Nothing gets done,” she adds. “And these people, like Mo, can be stuck there for years and not be allowed to return home to Australia, to your family, to your kids, your grandkids … it’s indefinite detention.”

His is a cautionary tale for Australian executives and workers plying their trades in far-flung, often unstable, regions of the world: get into trouble, and you’re on your own.

Billionaire miner Gina Rinehart is fond of saying that if Australia doesn’t pull up its socks and rid itself of red and green tape, the miners will simply take their bulldozers and drill rigs to another sandpit. “There are other countries that have iron ore and other minerals,” she thundered last year about delays to her $600 million McPhee project in the Pilbara. “Investments will continue to move offshore.”

Careful what you wish for.

The leviathan Anglo-Australian miner, Rio Tinto, has found that to tango with the Mongolian government is to dance with a bear. For almost two decades they have been squabbling, in and out of court, over the vast treasures being dug from the giant Gobi Desert copper and gold mine, Oyu Tolgoi.

It’s the single largest investment in Mongolian history and accounts for a quarter of the country’s GDP. It is also among the largest investment projects by an Australian company abroad. Rio owns 66 per cent of Oyu Tolgoi. The junior partner, the Mongolian government, holds 34 per cent of the shares, as well as all the aces.

In 2022, Rio wiped a $3.4 billion debt owed by the Mongolians for their share of the mine’s construction. It was an effort to “reset the relationship to allow the parties to move forward together”. It didn’t work.

The Mongolian government recently launched court proceedings in the UK, alleging Rio had bribed a former Mongolian politician, “transferring multi-millions of dollars” in the early stages of the project. It is demanding compensation. There have also been tax disputes, involving hundreds of millions of dollars, investor lawsuits and grave threats to the multibillion- dollar mine from political instability.

It’s been a nightmare for the dual ASX-London listed company, but, so far, none of its executives have ended up in jail. With tensions already heightened between the Mongolian government and the giant Australian miner, has this affected Australia’s willingness to push hard for Mo Munshi’s return?

“I wish I could say that Australian consular officials are not impacted by Australia’s economic interests,” says Munshi’s Australian lawyer, Alison Battisson. “But I’m not so sure … I am very concerned that the lack of any intervention could be to do with bigger economic concerns.”

Battisson says it would greatly help if Foreign Minister Penny Wong made a detour to Ulaanbaatar on one of her overseas trips. Wong’s office has written an official letter requesting the travel ban be lifted, but there has been no response.

Wong, Battisson says, could at least call in the Mongolian ambassador and give him a public dressing down. “I think the prime minister commenting on the fact that there’s an Australian businessman in Mongolia, who’s clearly had his assets stripped and has suffered gross human rights violations in prison, would be incredibly useful … I just don’t understand the timidity.”

“Unless something is done soon,” Battisson says, “he will die there. It’s as simple as that.”

Governor-General Sam Mostyn recently visited Mongolia to learn more about its “growing resources and energy sector where Australian companies are engaging and investing.”

AFR Weekend understands she did raise Munshi’s detention with Mongolian officials, but her office did not provide details of the discussions. Mostyn did, however, take a detour to Rio’s Oyu Tolgoi mine, to be greeted by the company’s senior executives, and was accompanied by Australia’s ambassador to Mongolia, Leo Zeng.

Mo Munshi moved offshore, “to engage and invest,” in the resources sector and ended up in solitary confinement. He’s now living alone in Ulaanbaatar, not knowing when he’ll see his kids, and the grandkids he’s not yet cuddled.

Welcome to the Hotel Mongolia, where you can check out, but leaving is another thing.

“I did the full time for a crime I didn’t commit.”

— Mo Munshi spent seven years in Prison 421 in Ulaanbaatar

The years in jail have left Munshi a broken shell. He has a litany of serious ailments – blocked arteries, chronic back, hip and leg pain, kidney failure, an enlarged prostate, which is possibly cancerous, and urinary tract infections. All were exacerbated by the squalid conditions in jail and repeated bashings from prison guards. The food was atrocious, mainly boiled tripe, and there were no fresh vegetables. A Muslim, he was forced to eat pork or starve. In winter, the cells were freezing, and in summer, it was a hothouse.

He cannot get treatment in Mongolia for his acute illnesses, and he now survives in his flat with a heater, an old TV, a laptop and his papers. He doesn’t speak Mongolian, and is cut off from the world outside. His family is extremely concerned about his mental well-being. “I get up in the morning, wash, have breakfast, read books, get on the internet and read articles,” he tells AFR Weekend. “I talk to my family when I can, but they’re all working. The days are very long and boring.”

He only ever leaves to stock up on food from a nearby market, fearful that if he’s out too long or wanders too far, “I’ll be threatened with intimidation and possibly things beyond that.”

“I just want to go back to Australia,” he says. “I did the full time for a crime I didn’t commit. I hate it here. I need proper medical care quite urgently. I just want to go home.”

Despite having completed his prison sentence, Munshi is still on the hook. Before he can go anywhere, the Mongolian government insists he must first pay influential Mongolian businessman - someone, who for legal reasons, we’ll call The Mogul – 31.7 billion tugriks, or around $13.5 million.

Munshi’s lawyer, Battisson, previously worked in the mining sector abroad, doing “due diligence on enormous mining projects” before specialising in human rights. She has pored over his documents and says it’s abundantly clear his mining assets were stripped from him while he was in jail, and that those assets are now worth billions. “And they’ve been sold off to the Chinese,” she says. “They were high-quality coal and uranium licences.”

Born in Pakistan, raised and educated in England, Munshi moved to Australia in 1987 to work in the Leinster gold fields in Western Australia. From there he built a solid career and moved up through the ranks of companies like Barrick Mining, Great Central Mines, Ashanti Goldfields and Johannesburg Consolidated Investments, or JCI.

AFR Weekend spoke with numerous associates and investors in Munshi’s businesses. They describe him as a clever storyteller with a nose for a good mining project. And most importantly for someone in the mining caper, he was very good at raising money.

“He was always prepared to take risks,” one US-based investor said. “He had a pool of people around the world he could call on for capital. He treated companies like pockets in his jacket, forever moving money in and out of them. But he knew what he was doing.”

And then, in the early 2000s, he set his sights on Mongolia. The ancient territory, once ruled by Genghis Khan, was emerging from socialism and the possibilities for chancers like Mo Munshi, it seemed, were as vast as the frigid plains.

“I thought I’d died and gone to heaven.”

— Mo Munshi about his deal with Malaysian financier Jho Low

In 2000, Canadian billionaire Robert Friedland unearthed the treasures hidden beneath the Gobi Desert. The deposits of Oyu Tolgoi were immense, with rivers of copper and gold stretching for kilometres. Munshi, the smooth-talking geologist-turned-financier, became a key figure in Friedland’s fundraising blitz for his company Ivanhoe Mines. Between 2001 and 2006, he flitted across time zones in Friedland’s private jet, pitching Oyu Tolgoi to sovereign wealth funds, pension funds and investment banks.

By the time Rio Tinto muscled in as the project’s long-term partner, Ivanhoe Mines had raised more than $US500 million, much of it thanks to Munshi’s ability to tell a compelling story about those rivers of gold and copper.

Those years cemented Munshi’s belief that Mongolia was the new frontier. After Friedland and Rio settled into a long and fractious partnership with the Mongolian state over Oyu Tolgoi, Munshi staked his own claims. By 2006, he secured rights to two vast coking coal deposits. Early studies suggested the mines could yield more than 300 million tonnes of coal, with the added bonus that China’s ravenous steel mills were just across the border.

Munshi formed Gobi Coal & Energy and quickly courted heavyweight investors – HSBC’s Sir John Bond, Rothschild family scion Fred Durr, and US hedge funds. By 2010, the company was gearing up for a $US500 million IPO in Hong Kong or Toronto. Coal prices were soaring thanks to China’s industrial boom, the start of a commodities’ super cycle.

But then he was ordered to dance with the Mongolian bear. Munshi was invited to a barbecue in the sprawling compound to meet with some very high-level Mongolians. As the steaks sizzled, one high-level government official cornered him and advised that Gobi Coal & Energy’s shareholder register was “too foreign” for his liking. “I was told that in Mongolia you needed to have Mongolians on your register,” says Munshi.

To smooth his path, that person steered him toward a friend who he said could help. His mate was The Mogul, the head of a Mongolian corporation. It was suggested the pair should meet at Ulaanbaatar’s towering Chinggis Khaan Hotel.

With coal prices hitting record highs, Munshi was keen to cement his local credentials. Over dinner at the Chinggis Khaan, The Mogul made it clear he wanted in. For weeks afterward, Munshi’s phone rang constantly as The Mogul peppered him with calls to finalise a deal. His brother, was circling too – flying him to Hong Kong and Singapore, taking Munshi out to long banquets, and even to the notorious hooker’s bar in Singapore, the Brix, where, Munshi recalls, “the staff seemed to know him by name”.

“He was like a leech,” Munshi says. “The guy just wouldn’t let go of me. He wanted to get that coal project.“

By late 2010, Munshi thought he had a better option. Talks with Mount Kellett, a Hong Kong fund formed by ex-Goldman Sachs bankers, were close to a deal at $3.50 a share. When Munshi pushed the price to $4 on the back of new feasibility results, the Americans walked and the Mongolian brothers stepped in.

Over drinks in Singapore, a deal was sealed. Between late 2010 and mid-2011, The Mogul invested $US20 million in three tranches, all wired to Gobi’s Hong Kong account under an offshore vehicle. According to transaction documents and contracts seen by AFR Weekend, the money never touched Mongolia.

Munshi was surprised by the lack of due diligence. No detailed reviews, no site visits. But the senior government figures had vouched for The Mogul, and Gobi’s board decided a powerful Mongolian name would insulate the company from the disputes Rio Tinto was facing at Oyu Tolgoi. With $US20 million fresh in the bank, Munshi and his team, led by veteran geologist Neil Rutherford, pressed ahead.

Then, in July 2011, while holidaying with his family in Thailand’s Koh Samui, Munshi’s phone rang again. It was the son of the senior Mongolian government official, who was then working in New York. He had an introduction: a Malaysian financier named Jho Low.

The Malaysian dealmaker would soon become infamous as the architect of the 1MDB scandal, but Low was then a rising star. Educated at Harrow and Wharton, a fixture in Hollywood parties with Leonardo DiCaprio and Paris Hilton, Low presented himself as a wizard with the wand to unlock sovereign wealth funds. “They loved the coal in Mongolia story,” Munshi says.

Soon Low and his cousin were pitching Munshi on a joint venture between Malaysia’s 1MDB fund and Abu Dhabi’s Aabar Investments. They were looking for projects and Gobi Coal looked perfect. Munshi opened Gobi’s data room. The Low’s due diligence lasted just days. “No hard questions, no models. It was like the deal was already done,” he says.

He pitched for $30 million. Low came back with a staggering $91 million private placement at $6.50 a share – valuing Gobi at $650 million. For a pre-IPO coal company in Mongolia, it was extraordinary.

“I thought I’d died and gone to heaven,” Munshi says. “The board was incredibly enthusiastic. And why not? At the time, you had two sovereign wealth funds knocking at the door, offering a very, very good price. Of course, they’re both poison now. But back then, the deal spoke to the value of these coal and uranium assets.“

But there was a catch. As part of the agreement, $14 million was skimmed off the top as “brokerage fees,” $9 million to the Malaysian side and $5 million to Abu Dhabi’s Aabar. According to contracts seen by AFR Weekend, the transfers were made in cash, not shares, routed through two British Virgin Islands shells: Blackstone Asia Real Estate Partners and Globalink Private Aviation.

“I said, ‘Why cash?’” Munshi recalls. “They didn’t want shares. That should’ve been the warning.”

Years later, that $14 million, along with $11.5 million in feasibility costs, would be bundled into a $40 million fraud accusation against Munshi. He insists it was engineered to cover up the kickbacks at the heart of the Aabar–1MDB deal, and to shift blame to him. “They flipped it completely around and accused me of theft,” he says.

“I had everything in writing … I thought I could reason with him.”

— Mo Munshi, speaking about The Mogul

After the initial success, the Gobi Coal project got bogged. They raised $US120 million, mostly from The Mogul and Aabar Investments in 2011. But then coal prices collapsed, following the global financial crisis, and the Gobi IPO was shelved, indefinitely.

Investors in New York and London, who’d lost money, shrugged. “It happens all the time,” one US-based fund manager said. “That’s why it’s called an IPO window because sometimes they close.” It’s the way international markets operate, but not in Mongolia. The Mogul wanted his cash, and then some.

Mongolia was unnerving foreign investors. In 2012, parliament passed a law requiring 51 per cent domestic ownership of “strategic” projects. Many foreign companies simply packed up and left. Rio Tinto was fighting tooth and nail to get Oyu Tolgoi off the ground. And Gobi Coal was put into care and maintenance after $45 million had been spent.

Munshi was entangled with The Mogul’s family. He had lent him $10 million and more to his brother. When coal prices collapsed and the project bled cash, the loan was never repaid. Munshi took the dispute to the Hong Kong arbitration court – and won. He even secured a further order in Mongolia demanding repayment. No money ever arrived.

Instead, relations with The Mogul turned hostile. Threatening letters appeared in Munshi’s inbox. These emails, seen by AFR Weekend, accused Munshi of “cheating the Mongolian people” and claimed his resource estimates were “fake”. The language grew more aggressive with threats against Munshi’s partner and family, who were living in Beijing.

Munshi was rattled. “It shook me, particularly the references to my partner,” he recalls. But he booked a ticket to Mongolia anyway. “I had shareholder agreements, I had everything in writing. We hadn’t falsified anything … I thought I could reason with him.”

Instead, he found himself being interrogated at the airport about The Mogul’s “missing millions”.

In March 2015, Munshi was making his way through the customs hall at Ulaanbaatar airport when he was intercepted by two plain-clothes police. He was frogmarched into a drab police station and his Australian and British passports were taken. For the next five hours, he was grilled about his dealings with The Mogul.

Munshi maintained that The Mogul’s company had bought shares in Gobi and that the $US20 million was an investment, not a loan. The basic mechanics of international finance fell on deaf ears with the Mongolian cops. He was released into Ulaanbaatar without his passports, but a travel ban in place. To this day, that ban has never been lifted.

“I have had many worst days of my life but that day was definitely one of the worst.”

Events 5000 kilometres to the south would add to his woes. In 2016, the smoke cleared, the mirrors cracked and the facade that had hidden the shonky dealings of Jho Low collapsed. The Malaysian financier was accused by the US Justice Department of masterminding one of the largest kleptocracy schemes in history: the siphoning of more than $US4.5 billion from the sovereign wealth fund 1MDB. Properties in New York and Beverley Hills, a $250 million yacht, art by Basquiat and Monet, and Hollywood movies like The Wolf of Wall Street, were all traced back to Low’s network.

Low fled Malaysia. Leonardo DiCaprio quietly returned gifts from the businessman, including Marlon Brando’s Oscar. And Low’s name was splashed across global headlines as the embodiment of corporate corruption.

It was a disaster for Munshi. What might have been a messy commercial dispute with The Mogul was soon recast. Prosecutors in Ulaanbaatar seized on the revelations. The $91 million private placement into Gobi Coal, once trumpeted as a coup, was now toxic. And Mongolia had just passed new laws to target white-collar crime. The commercial dispute was now a criminal prosecution.

Investigators bundled it all together: the 1MDB scandal, the $14 million “brokerage fees”, the $11.5 million feasibility studies, and the collapse of the IPO. In their telling, Munshi wasn’t a foreign geologist burned by bad luck and sagging coal prices; he was a crook who had used fraudulent data and offshore vehicles to steal millions from Mongolian investors.

The laws passed in 2012 gave them the hook. By charging him under theft provisions rather than contract or corporate statutes, they could reframe commercial risk as an act of criminal fraud. But as his lawyer, Battisson, points out, the offence that he was charged with didn’t exist at the time it was allegedly committed. “It was not a crime at the time,” she says.

When Munshi’s case was heard – with the 1MDB scandal blaring in the background – the outcome appeared preordained. He was first convicted in a lower court in 2017 of fraud and theft and sentenced to 11 years. In 2018, he appealed to the Mongolian Supreme Court. It upheld the conviction, but reduced the sentence to seven years.

The court added a condition that he was to repay The Mogul 31.7 billion tugriks, which is about $13.5 million today. He had no way of repaying The Mogul the millions the court says the Mongolian is owed. Munshi also couldn’t leave the country, despite having served his time.

“I have had many worst days of my life in the last ten years,” Munshi says of the ruling. “But that day was definitely one of the worst.”

“Unless something is done soon, he will die there. It’s as simple as that.”

— Alison Battison, Munshi’s lawyer

Following the 2018 Supreme Court sentence, Munshi was marched in shackles through the iron gates of Prison 421 – a notorious Soviet-era jail on the outskirts of Ulaanbaatar.

The cell blocks were crumbling and unheated. In winter, prisoners huddled together under blankets to survive as temperature fell below minus 30. The moisture from their breath turned to ice on the walls. His illnesses worsened. Regular beatings from guards left his back and ribs scarred. Requests for medical treatment were ignored. “There was no dignity in there,” he says. “You weren’t treated as a prisoner serving time, you were treated as something less than human.”

While Munshi languished, associates of The Mogul got to work. Over the following years, new directors were installed in Gobi Coal & Energy, the name was changed and coal and uranium licences were transferred.

During that time, Khaltmaa Battulga became president of Mongolia, and under his influence the country became even more protectionist about its mineral wealth. It was common for the courts to assist in consolidating disputed mining assets into the hands of domestic elites with long-standing ties to Battulga’s faction.

Court filings, company records and some government communications reviewed by AFR Weekend show how the paper trail was rewritten. Shareholder agreements were cancelled, loans to The Mogul were reclassified, and new holding companies were stood up. Within three years, virtually every piece of Gobi Coal’s portfolio, valued at $650 million prior to the IPO, had been stripped.

From his cell, Munshi could only watch as his assets disappeared. His lawyers’ attempts to challenge transfers went nowhere. At the same time, another part of his business empire was dismantled by The Mogul’s associates.

Paramount Mining, an ASX-listed company known as PCP, had been Munshi’s Australian flagship, holding a promising gold project in Java. In 2016, as his legal troubles deepened, Paramount shareholders approved a plan to spin that project into a new Singapore-based vehicle through a one-for-one share swap. The transaction was pitched as a way to attract Asian and Middle Eastern investors, but it effectively gutted the Australian entity, leaving a shell.

Once the Singapore vehicle was established, control shifted rapidly. In 2018, while Munshi was still incarcerated, the new board, helmed by a Dubai-based associate of The Mogul, issued billions of fresh shares, expanding the register from about 800 million to roughly 20 billion. It wiped the value of earlier holdings. (This person is currently the CEO of the company that was formerly Gobi Coal & Energy, Munshi’s old company).

Within a year, Paramount collapsed into administration in Australia, sparking a drawn-out court battle over a $300,000 loan that administrators sought to claw back. Non-executive directors quietly settled, while new management in Singapore snapped up the gold assets. By the time the litigation wound down the projects had been sold off, the company was dissolved, and the paper trail disappeared into offshore structures.

“He doesn’t look Aussie and doesn’t have an Aussie sounding name.”

— Kylie Moore Gilbert, who was detained in Iran

Earlier this year, Munshi’s lawyer, Battisson, filed a number of complaints to the UN, urging the international community to step in. She hopes that the UN will launch an investigation into his plight. “Mr Munshi’s treatment by the Mongolian judiciary and government should serve as a warning to foreign investors in Mongolia,” the complaint reads. “As should the lack of support from the Australian and British governments during his trial, imprisonment and his current travel ban.”

When WikiLeaks founder Julian Assange was seeking freedom in Britain, and avoiding extradition to the US, there was a conga line of supporters and politicians agitating on his behalf. Even Barnaby Joyce was calling for his release. Australia’s ambassador to the US, Kevin Rudd, boasted that it took “creative nous” to secure his freedom. After he’d hopped off the private jet that had returned Assange to Australia, Rudd was asked if it was his creative nous that orchestrated the deal. He replied with faux modesty, “That’s your term, not mine.”

Mo Munshi does not have a Kevin Rudd, or even a Barnaby Joyce, in his corner. There’s no private jet on standby, waiting to whisk him from Ulaanbaatar. DFAT has said that while it is advocating on Munshi’s behalf, it cannot “intervene in another country’s legal matters”. And so he sits and waits in his drab little flat with his boxes of papers, reliant on his family for money and his lawyer who works for free.

Kylie Moore-Gilbert says part of Munshi’s dilemma is that he’s not the right type of victim for the Australian public. His plight has not captured the public’s sympathy or garnered widespread media attention. “He’s an old man,” she says. “He doesn’t look Aussie and doesn’t have an Aussie sounding name. People are less interested, unfortunately, and I think there’s a correlation between the public outcry and media attention and the level of government interest.”

Munshi tells AFR Weekend that even if he did have the money to pay The Mogal, which he doesn’t, he wouldn’t.

“I’ve never done anything wrong,” he says. “I’ve had no help from the Brits or the Aussies because they don’t want to blow Rio Tinto up.”

He says he hopes this article will put pressure on Foreign Minister Wong, and “those other useless bastards down there” to do something. “Because until they’re pressured they [the Mongolians] won’t do anything,” he says. “When they’ve stolen all these assets there’s no incentive to let me out.”

He adds: “I’m 65 years old, and I’ve got a lot of health issues, and they’d much prefer to see me leave in a box than see me walk onto a plane.”

By Jessica Sier and Greg Bearup

Bank of Mongolia: Outlook for coal and iron ore prices remains uncertain www.gogo.mn

The Bank of Mongolia has expressed a cautious outlook for the national economy next year, highlighting potential challenges linked to slowing external demand and weakening commodity prices.

According to B.Lkhagvasuren, Governor of the Bank of Mongolia, the future balance of payments will largely depend on global mineral prices, tariff policies, and the economic performance of Mongolia’s key trading partners.

“The economic growth of our main trading partner, China, is expected to slow further. Therefore, the outlook for coal and iron ore prices is not certain” said B.Lkhagvasuren.

“At a time when export revenues are declining, it is essential to pursue an optimal combination of macroeconomic policies and reduce the current account deficit. Major construction projects should also be implemented without placing additional pressure on foreign exchange reserves.”

He added that rising geopolitical tensions, a decline in external demand, and a faster-than-expected drop in key export commodity prices could negatively affect Mongolia’s export revenues and foreign exchange inflows.

Other risk factors include potential oil supply disruptions, severe winter weather, and power outages, all of which could raise inflation and slow economic activity.

Despite these internal and external challenges, the Central Bank expects inflation to stabilize within 6 ±2 percentage points in 2026 and to gradually decline to 5% by 2027.

B.Lkhagvasuren emphasized that achieving these targets will require government support and the implementation of counter-cyclical fiscal policies to maintain economic stability.

...

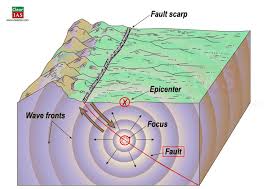

Over 14,000 earthquakes recorded in Mongolia in 10M2025 www.qazinform.com

The Permanent Sub-Council for Earthquake Disaster Prevention of Mongolia has held its regular meeting to discuss nationwide readiness and risk management measures, Montsame reported.

Over 14,000 earthquakes recorded in Mongolia in 10M2025

The meeting reviewed the implementation of the Sub-Council’s 2025 action plan, expert assessments on the earthquake resistance and structural reliability of buildings, the progress of seismic passporting activities, and issues requiring further attention.

According to the National Emergency Management Agency (NEMA), more than 14,000 earthquakes were recorded across the country during the first ten months of 2025. Among them, 43 quakes measured between 3.5 and 5.2 magnitude, representing a 26 percent decrease compared to the same period last year.

By Arailym Temirgaliyeva

Jaap Van Hierden on the UN in Mongolia (and Vice Versa) www.thediplomat.com

Since joining the United Nations in 1961, Mongolia has been an active member of the body, reaching major milestones in contribution to the U.N. missions. Mongolia will be hosting the 17th session of the Conference of the Parties to the U.N. Convention to Combat Desertification (COP17) in 2026, which also coincide with the United Nation’s 80th anniversary.

In recognition of the robust Mongolia-U.N. relations as the United Nations celebrates its 80th year, Bolor Lkhaajav spoke to Jaap Van Hierden, the U.N. resident coordinator in Mongolia, on climate change, climate financing, U.N. reforms, and Mongolia’s progress in implementing U.N.-led projects.

The United Nations has been one of the main pillars of the post-World War II international system and Mongolia is proud to be an active U.N. member that ratifies and engage with many of its goals. Considering the U.N.’s 80th anniversary and possible reform, what are some of the things Mongolia must focus on, particularly in the face of erosion of democracy and increase in authoritarian governance? How can Mongolia utilize this reformative space to strengthen its democratic institutions both at home and on the international stage?

As the U.N. approaches its 80th anniversary, Mongolia has a timely opportunity to contribute to global reform while reinforcing its democratic institutions. Strengthening judicial independence and the rule of law remains essential, and Mongolia can benefit from U.N. technical assistance to improve legal frameworks and anti-corruption efforts. Expanding civic education and youth engagement through U.N.-supported programs will help foster inclusive governance, especially with the use of digital tools for citizen participation.

Media freedom and digital governance are also key areas for Mongolia to lead by example. Collaborating with U.N. agencies to protect independent media and develop transparent digital governance frameworks will enhance democratic resilience.

Internationally, Mongolia can continue its strong peacekeeping contributions and take on leadership roles in promoting democracy and human rights through U.N. platforms. By leveraging its “third neighbor” policy, Mongolia can build regional coalitions and host dialogues that advance democratic cooperation and innovation.

Mongolia stands as a neutral bridge in Northeast Asia, championing peace through dialogue. The Ulaanbaatar Dialogue is its signature platform that is uniting nations, fostering trust, and advancing regional stability. From peacekeeping missions to policy dialogues, Mongolia is weaving gender equality into its peace and security agenda. In doing so, it ensures that women’s voices help shape the future of conflict resolution and sustainable peace.

Mongolia and the U.N. signed “The United Nations Sustainable Development Cooperation Framework (UNSDCF 2023-2027).” How do you assess Mongolia’s implementation of these goals? What are some of the hurdles that are preventing Mongolia from fully implementing this framework?

Mongolia’s implementation of the UNSDCF 2023–2027 has shown momentum, especially in 2023 and 2024, with over $90 million delivered by 24 U.N. agencies. However, the projected delivery for 2025 drops to around $40 million, which signals a potential slowdown unless additional resources are mobilized. Funding from key partners like the Green Climate Fund, the Adaptation Fund, the Global Environment Facility, the World Bank, the European Union, and bilateral donors such as Canada, China, Japan, Luxembourg, the Republic of Korea, and the U.K. has been instrumental in advancing UNSDCF priorities. Their role has become even more critical following the discontinuation of USAID’s operations in Mongolia.

Unfortunately, significant challenges persist. Poverty continues to affect more than a quarter of Mongolia’s population, while deep-rooted income inequality, particularly between urban and rural communities, remains a major barrier to inclusive development.

Corruption, while being addressed, continues to erode trust and efficiency in governance. Budget credibility issues like lack of transparency are also limiting the impact of public services.

Climate shocks like the 2023–2024 dzud have strained resources, especially in rural areas where digital infrastructure and service access are limited. Mongolia’s classification as an upper-middle-income country is also shifting donor priorities away from it, as seen in reduced commitments from traditional partners.

To meet UNSDCF goals, Mongolia needs to strengthen co-financing mechanisms and improve budget execution. U.N. agencies must also work together to help close the financing gap, which remains significant.

Mongolia recently released the official logo for COP17 next year in Ulaanbaatar. What tangible outcomes should we expect from Mongolia’s hosting of such a large, timely event?

Mongolia will host the 17th session of the Conference of the Parties (COP17) to the U.N. Convention to Combat Desertification (UNCCD) in Ulaanbaatar from August 17 to 28, 2026. This major global event will bring together delegates from 197 Parties, including heads of state, ministers, scientists, civil society, and the private sector, to address the pressing challenges of desertification, land degradation, and drought. It will serve as a platform for science-policy dialogue, innovation, and financing, while fostering knowledge exchange and capacity-building.

As host, Mongolia will be able to showcase its national initiatives such as the “One Billion Trees” campaign, the “White Gold” livestock movement, and the “Food Revolution” as models of sustainable land management and climate resilience. With 2026 also marking the International Year of Rangelands and Pastoralists, COP17 will further highlight Mongolia’s leadership in rangeland management and environmental diplomacy.

The Youth4Land Forum held in Dundgobi earlier this year has set a strong precedent by empowering young people and communities to co-create land restoration solutions.

Economically, COP17 is expected to benefit local businesses through increased demand in hospitality, transport, and services, with over 10,000 participants anticipated. It will also promote Mongolia as a unique tourist destination, generate employment across sectors, and potentially lead to lasting improvements in urban infrastructure and digital connectivity.

The successful hosting of COP17 will enhance Mongolia’s global image as a proactive and responsible environmental actor, opening doors for stronger trade, investment, and diplomatic engagement.

When discussing climate pledges, climate financing is extremely important. How are Mongolia’s leadership and institutions navigating climate financing, and how do you assess the Mongolian government’s own commitment to climate financing?

Mongolia has integrated climate finance into its Vision 2050 national strategy, committing at least 1 percent of GDP annually to climate and desertification efforts, including the “One Billion Trees” campaign. It is strengthening institutions and regulatory frameworks to support climate finance flows and actively promotes private sector engagement through incentives and capacity building.

The National Sustainable Finance Roadmap, led by the Ministry of Finance and Bank of Mongolia, aims to raise green loans to 10 percent of total banking sector lending by 2030, with strategic actions to align financial flows with climate goals. A Green Finance Policy Division has been established to coordinate efforts, and climate-related financial disclosure guidelines have been issued to improve transparency and attract investment.

Mongolia collaborates with partners like the U.N., Green Climate Fund, ADB [Asian Development Bank], and World Bank to mobilize climate finance and technical support. Projects such as the Carbon Market Readiness initiative and the ENSURE project reflect strong political will and long-term financial planning for climate resilience.

In Mongolia, climate change is a multilayered issue that is intertwined with air pollution, energy, as well as efforts to transition to renewable energy. What are some notable U.N. projects and initiatives designed to help Mongolia to combat this complex challenge?

To tackle the interconnected challenges of climate change, air pollution, and energy transition, the U.N. has launched several strategic initiatives in Mongolia.

A flagship effort is the Joint Program for a Just Energy Transition. It supports Mongolia’s climate goals through a national framework that integrates inclusive planning and financing, especially in health and education sectors, ensuring no one is left behind.

The Solar Facility Project in Chingeltei District replaces coal heating in ger areas with solar systems and smart meters. It supports households, tracks carbon savings, and promotes gender-responsive training and employment, thereby paving the way for market-based clean energy expansion.

In rural areas, the ADAPT Project strengthens herders’ resilience to desertification, drought, and dzud (a climate hazard unique to Mongolia) by enhancing the use of climate data, improving land and water management, and expanding market access for sustainable livestock products. These efforts directly support the objectives of the upcoming COP17 on desertification.

U.N. Mongolia also coordinated a humanitarian response to the 2023-2024 dzud, supporting people and conducting impact assessments to inform future resilience strategies. Together, these and other initiatives reflect the U.N.’s commitment to a just, inclusive, and sustainable future for all Mongolians, urban and rural alike.

You are originally from the Netherlands, where wind and solar power accounted for half of electricity generation in 2024. What can Mongolia learn from the Netherlands, particularly in its efforts to transition to renewable energy?

The Netherlands’ success in generating almost half of its electricity from (offshore) wind and solar in 2024 offers valuable lessons for Mongolia’s renewable energy transition. Mongolia can scale up onshore wind development, leverage its vast steppes and strong wind corridors, and explore regional energy export opportunities. Dutch households and business widely adopted rooftop solar supported by subsidies and net metering. Expanding decentralized solar systems with smart meters, especially in ger districts and rural areas, would reduce coal dependency and improve energy access. In doing so, it would reduce the very serious air pollution in Ulaanbaatar and other cities.

To support this growth, Mongolia must invest in modernizing its grid infrastructure to handle variable renewables and reduce energy curtailment. Aligning renewable energy with industrial decarbonization, particularly in mining and processing, can also attract green investment. Long-term scenario planning, as practiced in the Netherlands, would help Mongolia prioritize infrastructure and policy decisions. Finally, fostering a stable investment environment and promoting community-based energy projects will be key to building public support and accelerating the clean energy transition.

By Bolor Lkhaajav

Bolor Lkhaajav is a researcher specializing in Mongolia, China, Russia, Japan, East Asia, and the Americas. She holds an M.A. in Asia-Pacific Studies from the University of San Francisco.

Mongolia Trade Surplus Largest In Over a Year www.tradingeconomics.com

Mongolia’s trade surplus widened significantly to USD 487.2 million in September 2025 from USD 50.7 million in the same month last year.

This marked the largest trade surplus since June 2024, as exports rose by 10.1% to USD 1550.5 million, while imports grew by 6.6% to USD 1063.3 million.

For the January-September period, however, the trade plus narrowed to USD 2,174.8 million from 3,174.8 million a year earlier.

Exports declined by 9.1% year-on-year to USD 10,708.6 million, largely driven reduced shipments by textiles and textile articles (-35.3%) and mineral products (-9.7%), with China representing 91.2% of total exports, followed by Switzerland (5.7%), and the US (0.9%).

Meanwhile, imports slipped by 0.9% to USD 8,533.8 million, dragged down by reduced purchases of transport vehicles and their spare parts (-11.3%) and mineral products (-3.3%).

China accounted for the largest share of total imports (40.6%), followed by Russia (23.9%) and Japan (10.8%).

- «

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

- 1000

- 1001

- 1002

- 1003

- 1004

- 1005

- 1006

- 1007

- 1008

- 1009

- 1010

- 1011

- 1012

- 1013

- 1014

- 1015

- 1016

- 1017

- 1018

- 1019

- 1020

- 1021

- 1022

- 1023

- 1024

- 1025

- 1026

- 1027

- 1028

- 1029

- 1030

- 1031

- 1032

- 1033

- 1034

- 1035

- 1036

- 1037

- 1038

- 1039

- 1040

- 1041

- 1042

- 1043

- 1044

- 1045

- 1046

- 1047

- 1048

- 1049

- 1050

- 1051

- 1052

- 1053

- 1054

- 1055

- 1056

- 1057

- 1058

- 1059

- 1060

- 1061

- 1062

- 1063

- 1064

- 1065

- 1066

- 1067

- 1068

- 1069

- 1070

- 1071

- 1072

- 1073

- 1074

- 1075

- 1076

- 1077

- 1078

- 1079

- 1080

- 1081

- 1082

- 1083

- 1084

- 1085

- 1086

- 1087

- 1088

- 1089

- 1090

- 1091

- 1092

- 1093

- 1094

- 1095

- 1096

- 1097

- 1098

- 1099

- 1100

- 1101

- 1102

- 1103

- 1104

- 1105

- 1106

- 1107

- 1108

- 1109

- 1110

- 1111

- 1112

- 1113

- 1114

- 1115

- 1116

- 1117

- 1118

- 1119

- 1120

- 1121

- 1122

- 1123

- 1124

- 1125

- 1126

- 1127

- 1128

- 1129

- 1130

- 1131

- 1132

- 1133

- 1134

- 1135

- 1136

- 1137

- 1138

- 1139

- 1140

- 1141

- 1142

- 1143

- 1144

- 1145

- 1146

- 1147

- 1148

- 1149

- 1150

- 1151

- 1152

- 1153

- 1154

- 1155

- 1156

- 1157

- 1158

- 1159

- 1160

- 1161

- 1162

- 1163

- 1164

- 1165

- 1166

- 1167

- 1168

- 1169

- 1170

- 1171

- 1172

- 1173

- 1174

- 1175

- 1176

- 1177

- 1178

- 1179

- 1180

- 1181

- 1182

- 1183

- 1184

- 1185

- 1186

- 1187

- 1188

- 1189

- 1190

- 1191

- 1192

- 1193

- 1194

- 1195

- 1196

- 1197

- 1198

- 1199

- 1200

- 1201

- 1202

- 1203

- 1204

- 1205

- 1206

- 1207

- 1208

- 1209

- 1210

- 1211

- 1212

- 1213

- 1214

- 1215

- 1216

- 1217

- 1218

- 1219

- 1220

- 1221

- 1222

- 1223

- 1224

- 1225

- 1226

- 1227

- 1228

- 1229

- 1230

- 1231

- 1232

- 1233

- 1234

- 1235

- 1236

- 1237

- 1238

- 1239

- 1240

- 1241

- 1242

- 1243

- 1244

- 1245

- 1246

- 1247

- 1248

- 1249

- 1250

- 1251

- 1252

- 1253

- 1254

- 1255

- 1256

- 1257

- 1258

- 1259

- 1260

- 1261

- 1262

- 1263

- 1264

- 1265

- 1266

- 1267

- 1268

- 1269

- 1270

- 1271

- 1272

- 1273

- 1274

- 1275

- 1276

- 1277

- 1278

- 1279

- 1280

- 1281

- 1282

- 1283

- 1284

- 1285

- 1286

- 1287

- 1288

- 1289

- 1290

- 1291

- 1292

- 1293

- 1294

- 1295

- 1296

- 1297

- 1298

- 1299

- 1300

- 1301

- 1302

- 1303

- 1304

- 1305

- 1306

- 1307

- 1308

- 1309

- 1310

- 1311

- 1312

- 1313

- 1314

- 1315

- 1316

- 1317

- 1318

- 1319

- 1320

- 1321

- 1322

- 1323

- 1324

- 1325

- 1326

- 1327

- 1328

- 1329

- 1330

- 1331

- 1332

- 1333

- 1334

- 1335

- 1336

- 1337

- 1338

- 1339

- 1340

- 1341

- 1342

- 1343

- 1344

- 1345

- 1346

- 1347

- 1348

- 1349

- 1350

- 1351

- 1352

- 1353

- 1354

- 1355

- 1356

- 1357

- 1358

- 1359

- 1360

- 1361

- 1362

- 1363

- 1364

- 1365

- 1366

- 1367

- 1368

- 1369

- 1370

- 1371

- 1372

- 1373

- 1374

- 1375

- 1376

- 1377

- 1378

- 1379

- 1380

- 1381

- 1382

- 1383

- 1384

- 1385

- 1386

- 1387

- 1388

- 1389

- 1390

- 1391

- 1392

- 1393

- 1394

- 1395

- 1396

- 1397

- 1398

- 1399

- 1400

- 1401

- 1402

- 1403

- 1404

- 1405

- 1406

- 1407

- 1408

- 1409

- 1410

- 1411

- 1412

- 1413

- 1414

- 1415

- 1416

- 1417

- 1418

- 1419

- 1420

- 1421

- 1422

- 1423

- 1424

- 1425

- 1426

- 1427

- 1428

- 1429

- 1430

- 1431

- 1432

- 1433

- 1434

- 1435

- 1436

- 1437

- 1438

- 1439

- 1440

- 1441

- 1442

- 1443

- 1444

- 1445

- 1446

- 1447

- 1448

- 1449

- 1450

- 1451

- 1452

- 1453

- 1454

- 1455

- 1456

- 1457

- 1458

- 1459

- 1460

- 1461

- 1462

- 1463

- 1464

- 1465

- 1466

- 1467

- 1468

- 1469

- 1470

- 1471

- 1472

- 1473

- 1474

- 1475

- 1476

- 1477

- 1478

- 1479

- 1480

- 1481

- 1482

- 1483

- 1484

- 1485

- 1486

- 1487

- 1488

- 1489

- 1490

- 1491

- 1492

- 1493

- 1494

- 1495

- 1496

- 1497

- 1498

- 1499

- 1500

- 1501

- 1502

- 1503

- 1504

- 1505

- 1506

- 1507

- 1508

- 1509

- 1510

- 1511

- 1512

- 1513

- 1514

- 1515

- 1516

- 1517

- 1518

- 1519

- 1520

- 1521

- 1522

- 1523

- 1524

- 1525

- 1526

- 1527

- 1528

- 1529

- 1530

- 1531

- 1532

- 1533

- 1534

- 1535

- 1536

- 1537

- 1538

- 1539

- 1540

- 1541

- 1542

- 1543

- 1544

- 1545

- 1546

- 1547

- 1548

- 1549

- 1550

- 1551

- 1552

- 1553

- 1554

- 1555

- 1556

- 1557

- 1558

- 1559

- 1560

- 1561

- 1562

- 1563

- 1564

- 1565

- 1566

- 1567

- 1568

- 1569

- 1570

- 1571

- 1572

- 1573

- 1574

- 1575

- 1576

- 1577

- 1578

- 1579

- 1580

- 1581

- 1582

- 1583

- 1584

- 1585

- 1586

- 1587

- 1588

- 1589

- 1590

- 1591

- 1592

- 1593

- 1594

- 1595

- 1596

- 1597

- 1598

- 1599

- 1600

- 1601

- 1602

- 1603

- 1604

- 1605

- 1606

- 1607

- 1608

- 1609

- 1610

- 1611

- 1612

- 1613

- 1614

- 1615

- 1616

- 1617

- 1618

- 1619

- 1620

- 1621

- 1622

- 1623

- 1624

- 1625

- 1626

- 1627

- 1628

- 1629

- 1630

- 1631

- 1632

- 1633

- 1634

- 1635

- 1636

- 1637

- 1638

- 1639

- 1640

- 1641

- 1642

- 1643

- 1644

- 1645

- 1646

- 1647

- 1648

- 1649

- 1650

- 1651

- 1652

- 1653

- 1654

- 1655

- 1656

- 1657

- 1658

- 1659

- 1660

- 1661

- 1662

- 1663

- 1664

- 1665

- 1666

- 1667

- 1668

- 1669

- 1670

- 1671

- 1672

- 1673

- 1674

- 1675

- 1676

- 1677

- 1678

- 1679

- 1680

- 1681

- 1682

- 1683

- 1684

- 1685

- 1686

- 1687

- 1688

- 1689

- 1690

- 1691

- 1692

- 1693

- 1694

- 1695

- 1696

- 1697

- 1698

- 1699

- 1700

- 1701

- 1702

- 1703

- 1704

- 1705

- 1706

- 1707

- 1708

- 1709

- 1710

- 1711

- 1712

- 1713

- 1714

- »